Author: Jack Inabinet, Bankless; Compiler: Deng Tong, Jinse Finance

Over $500 million in ENA has just been distributed to qualified investors through Athena's first airdrop, but debate over the protocol is reaching fever pitch on Crypto Twitter. Why are two blue-chip DeFi protocols now in conflict over Athena?

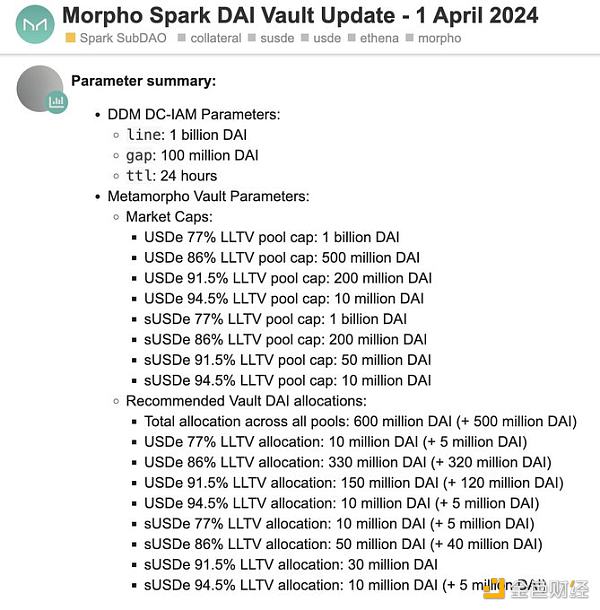

Yesterday afternoon, a governance proposal was posted on the Maker Forum asking delegates to consider increasing the capacity of the recently established USDe and sUSDe lending facility on Morpho from 100 million DAI to 600 million DAI, with the ability to expand the limit up to 1 billion With DAI, most funds will be loaned out at relatively high loan-to-value (LTV) ratios of 86% or higher.

Maker's move to increase the use of Athena's synthetic U.S. dollar stablecoin as collateral, in an effort to boost DAI adoption, comes amid a significant decline in market dominance of its stablecoin, which has plummeted since the start of the year 20%.

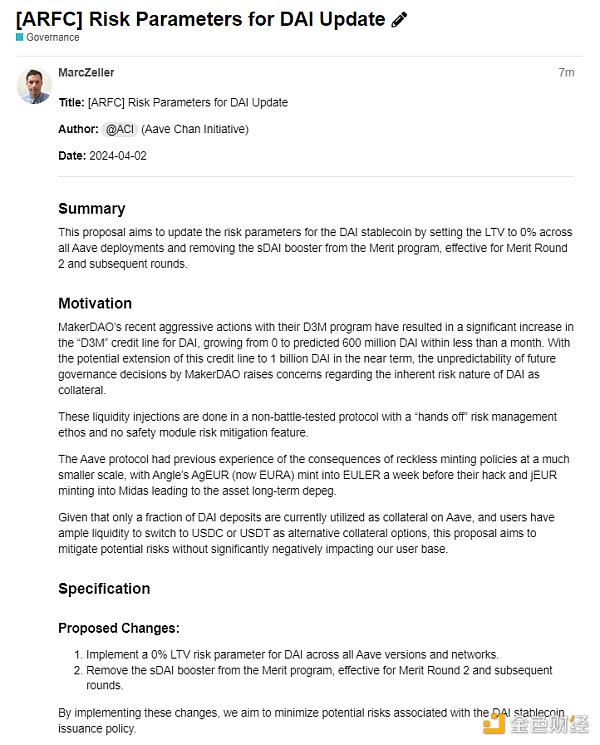

In response to Maker's governance proposal, Aave contributors launched their own proposal seeking to set DAI's LTV to 0% across all Aave deployments, thereby eliminating the ability for users to borrow and lend using DAI as a collateral asset.

To the confusion of many, Aave has shown a willingness to incorporate Athena's sUSDe into its V3 Ethereum deployment, with a March 19 temperature check passing with near-unanimous support, in line with the protocol's recent increase in lending activity against Maker In sharp contrast to the instinctive reaction of effort.

While it is possible that DAI lending through Aave would be done in a risk-isolated manner (similar to how the sUSDe market might operate in the future), thereby eliminating the possibility of contagion, Aave is no longer willing to take on the increasing risk. Maker has stated that it is committed to increasing DAI supply and fiscal revenue.

Aave founder Stani Kulechov reiterated this view, proposing that DAI be completely removed from all markets, saying that he sees "little value in the Aave DAO with the new risk direction MakerDAO is taking."

Source: Aave Governance

Given that the Athena stablecoin has extremely high yields, sUSDe generates best-in-class returns for stablecoins via funding/staking payments, and USDe offers huge airdrop rewards, demand for leverage on these assets is high and holders are willing to pay to obtain it .

Although Maker's current Athena lending operation only has 2% of the circulating DAI supply collateralized, these loans have an annualized return of 36% and contribute 10% to Maker's expected revenue.

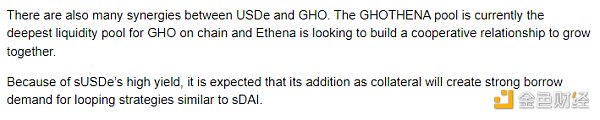

While Maker's increasing adoption of Athena assets as collateral has undoubtedly increased DAI's risk profile to some extent, Aave's retaliatory response feels harsh and can be seen as aimed at further supporting GHO - the protocol Its own stablecoin and a direct competitor of DAI - the governance proposal considers the potential benefits that the integration of Athena and Aave could bring to GHO to support the sUSDe market...

Source: Aave Governance