Author: Severin & Ian, MT Capital

TL;DR

Berachain originated in 2021. The founders felt the liquidity fragmentation between multiple chains and the ghost town effect of public chains, which led to the idea of creating a liquid public chain. The Berachain community has very distinct Ponzi culture, Meme culture and NFT cultural characteristics.

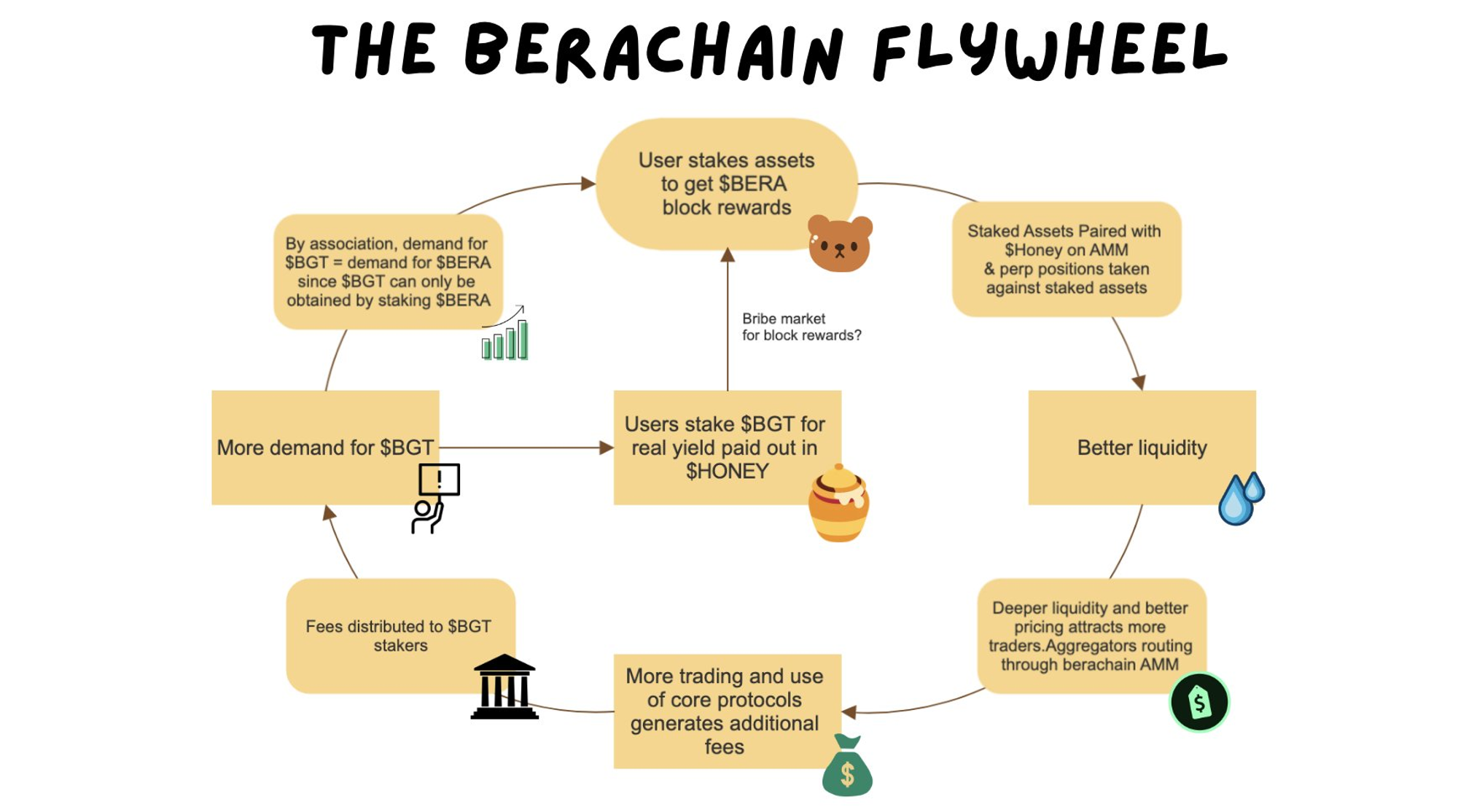

Berachain is a high-performance EVM-compatible public chain built on liquidity proof consensus. EVM compatibility enables Berachain to widely integrate the mature EVM ecosystem. The PoL consensus can help Berachain directly stimulate on-chain liquidity through BGT emissions and bribery, avoid the liquidity ghost town dilemma faced by existing public chains, promote the prosperity of the DeFi ecology and trading activities on the chain, and allow the public chain to gain protocol-level flexibility , can more effectively stimulate and guide the liquidity on the chain, thereby promoting the balanced development of the ecology and turning the upward flywheel of the public chain.

The ecological projects on Berachain are still in a very early stage of development. In addition to official components, ecological projects on Berachain have shown three different development trends: (1) Supplementing the long-tail market that cannot be reached by official components; (2) Innovating around the PoL mechanism, BGT and vote buying; ( 3) There are also a large number of external high-quality projects attracted by the PoL mechanism and siphoned into the Berachain ecosystem;

From the perspective of investment opportunities, we will focus on high-quality DeFi projects on Berachain and infrastructure that can innovate around Berachain's PoL mechanism, BGT mechanism and vote-buying mechanism. We will continue to pay attention to the NFTFi protocol that can combine NFT and DeFi and the L2 based on Berachain. and its related infrastructure. (Relevant track project parties are welcome to tweet DM @0X_IanWu, @Severin0624 at any time)

introduction

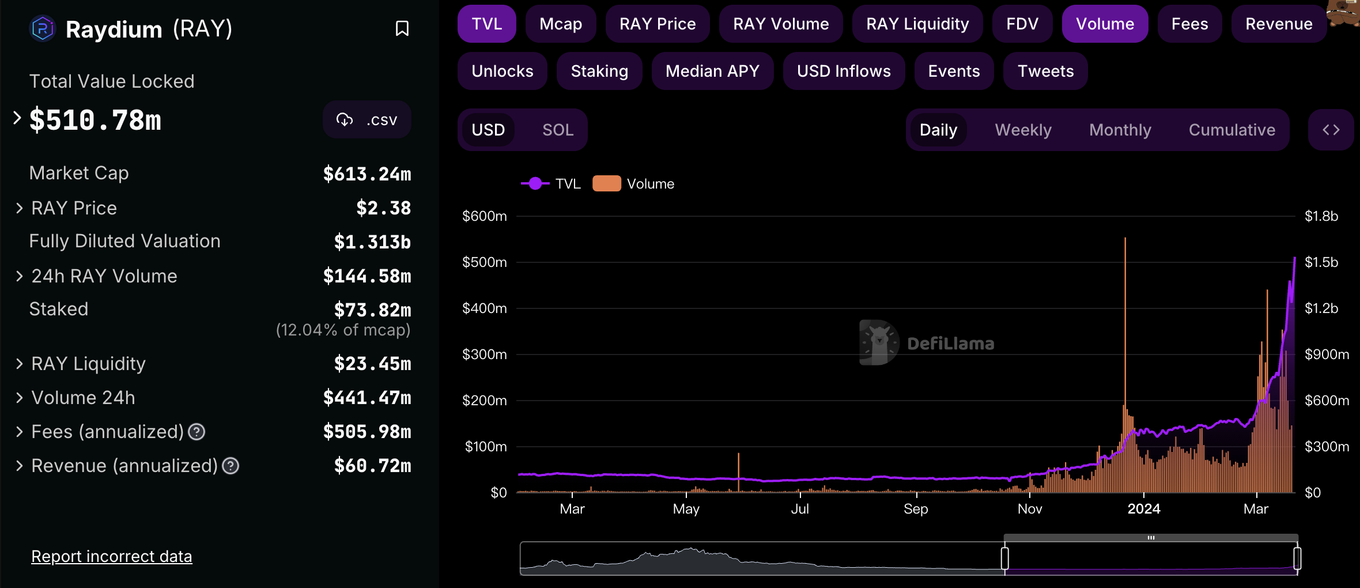

A very interesting phenomenon recently is that Alt-L1 public chains, which were once proud of their technology, have begun to use Meme to grab the attention of the Crypto market. Just like Solana, the technical advantages of high TPS and low confirmation delay were finally perceived by users in the magnificent wave of Meme speculation, achieving a bumper harvest of public opinion, funds, users and traffic. Solana's Meme speculation wave not only brought a lot of traffic attention and new users to Solana, but also brought a lot of active transactions and liquidity to Solana. The injection of liquidity also makes Solana's Meme ecosystem more vital and further drives the prosperity of the entire Solana ecosystem. In particular, Raydium, the preferred DEX for Solana Meme trading, achieved a monthly TVL growth of 246%. It can be seen that although technology is still the historical foundation of the iterative wave of blockchain, technology is by no means the only key to measuring the future development of public chains. Market attention and liquidity represented by Meme may become the main battlefield for a new round of public chain competition.

source: https://defillama.com/protocol/raydium?events=false&volume=true

However, there is such a public chain, Berachain, which has had its own Meme culture since its inception, allowing it to gather a large number of loyal community users in the Crypto bear market despite the anonymity of the team and the lack of technical documentation. The name Bera itself is one of the most distinctive Crypto Meme cultures. The reason why it was named Bera is to pay tribute to the classic old encryption stalker HODL, so Bear was rewritten as Bera. It also innovatively proposed the PoL mechanism, which aims to attract liquidity by giving token rewards for on-chain liquidity and avoid the ghost town dilemma of existing public chains. In addition, it is EVM compatible and supports seamless migration of developers and users in the EVM ecosystem. The superposition of the three major Buffs enabled the testnet to quickly attract millions of users as soon as it was launched, and achieved the growth of one million active wallets in just 7.5 days.

source: https://twitter.com/berachain/status/1749522523895570700?ref=research.despread.io

As a public chain with its own technology, community, Meme culture and liquidity, Berachain is expected to reshape the competitive landscape of existing public chains, break the dilemma of ghost towns with barren public chain liquidity, and become a superstar public chain in this bull market cycle.

development path

Berachain development history

Several of the founders of Berachain were early anonymous DeFi players. They began investing in Crypto projects and speculating on coins in 2015, and fully participated in DeFi Summer. During 2021-2022, the founders also participated in the DeFi ecology between different chains, switching back and forth between different Alt-L1s, and felt the liquidity fragmentation between multiple chains and the ghost town effect of public chains. They found that public chains always rely too much on token incentive subsidies to attract TVL and liquidity. Once token emissions are exhausted, most public chains will gradually lose liquidity. Moreover, they found that the PoS public chain also had some problems, and a large number of value tokens were used for pledge to ensure network security. Although the security of the network has improved, the liquidity price paid for this is also huge, and liquidity is the lifeblood of DeFi and ecological protocols. Their rich experience in participating in the DeFi industry has shaped their basic understanding of the ideal public chain model, and also laid the foundation for the subsequent proposal of the PoL mechanism.

About a year and a half ago, Smokey and another co-founder talked about making the Smoking Bear NFT Bong Beras in an almost joking tone. After the release of Bong Bears NFT, it unexpectedly received a lot of attention and support from the community. Since the founder himself is the first industry OG to be involved in the OHM and Luna communities, most of the community members who come here are also DeFi enthusiasts. In repeated exchanges with the community, several founders gradually came up with the idea of creating a liquid public chain and started voting in the community. Miraculously, having never built a public chain, they unexpectedly received a lot of support from the community, and Berachain came into being.

Although the founding team has rich DeFi experience and accurate market knowledge, after all, developing a public chain also requires a lot of technical work. During the conversation, the Berachain team got acquainted with the Polaris team, which focuses on compatible EVM development. The two teams hit it off and together form the main body of the current Berachain. At this point, Berachain is basically finalized. Technically, Berachain will use Polaris technology development to create a high-performance L1 based on Cosmos that is compatible with EVM. Mechanically, Berachain will adopt the PoL mechanism to promote the prosperity of the DeFi ecology on the chain by incentivizing liquidity on the chain.

key historical nodes

2021.8 Bong Bears NFT will be minted and released, paving the way for the subsequent emergence of Berachain.

2021.10 Bong Bears NFT rebase occurred for the first time.

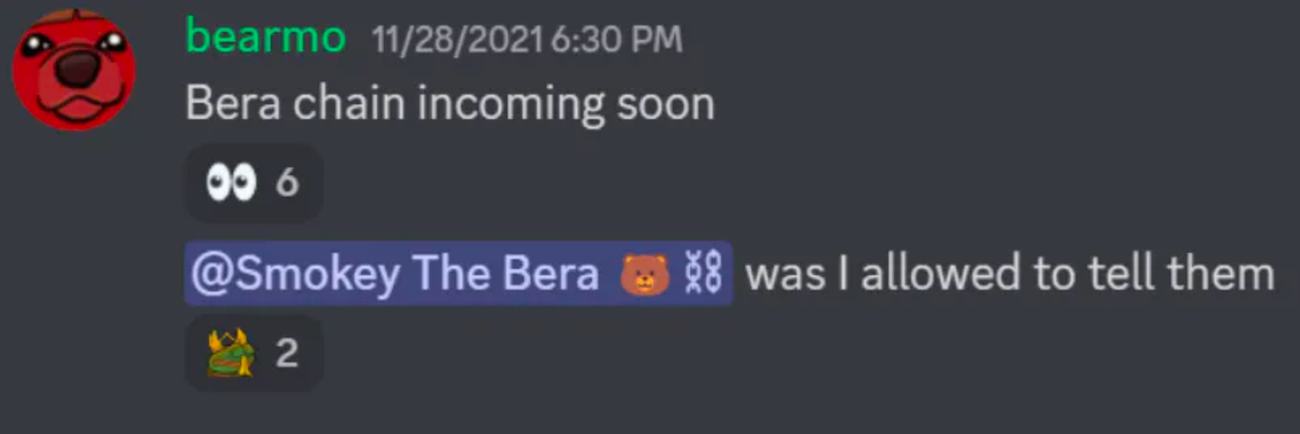

2021.11 Berachain was mentioned for the first time.

source: Bonga Bera 101 — The Honey Jar (mirror.xyz)

2022.3 Olympus DAO OIP-87's proposal for Berachain's seed round financing was approved. Berachain will receive 0.5M financing from Olympus at a valuation of 50M.

2023.4 Berachain disclosed 42M financing led by Polychain.

source: https://twitter.com/berachain/status/1649050293080915968?ref=research.despread.io

2024.1 Berachain testnet is released.

2024.3 Berachain was disclosed to be raising over 69M in financing led by Framework Ventures.

community culture

Ponzi culture

Berachain was first jointly launched by several old OGs who were involved in the OHM community and the Luna community. OHM and Luna are among the most ponzi DeFi protocols and public chains in the last cycle. The founding team of Berachain are all core members of the community and do not reject or even enjoy Ponzi culture. Therefore, in the Berachain community, everyone does not shy away from Ponzi, and even speaks of Ponzi. Berachain is also considered by the current market to be the next Luna with the Ponzi model. Although this metaphor is unreasonable, it also reflects the cultural core of the Berachain community and the outside world's perception of the Berachain community culture.

Meme culture

In addition to Ponzi, Berachain is also born with Meme culture. After all, the origin of Berachain comes from Bong Bears NFT, a smoking bear with a very Meme image. Bong Bears originally went from idea to implementation as a joke among several founders, and unexpectedly received a lot of attention and support from the community. In addition to Bong Bears, the name Bera itself is one of Meme culture. The reason why it was named Bera is to pay tribute to the classic old encryption stalker HODL, so Bear was rewritten as Bera. Smokey, the founder of Berachain, will also wear a Bera hood to attend various formal events and personally spread the Meme spirit. Meme culture is also very popular in the Berachain community. Official tweets will deliberately misspell words, for example, Hello will be spelled Henlo. In other communities, you may often see GM and GN, but in the Berachain community, you will see Ooga Booga, who has a very Meme personality, flooding the screen. It can be said that from top to bottom, from official to community, Berachain is immersed in the unique Meme culture.

NFT culture

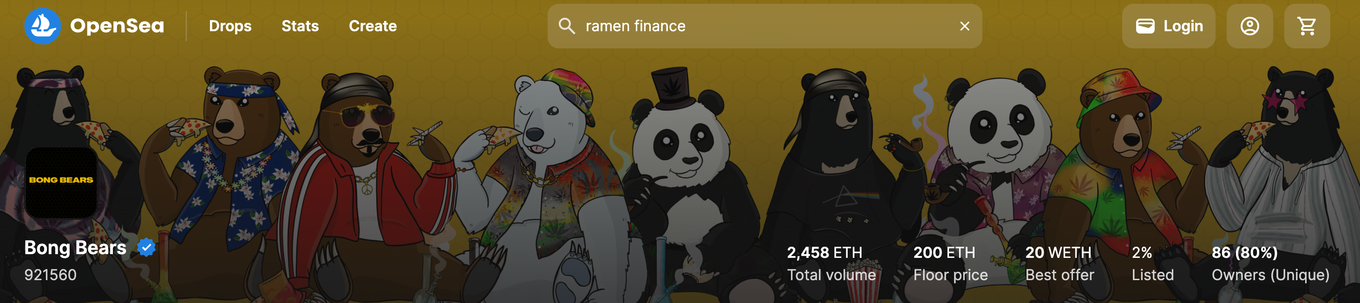

Since Berachain was born from the NFT Collection, NFT has naturally become one of the most representative cultures of the public chain. When we talk about other public chains, we rarely think of the symbolic NFTs of other public chains except Ethereum. But when talking about Berachain, the unavoidable topic is Bong Bear NFT based on the Rebase mechanism. In addition to the NFTs issued by the founders, ecological projects on Berachain are also issuing their own NFT collections, and the NFT collections of different projects will be linked to the theme of Bear. Even to a certain extent, for Berachain, NFT is an asset as important as Token. Compared with pure tokens, NFT comes with an additional layer of cultural attributes and community recognition, which also gives the entire Berachain community a stronger consensus and community stickiness. Take Bong Bear and Honey Comp as examples. Although these two NFT series have achieved considerable gains in the secondary market, few users have made profits from selling them. The listing rate of NFT is only less than 2%, which also reflects This demonstrates the strength of the community consensus under the Berachain NFT culture.

source: https://opensea.io/collection/bongbears

summary

Berachain's unique cultural attributes are also one of the distinguishing features of Berachain from other public chains. We expect that Berachain’s unique community culture will have the following impacts on Berachain:

Compared with other public chains, stronger purchasing power and wealth effect: Ponzi culture’s attraction to funds is self-evident. In the last cycle, the myth of OHM and Luna growing hundreds of times in a short period of time is still vivid in our minds. Berachain's origins in OHM, loyal users of the Luna community, and Berachain's preference for Ponzi may give Berachain greater purchasing power compared to other public chains, making it the best breeding ground for Ponzi projects.

Stronger traffic attention than other public chains: In this cycle, public chains have gradually realized that native Meme is the best marketing for public chains. From this perspective, Berachain, which is born with its own Meme culture, laughs at itself with Meme culture, and can continue to reproduce Meme culture, is more likely to get out of the circle and capture more market attention.

Stronger community cohesion than other public chains: To some extent, existing public chains lack a unified symbol as a spiritual consensus. But just like every country has its own national treasure as the representative and consensus of the country, for Berachain, Bera is the best spiritual symbol and consensus of Berachain. Almost all NFT Collections on Berachain are created using Bera as the basic carrier. The spread of NFT culture will further bring community recognition and enhance community stickiness. At the same time, different project parties on Berachain will also cooperate and share profits based on NFT, which will also bring stronger ecological synergy and community cohesion to the Berachain ecosystem.

Berachain technical architecture

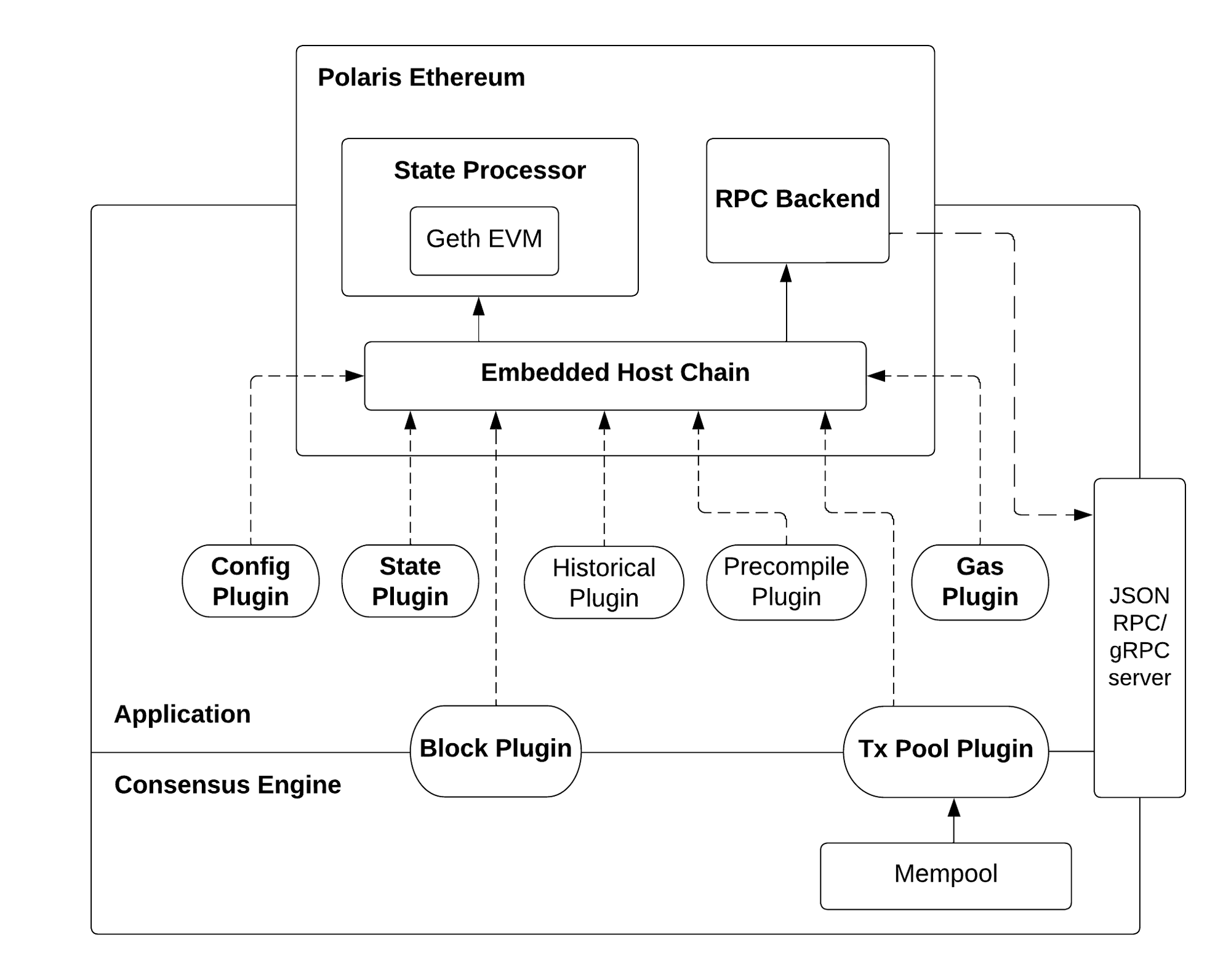

Berachain is a high-performance L1 public chain built on the Cosmos SDK, using the CometBFT consensus engine and compatible with EVM. Building on the Cosmos SDK enables Berachain to seamlessly integrate with the Cosmos ecosystem and achieve horizontal expansion between chains through the IBC module. At the same time, Berachain has also self-developed the Polaris Ethereum module, aiming to provide EVM compatibility for Berachain, so that Berachain can better aggregate developers and users of the existing EVM ecosystem, integrate the existing EVM ecosystem, and bring users Come to a more familiar development and use experience. Berachain wants to become the key node that unifies the EVM ecological liquidity and the Cosmos ecological liquidity, and creates the most powerful, fastest and most liquid blockchain network in the multi-chain ecosystem.

Polaris Ethereum

Polaris Ethereum can provide developers with an advanced EVM development experience. In addition to providing basic EVM compatibility, Polaris Ethereum can also provide developers with additional functions such as creating stateful precompiled contract modules and supporting developer-defined opcodes, allowing developers to use Polaris Ethereum to customize and build more Flexible and more adaptable smart contracts.

EVM compatibility

The basic principle of Polaris is similar to running an additional Ethereum-equivalent virtual machine on top of the L1 main chain. By plugging and unplugging corresponding plug-ins such as Configuration plugin, State plugin, Gas plugin, etc., Polaris can effectively input state transitions, thereby supporting any type of L1 main chain smart contract to execute Ethereum transactions.

source: Polaris Architecture – Polaris Ethereum Docs (berachain.dev)

Precompiled

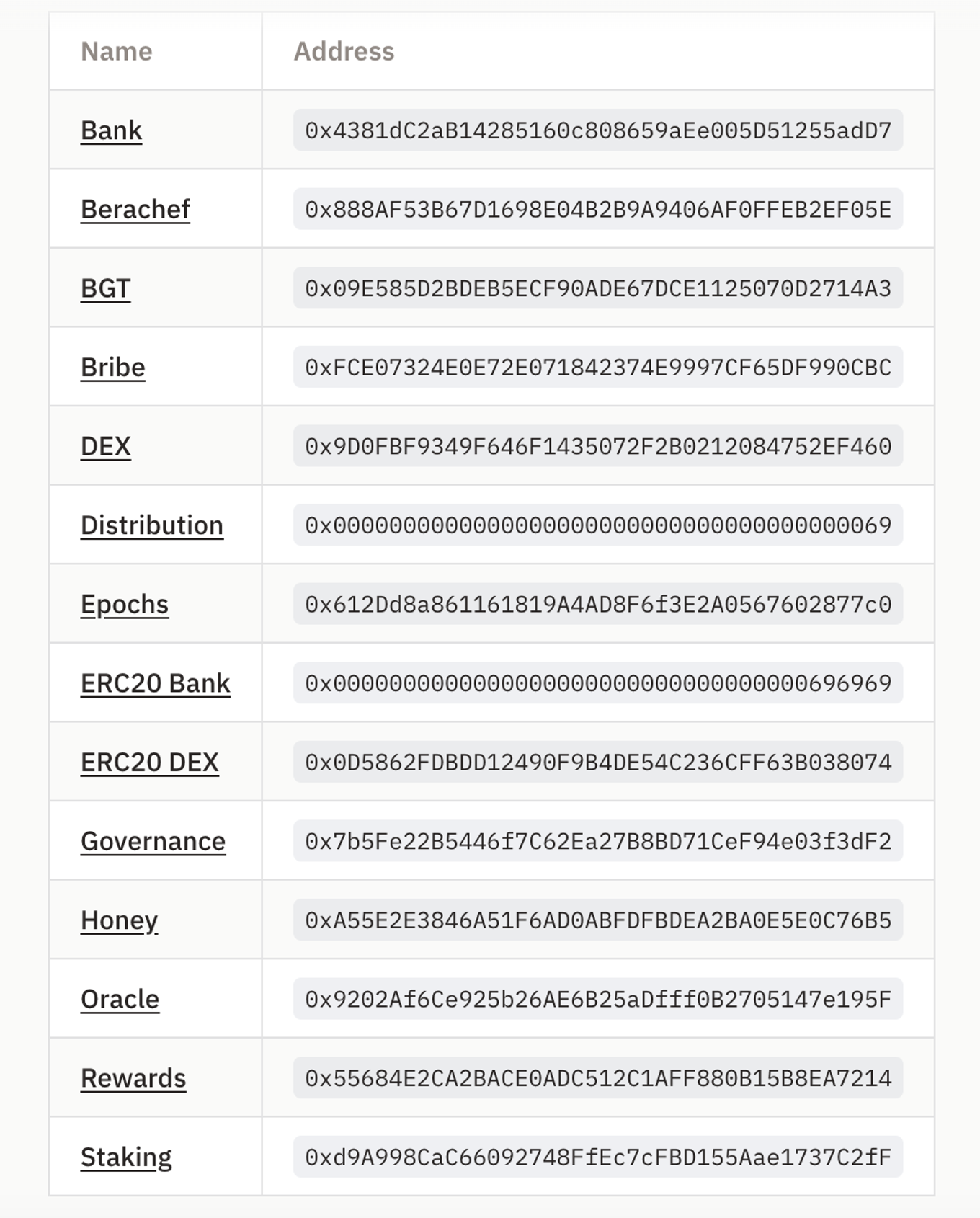

Precompilation, also known as precompiled contracts, is a set of smart contracts that have specific functions and are built directly into the blockchain node, rather than being executed as bytecode in the EVM. Precompiled contracts can implement more efficient state operations at lower Gas costs and provide additional functional logic. Polaris' support for precompiled contracts enables direct interaction with various Cosmos modules. Currently, Berachain’s precompiled contract types are as follows. For example, the BGT precompiled contract includes the redemption operation of BGT, and the Bribe precompiled contract includes operations such as creating bribes and obtaining bribe fees.

Support for custom opcodes has also been added to the Polaris EVM implementation to support more complex smart contracts.

source: Precompiles & Deployment Addresses | Berachain Docs

Modularity and interoperability

Polaris is a modular implementation of EVM, and Polaris can be easily integrated into any consensus engine. Each component of Polaris is developed as a unique package and comes with comprehensive testing documentation. Developers can use some components in Polaris individually according to complete documentation, or combine multiple components as needed to create personalized EVM integration. Polaris' modular implementation of EVM integration can help developers significantly reduce the time and cost of implementing EVM integration solutions by themselves.

In addition, the combination of Polaris Ethereum and the Cosmos SDK can also achieve interoperability with the Cosmos ecosystem in an EVM-compatible environment. By integrating multiple state precompilations on the chain, Polaris enables EVM users to perform native operations of Cosmos, such as governance voting, validator delegation, etc., as well as interact with other chains through IBC. This design further achieves true interoperability between Cosmos and EVM while retaining the native EVM experience, allowing Berachain to get closer to its vision of becoming the liquidity hub of the EVM ecosystem and the Cosmos ecosystem.

(Of course, since Polaris has not been tested in practice, Berachain’s specific performance, traffic load conditions and compatibility with EVM after the mainnet is launched remain to be seen.)

PoL consensus

Why PoL is needed

PoS is one of the most common consensus mechanisms currently. Although PoS has been tested in practice for many years and has been recognized by the market as an effective consensus mechanism that can take into account network security, decentralization and consensus efficiency, PoS also has some problems. For example, the security of the PoS network depends on the number of assets pledged in the network. The greater the value of the pledged assets, the lower the probability of the network being attacked. However, an excessive value of pledged assets is equivalent to a reduction in the value of assets that can be used for on-chain liquidity, which is not conducive to the prosperity of on-chain trading activities. Especially in 2021 and 2022 when liquidity staking is not yet highly popular. In addition, the token incentives in the PoS network will only flow to token pledgers, that is, the PoS network will only incentivize staking activities, and for on-chain transactions, providing liquidity and other activities that can promote ecological prosperity, the PoS network does not give enough Inspiring support. The existence of the above two major problems caused Berachain to finally abandon the PoS consensus and instead propose the PoL: Prove of Liquidity liquidity proof mechanism.

The core of PoL is to stimulate the prosperity of the DeFi ecosystem on the chain, and one of the vital points of DeFi is liquidity. Therefore, the core essence of PoL is to incentivize sustainable deep liquidity on the chain.

PoL mechanism

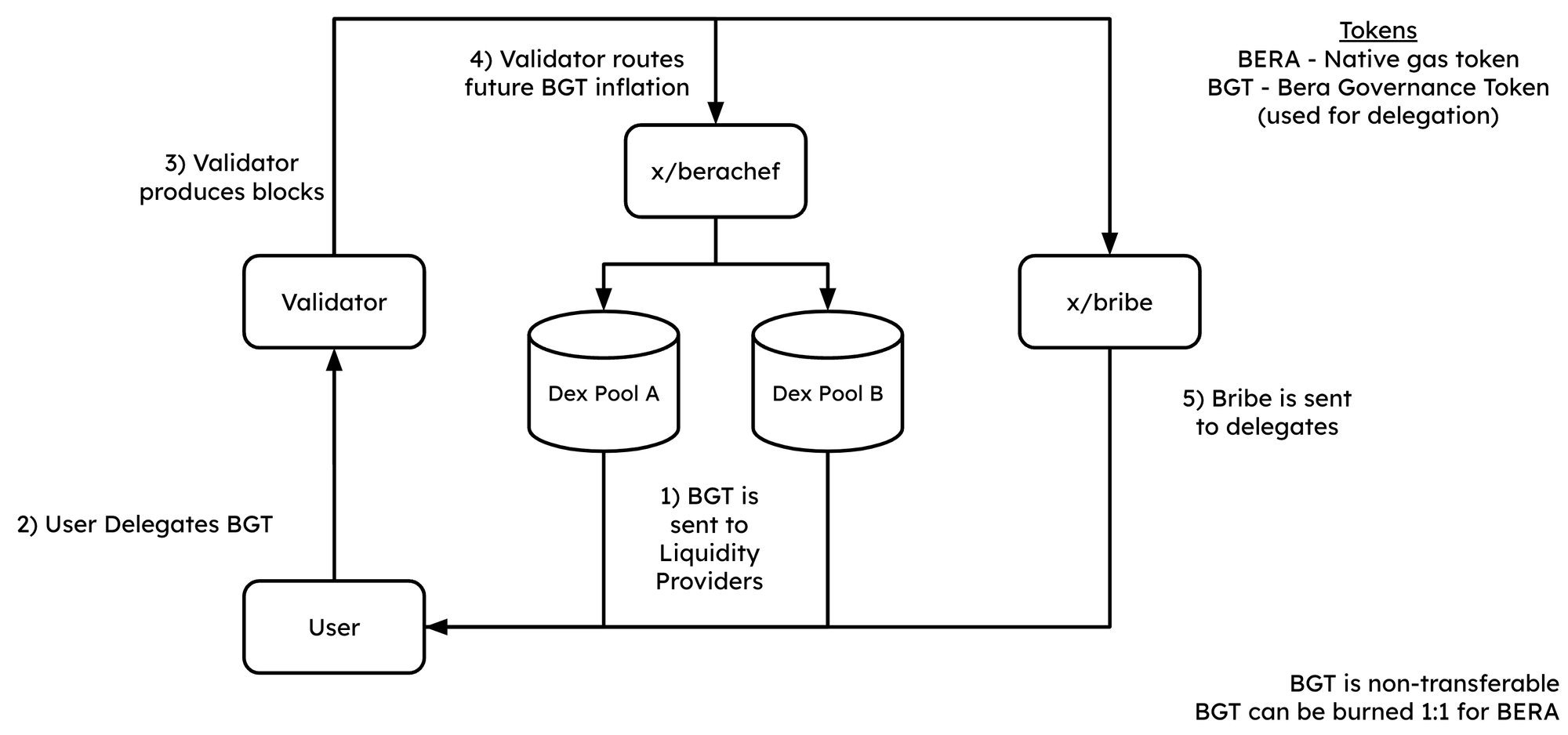

The specific mechanism of PoL is as follows:

Users who want to obtain token incentives similar to those in the PoS network need to provide liquidity to specific liquidity pools on Berachain, and Berachain will reward users with the governance token BGT. Note that the way to obtain native token rewards in the traditional PoS network is to pledge, while the way to obtain native token rewards in the PoL network is to provide liquidity.

Similar to token staking in PoS, users can also entrust the BGT they receive to verification nodes, and verification nodes will participate in the verification work of the network on behalf of users.

Similar to PoS, validators will also participate in block generation and construction according to their delegated BGT proportional weight, and receive block generation rewards and block fees as rewards.

Unlike PoS, validators can vote on the future BGT reward emissions in different liquidity pools. In the PoS network, the rewards received by stakers are relatively fixed. But in PoL, the rewards received by liquidity providers are dynamic and will be affected by governance factors.

Finally, the new round of BGT will be dynamically discharged between different liquidity pools based on previous voting results, and BGT rewards will be distributed to liquidity providers, forming a closed loop.

source: What is Proof-of-Liquidity? | Berachain Docs

PoL vs PoS

PoL's improvement over PoS is obvious.

First of all, PoL can directly stimulate on-chain liquidity and promote the prosperity of the DeFi ecology and trading activities on the chain. The only way to obtain token emission rewards in the PoL network is to provide liquidity. Therefore, the emission reward of the PoL network’s native currency will attract users to provide liquidity. Moreover, the higher the value of the network’s currency, the more attractive the token emission rewards will be, which will encourage more and more users to become LPs, continuously deepening the liquidity of the network. In addition, the durability of liquidity incentives also makes the liquidity of the PoL network more sustainable, unlike other PoS public chains, which will face the dilemma of a large withdrawal of liquidity once the airdrop incentives are completed.

Secondly, PoL enables the public chain to gain protocol-level flexibility, which can more effectively incentivize and guide on-chain liquidity and promote the balanced development of the ecosystem. The PoL mechanism of the public chain is similar to the vetoken mechanism at the protocol level. Through the governance module, the public chain can incentivize specific assets and specific liquidity pools, and guide the originally disordered liquidity. Its core essence is very similar to the public chain's token subsidies for specific ecology, specific protocols, and specific assets, but the implementation method is more elegant.

The PoL mechanism may achieve higher security than PoS. There is a potential positive flywheel for the PoL mechanism. In the PoL mechanism, users provide liquidity and obtain network token emission rewards while deepening the liquidity of the network, bringing a better user experience to DeFi users and promoting the prosperity of the network ecology. The improvement of network fundamentals will also be reflected in the price of tokens to a certain extent, promoting the rise of token prices. The increase in token prices will further encourage users to provide liquidity and capture the network's token emissions, thus forming a closed-loop positive flywheel. In this process, the increase in liquidity provided by users also means an increase in network security. Therefore, the PoL mechanism may achieve higher security than the PoS network.

In summary, the PoL mechanism can effectively promote sustainable liquidity on the chain and the prosperity of the DeFi ecosystem through token reward emissions, and get rid of the existing public chain's over-reliance on airdrop marketing to attract users and liquidity. While capturing greater security. The PoL mechanism can also allow public chains to more flexibly provide ecological incentives, which is expected to turn the flywheel of liquidity, currency prices and ecology.

However, the PoL mechanism also has its corresponding drawbacks, that is, PoL only incentivizes liquidity and only incentivizes the bottom-level liquidity needs of DeFi. Although liquidity is the lifeblood of DeFi, liquidity is not the whole of DeFi. PoL cannot incentivize DeFi protocols that do not have high liquidity requirements. For example, a transaction aggregator protocol does not have a very high TVL, but it can contribute a large amount of transaction volume. However, under the PoL mechanism, Berachain cannot effectively incentivize this type of protocol. In addition, for non-DeFi tracks such as NFT and GameFi, it is difficult for PoL to achieve a balanced incentive. Therefore, the current PoL version may also be further optimized in the future development process of Berachain to more evenly encourage the development of different DeFi protocols and different inter-chain ecosystems.

Token model

Berachain's token model is also different from other public chains. Berachain's token economy consists of three different tokens: the governance token BGT, the gas token BERA, and the stable currency HONEY.

Introduction to the three-token model

The positioning of BGT is similar to the governance token in the PoS network. The difference is that BGT is set to be non-transferable. Also, the ways to obtain BGT are relatively limited. Currently, users can earn BGT emission rewards by providing liquidity on BEX, lending HONEY, and providing HONEY in Berps’ bHONEY Vault. BGT can be used to participate in governance. Users can delegate BGT to validators and receive governance rewards and bribery rewards at the same time. Once a validator participates in producing a block, users can also receive transaction fee rewards and gas fee rewards from Berachain's native applications BEX, Bend and Berps within the block. BGT can also be converted into Berachain's Gas token BERA at a ratio of 1:1, but the process is one-way and irreversible, that is, users can no longer convert BERA into BGT at a ratio of 1:1.

BERA's positioning is similar to native tokens in other public chains, and is mainly used to pay gas fees and block rewards. The difference is that holding BERA tokens does not have governance voting rights, and governance rights are assigned to BGT.

HOENY is positioned as Berachain's native stablecoin, providing a stable transaction medium for applications on Berachain. Users can mint HONEY by staking USDC 1:1.

How to understand the three-token model

To understand the three-token model, we still have to go back to Berachain's PoL mechanism. PoL incentivizes Berachain's liquidity by rewarding users with BGT tokens. Therefore, in order to achieve the effect of stimulating liquidity, BGT must be valuable to attract sufficient liquidity.

So how to ensure the value of BGT? If, like other L1s, the currency is only used as a governance token, then the value of the token is actually difficult to guarantee. In this case, the token value is only weakly related to the fundamentals of the public chain, which is obviously not a reasonable path. There are two ways of thinking to ensure the value of BGT. One is that there is indeed real value inflow behind BGT, or it allows users to see expected benefits. The second is to try to ensure that users hold BGT instead of selling it. Based on these two ideas, it will be clearer when we look back at Berachain's PoL and three-token model design.

First of all, regarding the issue of asking users to try not to sell, Berachain's idea is very simple. It designs BGT as a non-tradable and transferable governance token, and adds an additional Gas token BERA. If users want to sell BGT, they need to exchange BGT for BERA at a ratio of 1:1, which is equivalent to setting up an additional layer of obstacles for users to delay users' selling of BGT as much as possible.

However, this approach always treats the symptoms rather than the root cause. To make users think that BGT is valuable, the most direct way is to let users see the benefits behind BGT. Based on this idea, Berachain provides two empowerment solutions. First, Berachain gives BGT governance rights. This governance right is not a governance right for project development, but a governance right directly aimed at BGT emissions, that is, user benefits. The significance of governance rights is that in order to maximize their own profits, every user must hold BGT and entrust BGT to the liquidity pool that is willing to vote for them to mine, thereby obtaining more BGT emission rewards. In the PVP between users, if one party chooses to mine and sell, it is obvious that the BGT emissions that this party is expected to obtain in the future are relatively less, which is not conducive to the goal of maximizing its own profits. From this perspective, by giving BGT revenue governance rights, Berachain can effectively delay the process of users mining, raising and selling BGT, encourage more users to hold BGT, and gain higher future returns.

Secondly, not only Berachain, but the nodes themselves will also empower BGT. Because the node's income comes from the ecological income and Gas income obtained from block production. In order to maximize its own interests, nodes must receive as many external BGT commissions as possible, thereby increasing their own block production rate. To attract external BGT, nodes need to bribe votes. There are many ways to bribe votes. For example, nodes can share the ecological income obtained by nodes with users, or nodes can start their own transactions and use the high APY of new disks in exchange for BGT in the hands of users. The competition process for nodes to maximize their own interests has gradually evolved into a process of empowering BGT. The value of BGT is guaranteed by the protocol revenue and vote-buying revenue shared by nodes, which can further enhance user confidence in holding.

At this point, the relationship between the entire PoL mechanism and the three-token model has gradually become clear. I believe it is not difficult for everyone to understand why Berachain officials want to take the three-piece set of DEX, Lending and Perps into their own hands. The reason is very simple. DEX, Lending and Perps, as the three components with the strongest money printing capabilities, can enjoy the huge gains brought by PoL and generate high protocol income. The official transferred this part of the income to the hands of the intermediate underwriter node, and the node empowered this part of the income on BGT as the most real value guarantee of BGT. Just imagine, if there are no income dividends from DEX, Lending and Perps, does the value empowerment of BGT feel a bit like a castle in the air?

Furthermore, BGT and the entire Berachain ecosystem are also interpenetrated. The income from ecological projects is the most real value inflow behind BGT. If the Berachain ecosystem is not active enough, the value of BGT will not be guaranteed higher, and users will tend to sell BGT. The decline in the value of BGT will make Berachain less attractive to LPs, causing users to withdraw liquidity and look for other mining pools with higher returns, which will further lead to a worsening of the DeFi experience on the chain and further reduce the activity of the ecosystem. sex, leading to a negative spiral. On the contrary, if the Berachain ecosystem is active enough, the protocol income of Berachain's official three-piece set is high enough, and the income and profit that can be shared with users is high enough, BGT will receive more value protection, and users will be more willing to hold BGT. The increased appeal of BGT to users will attract more users to provide more liquidity, thereby further promoting the prosperity of the DeFi ecosystem on the chain and starting a positive spiral. From a rational point of view, the start and stop of the spiral depends on the relationship between the entrusted pledge income of BGT and the current price of BGT. If the values of the two are similar, the system will maintain overall stability. If the value difference between the two is large, Berachain will easily enter an upward or downward spiral.

source: https://twitter.com/burstingbagel/status/1565705660888596481

Berachain Ecology

Although Berachain was born in 2021, because the core mechanism of Berachain has been optimizing the design and its relevant documents have not been made public to the outside world, a very complete project ecosystem has not yet been formed on Berachain. Even because the relevant documents of Berachain were released late, most community projects have been established since 2024.1, and the Berachain ecosystem is still in a very early stage.

Official ecology

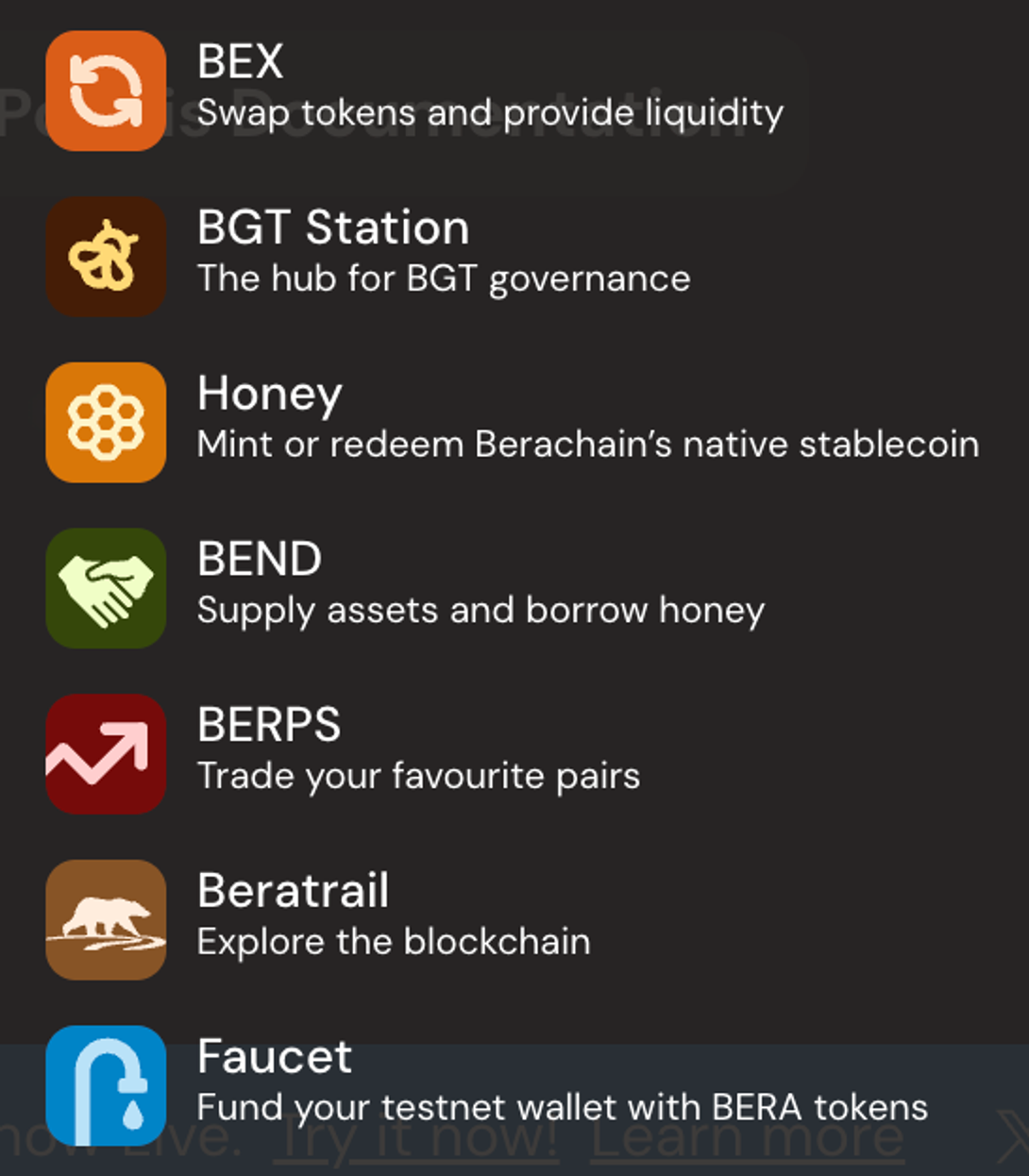

Berachain's official ecosystem is the most important basic component of the Berachain ecosystem. According to the founder, in order to prevent DEX, Lending, Perps and other protocols with similar product functions and services from being involved in each other and carrying out meaningless vampire attacks, the official decided to end it personally and provide DEX, Lending and Perps products on their own. Based on the above analysis, it can be seen that DEX, Lending, and Perps are also the majority of Berachain’s ecological revenue. The official holding of these three pieces will help better transfer profits to BGT holders and provide more sources of value for BGT. , turning the forward flywheel of the Berachain spiral.

In addition to BEX, BEND and BERPS, the official also provides BGT Station, a management platform based on BGT delegated governance, a casting and redemption platform for the native stable currency HONEY, Berachain's blockchain browser Beratrail, and a testnet faucet.

source: https://www.berachain.com/

DeFi Ecosystem

Infrared

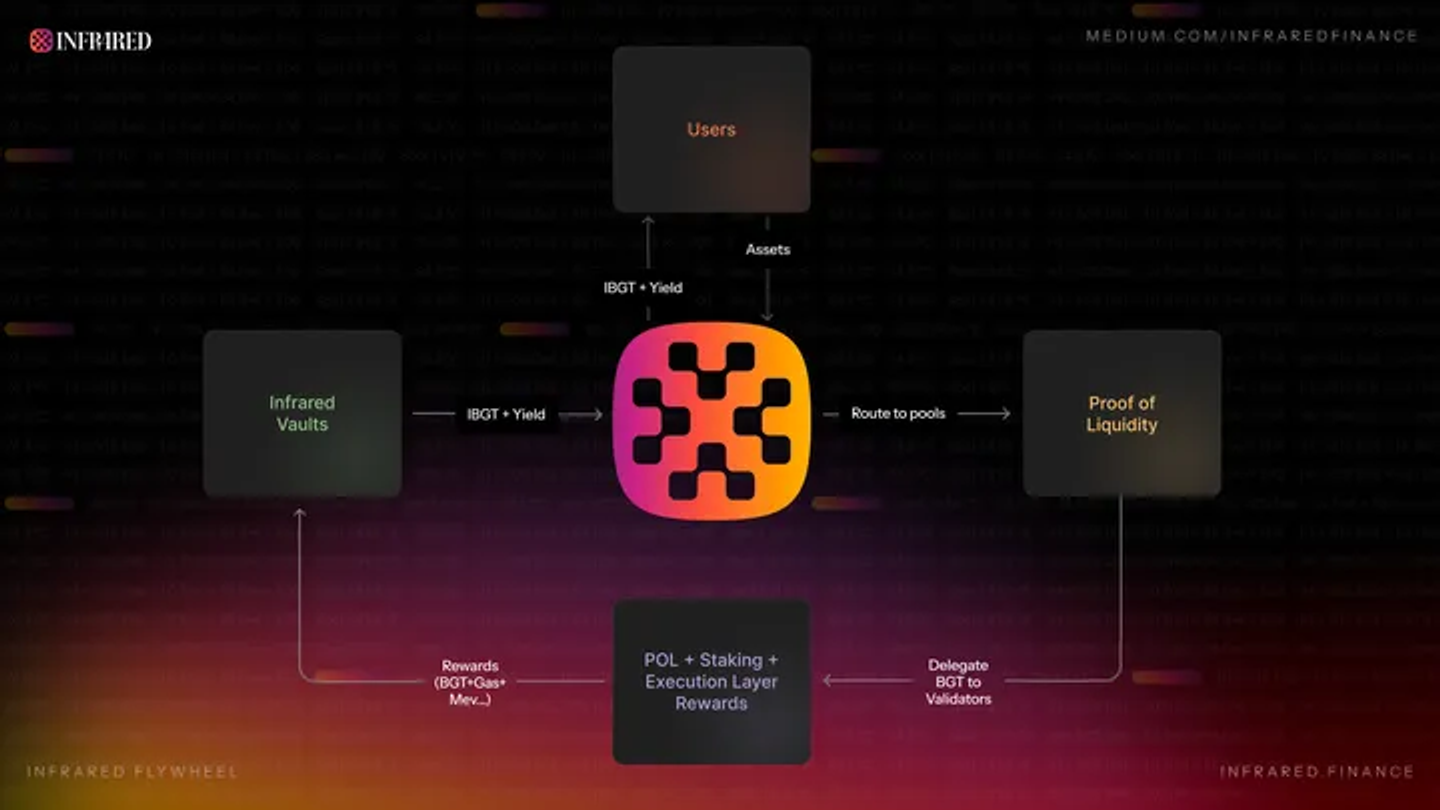

Infrared is a PoS and LSD protocol on Berachain, and in 2024.1 it disclosed a 2.5M seed round of financing led by Synergis, with participation from NGC Ventures, Tribe Capital, CitizenX, Shima Capital, Dao5 and other institutions. Infrared cleverly degenerates Berachain's PoL into PoS, which is more familiar to the market and users, and further releases users' capital efficiency by issuing pledged liquidity certificates. Infrared provides liquidity by receiving users' liquid assets and captures Berachain's BGT emissions. Subsequently, Infrared will give users the liquidity certificate iBGT and the pledge certificate siBGT as the mapping of BGT. Users can not only enjoy the corresponding BGT benefits, but also use iBGT and siBGT to further participate in other DeFi ecosystems on Berachain. Infrared is expected to become Lido on Berachain and expand its own iBGT ecosystem.

Kodiak

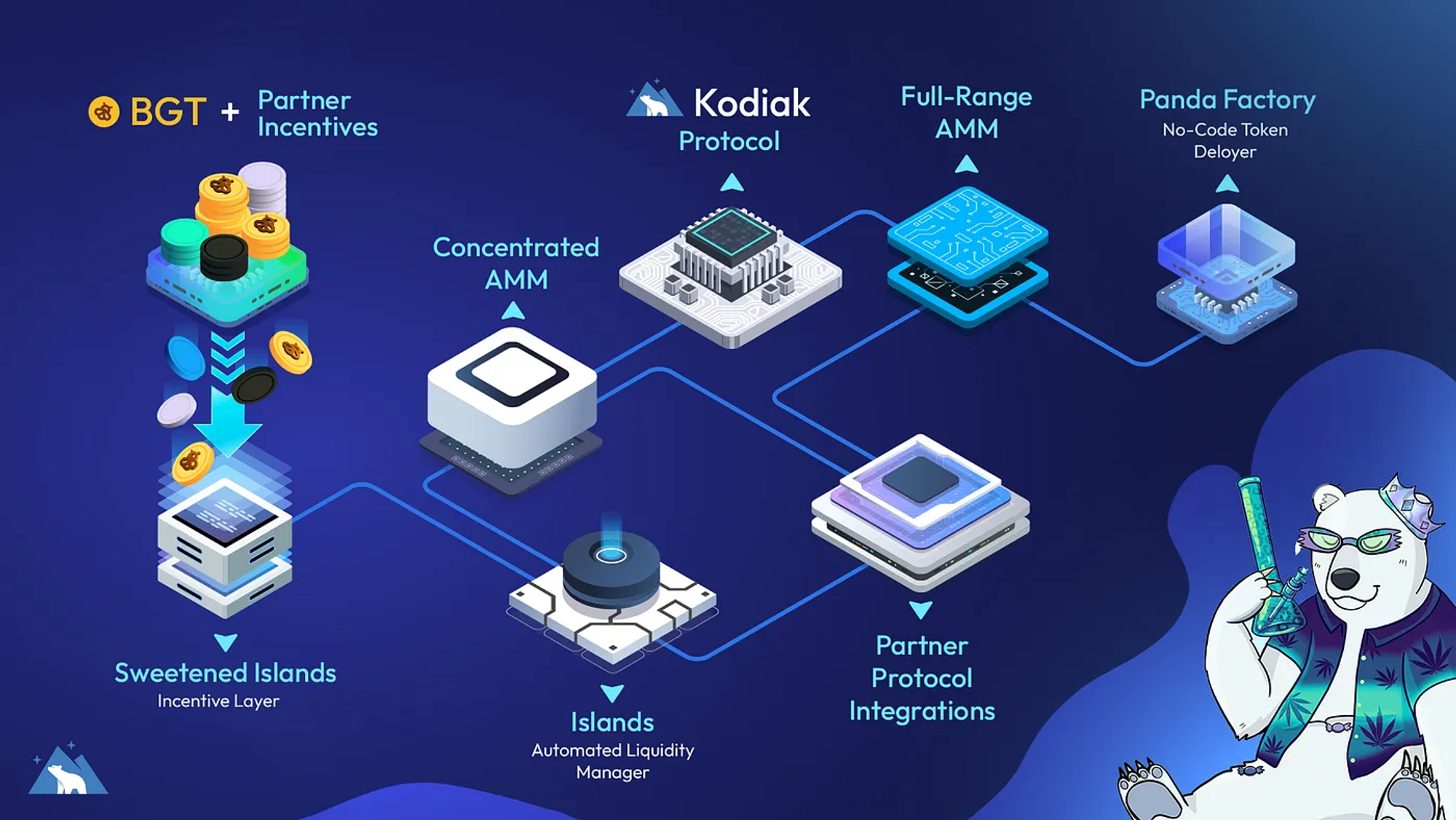

Kodiak is the only DEX project incubated by Berachain's Build-a-Bera accelerator program, and in 2024.2 it disclosed a 2M seed round of financing participated by Build A Bera, Amber Group, Shima Capital, DAO5 and other institutions.

Kodiak aims to become a comprehensive liquidity platform on Berachain, providing users on Berachain with services such as DEX + automated liquidity management + codeless token deployment. Although they are both DEXs, the positioning of Kodiak does not conflict with the official DEX. Kodiak aims to provide users with long-tail asset trading services on Berachain, and Kodiak can also provide automated liquidity management solutions for liquidity providers, eliminating the need for LPs proactively manage liquidity distress. In addition, Kodiak also provides a code-free token deployment solution to support developers to quickly deploy and issue tokens. It can be said that Kodiak provides a full set of service process solutions from token deployment and issuance to trading and liquidity management.

source: https://medium.com/@KodiakFi/introducing-kodiak-berachains-native-liquidity-hub-63c3e7749b30

Beradrome

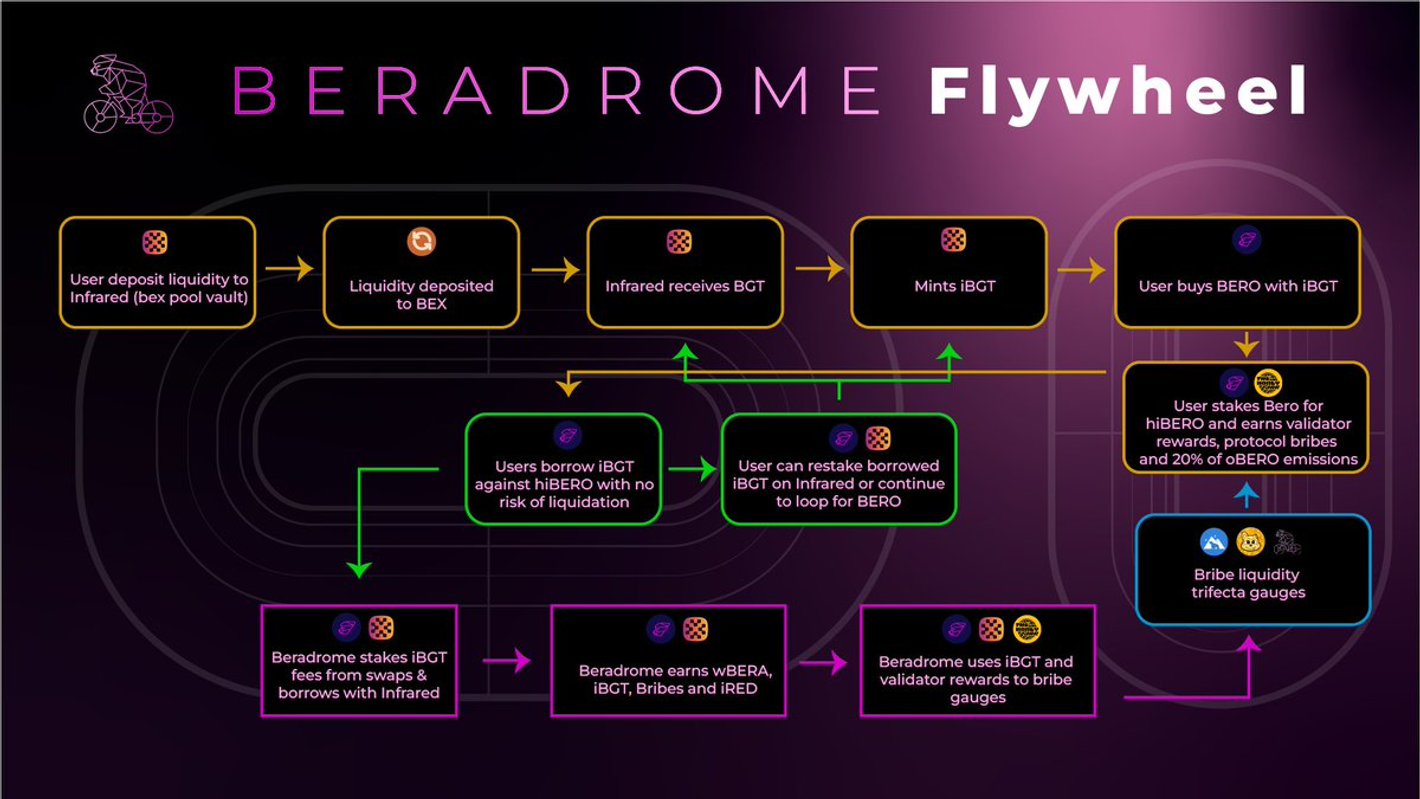

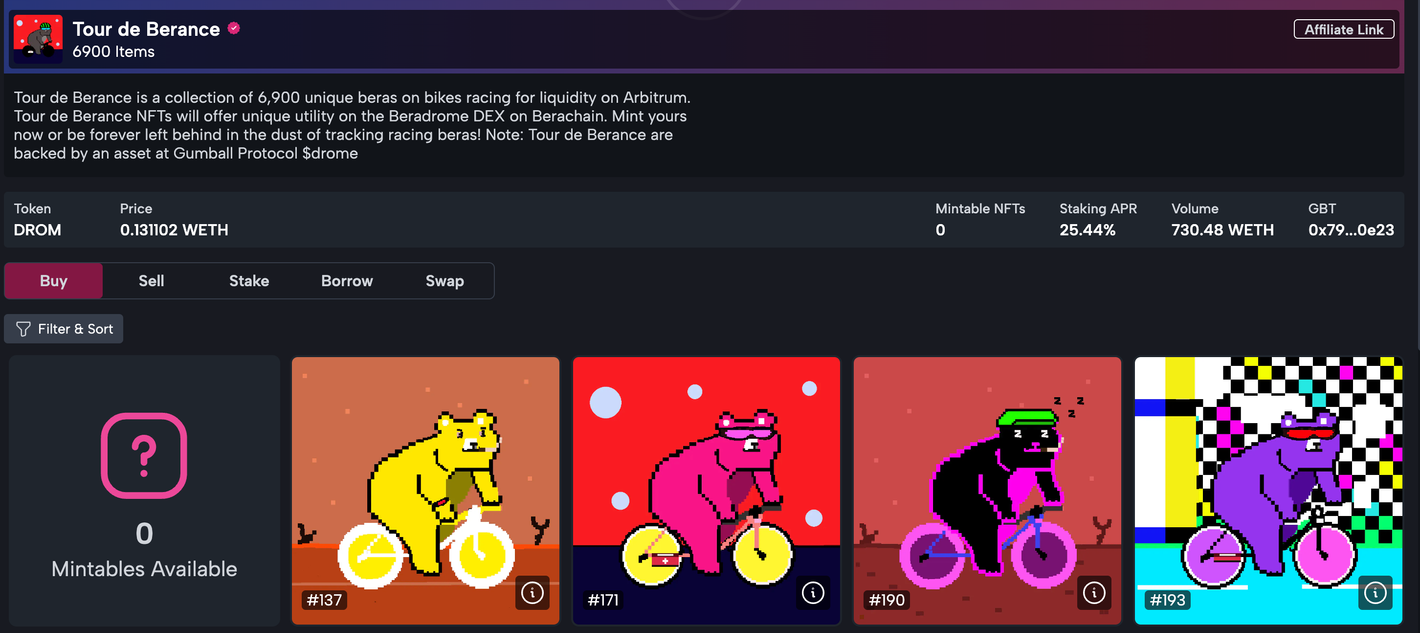

Beradrome aims to become a DEX and Restaking liquidity market on Berachain, bringing Solidly's gameplay into the Berachain ecosystem through the design of ve(3,3) token economics. Users holding iBGT can use Beradrome to purchase and pledge BERO. While receiving hiBERO certificates, they can also capture the verifier rewards, protocol bribery rewards and oBERO emission rewards owned by the Beradrome platform. At the same time, users can also use hiBERO revolving loan iBGT for pledge without liquidation risk, further improving the efficiency of fund use and amplifying returns.

source: https://twitter.com/beradrome

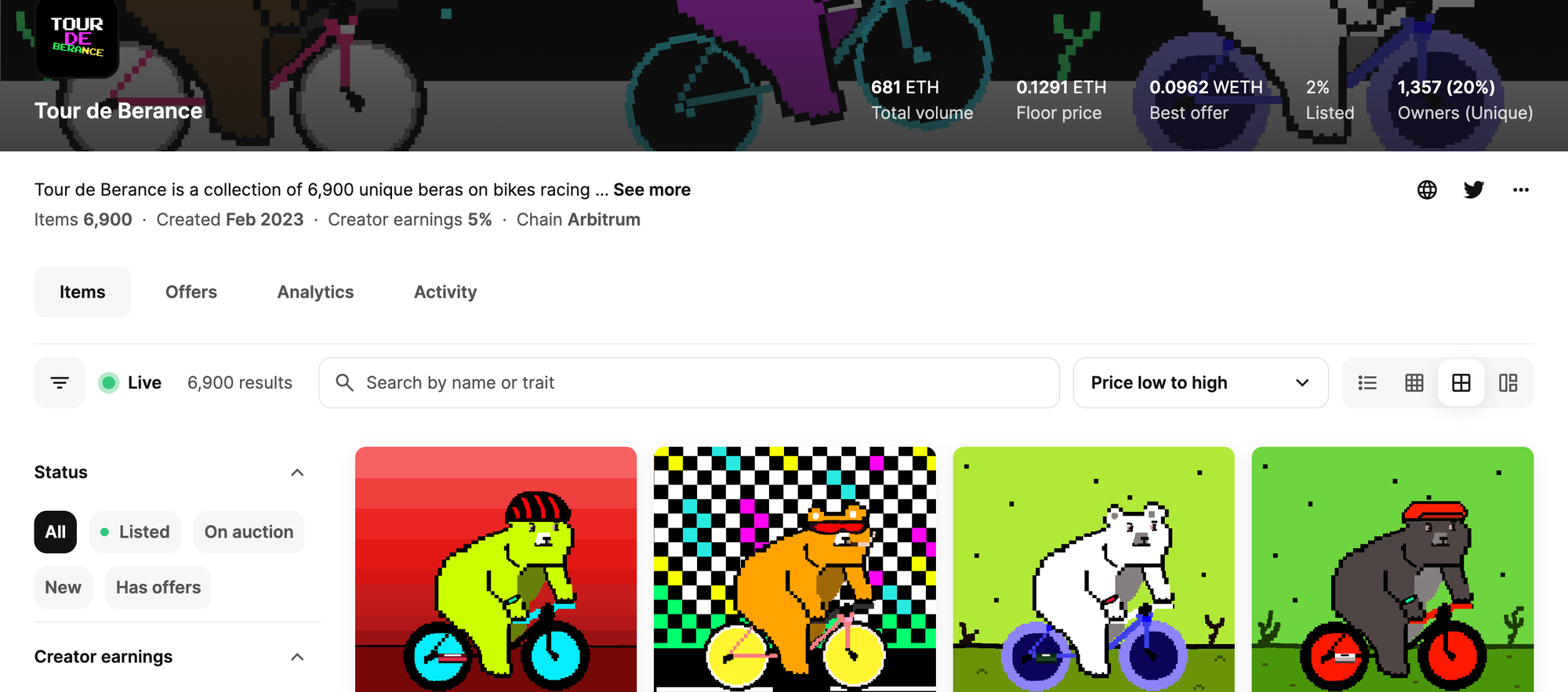

It is worth noting that Beradrome has reached a cooperation with The Honey Jar, and the two will cooperate to run a BeraChain validator node. In addition, Beradrome has also issued its own NFT Collection Tour de Berance. NFT holders can obtain higher hiBERO distribution rights and voting rights.

source: https://opensea.io/collection/tour-de-berance

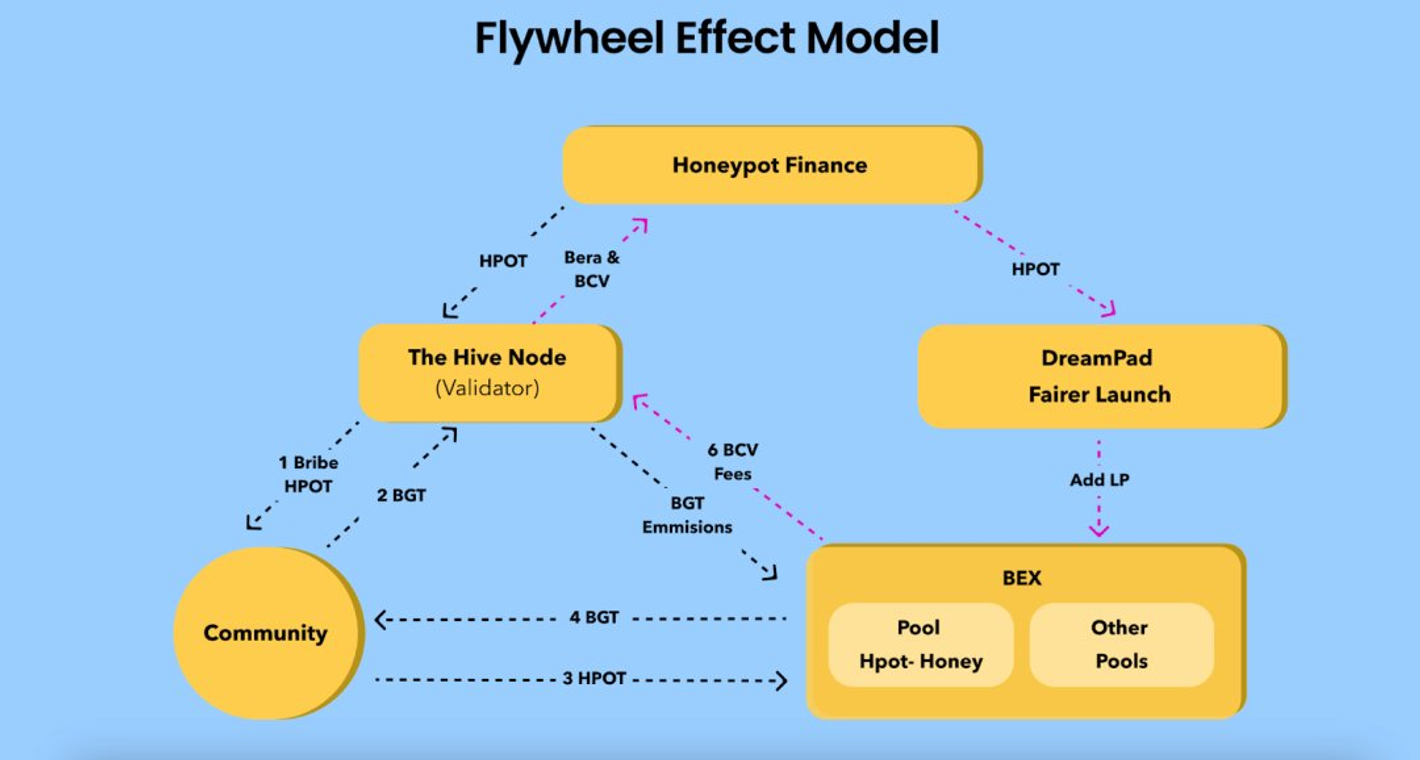

HoneyPot Finance

Similar to Infrared's idea, HoneyPot Finance also provides a set of BGT staking solutions that degrade Berachain's PoL into PoS, which is more familiar to users. Different from Infrared's idea of absorbing users' liquid assets and giving users iBGT liquidity certificates, HoneyPot Finance receives the BGT entrusted by users through platform currency bribery, and encourages users to use the liquidity provided by the bribe platform currency through revenue governance. sexual pool, obtain BGT emissions, and form POS. In addition, HoneyPot Finance has also launched Launchpad for the fair launch of long-tail assets, and the Batch AMM model to optimize long-tail asset transactions, aiming to become a liquidity infrastructure for long-tail asset issuance transactions on Berachain.

source: https://docs.honeypotfinance.xyz/v/zh-cn/overview/map

In addition to the above-mentioned DeFi Protocol, there are still a number of high-quality protocols in the Berachain ecosystem that are still under construction but have not yet disclosed product details, which are worthy of attention, such as

Supports any supported money market protocol Gummi

Commodities, RWA Protocol Wakalah on Berachain

oracle-free derivatives platform Exponents on Berachain

0DTE options AMM platform IVX

DEX trading aggregator OOGA BOOGA

Smilee Finance, an options protocol that provides up to 1,000 times leverage, no liquidation, and impermanent returns

Intent-centric order flow aggregator and modular intelligent liquidity routing platform Shogun

100% on-chain non-custodial multi-strategy hedge fund protocol D^2 Finance

….

NFT Ecology

NFT Collection

Bong Bears

Berachain originated from the Bong Bears NFT Collection. On August 27, 2021, the three anonymous founders of Berachain released the Bong Bears NFT Collection, which consists of 100 unique bears. The subscription process is also different from other NFTs. Each NFT is priced at 0.069 ETH, and buyers can view specific bears on OpenSea to subscribe before purchasing.

Bong Bears NFT also proposed the concept of Rebase NFT, and subsequently rebased four different NFT Collections: Boo Bears, Baby Bears, Band Bears and Bit Bears.

The extremely high user stickiness of the early Bong Bears community allowed the price of Bong Beras NFT to rise all the way, gradually rising from 0.069 ETH to over 50 ETH, even if Berachain did not disclose any relevant information to the outside world. With the disclosure of Berachain’s financing information, holding Bong Bears NFT is also regarded as the best option to win the Berachain airdrop. The listing rate of Bong Bears NFT immediately dropped rapidly. Currently, it has formed a state of price and no market, and the floor price has reached 200 ETH.

source: "Proof of Liquidity" Project Berachain Launches Public Testnet, Artio (investingcube.com)

The Honey Jar

In addition to the official Bong Bears NFT Collection, the most popular NFT Collection and community on Berachain is The Honey Jar. The Honey Jar is the traffic entrance of the Berachain ecosystem. Before Berachain was publicly publicized, The Honey Jar began to help Berachain operate related online and offline activities and its own The Honey Jar community. The Honey Jar is not only the traffic entrance of the Berachain ecosystem, but also responsible for user education for users of the Berachain ecosystem. In addition, The Honey Jar itself, as a community, also operates incubation and cooperation matters with other projects in the Berachain ecosystem.

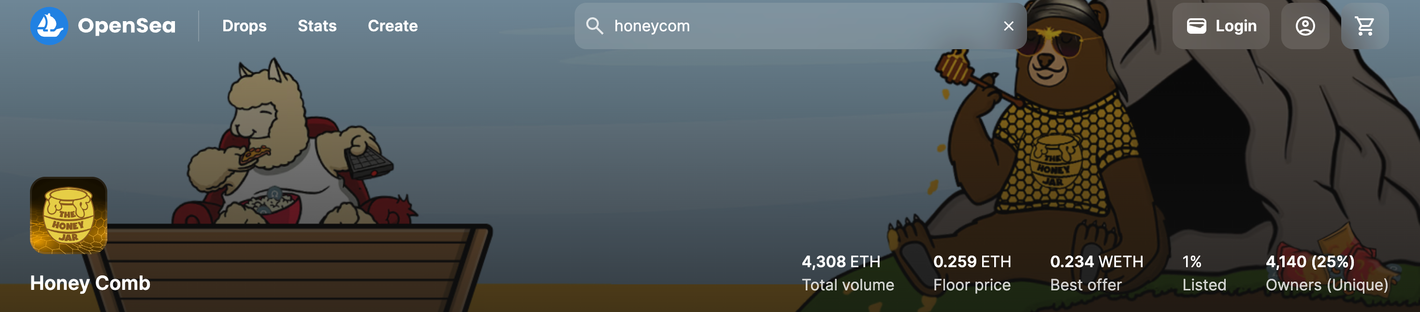

The Honey Jar also launched its own NFT series, Honey Comb NFT. As an NFT project of Berachain's core community, holding Honey Comb NFT can enjoy additional benefits brought by The Honey Jar's partners, such as NFT whitelist casting opportunities, additional mining revenue improvements, etc. At present, the transaction volume of Honey Comb NFT on OpenSea has reached 4.3k ETH, the floor price is about 0.25 ETH, and the listing rate is only 1%, which also reflects the extremely high user stickiness of The Honey Jar community.

source: https://opensea.io/collection/honey-comb-2

NFT Protocol

Goldilocks

Goldilocks is a comprehensive DeFi + NFTFi platform on Berachain. Goldilocks can provide NFT-based lending services to users on Berachain. The features of Goldilocks NFT lending service are: (1) The base price of the NFT Collection is determined by voting by holders of its governance token LOCKS, and there is no need to rely on oracles to feed prices. (2) NFT loans are priced in iBGT. Users can provide BGT to the lending pool and obtain liquidity certificates GiBGT. While enjoying the loan interest income, users can also use GiBGT to further participate in other Berachain ecosystems.

Kingdomly

Kingdomly aims to be Berachain's native OpenSea. For C-side users, Kingdomly can provide users with NFT casting, sales, trading and leasing services. For B-side users, Kingdomly supports users to quickly deploy NFT Collection and seamlessly complete NFT issuance. Kingdomly has reached a cooperation with Honeypot Finance and completed the issuance of Honeypot Finance Genesis NFT.

Protecc

Protecc is a comprehensive NFTFi platform. Protecc aims to become a one-stop NFT trading market that can provide NFT AMM for traders to trade at any time, provide NFT OTC and bulk trading platforms, support whale trading, provide NFT automatic income strategy vaults to help users automatically earn income, and Provide cross-chain NFT trading robots and other products.

Gumball Protocol

Gumball Protocol is an innovative NFT Launchpad and AMM protocol. In Gumball Protocol, each NFT Collection will have a corresponding token and underlying assets corresponding to it, allowing users to trade NFTs in a timely manner. By combining fragmented NFT assets and underlying assets to form liquid trading pairs, Gumball Protcol supports users' immediate buying and selling needs for NFT transactions.

source: https://www.gumball.fi/collections/arbi/0x794075aef95d9bd7e5cfd0ea8a1e68493b7e0e23/buy

GameFi Ecosystem

BeraTone

BeraTone is a multiplayer online open world role-playing game inspired by "Animal Crossing" and centered on farming. Each player has his own piece of land, allowing players to freely customize and expand the land. Players can grow crops, collect resources, raise animals and livestock, and trade with other farmers. BeraTone is also an evolving virtual world based on 3D aesthetics. In addition to basic planting and gathering activities, players can also explore the rich virtual world, interact with various characters, complete tasks, upgrade, and solve problems. Different game puzzles gradually reveal the mystery of BeraTone.

BeraTone also released its creation NFT BeraTone Founder's Sailcloth in 2024.1, with a casting price of 0.1E. The current floor price is close to 1E, the total transaction volume reaches 355E, and the listing rate is only 3%. Although BeraTone has not yet been released, the hot performance of its NFT in the secondary market also reflects the market's high expectations for BeraTone as a BAB incubation project.

source: https://opensea.io/collection/beratone-founders-sailcloth

Beramonium

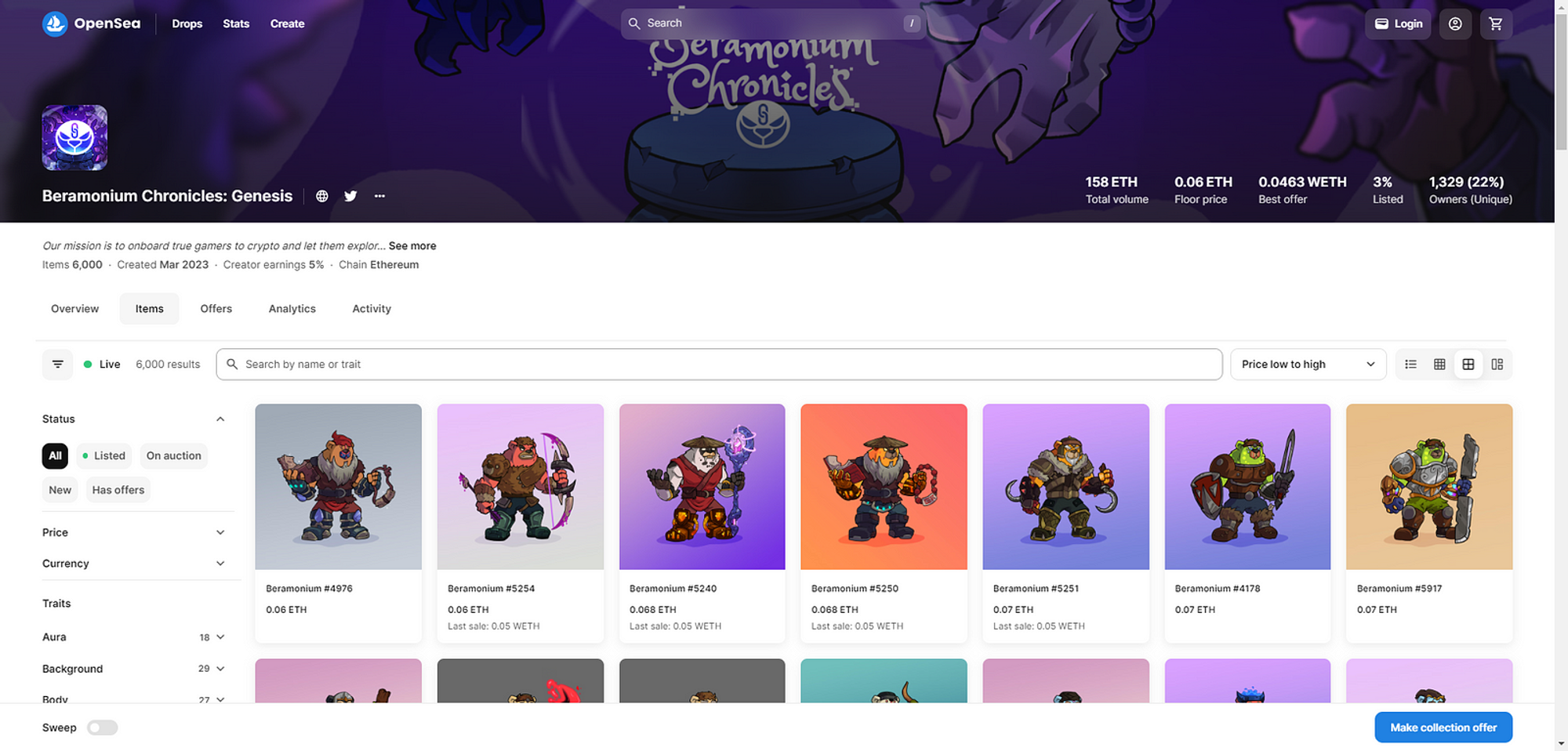

Beramonium is an ARPG chain game on Berachain. They released an action role-playing game called Gemhunters. In this game, players can have their Beramium Genesis beras explore dungeons, challenge bosses, and perform tasks to obtain gems, which can be exchanged for NFTs from other well-known Berachain projects, such as Honey Combs, Beradoges, and other NFTs. The current floor price of Beramonium's creation character NFT is about 0.06 ETH, the total transaction volume reaches 158 ETH, the listing rate is only 3%, and the overall gaming community is very active.

source: https://opensea.io/collection/beramonium-chronicles-genesis

Meme

BabyBera

BabyBera aims to become a three-in-one ecosystem of NFT + Yield Farming + Meme Coin on Berachain. BabyBera will be released in three phases, firstly NFT issuance, secondly Yield Farming, and finally $BBBERA Meme Coin issuance. All $BBBERA will be issued as liquidity mining rewards in the Yield Farming stage to ensure The users of BebyBera are all loyal Degen users with ultra-high stickiness to realize the vision of building $BBBERA into the premier Meme Coin on Berachain.

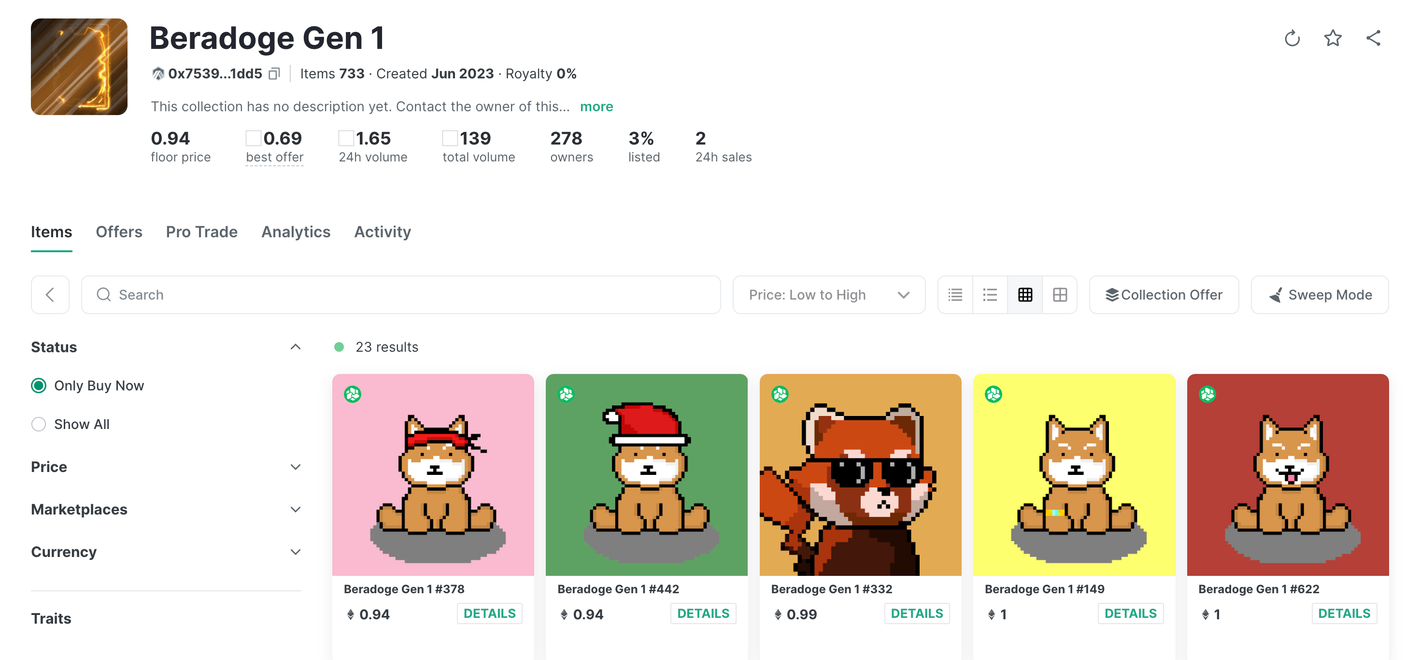

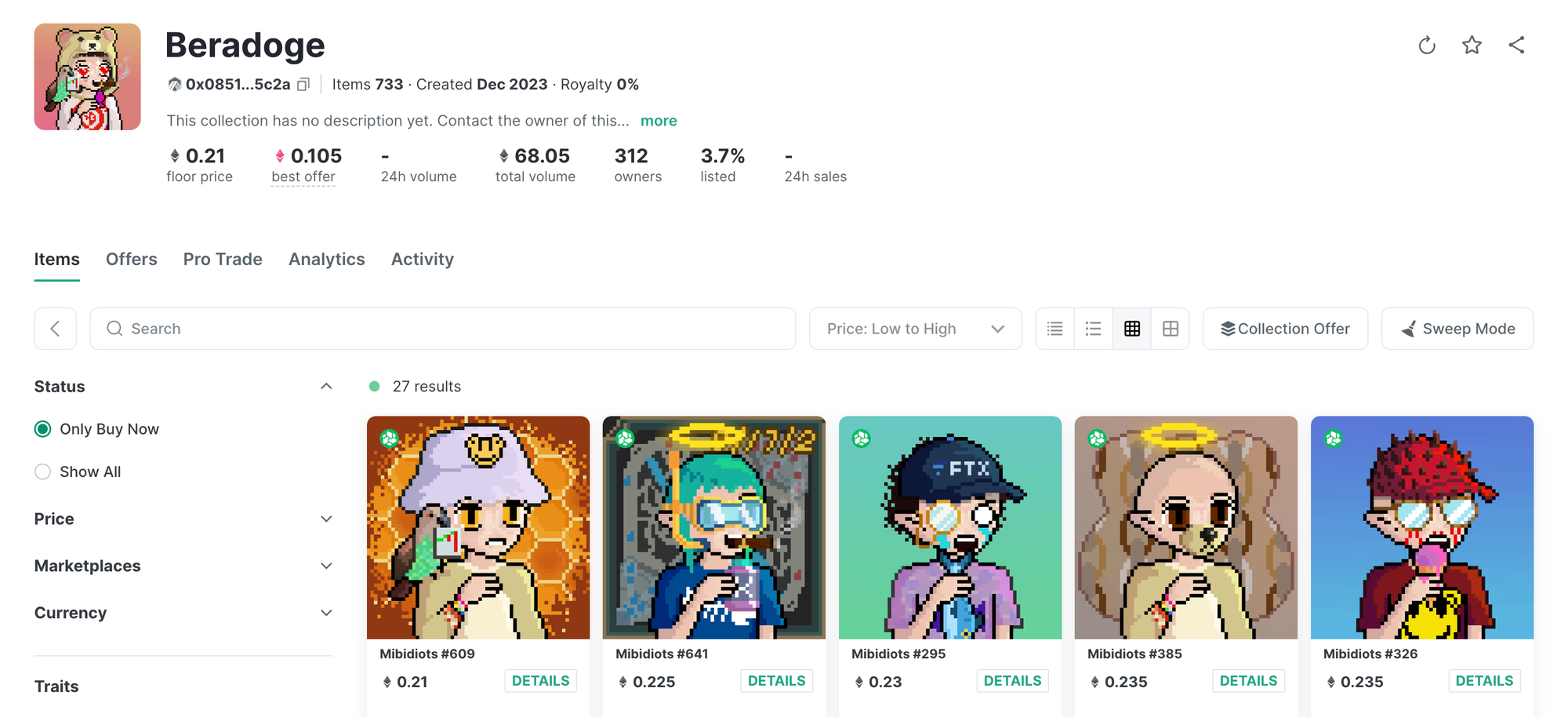

BeraDoge

BeraDoge is another major Meme project of Berachain. The project has two NFT collections, namely Beradoge Gen 1 and Mibidiots. Holding these two series of NFTs will be promised "a lot of useless stuff" or "a lot of useless BDOGE". In addition, there are also rumors that BeraDoge will also issue a DeFi platform of its own.

source: https://element.market/collections/beradoge-d51393

Ecological summary

At present, official components are still one of the most important infrastructures of the Berachain ecosystem. In addition to official components, the DeFi ecosystem on Berachain has shown three different development trends:

(1) Supplement the long-tail market that cannot be reached by official components;

(2) Innovate around the PoL mechanism, BGT and vote-buying;

(3) There are also a large number of high-quality DeFi projects attracted by the PoL mechanism and siphoned into the Berachain ecosystem;

Judging from the current DeFi ecology on Berachain, it is indeed as the official thought. After the official made the most basic but important DEX, Lending and Perps components, there will no longer be a large number of homogeneous projects that continue to reinvent the wheel. Wheels, play Vampire Attack. On the contrary, the existence of official components forces DeFi projects to explore actual innovation points and make higher-level innovations based on existing businesses.

At this stage, in terms of project quality, the quality of the projects incubated by the Build A Bear incubator is relatively higher, followed by the external high-quality projects introduced by Berachain. The quality of the native community projects on Berachain is slightly uneven and slightly inferior.

As mentioned above, because the public chain Berachain itself has its own NFT culture, the issuance and management platform and liquidity protocol for NFT will also be an extremely important part of Berachain.

At present, the games and Meme ecology on Berachain are still in a very early stage of development.

Investment Opportunities

Focus on high-quality DeFi protocols on Berachain

Berachain's PoL mechanism will have great appeal to high-quality DeFi protocols. Moreover, there are fewer vampire attacks on Berachain, and high-quality leading DeFi protocols can enjoy greater traffic exposure in their sub-divided tracks, and are expected to gain higher TVL, traffic and user support. More centralized liquidity will also further improve the protocol’s experience. We expect that on Berachain, the leading effect will be more obvious, and leaders in subdivided tracks will also receive higher valuation premiums. Therefore, early participation in high-quality segmented leading DeFi projects must be the best choice to enjoy the Berachain market premium.

Focus on innovative infrastructure around Berachain’s PoL mechanism, BGT mechanism and vote-buying mechanism

The biggest difference between Berachain and other public chains is its innovative PoL mechanism and three-token model. In addition to replicating the gameplay that other public chains have, there will inevitably be some projects on Berachain that innovate on the adaptability of the PoL mechanism and the three-token model at the underlying infrastructure level. The direction of innovation can be to follow Infrared and transform PoL, which is less familiar to market users, into PoS, which is more familiar to the public, so that the liquidity certificate tokens it issues can gain greater market adoption. Or we can start from the BGT mechanism and the vote-buying mechanism, innovate around the user's delegation rights, income rights, and vote-buying rights at the token model level, and combine it with Berachain's vote-buying mechanism to bring more composable gameplay. Innovations at the infrastructure level around the Berachain PoL mechanism and the three-token model are expected to create the protocol's own ecological moat and shape its own ecological barriers.

Optimistic about the NFTFi ecosystem that can combine NFT and DeFi

Unlike other public chains, NFT is also an important liquidity component on Berachain. How to release its liquidity around NFT and how to combine NFT gameplay with DeFi gameplay on Berachain is also one of the topics worth exploring on Berachain. Although the NFTFi protocols of other chains have not generated much sparks, the NFTFi protocol on Berachain is expected to capture sufficient liquidity and has a better chance of achieving substantial development. The income strategies and income treasury derived from the NFTFi protocol can also be combined with mechanisms such as node bribery to make the NFTFi protocol more flexible.

Optimistic about L2 based on Berachain and its related infrastructure

The popularity of the Berachain test network at this stage also reflects the market's strong expectations for Berachain to a certain extent. With the launch of the Berachain mainnet, and with the support of the PoL mechanism, Berachain is expected to replicate the prosperous Ethereum DeFi Summer. Although Berachain is positioned as a high-performance L1 public chain, Berachain also has scalability requirements in the face of massive traffic influx and high-frequency on-chain interactions. Moreover, once Berachain starts its forward flywheel, the increase in BGT price will also increase Berachain's interactive gas fees. Therefore, Berachain also has the need to reduce costs and increase efficiency. In summary, we predict that some Berachain super DeFi applications and applications with high-frequency interaction requirements such as GameFi and SocialFi will develop their own L2 based on Berachain for capacity expansion in the future. Based on this logic, we will continue to be optimistic and pay attention to L2 based on Berachain and its related infrastructure ecology.

Summarize

Liquidity has always been the most important topic in the crypto space. All Tokens, Grants, and Points ultimately compete for users and liquidity. Without liquidity as a foundation, no matter how complete the ecology and infrastructure are, they are just castles in the air.

Berachain is expected to become a solution to the liquidity dilemma of public chains. Through its original PoL consensus mechanism and three-token model, Berachain will siphon the liquidity of other public chains and become the liquidity center of the EVM ecology and Cosmos ecology. The solid liquidity can not only bring financial support to Berachain, but also bring more developers, users and market attention to Berachain. Berachain is expected to become a new infrastructure that carries massive Crypto liquidity, make liquidity, and make DeFi great again!

Finally: MT Capital is very optimistic about the future development of Berachain and welcomes early projects and entrepreneurs in the Berachain ecosystem to contact us at any time.

(Twitter: @0X_IanWu, @Severin0624, MT Capital Email: deck@mt.capital)

Reference

Welcome to Polaris Ethereum – Polaris Ethereum Docs (berachain.dev)

Berachain — The Convergence of a Strong Community and Experimental Endeavors | DeSpread Reports

Berachain - Innovating the Approach to L1 Building | blocmates.

Berachain: Building Sticky Liquidity - by Pavel Paramonov (shoal.gg)

https://twitter.com/berachain/status/1749522523895570700?ref=research.despread.io

https://twitter.com/burstingbagel/status/1565705660888596481

MT Capital

MT Capital is a global investment institution managed by a team of experienced investors. It focuses on investing in innovative Web3 projects around t