Jupiter as the Gateway to Solana DeFi

Decentralised Finance (DeFi), no matter the ecosystem within which it operates, is built upon the foundational building block of being able to swap assets at a price determined by the market. I like to think of the protocol that facilitates the majority of swap volumes as the gateway to its respective ecosystem.

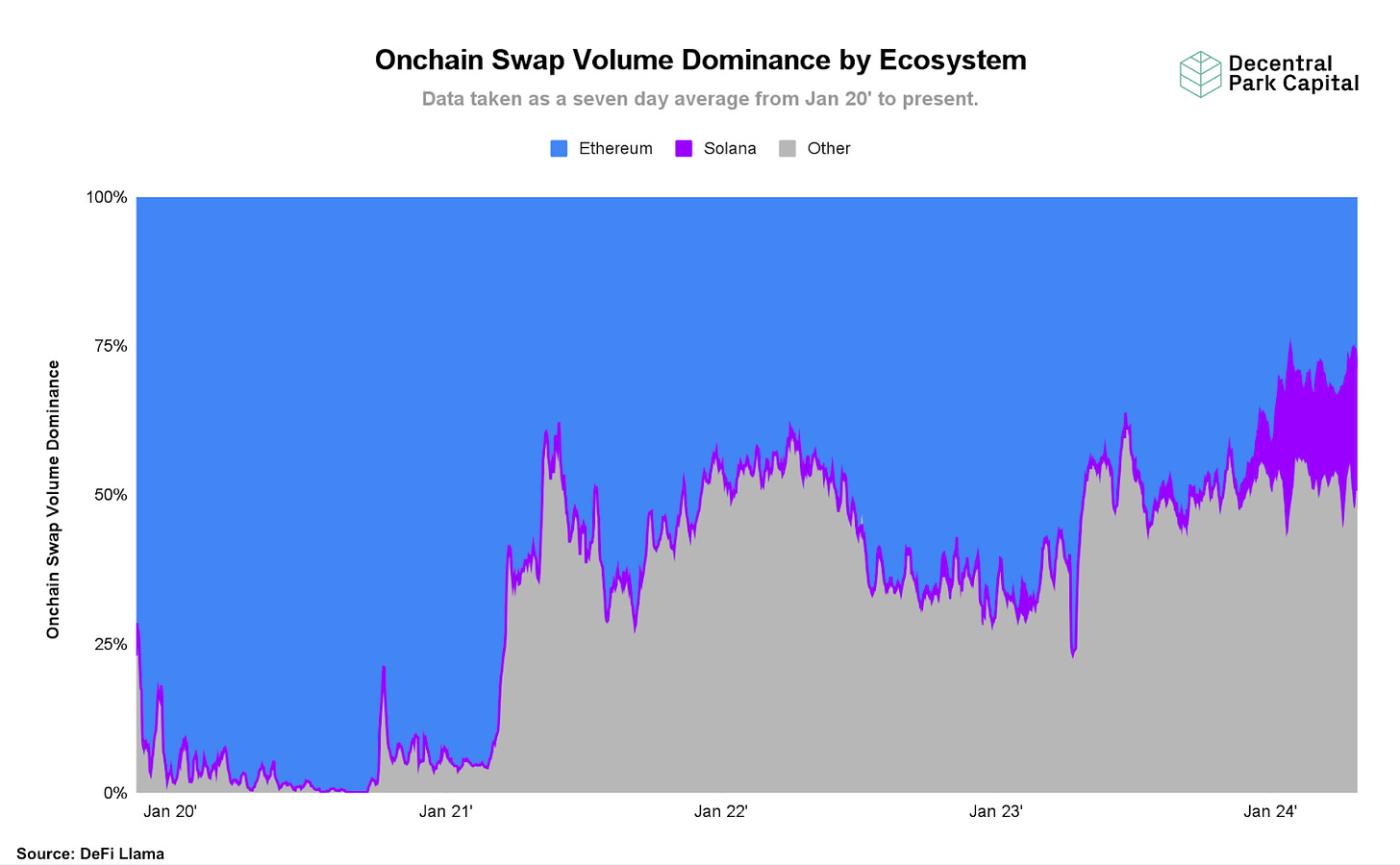

Historically, the majority of DeFi swap volumes have occurred in the Ethereum ecosystem, for which the dominant interface, and therefore its ‘gateway’ is Uniswap, a Decentralised EXchange (DEX).

This dominance has been gradually declining, with the Solana ecosystem in particular gaining market share over the past six months. In the Solana ecosystem, rather than the leading DEX being the dominant gateway for transaction volumes, it is a DEX aggregator.

For context, a DEX aggregator is simply a service that unifies liquidity from various DEXes and allows users to swap between multiple liquidity pools in what is one simple transaction to the user, to find an optimal price for a trade.

The reason behind Solana’s gateway being a DEX aggregator, while Ethereum’s is a DEX, boils down to transaction fees. In the Ethereum ecosystem, particularly Ethereum mainnet, transaction fees are relatively high. Given that DEX aggregators frequently require multiple transactions behind the scenes to achieve an optimal price, on Ethereum mainnet introducing more than one transaction cost generally outweighs the economic benefit of achieving this optimal price.

On the other hand, in the Solana ecosystem transaction fees are relatively low, so executing multiple transactions to route a trade through many markets is affordable for the end user, and ultimately the savings from finding an optimal price outweigh the cost of multiple routing transactions.

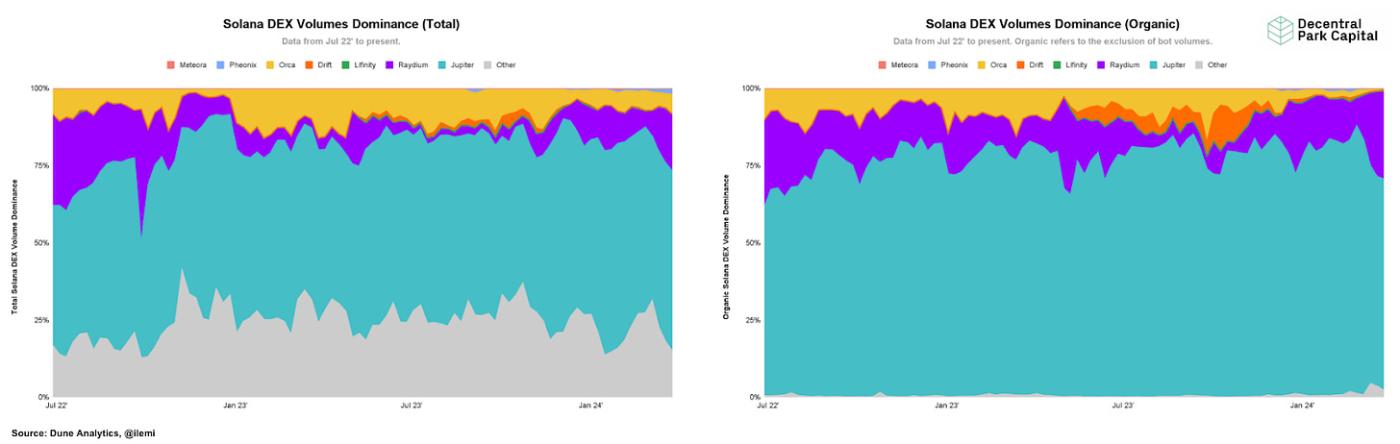

59.4% of Solana DEX volumes flow through Jupiter as a gateway, over 2x the second largest protocol by DEX volumes. With bots removed, i.e. prominent bots like BonkSwap, this figure jumps to 69.1%.

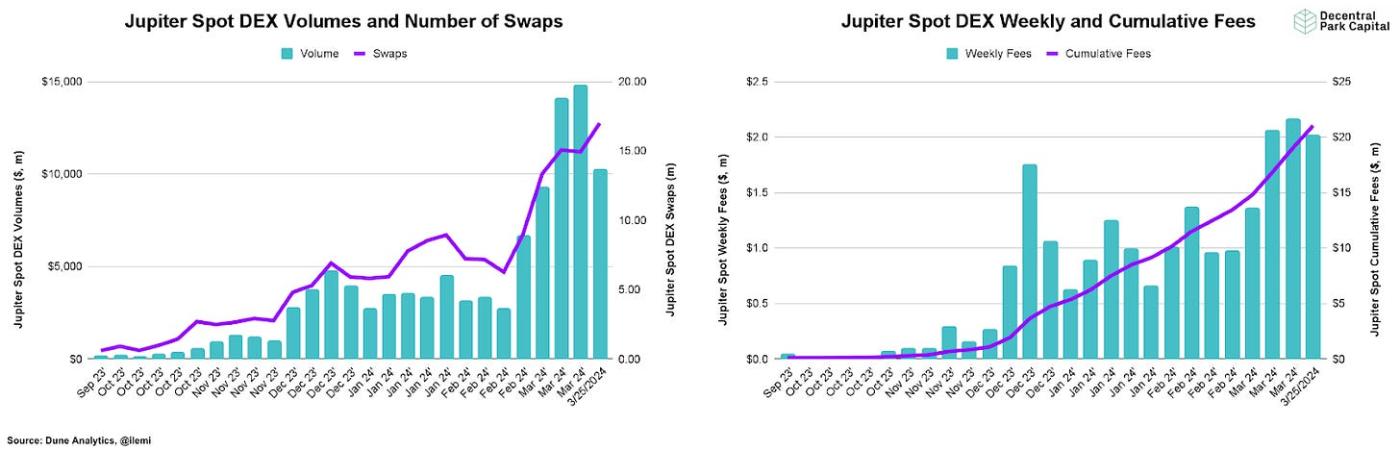

The week before last saw the largest week in Jupiter history for spot DEX volumes, reaching an ATH of $14.8b. This equated to ~15m swaps, with fees generated by the Jupiter spot DEX product amounting to ~$2.2m for the week. Note, that this does not equate to Jupiter revenue, with the protocol receiving 2.5% of these fees.

The picture I’m attempting to paint with the above analysis is that Jupiter is the most important protocol in Solana DeFi, which is the fastest-growing DeFi ecosystem. If you’re interested in Solana DeFi, and arguably DeFi at large, either from a research or building perspective, you should care deeply about everything Jupiter does.

With this in mind, last week I was able to sit down with Siong, co-founder of Jupiter, to discuss the future of the protocol with a particular focus on a relatively new product to the protocol's growing arsenal.

Expanding Jupiter’s Horizon: the Perpetual Exchange Product

If you’ve spent time in any DeFi ecosystem over the past few years, I’m sure you’ll be well aware of the leverage facilitating product known as perpetual futures, or as they’re better known ‘perps’.

In case you haven’t, perps are a financial instrument that allows traders to speculate on the future price of an asset without an expiration date, and without having to own or deliver the asset.

Native DeFi users, particularly degens, love leverage and love risk, it’s in their blood. So it comes as no surprise that perps have become extremely popular within both CeFi and DeFi, with degens often utilising maximum leverage in what can reach up to 100x.

Late last year, Jupiter expanded its product offering by launching its own perp exchange.

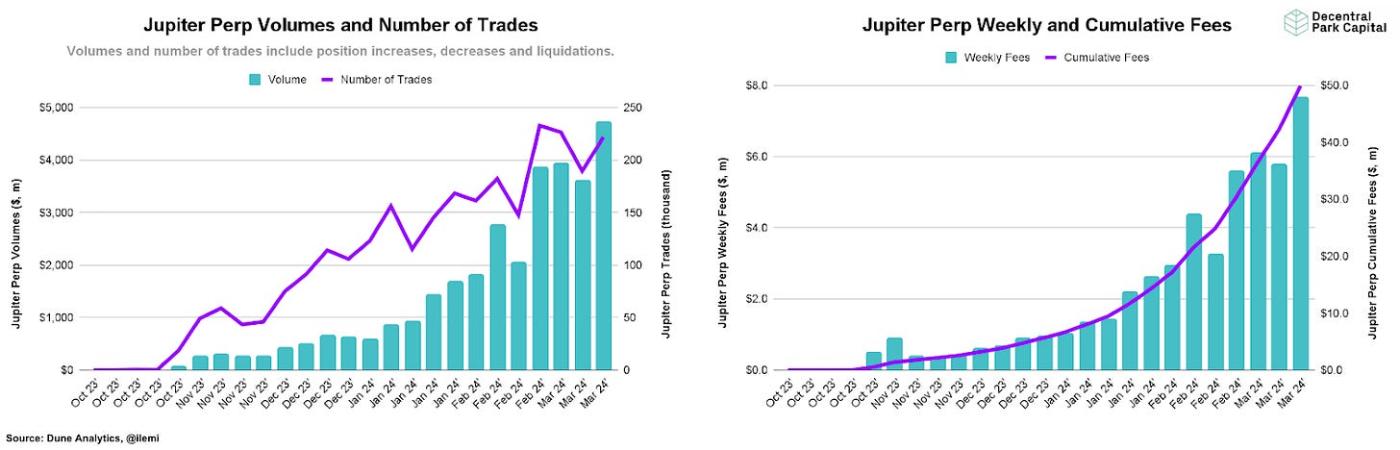

The product remains in beta today, offering Perps on only SOL, wBTC and ETH, although it has already facilitated over $32b in volume, in just under two months. This has been facilitated in only ~3m trades, amounting to $50m in total fees generated for Jupiter, of which ~$8m were generated in the last week alone. Note, that the Jupiter protocol takes a much higher portion of these fees generated as revenue relative to their spot product, at 30%.

Unlike the traditional order-book model, utilised by the majority of perp exchanges offchain, Jupiter’s perp exchange leverages a novel LP-to-trader model. By this, I am referring to the Jupiter LP (JLP) pool.

For required context, I’ll briefly explain how the JLP works. JLP is a pool of assets that includes SOL, ETH, wBTC, USDC and USDT. Holders of these assets can deposit them into the JLP pool, and in return earn a portion of the fees generated by trading Jupiter perps. The pool then acts as liquidity for trades on the Jupiter perp exchange, so LPs essentially act as a counterparty to traders. When a trader seeks to open a leverage position, they are borrowing tokens from the pool.

JLP holders not only earn an APR from depositing to the pool, which is a portion of the fees generated (more on that later) but are also able to borrow against their collateral in protocols such as Kamino.

Jupiter’s perp product can achieve zero price impact, zero slippage and deep liquidity, through the use of the JLP and integration to a leading oracle network, which ensures stable markets through liquidations and stop-loss events.

While the model is fairly novel, the result to users is an experience they’d expect of an established perp exchange on, say, a leading CEX. There are however areas in which Jupiter goes above and beyond. The primary example of this is that Jupiter taps into synergies between its flagship product offering and the perp exchange to dramatically its user experience for perp traders.

By utilising the Jupiter swap integration, any Solana-based token can be used to open a position. While this is simple for Jupiter, merely executing a swap of two tokens on the back end, it reduces the steps required of traders to enter a trade. This type of bottleneck reduction is precisely the marginal improvement that results in larger trading volumes from users.

A Side-Piece in Jupiter’s Product Arsenal or a Money Printing Machine?

So, by now you understand Jupiter, its importance to the Solana ecosystem, and its new perp product, but why exactly should you care about the perp product specifically, and why would Jupiter expand from swaps to derivatives?

Derivatives volumes outweigh that of spot volumes. In 2024 alone onchain derivative volumes have outpaced spot volumes across all chains by 1.3x. This may sound intuitive given the inherent leverage in perps, but this is a relatively new phenomenon onchain due to technical developments, and a trend I believe is only set to continue.

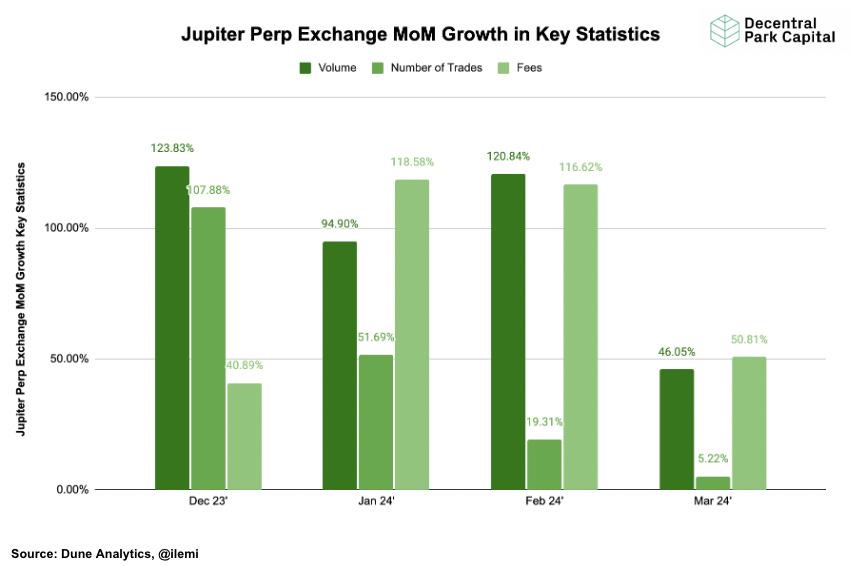

This shift from spot to derivatives dominance is evident in Jupiter’s perp exchange MoM growth statistics, which show that this product is growing, and fast. So fast in fact that it’s impossible to ignore as a product analyst. In the past four months alone, Jupiter has printed a monthly minimum of 46.05% and 40.89% growth in volumes and fees respectively.

In conjunction with this, we’ve seen Solana’s share of onchain derivative volumes increase from ~6% to ~10% from January to the present while Jupiter has maintained dominance of Solana derivative volumes at ~66%. This has equated to growth in Jupiter’s total onchain derivatives dominance from ~4% to ~7%.

Higher volumes and the ability to liquidate overleveraged positions result in higher fee-generating potential for derivatives protocols. By bolting the leading Solana perp exchange onto its leading spot swap venue, Jupiter has created a fee-generating beast.

This is one of the primary reasons you should care about the Jupiter perp exchange product, it is now responsible for ~80% of fees generated by the Jupiter protocol. To contextualise this for you, the total Jupiter generated fees last week totalled $9.8m, which annualises at $510m, $397.6m of which the perp exchange product would be responsible for.

In terms of revenue for Jupiter, this equates to $2.3m last week alone, at 2.5% of spot fee takehome, and 30% of perp fee takehome. This annualises at $122.1m.

Now, as mentioned, the economics of the Jupiter perp exchange vary from their spot product. The JLP pool receives 70% of the trading fees generated by the perp exchange product, which forms an APR for all JLP holders. This amount is directly reinvested into the JLP, increasing the price of JLP, and facilitating continuous compounding of yield and earnings. As I write this, the JLP APR, which as a reminder is simply exposure to SOL, ETH, wBTC, USDC and USDT, sits at a whopping 124.25%. In my opinion, this is one of the best risk-adjusted yields in DeFi today.

This wall of fees generated by the protocol makes the protocol materially more valuable. Interestingly though, since JUP TGE, which roughly coincides with the pick-up in perp exchange fees, the amount of JUP Market Capitalisation (MCap) per unit of daily fees generated has declined from ~$1.5k to ~$920. While this could be perceived as a cooling off of valuation multiples for JUP post-TGE, I instead think the hidden driver is a lack of understanding of the recent fruitfulness of Jupiter's perp exchange by the market.

I believe this for a few reasons, firstly, Jupiter’s perp exchange product remains in beta, and from conversations I am having with investors in the space, it is not yet as well understood or talked about as I would expect it to be.

Moreover, we have seen an uptick in MCap/Daily Fees since it bottomed out at ~$540 on the 8th of March. A reversal in decline of this metric to now growth of this metric shows the market correcting itself, which I take as early indications of market participants pricing in Jupiter’s perp exchange.

Fee generation from the new product started to kick in around February 24’, coinciding with a peak in JUP Mcap per unit of fees generated. As the market lag corrects itself, I believe JUP Mcap per unit of daily fees generated will revert to this peak, at ~$1.3k MCap per unit of fees generated. Market sentiment could see us push above this level, though I believe this to be a fair valuation multiple.

For a brief comparison, Uniswap currently sits at $1.93k on an MCap/Daily Fees ratio.

Aside from generating fees, it’s important to highlight that Jupiter’s perp exchange product also cements Jupiter’s dominance as the gateway of the Solana ecosystem. The introduction and success of this product future-proofs Jupiter’s relevance to volumes onchain, whether they flow predominantly through derivatives as forecast, or continue to flow through spot.

How Jupiter Will Scale it’s Perpetual Exchange Product

When looking at the mindblowing figures that Jupiter’s perp exchange product has been throwing up to date, it's easy to forget that this is a product in beta, with trading limited to only three key assets.

The question then becomes, what does this beast look like once the training wheels are off?

The obvious growth direction is that adding more assets increases the trading volume potential of the platform. This is particularly true of certain assets, such as memecoins, which dominate spot volumes onchain and will be expected to drive derivative volumes onchain too.

Co-founder of Jupiter, Siong, echoed this, “Solana has the upper hand across all chains in terms of memecoins, BONK brought a lot of value, and so did WIF. It is expected that memecoins will drive Perp volumes going forward, and we anticipate the memecoin dominance will continue for the next six months to a year.”

So, if the addition of new assets to the perp exchange product is the primary growth driver, what does the path to addition look like?

“You can think of the next phase of asset rollout on Jupiter as occurring on a pool-by-pool basis,” said Siong, “Just as we have JLP, we could look to launch a secondary pool. JLP is our low-risk pool, so it makes sense to next roll out a medium-risk pool that includes the likes of JUP, JTO and PYTH.”

The cycle could then continue, and further pools, segmented by category or risk level, could be deployed. By launching new pools, as opposed to expanding the JLP, it allows Jupiter to separate out the risk, both to the protocol and to LPs.

There are of course considerations that may limit the speed at which pools can be added, and thus volumes can grow. The primary consideration is whether there is sufficient liquidity in the tokens to be included in a pool, with Siong citing CEX liquidity as particularly important. This can help us as forecasters predict the next pools to be launched and the impact such tokens may have on the protocol.

While JUP, JTO and PYTH have deep liquidity on both Coinbase and Binance, making them good candidates for the next pool, anticipated volumes will be lower than those that could be generated on memecoins, which have fewer tier-one CEX listings. Should we see a WIF Coinbase listing, and a POPCAT Binance and Coinbase listing, for example, this could pave the way for a BONK, WIF and POPCAT pool.

There are also considerations outside of liquidity, such as volatility, oracle coverage etc. Jupiter has recently signed Gauntlet, an industry leader in quantitative optimization of DeFi risk, to ensure the protocol optimises risk parameters, which strengthens the protocol as a whole, but could slow the speed of deployment of new pools.

So, additional pools will be the primary volume growth driver, but does Jupiter have the capacity to handle further volumes?

According to Siong,” The current design for Jupiter has the capacity for volumes to increase 5-10x with the addition of new pools.” Note, this could increase further with both Firedancer, a new Solana client that is forecast to increase TPS significantly, and 1.18, a Solana upgrade with key improvements to the scheduler for transaction efficiency and prioritisation optimisation.

It is also more than possible that volumes continue to increase before the addition of new pools, given the recent acceleration in volume growth has sustained. This is a function of the increased demand for risk onchain, the increased demand to transact in the Solana ecosystem over alternative ecosystems, and liquidity depth in the JLP pool.

Is a driver for onchain derivatives volumes the migration of volumes from offchain venues such as CEXes?

While growth is trending in favour of onchain derivatives, “competing with offchain shouldn’t be the idea,” says Siong, “Speed is a major issue, not only is there is higher latency onchain, but there’s also a delay in oracles, which are still slow relative to offchain solutions. Liquidity used to be a problem, but this has improved a lot in the past six months.”

To fix these issues, advancements in oracle design are required, which Jupiter is researching alongside leading oracle providers. Perhaps once this has been achieved, migration of volumes offchain to onchain will be a driver of growth for onchain volumes, but until then, it will be native onchain capital.

Final Thoughts

Jupiter has already established itself as the go-to DeFi protocol in the Solana ecosystem with its DEX aggregator product. Bolstering this product offering with a differentiated product in the perp exchange allows Jupiter to maintain its dominance of Solana transaction volumes.

I am excited to see what Jupiter develops in the future, and frankly think that as the gateway to Solana, they are crucial to Solana DeFi’s success.

If you’d like to engage for more frequent thoughts or reach out for discussion, you can find me on Twitter at @0xbenharvey, or simply click the button below.

About the Author

Ben is an investment analyst at Decentral Park, investing within their liquid token fund across DeFi and infrastructure.

Prior to this, Ben worked at Wellington Management, in both their Fixed Income and Risk Management departments. Ben also spent time with Hedge Fund Max Giant Capital in Hong Kong, where he sat on the Forex desk.

You can follow Ben on Twitter at @0xbenharvey for more frequent analysis and updates.