The frequency with which Bitcoin retests support and immediately bounces back in the Derivative market suggests that its price is unlikely to fall to $50,000.

Senior analyst at digital asset fund UTXO Management, Dylan LeClair, explained in an analysis article on April 7 that if Bitcoin rises back to the $70,000 – $75,000 price range, it will put pressure on significantly on short positions.

According to data from CoinGlass, if the Bitcoin price rises to $70,000, about $174.17 million will be liquidated.

.png)

If it reaches the upper limit of LeClair's range, when it hits $75,000 about $830 million worth of short positions will be liquidated.

That means an increase of about 7.8% compared to Bitcoin's current price of $69,344. Similarly, the opposite percentage change of 7.5% to the downside occurred on March 15, resulting in $525.2 million in liquidations.

LeClair explained that a Bitcoin price drop to $50,000 (a 27% drop) could cause a massive liquidation of long positions, but the probability of that happening is currently quite low XEM the correction. Recent price correction with increasing support levels.

“Given the correction structure of higher short-term Dip and currently no signs of selling in the Derivative market, I find it highly unlikely that we will return to that level,” LeClair said. But it's not impossible!"

Bitcoin price last fell below $50,000 on February 13, hitting $49,725.

Just one day before, on February 12, BTC hit $50,000, a peak last seen in December 2021.

LeClair backs up his claims by citing global asset management group BlackRock's recent boom in updating its Bitcoin exchange-traded fund (ETF) prospectus on April 5, adding adds five major Wall Street firms as new authorized participants.

New members include ABN AMRO Clearing, Citadel Securities, Citigroup Global Markets, Goldman Sachs and UBS Securities

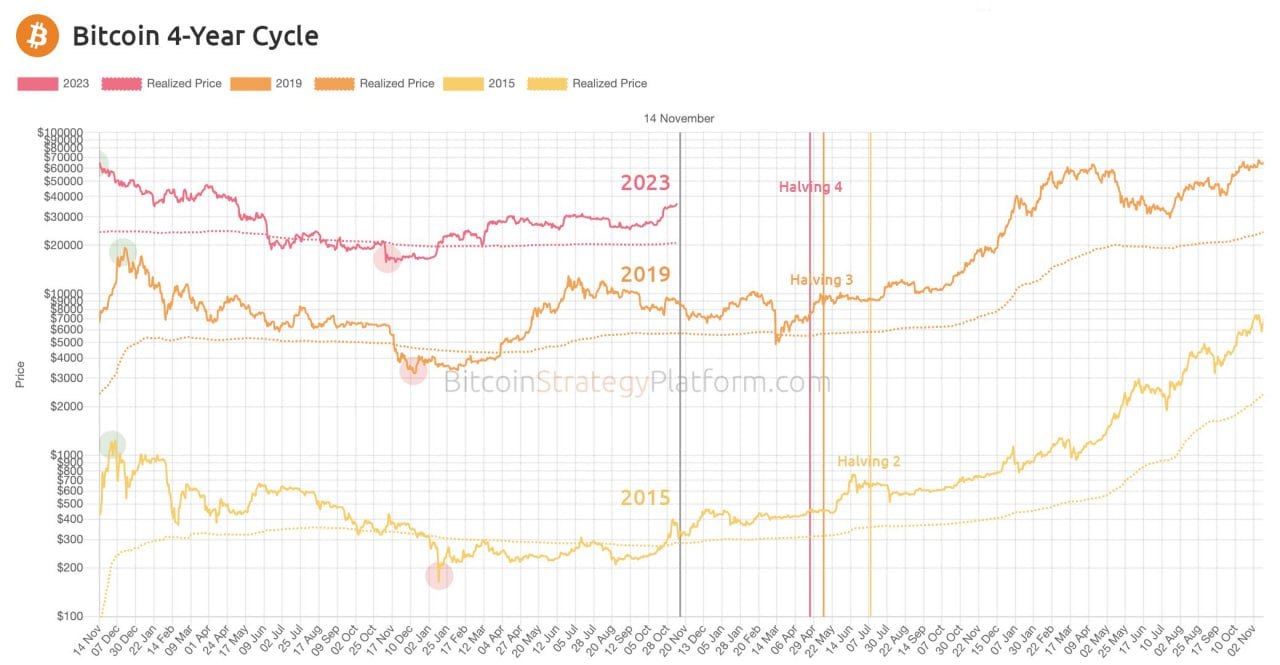

Besides, speculations about the price of Bitcoin before the halving event are taking place very enthusiastically. The halving will take place on April 20, only 13 days from now. This event takes place every four years and will cut miners' block rewards by 50% from 6.25 BTC to 3.125 BTC per block.

Bitcoin is currently up about 658% since the last Bitcoin halving in 2020. If the historical cyclical pattern repeats, the Bitcoin price will reach $434,280 by the 2028 halving.

Bitcoin is currently up about 658% since the last Bitcoin halving in 2020. If the historical cyclical pattern repeats, the Bitcoin price will reach $434,280 by the 2028 halving.

VIC Crypto compiled

Related news:

SEC calls for public comments on Ethereum ETF applications by Fidelity, Grayscale and Bitwise

SEC calls for public comments on Ethereum ETF applications by Fidelity, Grayscale and Bitwise

The amount of Bitcoin in BlackRock's Bitcoin ETF may soon surpass Grayscale in less than 3 weeks

The amount of Bitcoin in BlackRock's Bitcoin ETF may soon surpass Grayscale in less than 3 weeks