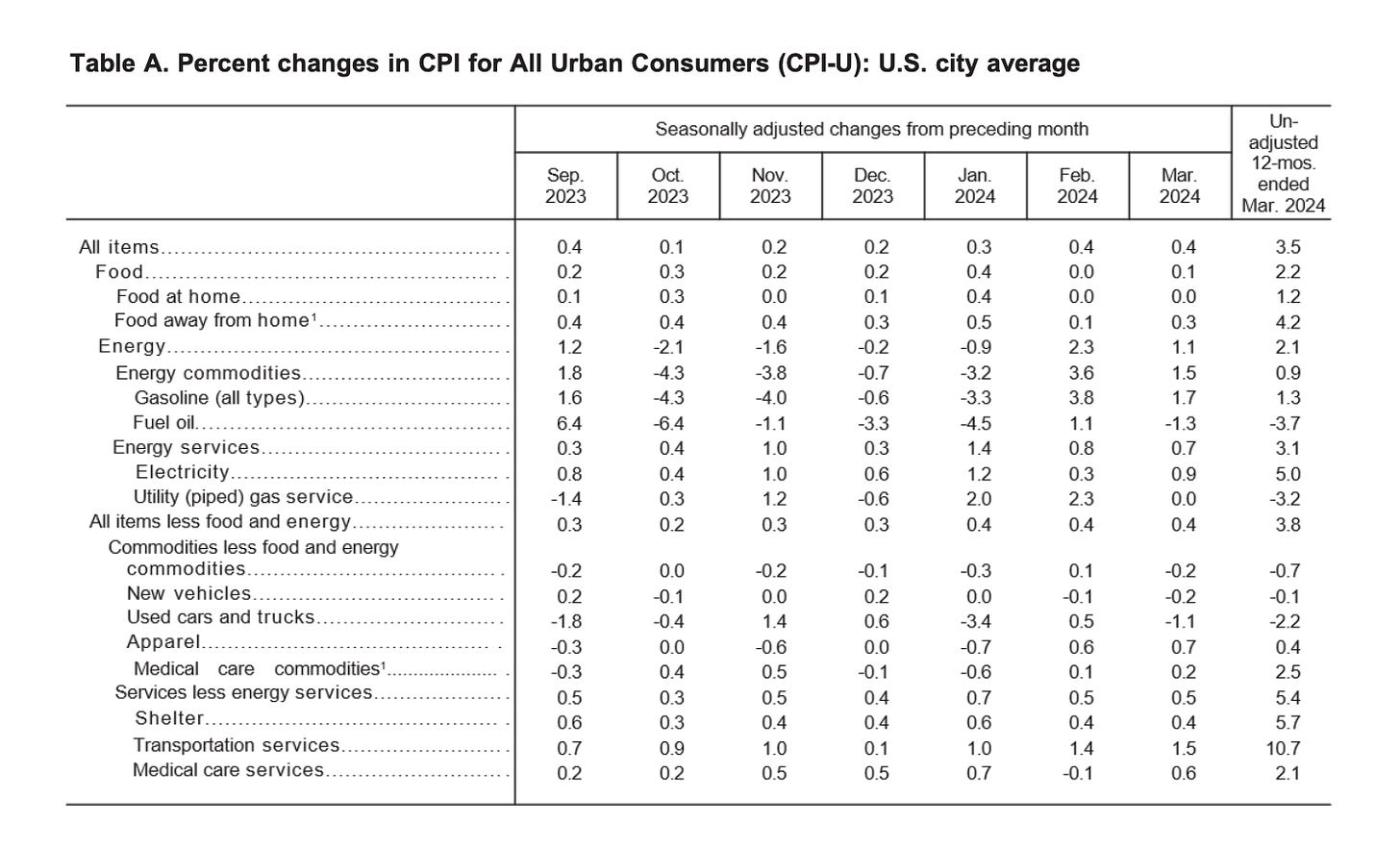

March CPI report was out this morning. Headline CPI MoM rose 0.4% in March vs. 0.4% in February while the core CPI MoM rose 0.4% in March vs. 0.4% in February. Headline CPI YoY rose 3.5% in March vs. 3.2% in February, 3.1% in January, 3.4% in December, 3.1% in November, 3.2% in October, 3.7% in September, 3.7% in August, 3.2% in July, 3% in June, 4.0% in May, 4.9% in April and 5% in March. Core CPI YoY rose 3.8% in March vs. 3.8% in February, 3.9% in January, 3.9% in December, 4% in November, 4% in October, 4.1% in September, 4.2% in August, 4.7% in July, 4.8% in June, 5.3% in May, 5.5% in April and 5.6% in March.

Core CPI MoM has been at the 0.4% level for three consecutive months!! Service inflation YoY is 5.4% in March vs. 5.2% in February and 5.4% in January. Transportation CPI YoY is up 10.7% in March vs. 9.9% in February and 9.5% in January!! It appears that inflation is reaccelerating, which makes it hard for the Fed to justify cutting rates in the near future. It’s kind of scary to see the 3-month annualized core CPI still at 5% while the Fed Fund Rate has been at 5+% for almost a year. People should probably prepare for potential rate hike surprises if inflation gets worse in the next few months.