By Stacy Elliott

Compiled by: Vernacular Blockchain

Bitcoin billionaire Arthur Hayes expects riskier assets like cryptocurrencies to struggle before May, meaning the market could see prices fall, not rise, when Bitcoin halvings occur.

“The narrative that Bitcoin halvings have a positive impact on cryptocurrency prices has become entrenched. When the majority of market participants agree on a certain outcome, the opposite usually happens,” the co-founder and former CEO of BitMEX wrote in his latest article. “This is why I think Bitcoin and cryptocurrency prices will fall during the halving period.”

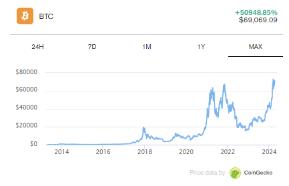

Bitcoin halvings are regularly scheduled events that reduce the rate at which new Bitcoins enter the market through miner rewards. This halving will reduce miner rewards from 6.25 BTC to 3.125 BTC, which will be the fourth halving since Bitcoin was first launched in 2009.

Typically, such regular reminders of Bitcoin’s scarcity lead to a rally in BTC prices, and the cryptocurrency market as a whole. But this time around, Hayes explained that USD liquidity could delay the post-halving price surge that most traders were expecting.

He went on to explain that dollar liquidity is impacted by U.S. tax payments, the Fed’s ongoing quantitative tightening (QT) program, and the Treasury General Account (TGA) balance. Together, these macroeconomic forces tighten dollar liquidity in the market, impacting asset prices and trading strategies.

As a result, Hayes expects that this Bitcoin halving may "add fuel to the wild sell-off of crypto assets" rather than triggering a rally.

As a result, he said he decided to temporarily exit the market until the market calms down in May. He explained that he has sold some Solana (SOL), meme coin Cats in Dogs World (MEW), and NetMind Chain utility coin NetMind Token (NMT).

“The funds were put into Ethena’s USDe to earn high yields through staking,” he said. “Before, I might have held USDT or USDC but earned nothing, while Tether and Circle received all the returns of U.S. Treasuries.”

Ethena's USDe is a "synthetic dollar protocol" that combines Ethereum's staking rewards and hedged derivatives positions to generate returns. However, the high yield has triggered comparisons with Terra's TerraUSD stablecoin, which caused $11 billion in losses in the 2022 crash. According to Ethena's official website, as of now, USDe's yield is 37.1%.

However, Hayes said there’s one thing he won’t be doing during this break: short the market. “I will be out of trading from now until May 1st,” he wrote. “I hope to be back in May with funds ready to deploy to position myself when the real bull run begins.”