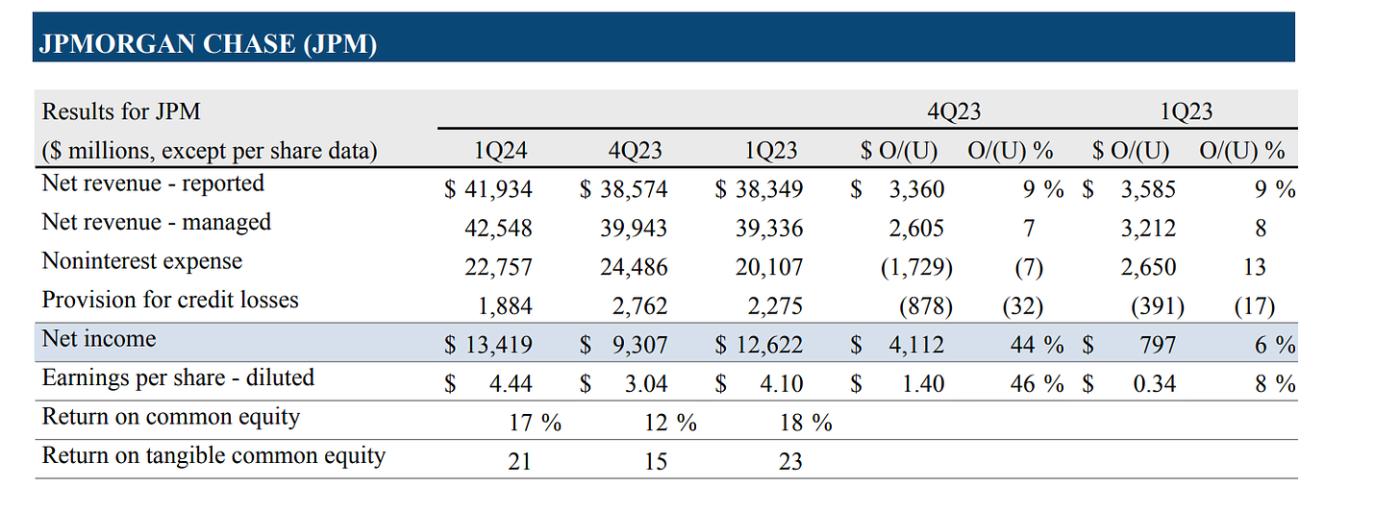

JP Morgan reports Q1 earnings this morning. Revenue was $42.55B vs. $41.85B expected. Adjusted EPS was $4.44 vs. $4.11 expected. It was a strong quarter but NII (net interest income) declined 4% from the previous quarter. The company said the decline is due to deposit margin compression and lower deposit balances, which is expected due to the new rate environment.

In his letter to shareholders, CEO Jamie Dimon said:

Many economic indicators continue to be favorable. However, looking ahead, we remain alert to a number of significant uncertain forces. First, the global landscape is unsettling – terrible wars and violence continue to cause suffering, and geopolitical tensions are growing. Second, there seems to be a large number of persistent inflationary pressures, which may likely continue. And finally, we have never truly experienced the full effect of quantitative tightening on this scale. We do not know how these factors will play out, but we must prepare the Firm for a wide range of potential environments to ensure that we can consistently be there for clients.

Mr. Dimon has been sounding the alarms on the economy over and over again in the past year and half. So far, things are better than expected. Eventually, some kind of disaster will strike. It’s good to be well prepared. At the same time, it’s probably not a good idea to be 100% in T-bills solely out of fear.