There are three kinds of fud about $ETH recently: 1) Ethereum's current revenue is far less than the previous bull market (mainly due to the popularity of Layer2), but the price is close to a new high; 2) A more competitive (more wealth-effective) Layer1 ecosystem, Solana, has emerged in the market; 3) After the Cancun upgrade, Ethereum's Layer2 fee income expectations have been greatly reduced.

From these fuds, we can see that the market is pessimistic/bearish on Ethereum. The main point is that Layer2 and Solana have weakened Ethereum's revenue, and Ethereum is further weakening Ethereum's revenue through the Cancun upgrade. From the perspective of revenue alone, Ethereum's prospects are indeed worrying, and Layer2 needs a very large increase to push the revenue of Layer 1 Ethereum back to the "normal level" of the last bull market.

However, from the perspective of ecological impact, Layer2 still has a lot of room for growth after the upgrade in Cancun.

In VanEck's research report on Ethereum Layer2, it is mentioned that the market value of Ethereum Layer2 will reach 1 trillion US dollars in 2030. The report emphasizes the important role of Ethereum Layer2 in expanding the Ethereum network, improving developer experience, user experience, and technical capabilities.

V God also mentioned at the ETH Taipei 2024 conference that Ethereum core developers had hoped that the Layer2 network would use an average of three blobs per block, but the current level is about 67% lower than that goal.

To translate it, Layer2 has a promising future, but the current Ethereum Layer2 traffic is still below expectations. Obviously, research institutions and Ethereum core developers are not concerned about Ethereum's revenue, but the number of users and developers that the Ethereum Layer2 network can capture. After all, users and developers are the cornerstone of network development, and only a sufficient number of interactions can drive the growth of Layer2 revenue. And now, Ethereum Layer2 has huge room for growth.

Among the Layer2 projects, there are two examples worth talking about. One is BaseChain and the other is Metis. BaseChain and Metis are two completely opposite extremes. The basic logic of Layer2 such as Base and Metis is: using the EIP-4844 upgrade (Cancun upgrade) to achieve higher data processing capabilities and lower costs, and reduce the burden on Ethereum Layer1.

The BaseChain sorter is dominated by Coinbase, and its revenue is also counted as Coinbase's revenue. Therefore, Coinbase has every reason to promote the development of the BaseChain ecosystem (wealth effect, the approach is basically the same as Solana). After all, for Coinbase, the future revenue space of BaseChain is large enough. Especially after the Cancun upgrade, the cost will be reduced, and the revenue space of the BaseChain sorter will become high enough.

Another one is Metis.

Metis reduces its reliance on the Ethereum mainnet, reduces transaction costs and shortens confirmation time by adopting optimized data processing and smart contract execution mechanisms. In particular, Metis is designed to support multiple revenue models and cost structures, including but not limited to generating revenue through transaction fees, data compression and smart contract execution. In addition, Metis also does a good job in user experience - in terms of fast deposit and withdrawal of assets and transaction confirmation.

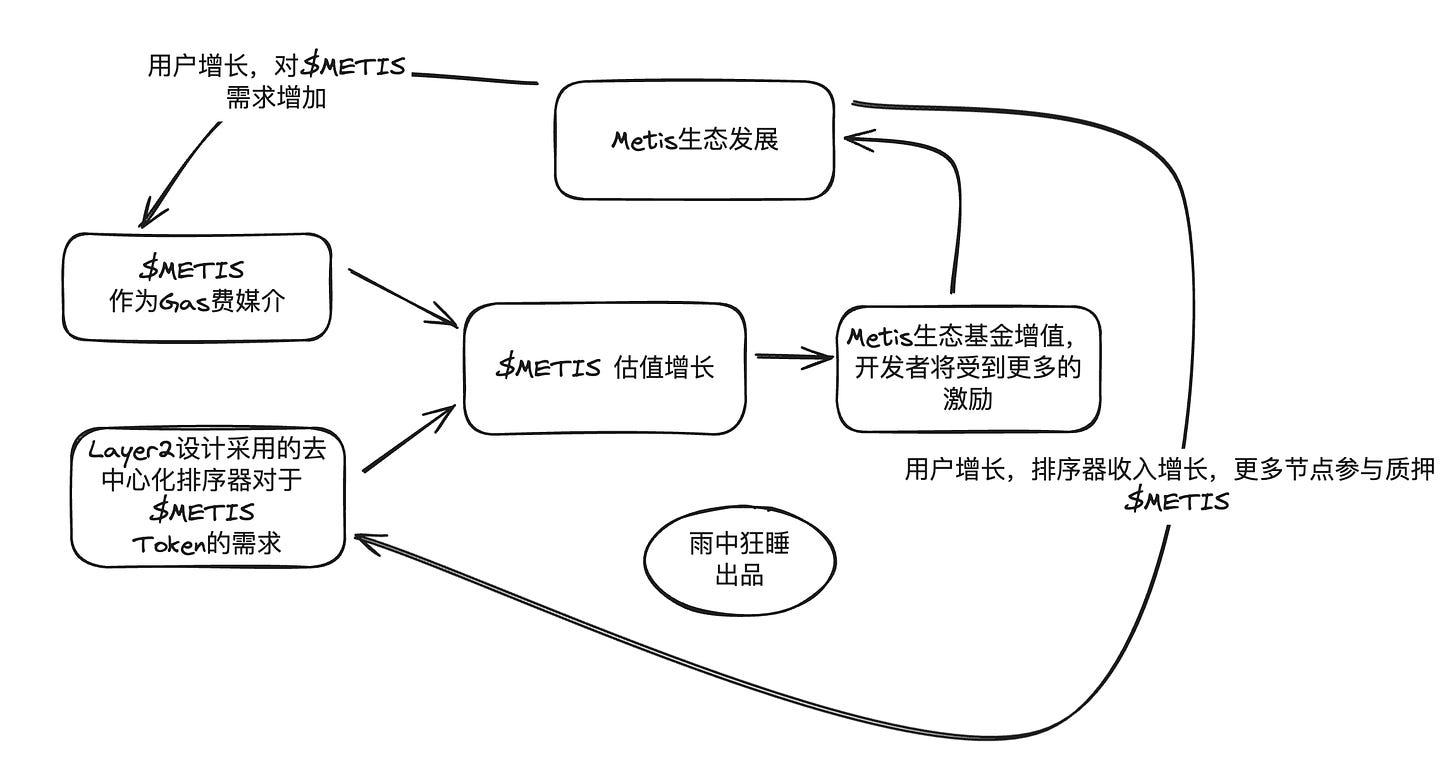

The most important point is that Metis is taking the path of decentralized sorting, that is, the official does not make money from the sorting, but instead divides the cake and builds a flywheel through ecological incentives. My point of view is that Metis's approach gives other Layer2 a guiding idea - if you want to expand the ecosystem and capture developers and users, you have to divide the cake and eat it together - unless you have a big daddy like Coinbase.

In the end, the Layer2 business is likely to become a highly competitive but flourishing landscape. The new Layer2 competes for users and developers, which is essentially competing for the wealth effect of the chain. The formation of wealth effect relies on two methods: 1) There is a big daddy behind the scenes, who provides resources and money to support. BaseChain is a living example, a bit like the last round of BSC; 2) Make your own token flywheel and spend a lot of money on the ecosystem. Metis is a typical example.