Written by: TechFlow

Before the halving, the market experienced an unexpected plunge.

Bitcoin once fell to the 60,000 mark, and Altcoin suffered even harder. Many people once again lamented that a day in the crypto is like a year in the real world, and short-term frustration and loss began to brew.

Long and spot players have suffered actual and nominal losses. Logically, this is the time for short sellers to be happy.

However, the "big short" in the crypto world, the well-known legendary trader GCR posted on social media, warming every injured leek with words of encouragement:

“If you have been sidelined, this is a good opportunity to add to the tokens you believe in ; if you are fully invested, then hold on, stick to your spot position and don’t surrender; someone once said that liquidation is a forced transfer of wealth from traders who need leverage to wealthy spot buyers.”

GSR also said frankly that he had "retired" from social media a long time ago, and the purpose of posting was that he did not want to see his brothers being eliminated when the future was still so bright. It can be said that he cares about the leeks.

Obviously, the investors who were hit hard by the sharp drop generally gained faith and emotional value from it. This post by GCR has received more than 40,000 likes on Twitter and has been widely circulated.

At the same time, a large number of new entrants to the circle are puzzled by the popularity of this post, and there are more and more posts asking " Who is G CR ".

The consensus in the crypto is very interesting. Not everyone’s chicken soup tastes good. The leeks believe more in the chicken soup from legendary figures who have keen judgment of the market and have made a lot of money.

If you are also a newbie who doesn’t know about GCR, here is a brief introduction.

The big short who is hostile to the public becomes famous in one battle

GCR is one of the most famous traders in crypto. Named after his alias “Gigantic-Cassocked-Rebirth” on the defunct exchange FTX , he is well known on Crypto Twitter for his proven top trading performance, many successful predictions, and clever writing.

From 2021 to 2022, he frequently appeared on FTX’s top trader rankings and beat many other market participants to become one of the exchange’s top overall profit and loss.

Although his identity remains unknown, he claims to be virtually self-made, having amassed his wealth solely through trading.

Looking back at GCR's experience over the past three years, you will find that his insight into the market is extraordinary.

In the second half of 2021, GCR predicted a bear market and started reverse trading, going against mainstream sentiment when the public was optimistic and firmly short Altcoin.

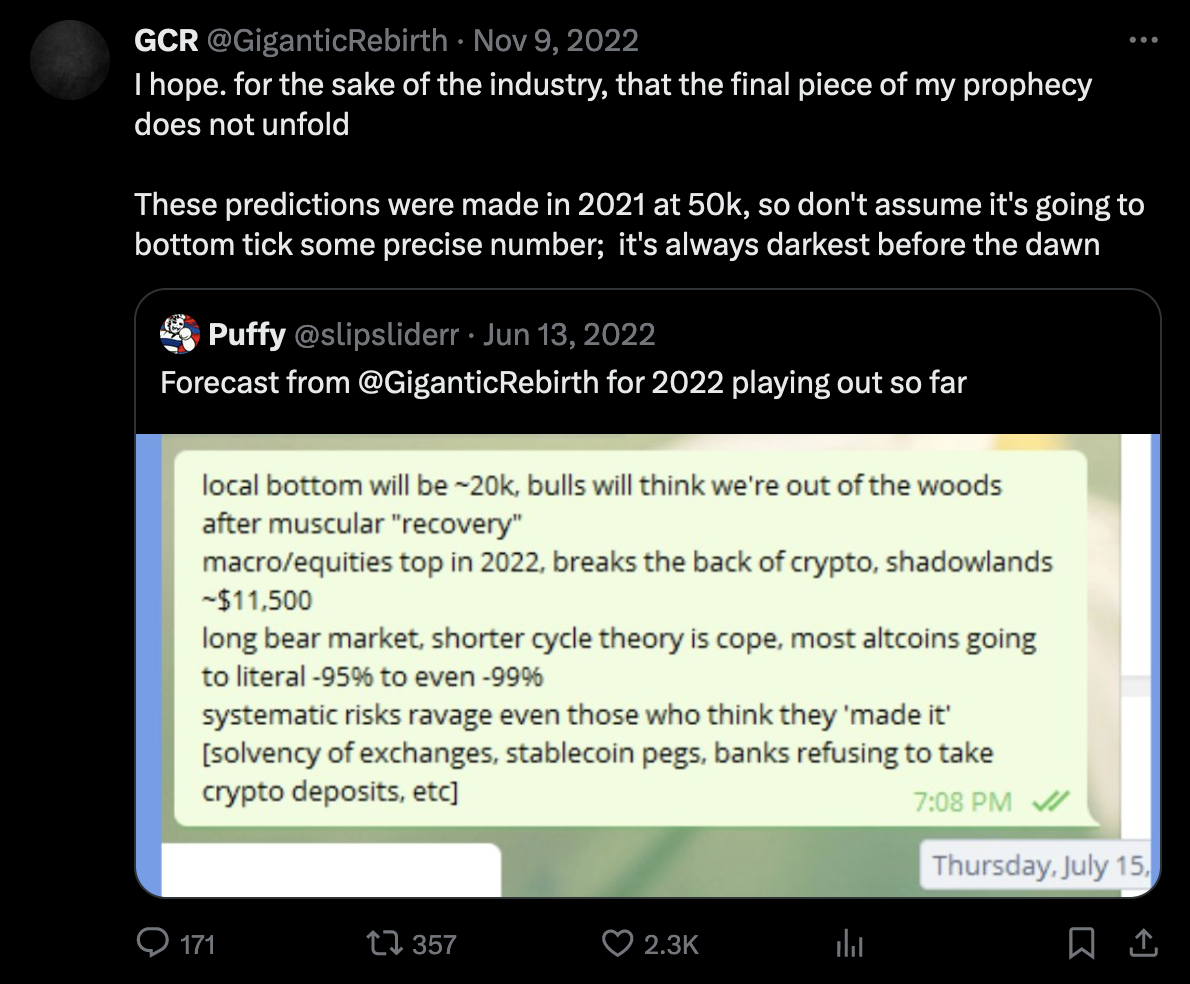

In July, GCR predicted in a telegram:

“Local bottom will be around 20k…macro/equities top in 2022, most Altcoin will be -95% or -99%”.

In the crypto craze of 2021, with zoos flying around and air coins rampant, GCR’s position is not complicated, it is just contrary to the “general market narrative”.

What really made GCR famous was the sniper bet on the downfall of LUNA.

On March 14, 22, GCR and Luna founder Do Kwon (who had not yet been involved in the game) publicly bet 10 million US dollars, believing that the price of Luna would be lower than the current price within a year, and took actual action to short it.

Do Kwon actually joined in the gambling, and the betting funds for both parties were managed by the account of another big boss, Cobie.

Everyone knows what happened later: UST decoupled, LUNA entered a death spiral, and the air stablecoin eventually fell into the abyss; 2 months later, GCR revealed that the betting position had made a profit of 2.3 million US dollars.

Winning the bet once may be luck, but consecutive successes must contain profound logic.

At the end of 2022, CGR issued a reminder that as the bear market develops in 2022, hackers and scams from bad actors and project teams will increase... Therefore, they will firmly short some tokens in the bear market.

Then in November, the FTX bankruptcy incident that shocked the circle and beyond occurred, bringing the crypto into a deep bear market; and SBF and his group did indeed engage in fraud.

The prediction came true, and the legend of the Big Short trade was born.

GCR's Top 10 Crypto Investment Tips

After the FTX collapse, GCR, perhaps because it had earned its freedom, permanently stopped posting on the @GiganticRebirth account.

His alternative account @GCRClassic provides fewer personal trading updates and more trading methodologies and insights.

Therefore, when GCR encourages people to “not surrender” in the face of a crypto market crash today, everyone believes in and absorbs the emotional value of it.

After all, if a big trader who has experienced many ups and downs advises you not to give up, then the bear market may not have come yet.

At the same time, Twitter user @0x_Lens also summarized GCR’s ten core crypto investment suggestions and experiences in recent years. We compiled them and shared them with everyone.

Be a Holder or a Trader?

I continue to hold a large spot BTC + ETH position as I believe we bottomed in November and remain bullish on the future; targeting 10k ETH by 2030.

For 90% of people, it would be better for them to be a Holder.

Note that this advice is only relevant to Degens who are into Altcoin narrative rotation.

The biggest benefit of Meme is "never deliver"

Ironically, the most optimistic path for $DOGE is that Twitter never actually integrates it into anything. It will be something Musk teases, hints, taunts, riddles, jokes, and just say there has been a master plan for years, letting people's imaginations run wild. Let's call it Hoskinson; never deliver.

The authenticity of crypto news is not important, the duration of the impact is more important

When news affects prices, market participants often focus on whether it is true.

Many times, the authenticity of the title doesn't matter.

The market's reaction to the news and its duration are more instructive.

Fast in the morning and slow in the evening

We observe the general trading principles when meme tokens rise:

During an Altcoin cycle, you should consider risk more heavily at the first trend reversal and begin to gradually protect capital over time.

People fail because they do the exact opposite; go slow when investing early on and All In more and more greedy and all in over time.

When the environment is good, bet on Ponzi

For the average person, the cost of flying to Macau or Las Vegas to gamble is too high.

When we have easy money and the macroeconomic environment is risky, decentralized casinos and/or decentralized Ponzi schemes are always the fastest horses.

The internal logic of speculating on new things instead of old ones

New coin: full of hope, lack of holders, the team is still not rich, so of course there is motivation to hype.

Consider profitability

Try to imagine a Ponzi scheme as a prizefighter fighting for a prize rather than a token; in a boxing match, the winner gets the prize and the loser gets nothing.

But people often make decisions such as selling one investment when it performs well (cut their winners) and adding to their investments when they perform poorly (add to their losers), rather than seeking professional help to deal with the emotions they may have about losing money.

Other people making money is disturbing, taking profits is the real thing

I gave out some suggestions before, and some people made a lot of money because of the suggestions, and then you received news that others made a lot of money.

However, wealth is only wealth when it is actually realized.

When the trading volume is larger than the market capitalization, it often means that the price increase has reached the final stage.

The worst token design and the best market performance are not contradictory

Some of the best performing tokens will be the ones with the worst token economics and from the most predatory teams.

Many of the teams that launched at the peak of the bear market have been anxiously awaiting more favorable conditions so that they can work their tricks and perform some market manipulation.

The lower the unit price, the more transactions

No matter how many times people see it, they still underestimate the pull of the “low unit deviation effect” on retail investors.

(Note, low unit bias refers to this bias that people tend to think that stocks or currencies with lower unit prices are more valuable because they can buy more "units", even though the actual value may be average)

This is the most attractive thing in the world of cryptocurrency.

If you think about it, why would a sane person buy 100 coins of a higher price when they could have 1 million coins of a lower price?

Finally, by reviewing the past, we can learn new things. The success of top traders may be impossible to imitate, but their opinions can guide everyone to move forward more cautiously in the crypto world.