Written by Mike

A. Market View

1. Macro liquidity

Monetary liquidity improved. The US core CPI was higher than expected again, and the probability of the Fed's interest rate cut in June dropped to less than 50%. The swap contract showed that the Fed would only cut interest rates by 50 basis points in 24 years. Inflation returned, and US Treasury yields began to rebound. The US stock market adjusted on a weekly basis, and the crypto market followed the overall weakening of the US stock market.

2. Market conditions

Top 100 market capitalization gainers:

This week, BTC fluctuated at a high level, and the halving is approaching. The market focus is on the BTC ecosystem and Defi protocols with real yield. When the market is booming, imaginative grand narratives such as AI and Meme are sought after. When the market adjusts, re-staking and stablecoins with safe returns are favored.

1. CKB: An old domestic public chain, which recently released the BTC L2 protocol of RGB++. The first test coin SEAL on it has increased by hundreds of times. Runestone and PUPS of BTC Rune Ecosystem have also increased significantly. Rune is an upgraded version of inscription, which can effectively reduce BTC network congestion and is planned to be launched at the end of April.

2. ENA: It is the fastest growing stablecoin protocol in recent times, providing a 30% arbitrage rate. Currently, ENA tokens are empowered, and mining income can be accelerated by staking ENA. ENA is similar to the logic of mining coins to encourage large-scale use.

3. TON: The public chain has entered the top 10 in market value, and the chips are relatively concentrated. Eco-currency Notcoin will issue coins in the near future, which is free mining on mobile phones. It has 30 million users and 5 million daily active users.

3. BTC Market

1) On-chain data

BTC's retracement is smaller than in previous years, and risks are gradually accumulating. BTC miners' income is in a downward trend. Although the current number of transactions is still high, it is significantly lower than last year. Since the previous historical high was broken, the current market has only experienced two adjustments of more than 10%, but most historical retracements have been much larger, and more than 25% is common.

Stablecoin market capitalization increased by 1%. The United States accused Russia of using the stablecoin USDT for activities.

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is the top range; when the indicator is less than 2, it is the bottom range. MVRV falls below the key level of 1, and the holders are generally in a loss state. The current indicator is 2.8, entering the middle stage.

Institutional funds continued to flow in for two weeks, but the inflow rate slowed significantly.

2) Futures market

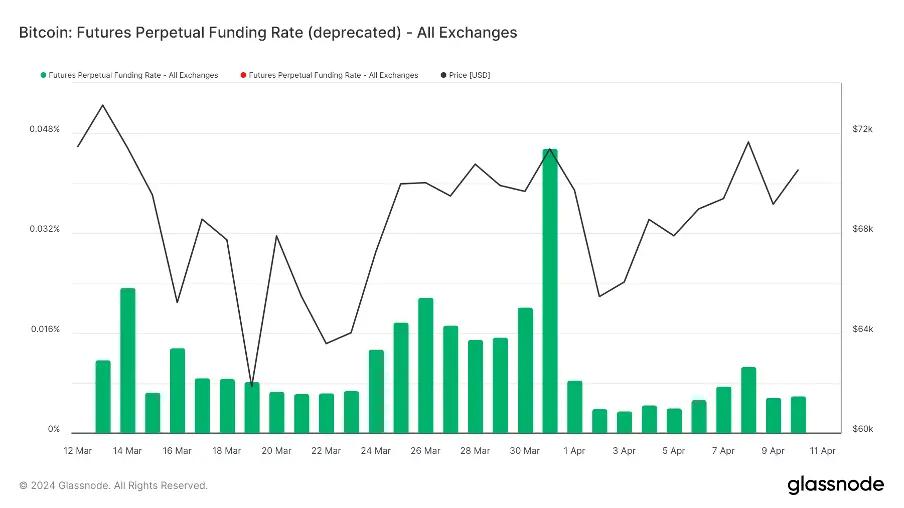

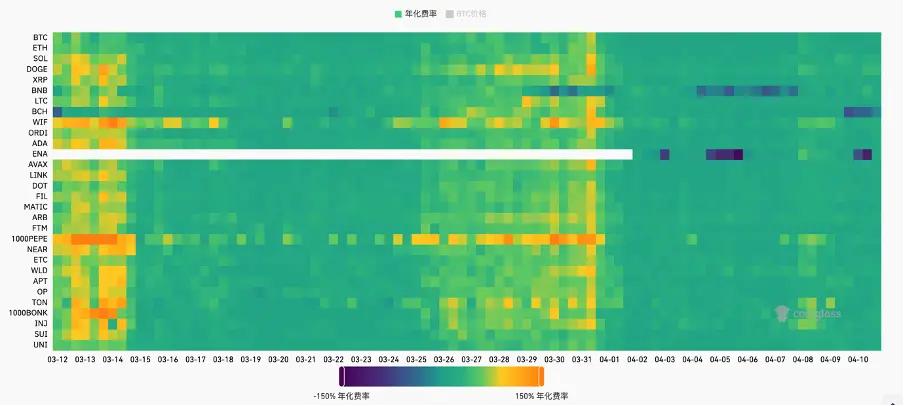

Futures funding rate: This week, the rate returned to normal. The rate is 0.05-0.1%, with more long leverage, which is the short-term top of the market; the rate is -0.1-0%, with more short leverage, which is the short-term bottom of the market.

Futures open interest: BTC open interest remained basically unchanged this week.

Futures long-short ratio: 1.1, market sentiment is normal. Retail investor sentiment is mostly a reverse indicator, below 0.7 is more panic, above 2.0 is more greedy. Long-short ratio data fluctuates greatly, and its reference value is weakened.

3) Spot market

BTC is fluctuating at a high level, and the halving is about 10 days away. BTC hit a record high before the halving, the first time in 15 years. Last year, ETH earned 100 times more fees than SOL, but now it only earns 4 times the fees. At the same time, the market value of ETH has dropped from 25 times that of SOL to 5 times. From a valuation perspective, as the ability to earn fees converges, SOL's market value has more room to catch up with ETH. And as SOL becomes increasingly congested, a lot of funds are also flowing to the emerging BASE chain and TON chain.

B. Market Data

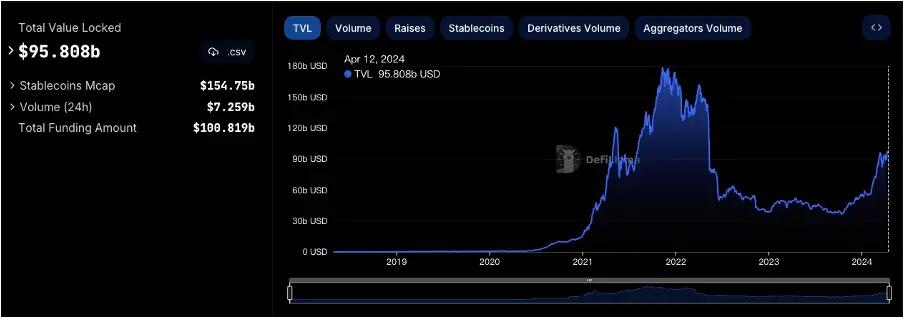

1. Total locked-up amount of public chains

2. TVL Proportion of Each Public Chain

This week, the total TVL is 95.8 billion US dollars, down 2.5 billion US dollars, or 2.5%. This week, the TVL of mainstream public chains is mainly rising, with the ETH chain rising 7%, the TRON chain and the BSC chain both rising 1%, the ARB chain rising 5%, the BTC chain rising 7%, and the best performing SOLANA chain in the past few months falling 10%. The most noteworthy are the recent hot BLAST chain and BASE chain, which soared 28% and 23% respectively, and ranked sixth and seventh with a total TVL of 1.7b and 1.5b. The head project of the BLAST chain, Thruster, has soared 521% in the past month, and Hyperlock Finance has soared 12,565%. The OP chain fell 2% this week and has fallen out of the top ten in the public chain TVL ranking.

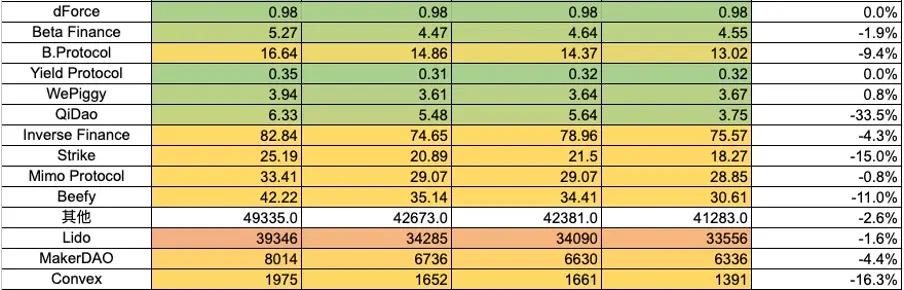

3. Locked Amount of Each Chain Protocol

1) ETH locked amount

2) BSC locked amount

3) Polygon locked-up amount

4) Arbitrum locked amount

5) Optimism lock-up amount

6) Base lock-up amount

7) Solana locked amount

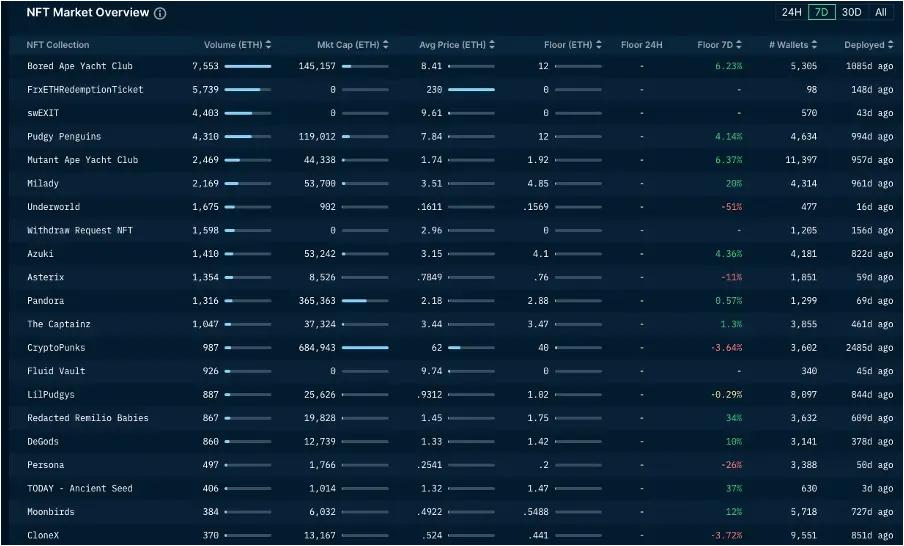

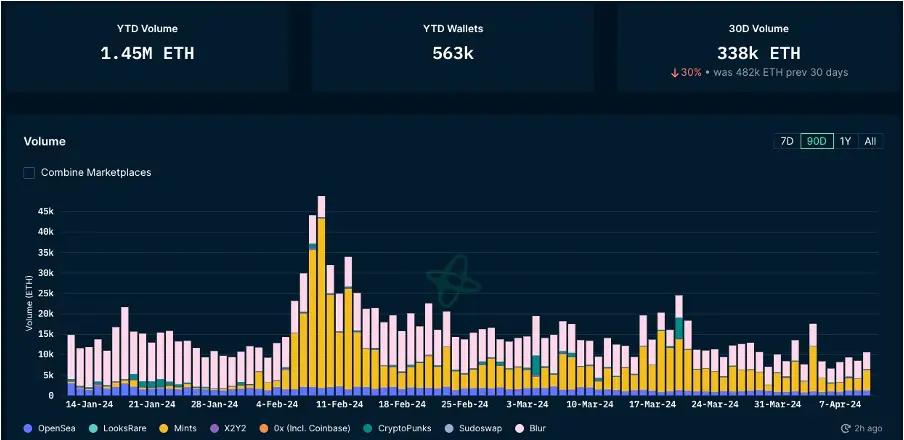

4. Changes in NFT Market Data

1) NFT-500 Index

2) NFT Market Situation

3) NFT trading market share

4) NFT Buyer Analysis

This week, the floor prices of blue-chip projects in the NFT market are mainly rising, and the market is still looking for support levels, with an increase of more than 3% today. BAYC and MAYC both rose 6%, Pudgy Penguins rose 4%, Milady rose 20%, Azuki rose 4%, DeGods rose 10%, and CryptoPunks fell 4%. The total transaction volume of the NFT market has rebounded slightly, and BAYC has regained the top position with a seven-day transaction volume of 7,553 eth. The number of first-time and repeat buyers has not changed much. The depressed sentiment in the NFT market continues, and it is still a question whether this bull market cycle can bring the NFT market to life.

V. Latest project financing situation

6. Post-investment dynamics

1) bitSmiley — BTC Ecosystem

No subscription required. The first phase of the joint public beta event "The Trumeme Show" by bitSmiley and bitCow was launched at 19:00 on April 8. Currently, the Merlin test network is overloaded due to excessive access traffic. The bitSmiley project founder is actively coordinating with Merlin officials to expand support and provide a better testing experience for the majority of participants.

2) Polyhedra Network — ZK

Polyhedra Network has reached a strategic cooperation with ether.fi. Through zkBridge technology and EigenLayer Active Verification Service (AVS), Polyhedra Network implements a trust-minimized interoperability protocol between the Bitcoin network and other blockchain systems. Ether.fi will further provide $3 billion in cryptoeconomic security for the protocol. At the same time, ether.fi will use Polyhedra as its default decentralized validator network (DVN) on LayerZero to improve the security and efficiency of the protocol. In the future, ZK token stakers will have the opportunity to receive $500,000 in ETHFI token rewards.

Currently, the Polyhedra Bitcoin Interoperability Protocol has a total of over $5.3 billion in cryptoeconomic security, supported by ether.fi, Renzo and Swell's LRT. In addition, its double staking mechanism also allows ZK token stakers in its AVS to obtain benefits from its Bitcoin Interoperability Protocol in the future.

3) ORA — Verifiable Oracle Protocol

The total amount of OpenLM IMO token OLM is 1 billion, 50% will be used for IMO public sale, 30% will be used for liquidity, 10% will be allocated to OpenLM contributors, and 10% will be allocated to the ORA team. The fully diluted valuation of OLM is 300 ETH, IMO will raise 150 ETH (500 million OLM), and the IMO price of OLM is 3e-7 ETH (about 0.001 USDT). OLM has two major characteristics: revenue sharing and destruction. Part of the revenue from OAO or other sources will be allocated to the revenue sharing pool composed of OLM tokens, and token holders can apply for income every 90 days after the snapshot. Part of the revenue from OAO or other sources will be allocated to the destruction pool of OLM tokens. Token holders can destroy their tokens as a repurchase mechanism, and the destruction mechanism will support the OLM floor price.