Bitcoin will have difficulty recovering lost ground as the new week begins, following a 15% drop in BTC price. Traders are nursing the wrong wounds of a volatile weekend for cryptocurrencies – but Bitcoin has begun to recover.

The week started strong, with Bitcoin rising above $66,000, up 3.02% from the previous day, thanks to ETF developments in Hong Kong.

As the spot crypto ETF craze continues, Hong Kong approved several spot Bitcoin and Ethereum ETFs on Monday, joining the trend.

Dynamics of Bitcoin ETFs in Asia

To facilitate the successful launch of this ETF, China Asset Management (Hong Kong) has partnered with OSL Digital Securities and BOCI-Prudential Trust. These links are designed to leverage their expertise in virtual asset management and custodial services.

As a result, the announcement boosted the value of Bitcoin, with the price skyrocketing to $66,000. This positive reaction underscores the market's excitement, especially after reports last week that an ETF was nearing approval.

Furthermore, through the launch of this ETF, Hong Kong aims to strengthen its position as a global cryptocurrency hub. The city's proactive regulatory approach aims to balance market development with investor protection, creating an environment that promotes both.

The Hong Kong Direct Bitcoin ETF will provide investors with direct exposure to the Bitcoin market price. This strategy is designed to provide greater transparency and minimize the risks associated with financial Derivative. These features are especially attractive to conservative investors looking to explore cryptocurrency investing.

In the US, the launch of similar Bitcoin ETFs has had a transformative impact on the market. Since launching in January, these ETFs have attracted about $59 billion in assets. This massive Capital inflow has significantly increased the value of Bitcoin, suggesting that new Hong Kong ETFs have similar potential to drive market growth.

Furthermore, the timing of this approval is important as global interest in cryptocurrencies continues to grow across different regulatory environments. Hong Kong regulators have prepared a fully supportive framework, prioritizing market expansion and investor safety.

Hong Kong is strategically located in Asia and has a strong financial infrastructure, making it well-suited to lead the expansion of cryptocurrency services in the region. Additionally, the launch of this ETF is expected to attract global investors and enhance Hong Kong's status as a financial powerhouse.

Hong Kong welcomes Bitcoin and Ethereum spot ETFs

The latest development reflects the country's efforts to establish itself as the leading cryptocurrency hub in the region.

The famous Chinese asset management company announced that its Hong Kong branch has been approved by the Securities and Futures Contract Commission (SFC) of Hong Kong to provide related retail asset management services to direct cryptocurrency ETFs. The next step will be to partner with OSL and BOC International to launch direct Bitcoin and Ethereum ETFs.

Harvest Global Investments also revealed that two of its direct cryptocurrency ETFs have received preliminary approval from the CSRC. The company commissioned OSL to launch these ETFs to address issues such as excessive margin requirements.

Hong Kong regulators have also approved Bosera Asset Management (the Hong Kong branch of a major Chinese asset management company) and Hashkey Capital to jointly manage two direct cryptocurrency ETFs.

The SFC approval comes less than a week before the anticipated Bitcoin halving, sparking further optimism in the cryptocurrency market.

Recovering the cryptocurrency market

The weekend was especially harsh for the price of Bitcoin and the cryptocurrency market in general. However, news of Hong Kong's approval for BTC and ETH ETFs directly coincides with an industry-wide rally.

BTC is up 3.1% over the past 24 hours, while ETH is up nearly 6%.

Other option coins also increased in price. Solana is up 7.4%, which could also be related to the fact that the development team behind it just rolled out an update to address network congestion.

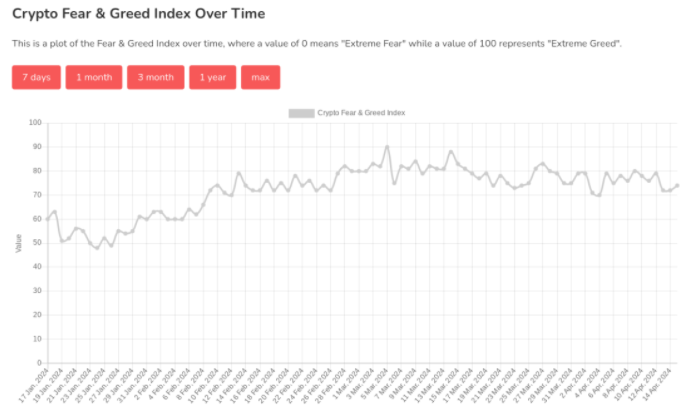

The 'greedy mood' still prevails

For those hoping for a steady recovery in cryptocurrency prices, this is a warning signal that market sentiment remains strongly in a “greedy” mode. According to the latest data from the classic sentiment index Crypto Fear & Greed Index, even the weekend's pullback failed to produce a significant pullback in investor mood. Fear & Greed scored 72/100, and while this was its lowest score in about ten days, it wasn't a capitulating move. By the time of writing on April 15, the index had increased again, reaching 74/100, approaching the "extreme greed" zone.

In the April 15 X survey, WhalePanda revealed the changing mood of market Watcher . When asked about the direction of BTC/USD post-halving, the majority of respondents were Chia , but a few still expected $70,000 to be reclaimed by the end of next week.