A survey conducted by Mudrex, a global crypto investment platform, paints an optimistic picture of crypto's mainstream acceptance. In a report titled ‘Investment Trends in FY 2023-24: The Indian Crypto Renaissance’, it stated that 50 percent of the respondents in a survey envisioned cryptocurrencies becoming a mainstream asset class within the next five years.

“This surge is indicative of evolving investment preferences and changing attitudes toward digital assets,” says Edul Patel, CEO of Mudrex, a Global Crypto Investment Platform. He added data from the survey suggests a broader shift in the financial landscape and how different groups of investors perceive crypto as part of their portfolios.

The Mudrex survey, which was conducted between June 2023 and January 2024 to explore crypto investment behaviours and challenges, had 8,976 participants from across the country.

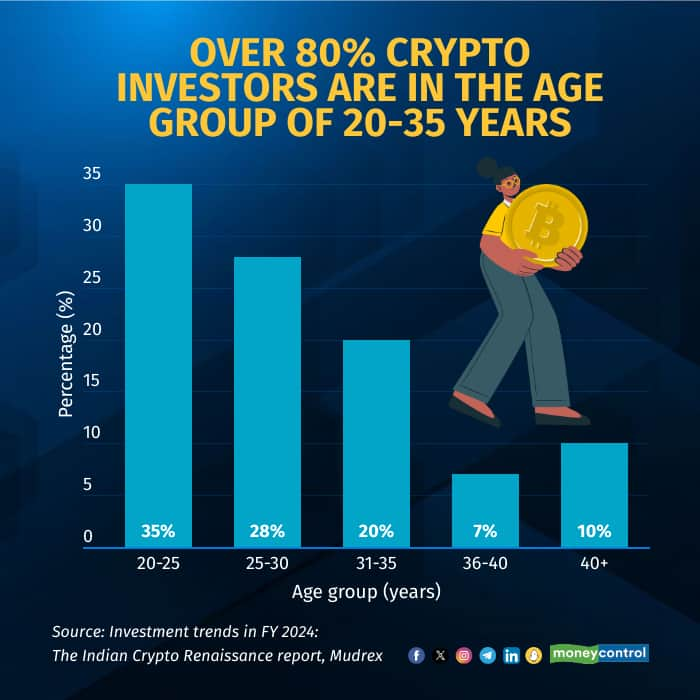

Young investors are adventurous, while older ones are cautious

According to the survey, more than 80 percent of the participants were from the young adult demographic, aged between 20 and 35. The survey found growing interest in cryptocurrency investments among the youth (see graphic).

“This generational preference underscores a higher openness to innovative financial technologies and alternative investment avenues among younger investors,” says Patel. In contrast, as the age groups advance, the interest in crypto investments slightly diminishes, suggesting a more cautious approach from older investors.

Males dominate crypto investments

Of those who invest in cryptocurrencies, the survey found that 69 percent were male, and 29 percent were women, while 2 percent chose not to reveal their gender. “This diverse participation can be attributed to factors such as the pursuit of financial independence, the individual’s inclination towards calculated financial risk, and varying levels of digital literacy among respondents,” says Patel.

Also read | Crypto SIPs gaining traction in India, but tread carefully while investing

Lower income groups also invest in cryptos, highlighting increased risk-taking

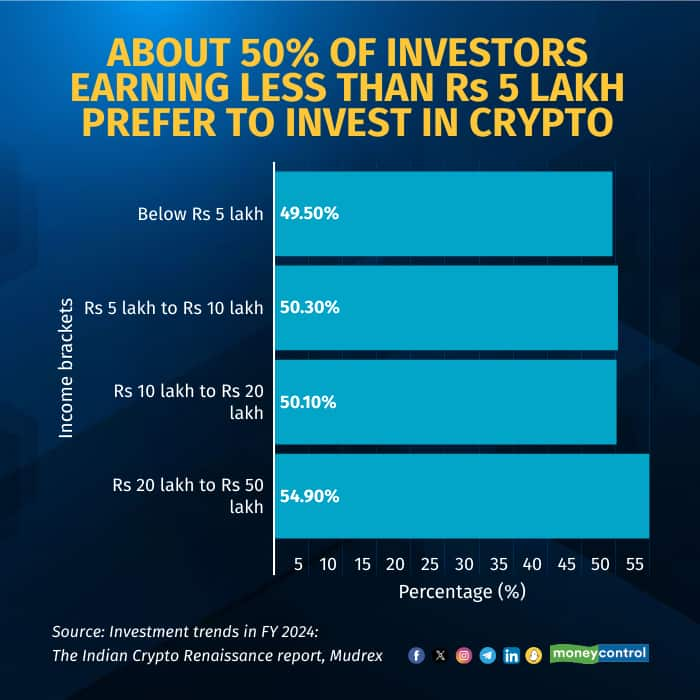

Cryptocurrencies' accessibility across all income brackets was also very evident in the survey, which found a minimal gap among high-income, mid-income, and low-income crypto investors. Notably, even individuals earning less than Rs 5 lakh annually invest in cryptocurrencies, highlighting their increasing accessibility and adoption across income brackets (see graphic).

On the flip side, this also raises questions about whether they understand the risks of investing in cryptocurrencies, especially given their low income, and when there are other well-regulated investment options available to them, such as mutual funds.

Financial decision-making dynamics

According to the survey, 60 percent of the respondents prefer taking financial decisions independently, while 20 percent seek assistance from family and friends, 14 percent take their partner’s help, and 6 percent rely on financial advisors.

Also read | Bitcoin halving, spot ETF approval set stage for next crypto bull run

According to the survey, approximately 70 percent of those who have invested in cryptos make financial decisions on their own. “This shows the growing financial awareness,” says Patel. However, there is a lack of financial advisors, especially in the crypto space, as it is fairly new compared to traditional asset markets, he adds.

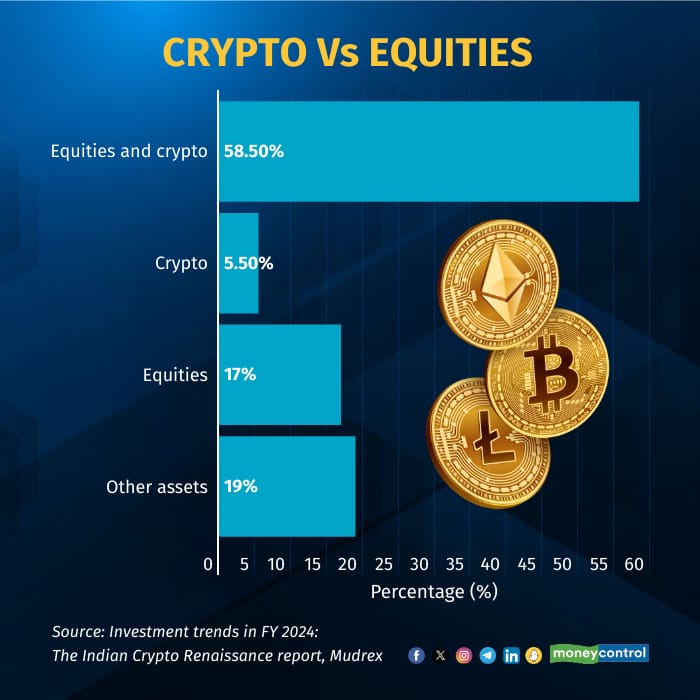

The data from the survey suggests that investors are not focusing solely on cryptos; about 58.5 percent of the respondents have investments in both equities (stocks and mutual funds) and cryptos (see graphic). “This demonstrates an understanding of diversification and the role cryptos play as an alternative asset class within a balanced portfolio,” says Patel.

Avoid investing in cryptocurrencies to build a retirement corpus

The survey also highlights a growing trend of integrating cryptocurrencies into long-term financial planning, with 45 percent of users including cryptocurrencies in their retirement plans. This indicates a growing acceptance of cryptocurrencies as a legitimate asset class for long-term wealth accumulation. “The trend could reflect a belief that cryptocurrencies offer opportunities for substantial returns over the long term or a desire for portfolio diversification beyond traditional assets like stocks and bonds,” says Patel.

Not everyone agrees. “Do not rely on cryptocurrencies for your retirement corpus as they are very volatile,” says Rishabh Parakh, founder of NRP Capitals. "Check your risk profile before investing. You should understand cryptocurrencies before investing. Limit your overall exposure in cryptocurrencies to 2 percent of your total investment portfolio, especially if you aren’t used to the hyper-volatility of cryptos," he adds. Sticking to equity and other regular investment avenues is better and more peaceful, Parakh concludes.