Source: coingecko, Translated by: Jinse Finance@Zhe Ye

Following a strong performance in the fourth quarter of 2023, the total cryptocurrency market capitalization continued to rise in the first quarter of 2024, increasing by 64.5% to reach a high of $2.9 trillion on March 13.

In absolute terms, this quarter’s growth (+$1.1 trillion) was almost double the growth in the previous quarter (+$0.61 trillion). This was mainly due to the approval of a spot Bitcoin ETF in the United States in early January, which led to a new high in Bitcoin prices in March.

Our Q1 2024 Crypto Industry Report provides comprehensive coverage from the cryptocurrency market landscape to analysis of Bitcoin and Ethereum, a deep dive into the DeFi and NFT ecosystem, and a review of the performance of CEXs and DEXs.

7 highlights from CoinGecko’s Q1 2024 cryptocurrency industry report:

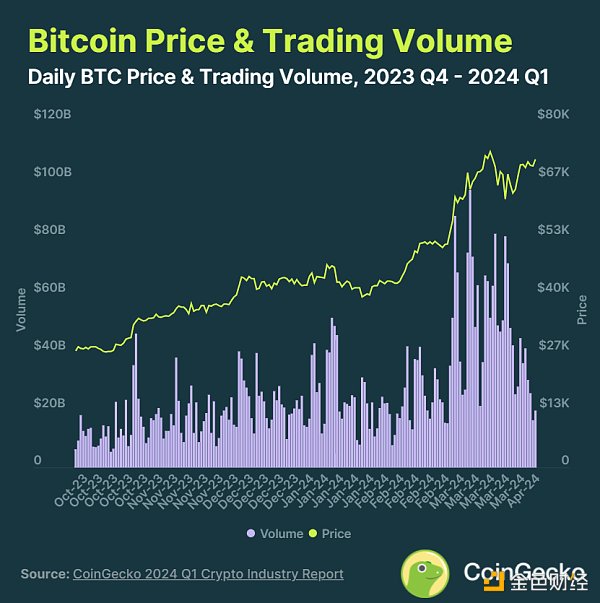

1. Bitcoin price increased by +68.8% in the first quarter of 2024, setting a new all-time high of $73,098.

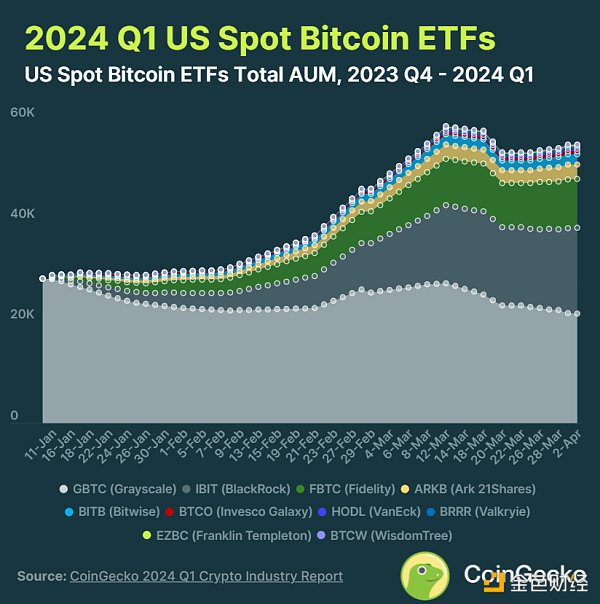

2. As of April 2, the assets managed by US spot Bitcoin ETFs have exceeded US$55.1 billion

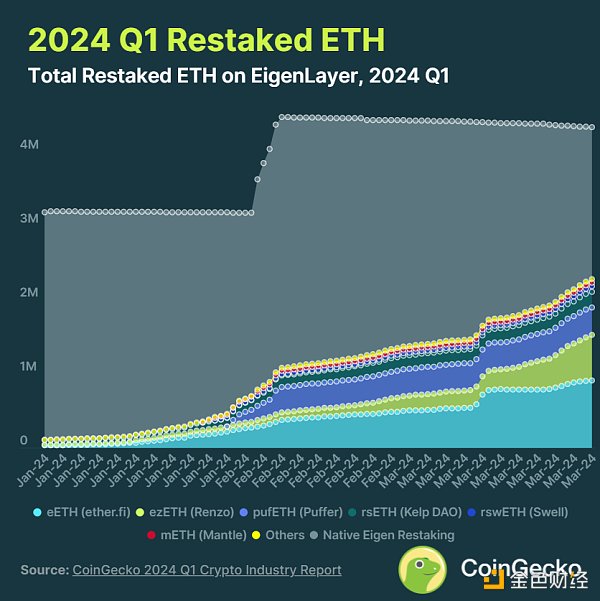

3. Ethereum re-mortgage on EigenLayer reached 4.3 million ETH, a quarterly increase of 36%

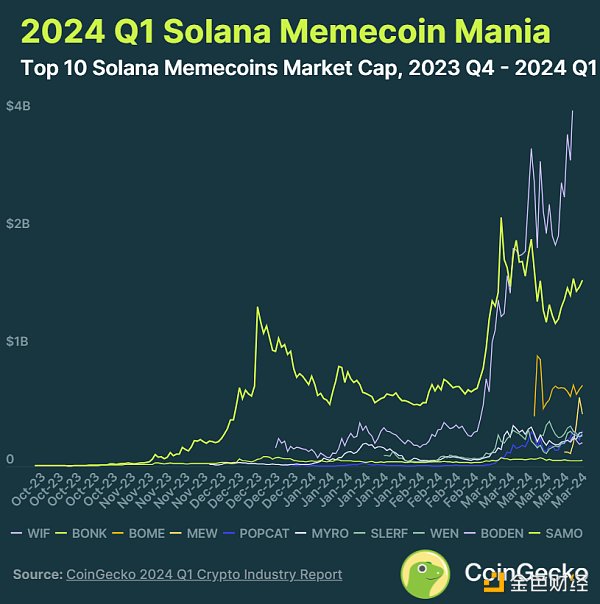

4. Solana’s memecoins surged in Q1 2024, with the top ten market caps increasing by $8.32 billion

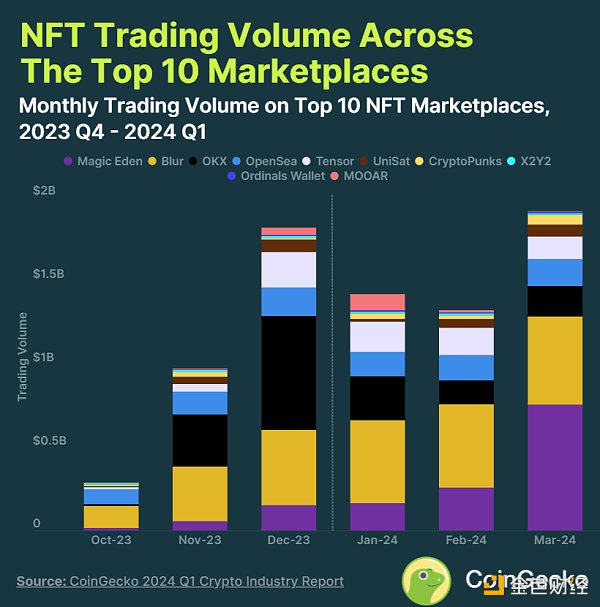

5. In the first quarter of 2024, the NFT trading volume of the top ten market trading platforms reached 4.7 billion US dollars, and Magic Eden currently leads in market share

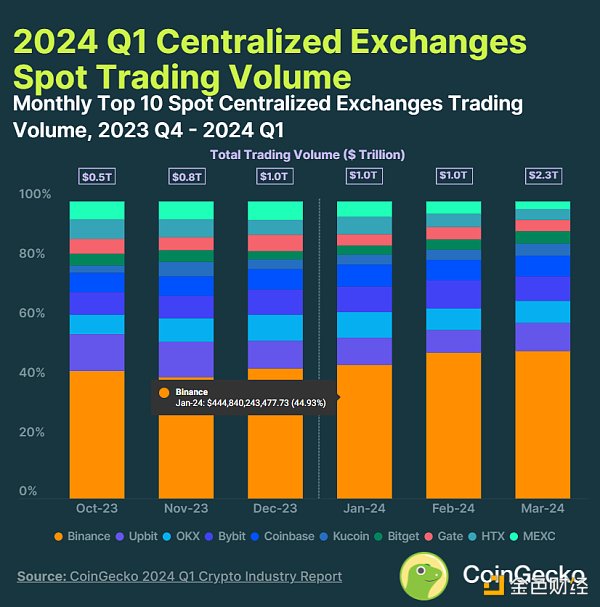

6. CEX spot trading volume reached $4.29 trillion in the first quarter of 2024, the highest level since the fourth quarter of 2021

7. Ethereum’s share of DEX trading volume drops below 40%, while other chains attract more attention

1. Bitcoin price increased by +68.8% in the first quarter of 2024, setting a new all-time high of $73,098

BTC prices continued to rise in the first quarter of 2024, increasing by 68.8% during the period.

BTC prices continued to rise in the first quarter of 2024, increasing by 68.8% during the period.

After the US spot Bitcoin ETF was approved, BTC immediately saw a -16.0% correction to a quarterly low of $39,505. However, it then rose 85.0% to a new all-time high of $73,098. It then fell back -18.0% before recovering to $71,247 at the end of the quarter.

As for transaction volume, it gradually increased in the first quarter of 2024, reaching an average of $34.1 billion per day. This is an increase of 89.8% compared to $18 billion in the fourth quarter of 2023.

Bitcoin ETFs manage over $55.1 billion in assets.

2. As of April 2, the assets managed by US spot Bitcoin ETFs have exceeded US$55.1 billion

As of April 2, 2024, the funds under management of US spot Bitcoin ETFs have exceeded $55.1 billion. This happened after the US Securities and Exchange Commission (SEC) approved spot BTC ETF trading on January 10.

As of April 2, 2024, the funds under management of US spot Bitcoin ETFs have exceeded $55.1 billion. This happened after the US Securities and Exchange Commission (SEC) approved spot BTC ETF trading on January 10.

BlackRock’s IBIT ETF has accumulated over $17 billion in Bitcoin and established itself as the second-largest Bitcoin ETF. It also had the most trading volume in the first quarter of 2024.

Meanwhile, Grayscale’s converted GBTC ETF had $21.7 billion in assets under management at the end of April 2. It experienced $6.9 billion in net outflows due to early investor profits and higher fees relative to competitors. Still, it was the largest Bitcoin ETF in the first quarter.

3. Ethereum re-mortgage on EigenLayer reached 4.3 million ETH, a quarterly increase of 36%

In the first quarter of 2024, Ethereum (ETH) re-pledged on EigenLayer began to take off, with the total amount of re-pledged increasing by 36% to 4.3 million.

In the first quarter of 2024, Ethereum (ETH) re-pledged on EigenLayer began to take off, with the total amount of re-pledged increasing by 36% to 4.3 million.

Most of the re-collateralized Ethereum (52.6%) came from LRTs, totaling 2.28 million ETH. EtherFi was the largest LRT protocol in Q1, with a market share of 21.0%. It grew 2,616% over the quarter and held 910,000 ETH at the end of March.

4. Solana’s memecoins surged in Q1 2024, with the top ten market caps increasing by $8.32 billion

The top 10 Solana-based memecoins grew 801.5% and added $83.2 billion in Q1 2024. They ended the quarter with a combined market cap of $93.6 billion.

The top 10 Solana-based memecoins grew 801.5% and added $83.2 billion in Q1 2024. They ended the quarter with a combined market cap of $93.6 billion.

Of the top 10 Solana memecoins, only Bonk (BONK) and Samoyedcoin (SAMO) exist before Q4 2023. BONK has been the top memecoin on Solana since its launch in December 2022, but was overthrown by dogwifhat (WIF) in early March. WIF launched in November 2023. Meanwhile, Book Of Memes (BOME) launched on March 14 and reached a market cap of $1 billion within two days.

5. In the first quarter of 2024, the NFT transaction volume of the top ten markets reached 4.7 billion US dollars, and Magic Eden currently leads in market share

In the first quarter of 2024, NFT trading volume in the top 10 markets reached $4.7 billion.

In the first quarter of 2024, NFT trading volume in the top 10 markets reached $4.7 billion.

Blur remained the leading NFT marketplace in Q1, with over $1.5 billion in trading volume. Its market share was 27.6% during the same period, an increase from 24.9% in Q4 2023. Meanwhile, Magic Eden surpassed Blur in volume in March, thanks to the introduction of its Diamond rewards program and an Ethereum marketplace in partnership with Yuga Labs. It had over $760 million in trading volume in March.

OKX dominated Bitcoin NFT trading volume in 2023, but its trading volume fell by 73.3% from $680 million in December 2023 to $180 million in March 2024. Bitcoin NFT trading volume shifted to other platforms such as Magic Eden and UniSat. OKX's market share in March 2024 was 9.5%.

6. CEX spot trading volume reached $4.29 trillion in the first quarter of 2024, the highest level since the fourth quarter of 2021

In the first quarter of 2024, the spot trading volume of the top 10 CEXs reached 4.29 trillion US dollars. This is an increase of 95.3% from the previous quarter. This is the highest quarterly trading volume recorded by the top 10 spot CEXs since December 2021.

In the first quarter of 2024, the spot trading volume of the top 10 CEXs reached 4.29 trillion US dollars. This is an increase of 95.3% from the previous quarter. This is the highest quarterly trading volume recorded by the top 10 spot CEXs since December 2021.

Binance remains the largest CEX, ending March 2024 with a market share of 50%, gradually regaining its dominance throughout the quarter. At the same time, the number of new listings and project launches on the exchange increased significantly. Meanwhile, MEXC, an exchange known for its large number of small-cap tokens, saw its market share shrink as traders focused on major tokens such as BTC, ETH, and SOL.

7. Ethereum’s share of DEX trading volume has dropped below 40%, while other chains have attracted more attention

Ethereum’s share of DEX volume fell below 40% in Q1 2024. It hit an all-time low in February 2024, accounting for just 30% of the market. However, despite the decline in market share, it still recorded $70 billion in volume in March 2024, driven by a surge in market-wide trading activity.

Ethereum’s share of DEX volume fell below 40% in Q1 2024. It hit an all-time low in February 2024, accounting for just 30% of the market. However, despite the decline in market share, it still recorded $70 billion in volume in March 2024, driven by a surge in market-wide trading activity.

On Arbitrum, DEX trading volume boomed in January and February 2024, boosted by its STIP incentive program. It even managed to surpass Ethereum’s trading volume during the same period. However, once the incentive ended, trading volume plummeted in March, and the chain ended the month with 8% market share.