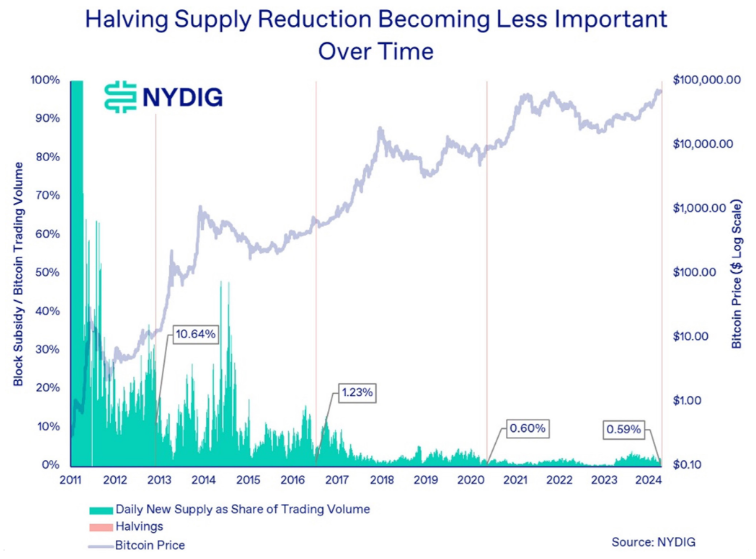

The reduction in daily supply represents only 0.6% of trading volume, which will have less impact on price than before. In addition, the demand side associated with spot ETFs will play a more critical role in determining prices than supply.

Original article: The Implications of Bitcoin's Fourth Halving (NYDIG)

Author: NYDIG

Compiled by: Felix, PANews

Cover: Photo by Muhammad Asyfaul on Unsplash

Key points:

- Bitcoin halved its reward on April 20 (Beijing time), reducing the block subsidy by 50%. This is the fourth halving since Bitcoin was launched 15 years ago.

- Halving is the basis for fixing the supply of Bitcoin, capping the total supply at (close to) 21 million coins.

- The supply reduction represents just 0.6% of daily trading volume and is currently having less of an impact on prices than before.

- The halving has a greater economic impact on miners, with their main source of income reduced by 50%.

- After previous halvings, mining difficulty has been adjusted down by 5.4% - 14.7% as uneconomic hashrate is eliminated. However, given Bitcoin prices and miners’ breakevens, it’s unlikely that much hashrate, if any, will be offline.

Introduction

At block 840,000 on April 20, Bitcoin will experience an event that has only occurred three times before, a halving of the block reward. This event, also known as the “halving,” is critical to the economic prospects of Bitcoin’s scarcity. For some, the event is a significant price driver, reducing the daily supply of new Bitcoins by 50%. For others, the event is a technical milestone and a vindication of the code that Satoshi Nakamoto pioneered 15 years ago. For others, such as miners, the event could pose risks to business models and network security.

This report will look at the impact of the halving on price, network security, and miners. It will reference previous halvings, look at the current network and price, and make an educated guess as to what might happen in the future.

What is halving?

The Bitcoin block reward halving means that the new Bitcoins awarded to the creators of new blocks, i.e. miners, are reduced by 50%. Miners are incentivized to create blocks, adding new transactions to the growing database (called the blockchain), and are rewarded in two forms: transaction fees and block rewards (also known as block subsidies). Transaction fees are paid by the sender of a transaction in a transaction and are a form of "tip" to incentivize miners to select their transactions from among the many transactions. Transaction fees do not generate new Bitcoins, but simply transfer existing Bitcoins from the sender to the miner.

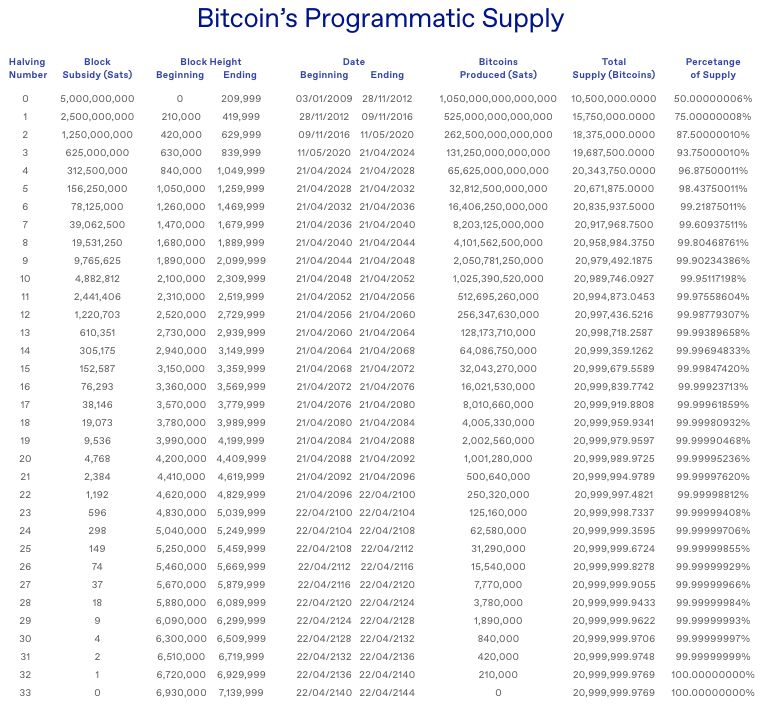

However, block rewards are how Bitcoin was created. As an incentive for creating and propagating new blocks, the Bitcoin protocol mints new Bitcoins to miners. When the Bitcoin network launched in 2009, the block reward was set at 50 Bitcoins from the Genesis Block(block 0) to block 210,000. Every 210,000 blocks, approximately every 4 years, Bitcoin will reduce the block reward by 50% based on the expected 10-minute block generation time. After 3 halvings, the block reward is 6.25 Bitcoins, which will drop to 3.125 Bitcoins from April 20th.

Bitcoin's reward halving is the basis for its finite supply, a key economic feature. The supply cap, known as 21 million bitcoins, but more accurately 20,999,999.9769 (slightly lower due to unspendable bitcoins), is achieved through subsidy halving. As part of the Bitcoin code, the block subsidy, measured in satoshis (0.00000001 bitcoins), reaches a point where it can no longer be halved. This milestone is reached at the 33rd halving, occurring at block 6,930,000 in the year 2140. Once this point is reached, no new bitcoins will be produced and the final satoshis will be in circulation.

The economic significance of the halving

The Bitcoin halving has significant economic implications. Since the block reward is how new Bitcoins are created, the halving reduces the annual rate of new Bitcoins (often referred to as “inflation”) by 50%. In the short term, the growth in Bitcoin supply will drop from 1.7% per year to 0.85% per year. There is nothing special about the 21 million Bitcoin cap chosen by Satoshi Nakamoto, other than some broad assumptions about acceptability and usage, but its scarcity is intended to confer value. While a declining supply function may mimic real-world commodities in the abstract, in reality, commodities such as gold have an exponential annual supply growth function.

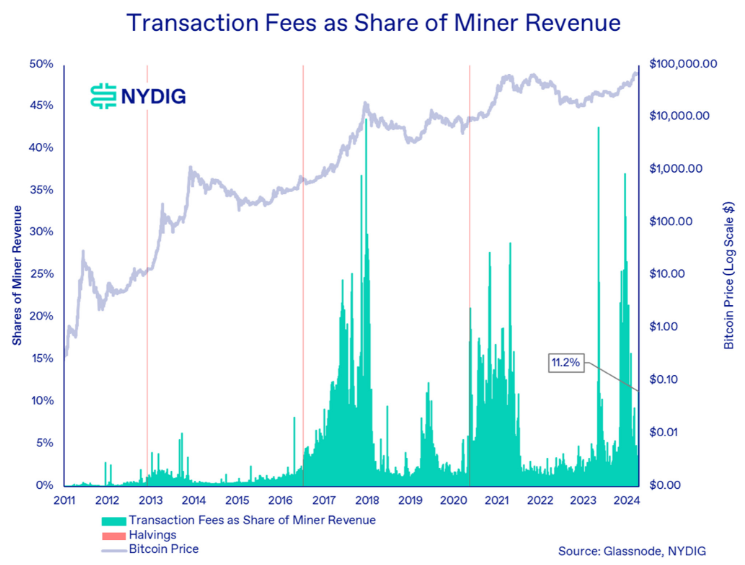

Another economic impact could be on the network itself. Bitcoin’s block subsidy is the primary source of revenue for miners. Before Ordinals emerged over a year ago, block subsidies accounted for 97-98% of miners’ revenue, while transaction fees only accounted for 2-3% of revenue. While that number has just jumped to 11.2%, a 50% reduction in the primary source of miners’ revenue could still have important implications for network security and the miners themselves.

Miners’ income depends on block subsidies

Miners are the lifeblood of Bitcoin, producing new blocks every 10 minutes. Miners play a vital role in aggregating transactions and adding them to the blockchain. In return, miners receive Bitcoin through block subsidies and transaction fees attached to transactions.

Throughout Bitcoin’s history, miners’ income has been derived primarily from the block subsidy, not transaction fees. Since launch, the block subsidy has accounted for 98.5% of miners’ income, with only 1.5% coming from transaction fees. The importance of transaction fees has been rising, especially with the introduction of Ordinals and Inscriptions. In March of this year, transaction fees accounted for around 5% of miners’ income (a figure that recently jumped to 11.2%). In some recent blocks, transaction fees have even exceeded the block subsidy. Despite this shift, miners still rely heavily on the block subsidy, so the halving is a big deal for miners. As the block subsidy decreases after the halving, miners will increasingly rely on transaction fees for income.

What can we learn from past halvings?

This halving is the fourth halving of Bitcoin. Although the previous three halvings were not significant and no definite conclusions can be drawn from them, they are still instructive because the development patterns of cryptocurrencies tend to repeat. Based on this, the price of Bitcoin before and after the halving, the adjustment of network difficulty, the change in hash rate and the hash price (the value of miner hashes) have certain reference value for investors.

Price performance

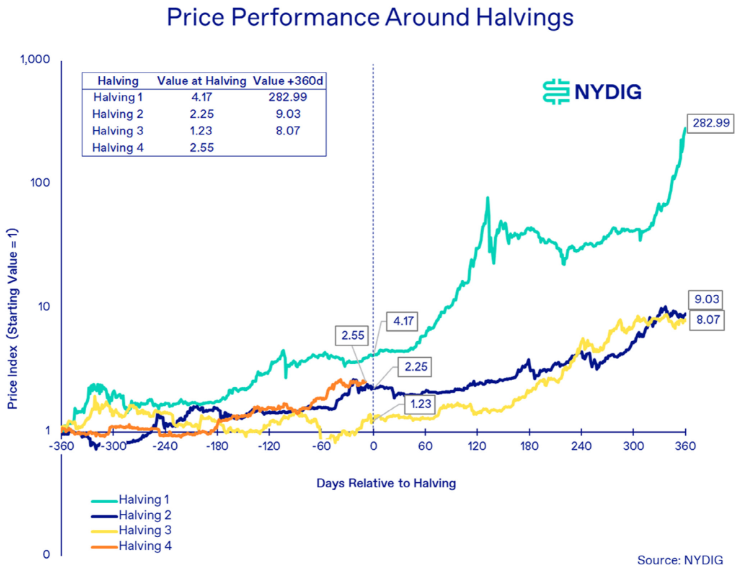

The impact of halving on Bitcoin price is a frequently discussed topic, especially for investors. While past performance is not indicative of future performance, there seems to be some repetition in past patterns. Looking back at previous halvings, Bitcoin rebounded strongly, and this halving is no exception, with Bitcoin rising 155% last year. In the 360 days before the previous three halvings, Bitcoin rose 317%, 125%, and 23%, respectively.

While Bitcoin has shown strong momentum in previous halvings, it has seen greater growth in the 360 days following the halving. The gains after the three previous halvings were 2,819%, 803%, and 707%, respectively. An interesting difference with this halving is that Bitcoin reached a new all-time high before the halving, unlike past cycles where new highs were reached after the halving.

While the outlook for the Bitcoin cycle remains positive, the surge in demand for spot ETFs may have accelerated the returns cycle.

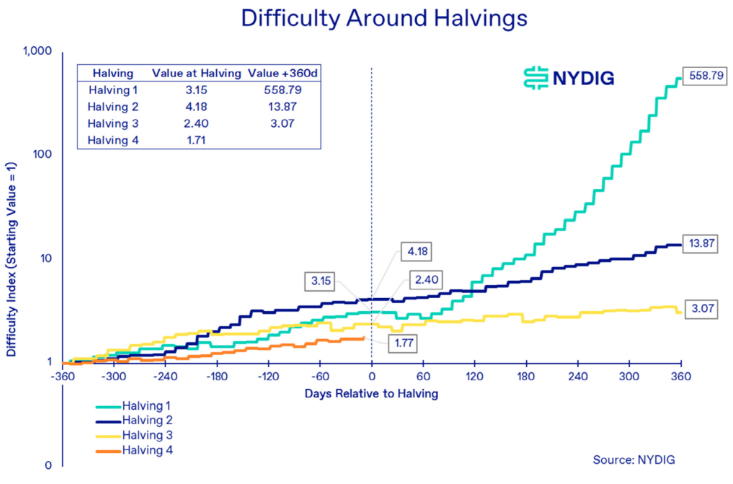

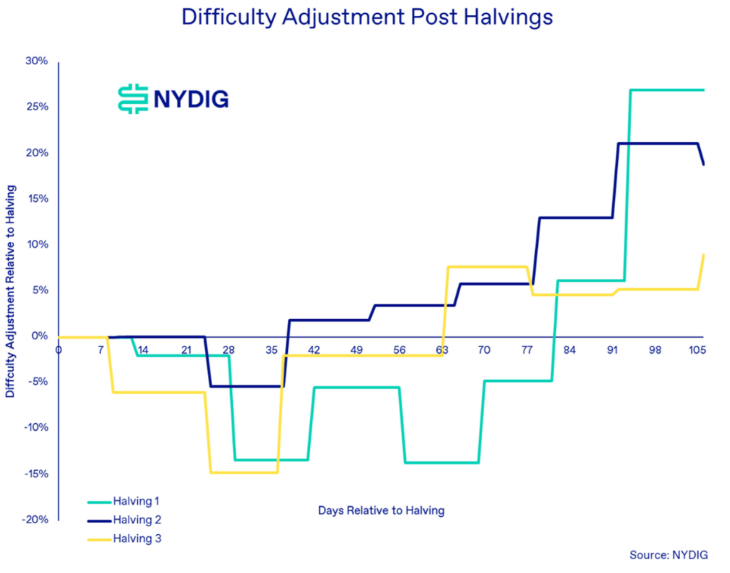

Difficulty adjustment reflects hash rate offline

Bitcoin's difficulty is a key metric for mining activity on the network and plays a vital role in the process of creating new blocks. The metric is directly tied to the network's hash rate, which fluctuates based on whether miners are online or offline. The difficulty level is adjusted every 2,016 blocks, or about two weeks. The impact of halving events on miner economics cannot be underestimated, as they directly affect the amount of hashing power, and therefore the difficulty level. When the difficulty decreases, it means that less efficient miners are shutting down their machines. Looking at historical data, we can see that miners increase their hash rate before a halving event, reflecting a significant increase in difficulty.

While difficulty may drop slightly immediately after a halving, the overall trend shows a significant increase in difficulty levels 360 days after the halving. This highlights the resilience and adaptability of the Bitcoin network to changes in mining activity.

An important factor to consider during the halving, especially for miners, is the potential impact of hashrate being taken offline due to reduced profitability. Since the halving essentially doubles the breakeven price for miners (excluding transaction fees), there has been speculation that miners running above these costs may be forced to shut down.

However, NYDIG’s prediction for this halving is that hashrate will rarely, if ever, go offline after the halving, as some of the oldest mining machines are still profitable at current price levels. In previous halvings, the peak downward adjustment in difficulty was 13.7%, 5.4%, and 14.7%.

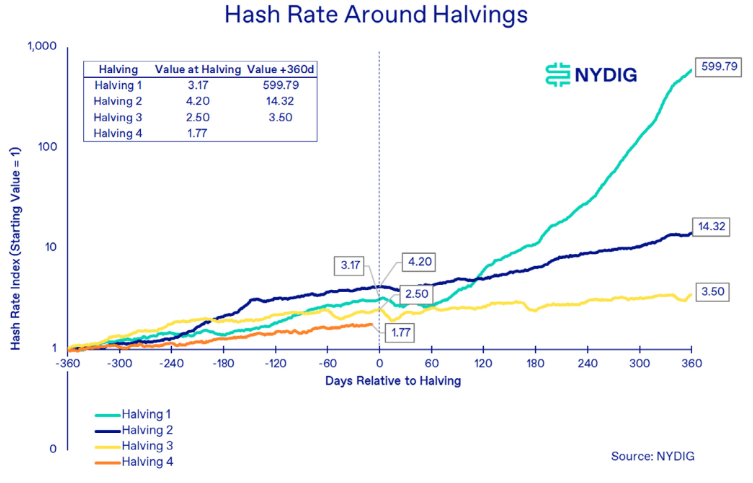

Hash rate halved, corrected, but then continued to grow

The network hash rate reflects the pattern of difficulty adjustments before and after the halving. It is common to see a surge in the network hash rate when the halving is approaching as miners are stepping up operations to maximize returns. After the halving, the hash rate may temporarily drop as less profitable mining operations go offline. However, historical data shows that the hash rate usually stabilizes and rebounds as the network adapts to the new environment. Based on the current market price and the break-even of miners, most mining machines will not be offline or shut down during this halving.

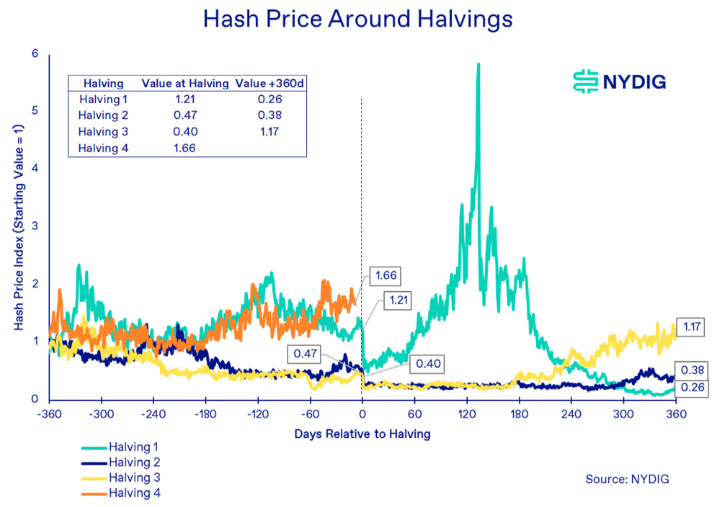

High variability in hash prices

Hash value (known as hash price) is a key factor for miners and is affected by block rewards and transaction fees, and can change significantly before and after a halving. In some cases, such as the current halving, hash price spikes before the halving occurs, while in other cases, it drops. Typically, hash price drops by about 50% after a halving, depending on the contribution of fees to miners' revenue. However, the results 360 days after a halving have proven to be unpredictable, with some cases showing an increase from initial levels and others showing a significant drop after a significant increase.

Supply reduction no longer matters

A common argument surrounding the halving event is that it will have a positive impact on price, given the reduction in new supply available to investors. This certainly sounds like it, as Bitcoin’s daily supply is expected to decrease by 450 on April 20, which works out to about $31.5 million per day at a price of $70,000/BTC. However, in terms of global trading volume, this reduction represents only 59 basis points (about 0.6%) of daily trading volume, a relatively small percentage. It is worth noting that this percentage was much higher in the past and could have a greater impact on trading volume and price. For example, the first halving reduced trading volume by about 10.64%, a more pronounced impact than the current situation. NYDIG believes that the demand side, especially as it relates to spot ETFs, will play a more critical role in determining price than supply.

in conclusion

With the halving just completed, it is important to recognize its importance in Bitcoin's history. This rare phenomenon is not only of technical significance, but also has implications for the economy of the entire ecosystem. While the direct impact of the halving on Bitcoin's price may diminish over time, the halving remains a key factor in understanding Bitcoin's price cycles. While this event will reduce miner revenue, the halving, along with the difficulty adjustment, is a fundamental feature of Bitcoin's programmatic and fixed supply.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the author and guests, and have nothing to do with the position of Web3Caff. The information in the article is for reference only and does not constitute any investment advice or offer. Please comply with the relevant laws and regulations of your country or region.