The Market

The crypto market underwent a significant stress test last week. When Iran launched the drone attack on Israel last Saturday, BTC immediately sold off 10% while the altcoin market sold off 15%. As the market recovered from the initial shock, Powell’s speech on 4/16 further dampened any expectation of rate cuts in the short term, which sent the market down again. The muted response after Israel’s retaliation attack on 4/18 seems to indicate a low probability of escalation of the geopolitical crisis. Overall, BTC ended the week selling off ~4.5% while the altcoin market fared a bit better, selling off 3.5%. What’s interesting is the price response for some of the high risk assets. For example, Degen, the top meme coin in the base ecosystem, has sold off ~35% after the drone attack but bounced back harder and ended the week up ~24%, indicating risk appetite exists in selected parts of the crypto market.

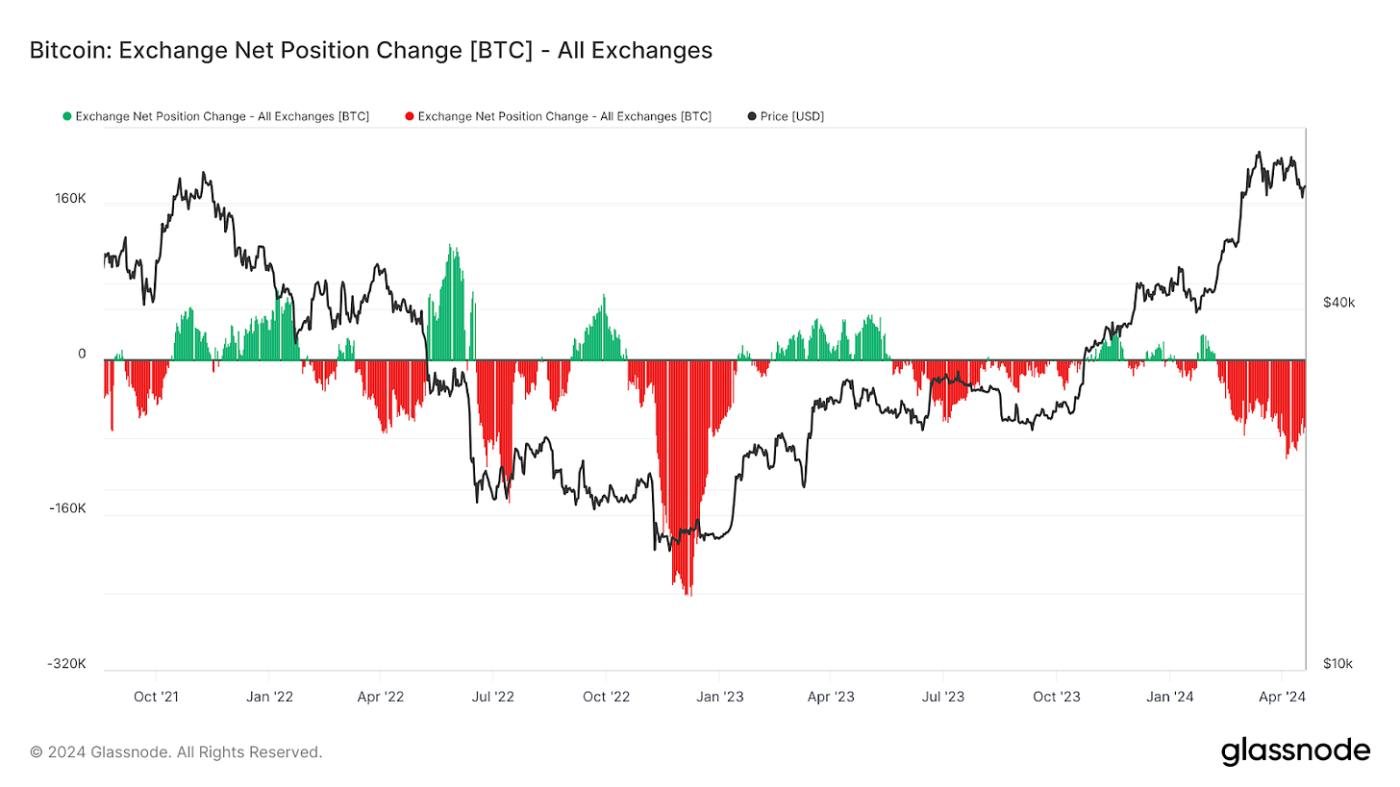

The OI-weighted funding rate of BTC turned negative last week, as the market went through the largest long liquidation this year. The Exchange BTC supply has been constantly declining since February. Halving will further exacerbate the supply. With the selloff and downward trending supply dynamics, the market presents favorable conditions for fresh capital to enter. In fact, the total supply of USDC and USDT has increased by more than 2.7% last week, indicating fresh capital coming in to pick up stressed assets. Although USDT supply has already hit ATH, USDC supply is still half of its peak level, indicating further room to grow.

So where do we go from here? As BTC retraced from its new ATH in March, it seems to find a support level around $60K, indicating a 20% correction, which is within the normal range of previous corrections. The altcoin market cap has found support level around $610B, which is 42% down from its ATH level of $1.06tr in November 2021.

As the geopolitical risk abates, the oil market sold off 2.6% last week, pricing in no escalation of the Middle East crisis. VIX only briefly rose above 20 last week and at a current level of 18, is not pricing in any significant downside move in the near term. The market is also adjusting to the new reality of fewer than 3 rate cuts this year. While the unprecedented liquidity injection in 2019-2021 helped the DeFi summer, we don’t think it is the only driver for a crypto market rally. Ultimately the value of a crypto project depends on its earnings potential and what type of multiples the market is willing to assign to future earnings. We see two type of projects potentially doing well in this cycle:

Projects with strong earnings potential as they find Product-Market-Fit (PMF) and have access to a growing user base:

Solana, with its high-performing monolithic infrastructure, has demonstrated PMF, with its DEX trading volume rivaling that of Ethereum. With its recent fix on the congestion issue and the Firedancer upgrade later this year, we expect Solana to continue building on its strengths and attract users. Its ecosystem is still young and growing, showing healthy diversity from DeFi to DePin applications.

Base, the Ethereum L2 built by Coinbase, has shown strong growth momentum and will benefit greatly from Coinbase’s UI improvement efforts, such as smart wallet, Magic Spend and storing USDC on base. Base will be Coinbase’s gateway for a frictionless experience to on board its 110 million users to Web3.

TON, reuniting with Telegram as their blockchain partner, could follow the same trajectory as Base, with the potential to tap into Telegram;’s 900 million users. The Ton wallet and dApps will leverage Telegram channel to create a smooth user onboarding experience. Telegram has just announced USDT on TON and offers incentives for free USDT transfer and high USDT interest rate, which will accelerate fiat money entering the TON ecosystem.

Projects with high valuation potential either with narratives that can go viral or are building products from Zero-to-One in a market with large TAM.

The recent rally in meme coins has demonstrated the power of narratives. In our view, the real value of meme coins lies in the social value they create. Each meme coin has its own community of followers, and while they may start as funny pictures, they can go viral because communities rally around them. For example, WIF, the biggest meme is Solana recently raised ~$700k in donations from the community to put the dogwifhat picture on the Las Vegas sphere. However, not every meme will succeed. While they can attract quick money for asymmetric payoffs that are not available in other markets, if there is no community or culture supporting them, the price could drop quickly.

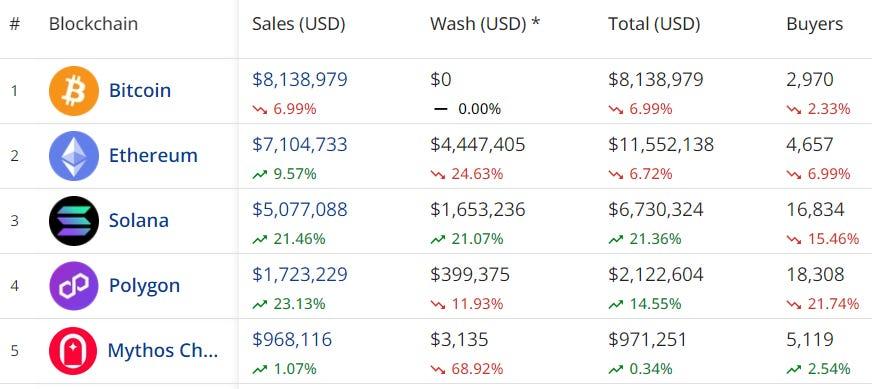

The Bitcoin ecosystem is another example with high valuation potential. Ordinals have started the Zero-to-One moment for asset issuance on the Bitcoin chain. NFTs on Bitcoin have recently surpassed Ethereum in sales volume. The launch of Runes protocol on the halving day led to a new high in transaction fees on Bitcoin, given the interest in minting the RUNE assets. The rapid development of Bitcoin L2s could lead to another Zero-to-One moment, providing utilities to these assets and BTC itself. The current Ethereum TVL is about one-third of Ethereum’s market cap. If one-third of Bitcoin’s market cap were unlocked, it would unleash $433B in value, indicating a significant TAM for the Bitcoin ecosystem. After all, Bitcoin is the biggest meme in crypto.

The recent market volatility has proven to be a stress test for the crypto market. The limited impact and the strong rally for selected high risky assets demonstrate the market’s resilience. We still believe we are in a bull market trajectory. While large liquidity injections by the Fed is unlikely in the short term, there are growth drivers in selected parts of the market that could still yield handsome returns.

Top 100 MCAP Winners

Core (+64.06%)

SigularityNET (+37.02%)

Internet Computer (+35.17%)

Arweave (+35.17%)

SUI (+33.89%)

Top 100 MCAP Losers

Starknet (-1.86%)

UNUS SED LEO (-1.2%)

Bittensor (-0.81%)

Nervos Network (-0.25%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.

About the Author

Kelly is Portfolio Manager and Head of Research at Decentral Park Capital. Investing across sectors with a thesis driven, deep research approach.

Prior to this, Kelly has led research and product efforts at CoinDesk Indices and Fidelity Digital Asset Management. Kelly has been a TradFi investor for 15 years before joining the crypto space.

You can follow Kelly on Twitter and LinkedIn for more frequent analysis and updates.