The imagination of the crowd changes everything, whether it is true or imaginary.

——Le Pen

The essence of a decentralized community is the deconstruction and innovation of asset allocation models.

In the evolution of communities, the concept of assets always plays a pivotal role. In the real world, people often come together because they have common interests. As society changes, the presentation of interests has become more diverse, becoming different types of "assets". The acquisition, distribution and value growth of community assets are essentially driven by "consensus".

In primitive society, based on the consensus of tribal totems, tribal members cooperated to obtain food, resist foreign enemies, and protect assets to maintain the development of the tribe. In the Internet era, while satisfying people's desire to express themselves through various media empowerment, it also promotes people's consensus on traffic. Nowadays, large traffic and many fans often represent a certain authority and become a virtual asset with monetization capabilities. Today, the monetization of traffic assets has become smoother and smoother, which is also the core way for the current growth of traditional Internet social networking.

In Web3, the iteration speed of the community is much faster than that of the Web2 era. Every day, a new project emerges and becomes a large MC memecoin on a chain in the news. Of course, every day, many on-chain meme quietly return to zero. In these ups and downs, we can already summarize a rule: the essence of a truly sustainable decentralized community is to embed a fair asset allocation plan that is both incentive-based and sustainable in the community structure. This is like in primitive society, although the totem is the common belief of each member, it is still necessary to dispose of collective assets fairly and reasonably to maintain the trust and consensus of members on the collective. More work, more pay, this is the most basic and best understood asset allocation plan, which is also applicable in the crypto world.

Pioneers in the crypto world try to play new tricks in asset allocation

Focusing on Web3, the founders of the community have been pursuing the most "decentralized" way to achieve asset allocation through continuous innovation, experimentation and improvement. Asset allocation based on Bitcoin's Nakamoto Consensus is the first attempt. Under the Proof of Work (PoW) mechanism, miners compete for the right to record accounts based on computing power in order to obtain Bitcoin as a mining reward. We know that mining is very difficult and costly, so how did the Bitcoin consensus successfully break through the circle and attract a large number of miners to invest a lot of capital? Of course, it is because of the soaring Bitcoin price and the scarcity of the reward halving every four years, which makes Bitcoin as an incentive mechanism under the Nakamoto Consensus attractive enough, and then makes miners become loyal supporters of the Nakamoto Consensus, maintaining a high degree of enthusiasm and investment.

How can the illusory meme coins become high-quality assets that are loved by everyone?

If Bitcoin is the cornerstone of the crypto world and the first and most core asset for blockchain value realization, how did the memes that have exploded in recent years gradually become high-quality assets in people’s eyes? From the initial Dogecoin, Shiba Inu and other cute pets to the abstract pictures of sad frogs, sloths, stickmen and so on in this round of bull market.

These currencies, which were originally created for the purpose of "parody", are sought after by Web3 players because they are both trendy and entertaining, and do not require the understanding of any complex technical principles. This trend has also successfully attracted the participation of capital, and Musk's platform has directly made Dogecoin the mainstream currency in the market. Nowadays, popular meme coins have begun to be spontaneously created by project parties or players to create communities and become well-known IPs in the crypto world. In essence, they are based on the group's recognition of this trend culture. The originally illusory memes have become real because of the entry and accumulation of capital, forming a trend consensus and radiating new vitality.

Runestone’s past and present, attempts and depths to further strengthen community assets

After talking about Bitcoin and memes, we have to mention Runestone, a popular IP, from the perspective of asset innovation, as the halving has just been completed. One of the important reasons why the Runestone project can become popular is that it has set three records on the Bitcoin chain: the largest Bitcoin block ever, the largest Bitcoin transaction ever, and the largest Ordinals inscription ever. The famous 8 BTC auction proceeds used to pay for the airdrop mining fee also reflects the Runestone project's commitment to the entire community.

Of course, there are three most important reasons why Runestone has become so popular: fairness, fairness, and damn fairness.

The narrative of "airdrop" + "fairness" + "Runes Protocol" has made the secondary market Fomo, and the price has soared to nearly $6,000. Unlike the previous inscriptions, BRC-20 is more played by Chinese-speaking areas, while Runestone has the consensus of users in both Chinese and Western communities. The tweet of founder Leonidas mentioned that there would be no achievements today without the joint efforts of the East and the West, highlighting the important role of Runestone in connecting the global community. The famous 8 BTC auction proceeds used to pay the airdrop mining fee also reflects the commitment of the Runestone project to the entire community.

Although the price of Runestones has fallen due to market panic caused by the local geopolitical crisis in the past two weeks, when Bitcoin was halved and the Rune Protocol was officially launched, coupled with Leonidas' crazy cx on Twitter about the expected airdrop of subsequent Runes, the absolutely fair free airdrop mechanism continued, making the price of Runestone still strong. There is no pre-sale of RUG at any time, no scientists, and no soaring gas, and it attracts many project parties to take advantage of the popularity and give free airdrops to holders. Leonidas has already made Runestone a golden shovel for playing with the inscription ecosystem. It can be said that the emergence of Runestone is an attempt and depth to further strengthen the community assets of the crypto world.

The secret of decentralized social networking: the integration of community communication and asset allocation

As for Web3 social networking, the mainstream carrier is still Twitter + Tg, which is not in line with the spirit of decentralization. SocialFi products are committed to creating a decentralized carrier for the Web3 community and developing a decentralized social platform at the level of Facebook and Twitter. Therefore, while focusing on social functions, we should also follow the above rules and drive community communication by strengthening the nature of assets and building a diversified asset structure to help products successfully break through the circle.

A wolf in sheep's clothing: Ponzi based on social network tokenization

The idea of the previous generation of SocialFi products was relatively simple and crude. Friend.Tech focuses on the assetization of social network influence and brings a sufficiently large wealth effect to early users through the bonding curve.

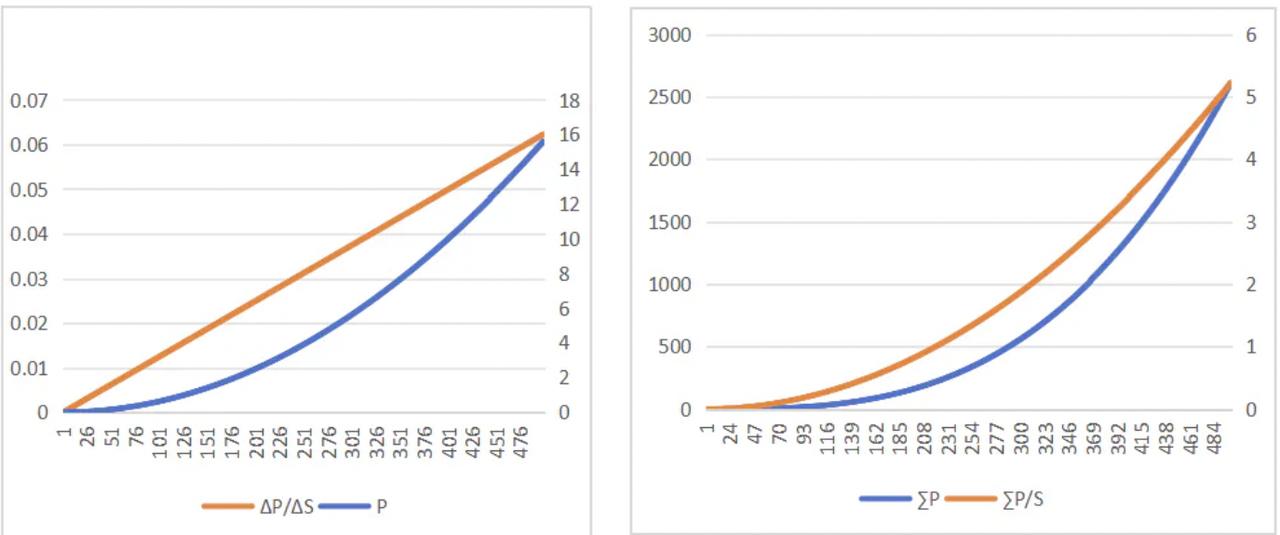

FT has created an extremely Ponzi SocialFi product through its economic model and the pricing formula of the community's core asset Key, Price = S^2/16000 (S is the number of people entering the room). From the picture, we can also see that the steep yield curve is the root of FT's popularity, which gives users the intuitive feeling that as long as I enter the market earlier than others, I can get higher returns.

However, because this model is too direct, it is not sustainable when the number of users surges. Although the handling fee set for each transaction is 10%, of which 5% is distributed to the protocol and 5% to the Key issuer, the model can be combined to deduce that the actual user transaction wear and tear is far more than 10%. Therefore, for users who enter the market later, the expected high returns cannot be achieved, resulting in a large gap between the user's EV and BV, and the user's assets are sucked by the protocol and the Key issuer who enters the market early. This is the essence of this Ponzi.

From the perspective of game theory, FT hopes to achieve a stable model of (3, 3) on the asset side. However, since those who rush to the front can obtain higher returns and cause losses to others under this economic model, the motivation of players to rush to the front will increase, and they will begin to suspect each other. Once the chain of suspicion is formed, the final Nash equilibrium is only (-3, -3). At this point, everyone may have forgotten that we are not talking about a DeFi product but a SocialFi product, and this is one of the biggest problems of FT.

In short, FT overemphasizes the attributes of finance, making itself a DeFi Ponzi disguised as a social network. At the same time, since the consensus of users mainly comes from expected returns rather than the community itself, when users realize that they have fallen into a Ponzi scam where the expected returns cannot be achieved at all, Friend.Tech cannot prevent the loss of users, which eventually leads to the bursting of the bubble.

My name is Degen, currency

One of the most popular products of this generation, Farcaster, has made a better attempt. By organically combining traditional social functions with asset allocation, Farcaster has created a SocialFi product with more social attributes.

Farcaster has put a lot of thought into encouraging user interaction and deep participation in the community, such as launching interactive posts, various forms of community activities, encouraging long and high-quality tweets, and enabling $degen rewards. It is worth emphasizing that Farcaster's reward system has set a new benchmark for the combination of decentralized communities and assets. This function encourages users to deeply participate in the community, publish high-quality content, and spontaneously promote the community.

Because of this, the community asset $degen can circulate like currency in the ecosystem, and users can both "earn" assets and "consume" them in the ecosystem, completing a closed loop of asset structure. At the same time, Farcaster officially released two NFTs: OG NFT and Farcats. As an official asset, there is also an expectation that it will be empowered by Farcaster in the future.

Compared with Friend.Tech, Farcaster's asset allocation method focuses more on the user's participation in the ecosystem rather than relying on gambling. We can compare FT to a casino, where users need to bring assets to gamble with opponents. It is essentially a negative-sum game where the dealer makes a profit. Farcaster's asset allocation method achieves the positive mutual promotion of $degen coin price, platform DAU and user benefits. In short, the circulation of assets and the spread of the community complement each other to create a decentralized social ecosystem with sustainable growth.

Regarding the future, the path of connecting communities and assets based on economic models

UXLINK, as the most popular decentralized social product at present, also has a unique idea in combining community and assets. UXLINK's community asset penetration path is mainly divided into levels: decentralized applications, community interaction and dual-currency economic model.

Users can create their own DID, Web3 wallet, Web3 social network through DApp, and can achieve docking with Web2 social network. The integration of a full set of financial-related DApps promotes users to come to UXLINK with assets, rather than just for free. Because these supporting DApps lower the threshold for users with assets to participate in ecological and community interactions and provide greater flexibility. For example, through the combination of UX Wallet and DEX, users no longer need to go to another wallet or exchange to exchange tokens and then transfer them to social platforms for use. Instead, they can exchange them directly in UXLINK, which enhances users' willingness to participate in community communication by improving convenience and liquidity.

Similar to Farcaster, UXLINK also focuses on community interaction. Users provide traffic and use their social networks to promote social games, product marketing, and Dapp fission. At the same time, users' traffic can be used to attract new audiences and reward users who contribute to growth. In addition, UXLINK's dual-currency economic model divides the main community assets into two parts, the utility token $UXUY and the governance token $UXLINK. Following the concept of the Ve (3, 3) model, it aims to pursue the maximum return based on fairness for the overall ecosystem and ecological participants. Such an economic model first ensures that community assets have the ability to capture value, so that assets have intrinsic value that does not depend on liquidity.

Conclusion

Driven by Crypto consensus, the relationship between communities and assets is also evolving. From Bitcoin to memes to inscriptions, the driving force of consensus has also evolved from the initial most practical price to culture, and finally to the abstract "fairness" at the spiritual level. In the future, there are many new development models worth imagining. For example, a tribe spontaneously creates a totem, and each decentralized community can publish its own meme as a community asset.

After all, in the final analysis, interests are the eternal king.