“A key aspect of Safe is its inherent modularity, which makes it future-proof.”

Interview: Sunny, TechFlow

Guest: Lukas Schor, Co-founder of Safe

“A key aspect of Safe is its inherent modularity, which makes it future-proof.”

—Lukas Schor, co-founder of Safe

Safe is the largest account abstraction wallet in Web3, securing over $100 billion in assets.

Today is an important moment for Safe : the Safe token contract is officially unsuspended and SAFE can be freely circulated in the market.

Subsequently, the Safe token was traded at a global valuation of $2.8 billion.

$100 billion in assets and $2.8 billion in global valuation are both milestones for Web3 smart contract wallets. Last week, Safe successfully acquired a financial management platform invested by Sequoia. These consecutive events have given Safe strong momentum, and also mean that more users will switch from Ethereum external account wallets to smart contract wallets.

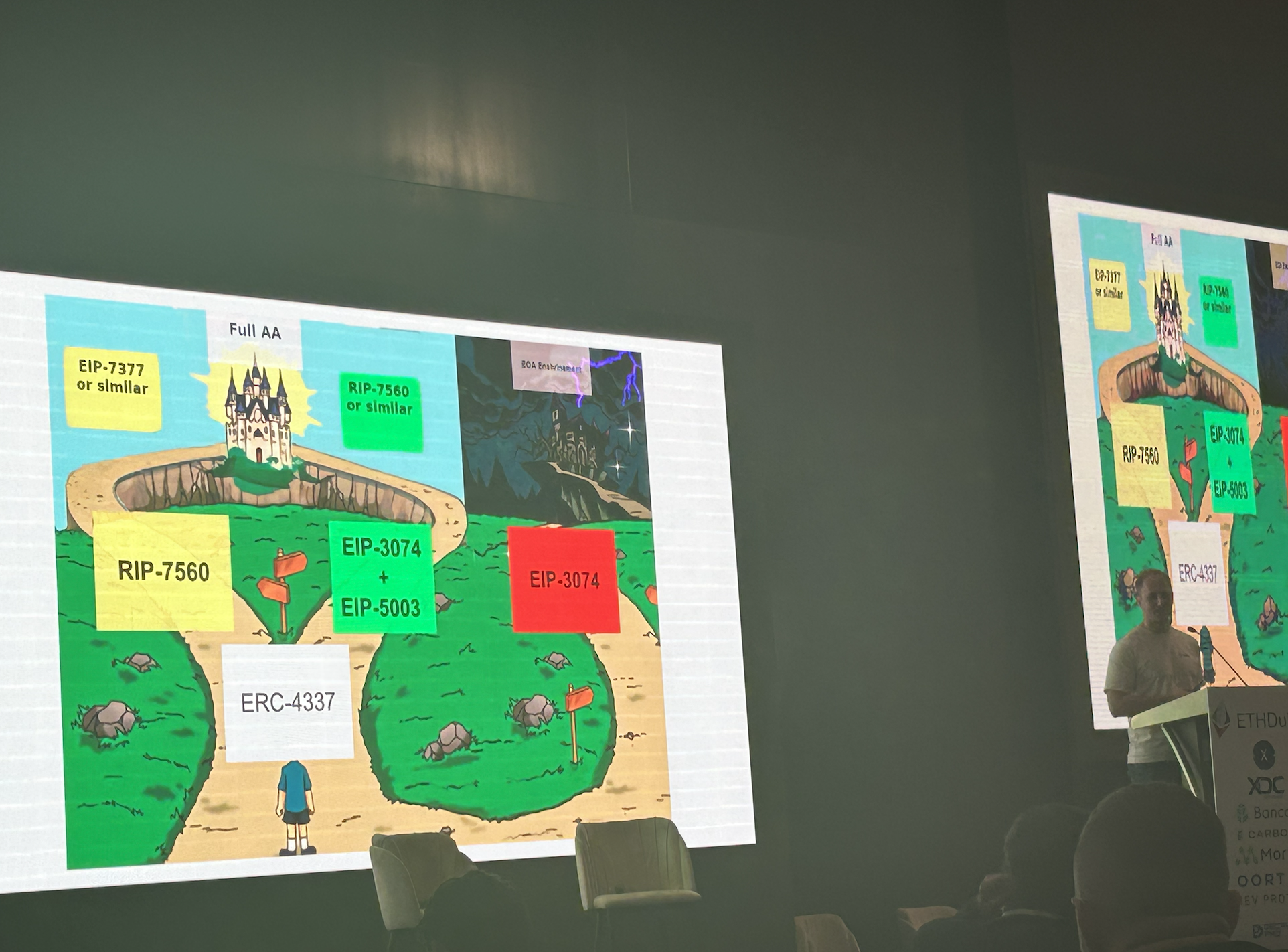

At the recent ETH Dubai event, Safe co-founder Lukas expressed his views on ERC-4337 and the recently re-engaged EIP-3074. As the largest consumer application in the smart contract wallet space, Safe is crucial to the adoption of any standard because it has the largest smart user base.

TechFlow TechFlow Lukas on issues such as smart contract wallet standards.

TechFlow : Should we call it "Safe" instead of "Gnosis Safe"? Is this the preferred brand name you want to convey to your audience?

Lukas Schor :

Safe's history is closely tied to Gnosis, it's part of our DNA and forms part of the so-called "Gnosis Mafia" - a network that includes projects like Cow Swap. Although the name "Safe" faces challenges in terms of search engine optimization (SEO), we are committed to building and strengthening the brand around it. Our focus is to strengthen Safe's identity within the ecosystem.

TechFlow : Is SAFE built on the Gnosis chain?

Lukas Schor :

Safe is very flexible; our smart contracts are deployed on 100 different EVM networks, although not all of them are major players from a usage perspective. Initially, Safe was spun off from Gnosis, which established a foundational connection. However, this relationship is more of a soft link than an exclusive commitment to the Gnosis system.

Safe Overview

TechFlow : Safe is the largest smart account known for its multi-signature system. Could you briefly introduce Safe?

Lukas Schor :

Safe's core mission is to transform every user account into a Smart Account.

Security of ownership is critical; users should have confidence that they will not lose access to their accounts even if they lose their private keys. This can be achieved through Smart Accounts, which move away from reliance on a single private key in favor of more sophisticated access control systems such as multi-signature systems.

Safe’s capabilities extend beyond multisig: it also includes features like the use of session keys for low-risk operations, two-factor authentication setup, and account recovery options, which together amount to a hybrid custody solution where trusted parties can co-sign or block malicious transactions without initiating them.

Currently, SAFE Smart Accounts manage approximately $100 billion in assets, primarily from the collective initiation of the team and significant contributions from high net worth individuals and institutional participants.

The shift to smart accounts offers a variety of benefits, from improved user experience to enhanced security and protection against future quantum threats, as traditional Elliptic Curve Digital Signature Algorithm (ECDSA) signatures are susceptible to compromise.

Our project is not just about building technology, it's about fostering an ecosystem. We are developing open source tools and infrastructure to support a variety of user groups transitioning to Smart Accounts, from retail traders to teams focused on financial management. Safe is a collaborative effort to achieve a quantum-resistant Web3 reality.

A quick read on Safe’s founding history ( link )

ERC-4337, EIP-3074, EIP-5003: Which account abstraction path is best?

TechFlow : Can you explain in detail why you moved from ERC-4337 to EIP-3074 and how this decision fits in with your broader strategy for account abstraction?

Lukas Schor :

We are committed to advancing the roadmap for account abstraction on Ethereum, with a focus on transitioning from EOAs (Externally Owned Accounts) to Smart Accounts.

Initially, we planned to build on ERC-4337 with no protocol changes, using the application layer and bundler paymaster ecosystem. However, due to complexity reasons, we started the rollout using EIP-7650 for an efficient and decentralized approach.

The decision to move to EIP-3074 by the end of 2024 reflects a practical step to enable batched transactions and simpler migration from EOAs to Smart Accounts, leveling the playing field. This lays the foundation for EIP-5003 , which will allow full conversion of EOAs to Smart Accounts at the same address.

Our strategy emphasizes not only enhancing the functionality of EOAs, but also pushing for full native account abstraction to avoid hindering progress. Integrating EIP-3074 with EIP-5003 will provide a clear upgrade path, ensuring a coherent and efficient transition.

Detailed smart contract standard analysis ( related links )

TechFlow : What is the connection between Safe and companies like Pimlico that provide Paymaster services?

Lukas Schor :

Pimlico is essentially a partner who provides a Paymaster bundler infrastructure that Safe does not. They integrate this infrastructure with Safe Smart Accounts, focusing on transaction sponsorship to enhance the usability of the app. They also provide an SDK that allows developers to specify which transactions should be sponsored. This strategic integration expands the functionality and accessibility of Safe Smart Accounts.

Short description: Safe is designed to be modular and adaptable in nature. You can choose to use only Safe's own account abstraction system, or add an ERC-4337 module to make it fully compatible with ERC-4337.

(Thanks to Kristof Gazso, founder of Pimlico and co-author of ERC-4337, for the feedback.)

Smart Accounts are Quantum Verified

TechFlow : Earlier, you mentioned the threat of quantum computers to EOAs. Can you elaborate on this?

Lukas Schor :

Current cryptographic methods, such as ECDSA signatures, are vulnerable to quantum attacks. As quantum computing advances, these vulnerabilities could be exploited to render existing Ethereum accounts (EOAs) insecure. The community believes that a transition to Smart Accounts using advanced cryptography like Schnorr signatures is necessary. Discussions include a potential emergency upgrade (similar to EIP-5003) in the event of a quantum attack, which would force the migration of accounts to Smart Accounts. However, a voluntary transition is preferred over a forced, ex post facto upgrade to avoid the complexity and risk of a forced upgrade.

Keystore is the next step for Safe

TechFlow : Can you choose a topic related to the future development of Safe and share more information?

Lukas Schor :

I'm particularly excited about the potential of Keystore.

Keystore will allow us to abstract the complexity of the network from both the user and developer ends. Ideally, users won’t need to worry about which network their assets are on, a bit like we don’t need to worry about where the server is when we visit a website. This abstraction is critical to simplifying interactions across various networks such as Optimism or Arbitrum.

Keystore centralizes access control mechanisms - much like a password manager - where you can manage your keys and perform operations such as key rotation seamlessly across all accounts. This is particularly beneficial for cross-chain operations, where you may have assets on different networks but can manage them through a single centralized keystore.

These keystores will typically be synchronized with all associated accounts using cryptographic proofs, ensuring that any updates to your keys are automatically propagated. We are considering implementing these keystores on dedicated rollups optimized for this functionality, which will interact with state proofs from various networks to reliably provide current account state.

This development aims to simplify the process of managing multiple accounts across chains, solving the problem through a unified access point. It solves some common problems associated with smart accounts, especially those related to state synchronization and deploying accounts on multiple networks.

Safe is actively involved in this space, and Scroll and Base are also working on prototypes. There will be exciting updates in the coming weeks, and Safe will play a big role in them.

Will MetaMask be one of the competitors?

TechFlow : Do you think MetaMask will become a competitor of Safe in the future?

Lukas Schor :

Considering Safe's mission is to turn every account into a Smart Account, MetaMask currently operates primarily with EOAs (Externally Owned Accounts) and has only partially adopted account abstraction through Snaps, a transition that has not seen significant adoption. In this sense, they can be considered a competitor. However, their commitment is unclear, especially with developments like EIP-3074, which they do not strongly support. This EIP tends to enhance EOAs, unlike EIP-5003's direct transition to Smart Accounts. MetaMask's platform is primarily built around EOAs, and moving to Smart Accounts could significantly impact their current model. The extent of their support for Smart Accounts, which would be more in line with Safe's goals, remains to be seen.

TechFlow : What do you think is Safe's competitive advantage? Is it the go-to-market strategy that attracts a variety of customers, the capabilities of the engineering team, or the flexibility of the organization?

Lukas Schor :

Safe is not the most flexible project, mainly because our focus is on security, which is often at odds with flexibility. Our smart contracts have been running for seven years and safely manage over $100 billion in assets. This longevity and reliability helps to enhance user trust that grows over time ( Lindy effect ).

A key feature of Safe is its inherent modularity, which allows for future adaptability. For example, when new standards such as ERC-4337 emerge, we can simply integrate the new adapter into our Safe account, maintaining compatibility and flexibility.

Another competitive advantage is our commitment to open source principles and token economic neutrality. Although Safe has its own governance token, our core contracts remain tokenless. This policy not only fosters an ecosystem built on trust and utility, but also promotes network effects as it attracts a wider developer community and promotes shared learning and tool creation. Together, these elements strengthen Safe's position as a foundational component in the smart contract landscape.

The Secret to Reaching a Billion Dollar

TechFlow : How did Safe attract such a huge amount of capital, totaling billions of dollars, in six years? Can you point to a "snowball moment" that promoted this growth?

Lukas Schor :

Before Safe, the concept of a less opinionated and more efficient multi-sig like ours didn’t exist. We launched Safe as a superior solution that was more energy efficient and modular, but convincing people to transition from a traditional setup to Safe was challenging. Especially because trust in smart accounts was low due to issues with other products like Parity, it took about one to two years to complete 50% of the migration.

Key milestones really helped accelerate this transition. Initially, Gnosis moved $50 million of their assets to Safe, showing a strong sign of confidence. Soon after, major centralized exchange Bitfinex moved all customer assets to Safe, totaling about $1 billion. Another important endorsement came from Vitalik Buterin moving his ETH to Safe, which likely involved his own rigorous review.

These key actions created a snowball effect, significantly increasing trust and adoption of the Safe contract.

SAFE Tokens and Community Governance

TechFlow : Do you have anything to share about Safe tokens?

Lukas Schor :

The Safe token is gaining traction, which could soon impact its perception. Interestingly, a key governance vote took place just last week. Initially, the Safe token was allocated as a non-circulating asset to ensure the community has a say in its future development.

The decision on whether the tokens should be made transferable was left to the community to decide through a vote. After the FTX collapse caused chaos in the industry, the community initially voted against making the tokens transferable. They set some milestones and did not reconsider their decision until these milestones were reached.

We have been working towards these milestones for the past year and a half, and last week the community approved making the token transferable in a new vote. This change will go into effect next week, on the 23rd (today). This is the first time we have participated in such an extensive community-driven process to change the status of a token, and it will be very interesting to see the impact of this new phase on Safe.

TechFlow : What guiding principles or “bible” does Safe follow when designing its governance token?

Lukas Schor :

From the outset, we chose not to allow any backers or investors to purchase equity, which sets us apart from projects that may have conflicts of interest due to their financial structure (such as Uniswap). The key entity of Safe is a foundation, and the Safe token fundamentally represents the value of the ecosystem, which facilitates its operation.

Next week, we will be introducing additional utility for the Safe Token as part of a new initiative that several key projects within the ecosystem are participating in. This is intended to encourage more users to migrate to Smart Accounts.

While the exact details are still under wraps, this update will significantly increase the value of the Safe Token. Additionally, we are exploring creative ways to utilize Safe Tokens for transaction fees on Safe, but these ideas are still in the development stage. ( Related link )

TechFlow : How does Safe’s investment structure work, especially with regard to token warrants? Do investors not receive token equity as part of the agreement?

Lukas Schor :

Unlike typical Web3 projects, where backers typically receive equity plus tokens, Safe backers purchased tokens purely two years ago, which is consistent with our ethos. We intentionally avoided equity to prevent misaligned incentives that could compromise our mission as an open source project. At Safe, we believe that the utility and value of a project should be encapsulated within the Safe token itself, ensuring that all benefits directly enhance the value of the token ecosystem without the complexity of equity.

TechFlow : How does Safe incentivize investors to participate in governance? Do they also contribute to the go-to-market strategy of the product portfolio?

Lukas Schor :

We simplified our governance to avoid subjecting token holders to frequent proposals. We also established a participation agreement early on, which clarified the legal aspects of governance participation. This gave institutional backers the confidence to actively participate.

In fact, our last proposal voted about 15% of the total token supply, with higher participation compared to other projects, with over a thousand voters out of 20,000 holders.

TechFlow : While I understand that smart contracts effectively replace traditional contracts, meaning “code is law,” you still use off-chain protocols for governance. How did you determine these regulations for your community? Is this more of a grassroots initiative, or is it dictated by the foundation, especially given that you are based in Switzerland?

Lukas Schor :

We implemented a participation agreement that participants must accept on Snapshot. This off-chain solution was approved as the standard for participation, ensuring legal clarity for everyone involved in governance. This framework significantly improves voter confidence by clearly defining legal boundaries.

How does Safe work with Web2&3 giants to attract users?

TechFlow : Given your interactions with major Web2&3 giants, what do they think about using Safe’s smart accounts to execute customer transactions?

Lukas Schor :

Different organizations use Safe for different applications. For example, Reddit uses Safe to handle NFT avatars, although I don't know the details. Sotheby's uses Safe to auction NFTs, benefiting from the security of not relying entirely on private keys due to the high value of the NFTs involved.

Additionally, Budweiser used Safe when purchasing the beer.eth domain and used it as his profile picture on the social platform in a deal valued at $100,000.

Safe’s structure enables them to enforce corporate policies through multi-signature approvals and hierarchical controls, providing a secure self-custody solution that avoids the risks of a single private key or shared password.

Approximately 10% of all USDC is securely held in Safe. This important use case highlights the importance of Safe in the ecosystem. Circle is particularly interested in how we can optimize this for users holding USDC in Safe, such as exploring ways to generate interest on these holdings.

TechFlow : Can you discuss your strategy for bringing Web2 users into the ecosystem?

Lukas Schor :

Passkeys is perhaps the most impactful development for on-chain transaction authentication this year.

Distributing private keys has always been a challenge in cryptography. Currently, people use a 12-word seed phrase to manage their keys, but this can be easily lost or improperly stored.

Passkeys aims to solve this problem by simplifying the generation and storage of private keys, thanks to standardization efforts by Apple, Google, and other Web2 companies that are looking to replace passwords. This will allow storage in systems like iCloud Keychain, enhancing interoperability and security.

This setup would enable passkeys to manage account behavior, and ultimately we might see every domain, email, or AI agent managing an on-chain account through methods like zero-knowledge proofs (ZK proofs) that verify off-chain state.

While some smaller teams are exploring passkeys, mass adoption is not immediate. For example, Shopify is looking at the technology, but typically, rollouts are signaled 6-12 months in advance, and we haven’t seen full signs of commitment this year. From a Safe perspective, we are watching these developments but don’t expect widespread adoption to happen immediately.

Previous TechFlow conversations about the Gnosis ecosystem ( related links )

https://www.techflowpost.com/article/detail_17521.html

Community:

Public account: TechFlow

Subscribe to the channel: https://t.me/TechFlowDaily

Telegram: https://t.me/TechFlowPost

Twitter: @TechFlowPost

Join the WeChat group and add assistant WeChat: blocktheworld

Donate to TechFlow to receive blessings and permanent records

ETH : 0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A

BSC : 0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A