Written by: Tia, Techub News

Bridges are the cornerstone of a multi-chain ecosystem, providing infrastructure for cross-chain value transfer. The total value locked in Layer 2 has been soaring since 2021, not to mention the countless new chains that have been launched this year. In this new world, users need powerful cross-chain solutions to transfer assets between different networks. Cross-chain bridges are a large market. As of March 31, 2024, according to DefiLlama data, the total locked value of cross-chain bridges reached US$25.9 billion, and the 24-hour transfer of cross-chain assets reached US$372 million.

In the early days, the most widely used cross-chain bridges were mostly in the lock/mint mode. When assets cross chains, the tokens from the source chain are locked into the smart contract of the cross-chain bridge, and then new tokens are generated on the target chain. When the assets cross back, the new tokens are burned on the target chain, and the native tokens are then unlocked/released on the source chain. Most official bridges use this mode. The biggest problem with this type of cross-chain bridge is its security, and the smart contracts on the source chain are easy targets for attack.

Liquidity network bridges attempt to solve this problem. Bridges that use on-chain liquidity usually have liquidity pools on each chain and require verification between the source and target chains. When the source chain transaction is confirmed on the target chain, the user's order on the target chain will be executed. However, there is a disadvantage of such cross-chain bridges, which is that cross-chain takes a long time. When users deposit funds on the source chain, their deposits can only be verified after the source chain is finalized, and they can only withdraw funds after the target chain is finalized. That is, the shortest transmission time = starting point finality + end point finality. Moreover, such bridges are not cheap and usually require expensive on-chain verification.

Cross-chain has always had this problem, and messaging is almost impossible to achieve cheaply, quickly, and securely. But the intent-centric cross-chain bridge proposed by Across Protocol seems to have changed this trilemma of cross-chain bridges.

Intention-centered

Intentions are different from ordinary transactions. Ordinary transactions directly change the state of the chain, while intentions initiate a state that the user wants to complete, and leave the specific details of completion to a third party. Different protocols have different names for these third parties, and they are usually called solvers, resolvers, searchers, fillers, takers, and relayers. In Across, after the user expresses the intention to cross the chain, a third-party relay is introduced, which is responsible for quickly delivering assets and executing user transactions.

fast

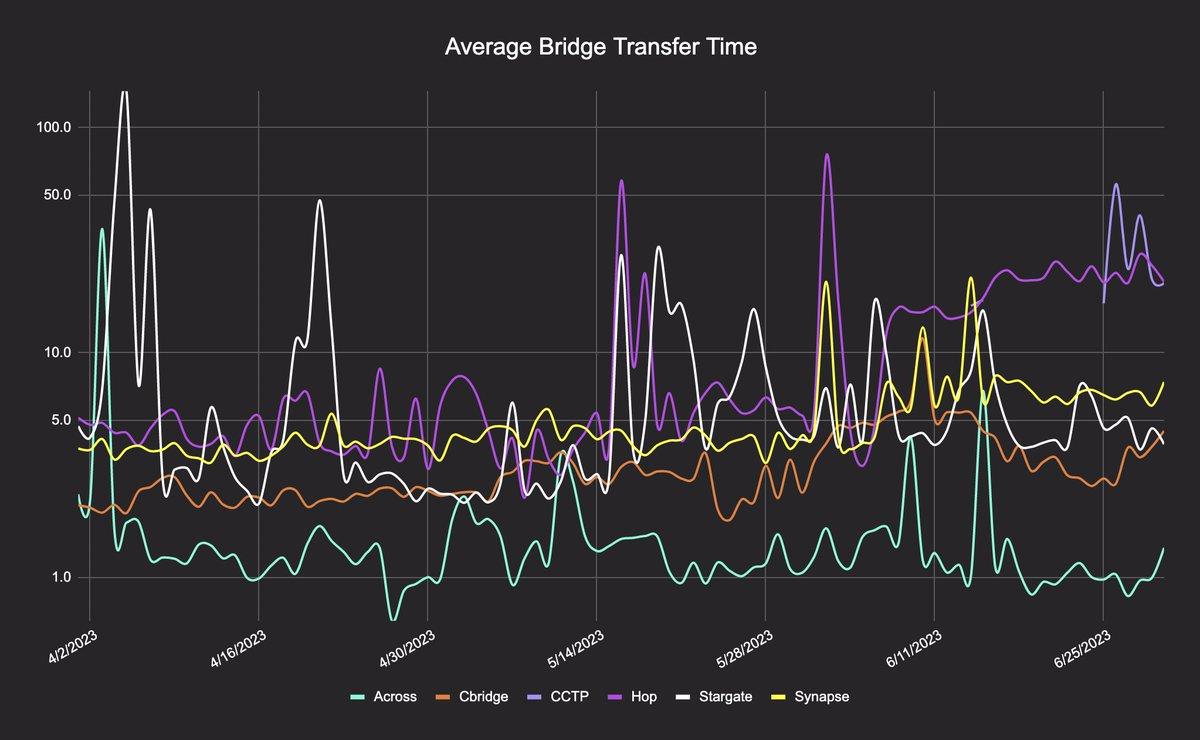

The third-party relay will monitor the user's cross-chain transactions. Once it sees the transaction, it will use LP to lend money to the user on the target chain. The relay will transfer the user on the target chain when it sees the transaction instead of waiting until the original chain reaches finality to transfer the user, so as to achieve the effect of quickly transferring the user across chains. In comparison with cross-chain bridges such as Stargate, Cbridge, CCTP, and Hop, it can be seen that Across has the shortest cross-chain time.

safety

Since relayers transfer funds to users when they see a transaction rather than waiting until finality is reached on the chain, this means that relayers take on risk on behalf of users. In exchange for taking on risk, relayers expect to receive a return on their assets. This is effectively equivalent to issuing a short-term loan. Relays take on risk when filling orders because they receive interest on the loan and they trust UMA to ensure that they are repaid in a timely manner.

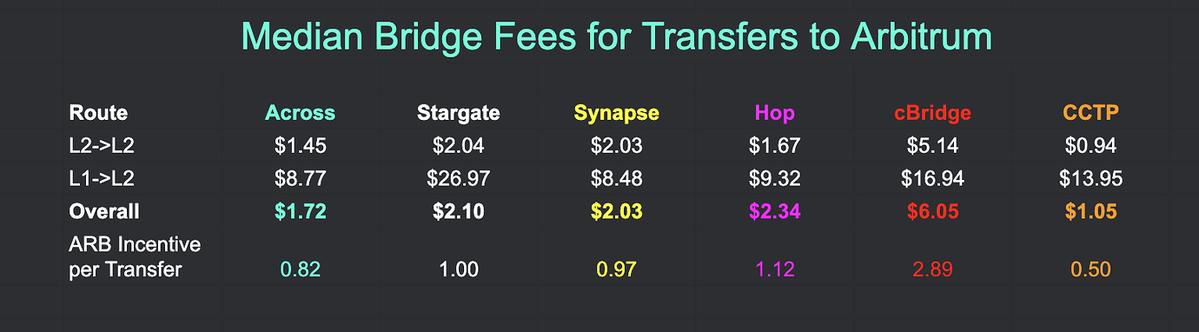

low cost

The cost of the loan paid to the relay is extremely low.

Assume that a relayer is willing to lend funds at an interest rate of 10% for a period of one hour (this number is an approximation based on market interest rates).

At an annual interest rate of 10%, there are 8760 hours in a year. This means that the cost of the loan is only 0.001142%, or about 0.1 basis points. We can use the following formula to calculate the cost of relay loans:

Annualized loan rate ÷ (number of days in a year x number of hours in a day) = cost of one hour of loan

10% ÷ (365 x 24) = 0.001%

If a relayer lends $1,000 per hour, the cost is about $0.01.

If a relayer lends $100,000 per hour, the cost is about $1.

If a relayer lends $10 million per hour, the cost is about $100.

In addition to paying the fees for relay loans, LPs also receive a fee. Across’s intent-based architecture also supports Gas optimization. After confirming the target chain transaction, multiple transactions will be packaged into one transaction during the settlement phase of payment to the relay, thereby improving capital efficiency.

summary

This is the innovation of Across. Across can satisfy user orders very quickly through the intent architecture. User funds are held in custody in the protocol and are only released to the relayer after the protocol verifies that the user's intent is satisfied. By decoupling the urgent part (filling the user's order) from the complex part (message verification), the tricky verification part is performed after the user's order is completed. The only trade-off required is that the relayer must lend the funds in a short period of time, which proves to be worth it.