Author: Mary Liu, BitpushNews

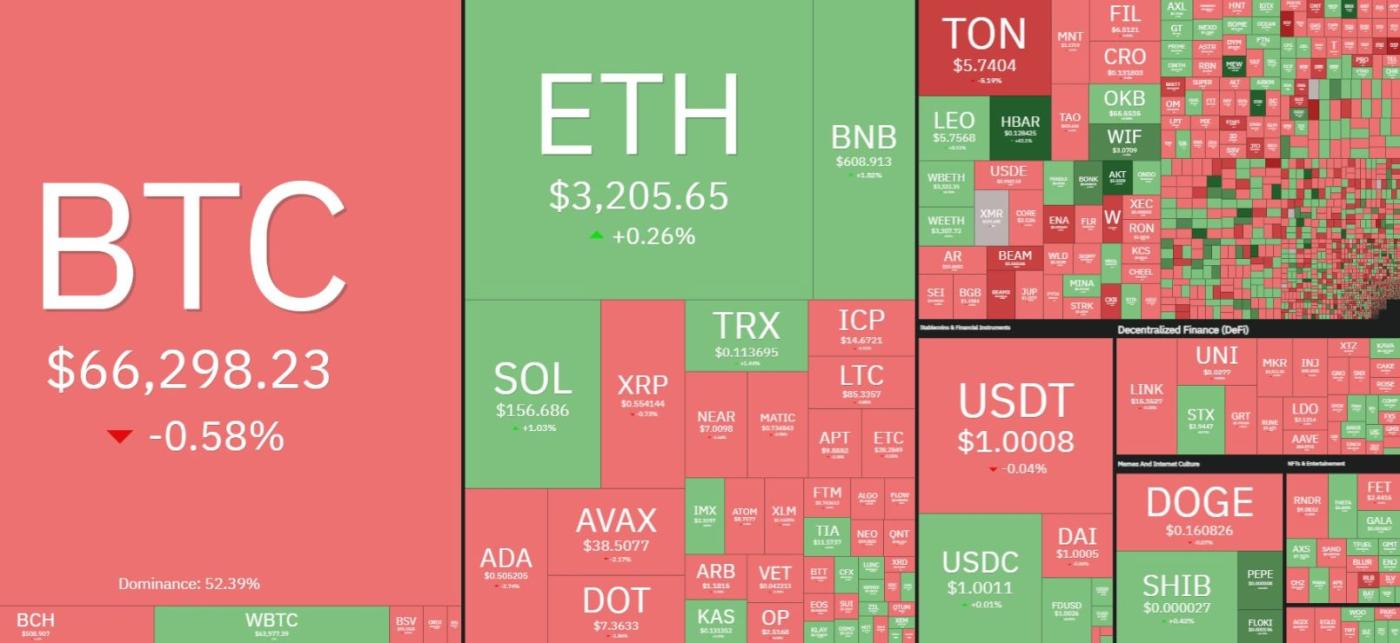

Cryptocurrency markets had a mixed day on Tuesday, with Bitcoin bulls and bears evenly matched following the halving event and trading steady above $66,000.

The top 200 Altcoin by market cap saw mixed gains, with seven tokens recording double-digit gains. Hedera (HBAR) led the gains, up 40.4%, followed by cat in a dogs world (MEW) up 31.9%, and Akash Network up 24.2%. Stablecoin projects Ethena (ENA) saw the biggest drop, down 7.7%, Ontology (ONT) down 7.6%, and Jito (JTO) down 5.8%.

The overall cryptocurrency market cap is currently $2.45 trillion, with Bitcoin’s dominance rate at 53.4%.

As of the close, the S&P, Dow Jones and Nasdaq closed higher, up 1.20%, 0.69% and 1.59% respectively. The U.S. dollar index fell 0.4% on the day.

Bitcoin's 200-day moving average approaches a record high

Analysts at Secure Digital Markets said: "Bitcoin recently rebounded from the rising trend line and is currently trying to break through the short-term resistance level of about $67,500. The US manufacturing and services PMI data released this morning stimulated a surge in risk assets."

Analysts also said that Bitcoin's 200-day moving average, a key indicator of long-term trends, is approaching a new all-time high, challenging its peak of $49,452 set in February 2022. Past data shows that after this value exceeds the previous peak, the most intense phase of the bull cycle will unfold, that is, when this indicator rises to a new high, the price of Bitcoin will rise.

In early November 2020, six months after the third halving, Bitcoin’s 200-day moving average rose to a peak of over $10,320 at the time. By mid-April 2021, Bitcoin had risen 4.5 times to $63,800.

After the 200 moving average hit a new high in December 2016 (five months after the second halving), BTC surged more than 2,000% in 12 months to nearly $20,000. A similarly rapid rally occurred in November 2012, around the time of the first halving, after the moving average reached a new high.

Short-term weakness, long-term bullish

However, historical performance is not indicative of future results.

Matt Ballensweig, head of network at BitGo, said in a report: "In the short term, Bitcoin price action tends to be quite quiet after the halving. The incremental amount of newly mined Bitcoin per day after the halving is 450 BTC, which is hardly enough to affect daily liquidity or immediate price action. In fact, miners may even need to sell some existing BTC inventory to offset the reduction in daily revenue, leading to increased selling pressure in the days/weeks after the event."

Ballensweig believes that in the long run, the daily reduction in supply, totaling 164,000 BTC ($12 billion) per year, combined with net new demand for Bitcoin from ETFs, could lead to a significant increase in the price of Bitcoin in the long run. The data confirms this, as the average return of Bitcoin one month after all halving events in history is only 1.67%, while the average return of Bitcoin one year after the halving event is as high as 3,211%, highlighting the difference between short-term and long-term effects.

Steven Lubka, head of private clients at Swan Bitcoin, agreed with Ballensweig that “in the medium to long term, the impact of the halving will be more pronounced.”

“At current prices, there is about $30 million unsold every day, which may not seem like a lot every day, but over time it adds up to, say, $1 billion over a month, $12 billion over a year,” Lubka said.

“The reduction in supply has a mechanical effect that pushes prices higher,” Lubka noted. “Furthermore, the halving is built-in marketing for Bitcoin, attracting new users and creating a reflexive social layer that further drives prices higher through increased demand. Ultimately, the combination of a guaranteed supply reduction and social impact drives the long-term bullish case for Bitcoin.”

As the market awaits the next catalyst to put cryptocurrency prices back on an uptrend, MN Trading founder Michaël van de Poppe said any pullback in Bitcoin below $60,000 would be a “huge buying opportunity.”