The Ethereum community is debating ETH monetary policy amid proposals to limit the rapid expansion of staking pools. The move was driven by a surge in demand for Liquid Staking and Restaking protocols.

Original article: Ethereum's Staking Issue (glassnode)

Author: Glassnode , Alice Kohn

Compiled by: Vernacular Blockchain

Cover: Photo by Shubham's Web3 on Unsplash

There has also been ongoing discussion in the Ethereum ecosystem about possible changes to the issuance rate, sparked by a proposal from two Ethereum researchers to slow down the issuance of ETH, thereby reducing staking rewards.

The overall goal is to reduce the growth of staking pools in response to the continued growth of new innovations such as Liquid Staking and Restaking, and to protect Ethereum's functionality as a currency.

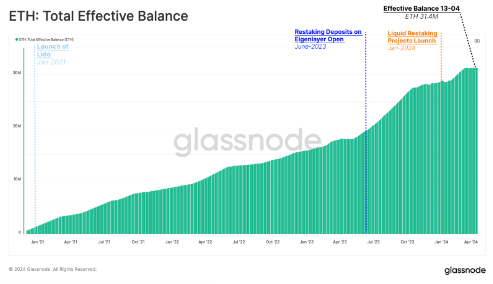

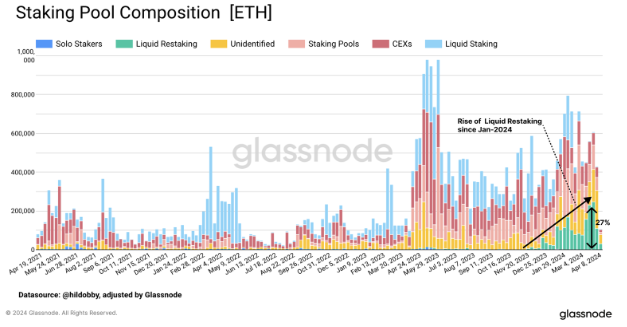

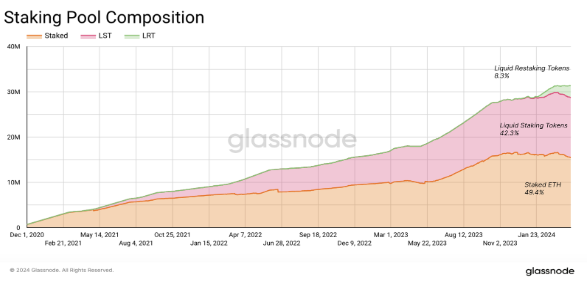

Ethereum staking has experienced unexpectedly high demand, with 314K ETH currently participating in Ethereum Proof of Stake ( ~26% of total supply ). We can see that the growth rate of staked ETH has been accelerating in recent months, especially after the introduction of new innovations such as the Eigenlayer restaking protocol in June 2023 and the Liquid Restaking protocol in early 2024.

1. Distorted incentives

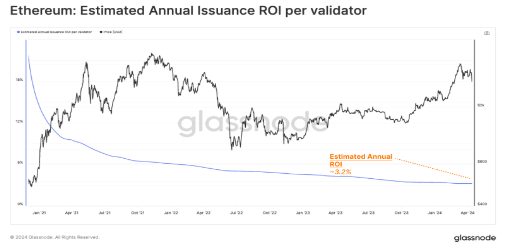

Initially, the proof-of-stake protocol was designed so that as the amount of staked ETH increased, the marginal income of each validator would decrease. This mechanism self-regulates the size of the staking pool, and the current amount of staked ETH is 314,000 ETH, with each validator expected to earn an annualized rate of return of approximately 3.2%.

However, new developments like yield from MEV, Liquid Staking, Restaking, and Liquid Restaking have introduced additional opportunities. As a result, the motivation and demand for users to stake has expanded beyond the original vision.

If we break down staking deposits by where they came from, we see that the amount of ETH staked by Liquid Staking providers has increased significantly since the beginning of the year. These protocols now account for 27% of new staked ETH, while new deposits to Liquid Staking providers have declined since mid-March.

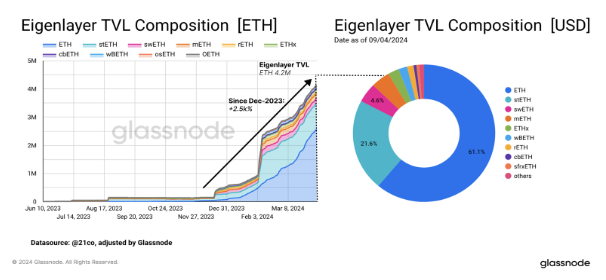

Last year, the EigenLayer protocol launched the Restaking feature. EigenLayer enables users to deposit their staked ETH or liquid staked tokens into the EigenLayer smart contract . These assets can then be used as security collateral by other services such as Rollups, Oracles, and bridges . Restaking users can earn additional fees from these services in addition to the local staking income they receive on the Ethereum main chain .

Since the launch of the protocol, staking on Eigenlayer has surged, with the total value locked (TVL) now exceeding 14.2 million ETH (~$13 billion). This high level of demand for re-staking is also partly due to the anticipation of the Eigenlayer airdrop event.

61.1% of Eigenlayer’s TVL comes from locally staked ETH, and the rest comes from liquid staked tokens, of which Lido’s stETH accounts for 21.5% of the total TVL, leading other tokens.

2. The rise of Liquid Restaking

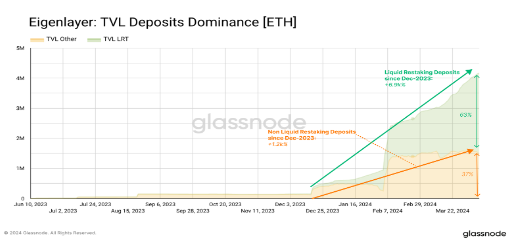

Liquid Restaking is similar to Liquid staking, allowing users to re-stake their tokens and receive corresponding Liquid Restaking assets in the form of liquidity. This is an option that appears to be favored by Eigenlayer users, with 63% of deposits entering Eigenlayer through Liquid Restaking providers.

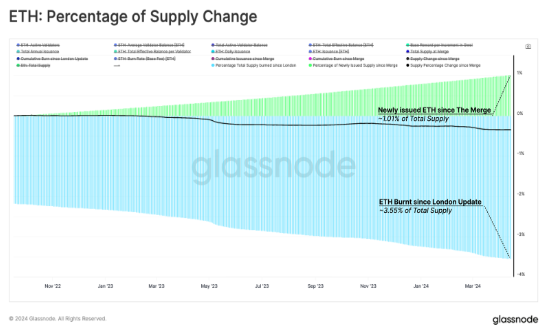

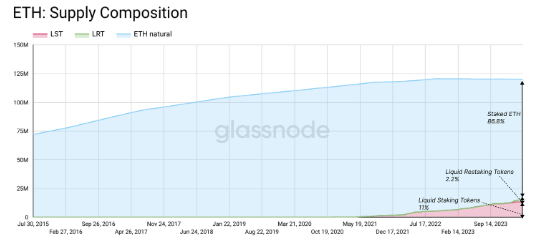

Researchers at the Ethereum Foundation have expressed concern about the growing high staking rate. While staking more ETH will result in a lower reward rate for each validator, the total rewards paid could still lead to inflation if the total amount of ETH staked becomes large. Currently, approximately 1.01% of the total ETH supply has been newly issued tokens since the "merge", although approximately 3.55% of the supply has also been destroyed during the same period, which offsets some of the inflationary effects.

As more ETH flows into the staking pool, the effects of inflation begin to affect fewer and fewer ETH holders. In other words, assets are being transferred from the shrinking non-staked ETH holders to the growing staked ETH holders.

Over time, this “ real yield ” component could make holding ETH less attractive and could erode ETH’s function as a monetary asset in the Ethereum ecosystem. Instead, the role of “currency” could shift to Liquid staking tokens similar to stETH, or even Liquid Restaking Tokens, which serve as enhanced yield-bearing instruments. A side effect of this development would be that projects issuing these derivative tokens would gain an outsized influence over the governance and stability of Ethereum’s execution and consensus layers.

Today, we have noticed that half of the staked ETH is provided through these derivative projects. 42% of the staked ETH is re-liquidized through liquid staked tokens, and another 8% is re-collateralized through liquid derivatives.

The concerns of Ethereum researchers also apply to the monetary nature of Ethereum. Of the total ETH supply, 11% is stored in liquid staking tokens and 2.2% is stored in liquid re-staking tokens.

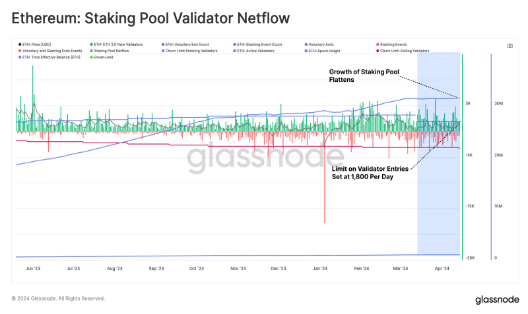

The proposals put forward by the Ethereum Foundation aim to limit and constrain annual issuance, thereby reducing the incentive for new stakers to enter the pool and hopefully slowing down the growth rate of stake. These proposals have been met with great opposition in the community, with many believing that no changes are needed at this time and questioning the need to update ETH monetary policy again.

However, the growth of the staking pool was already slightly limited during the last Decun upgrade. This hard fork introduced a limit of 8 new validators per 6.4 minute cycle and replaced the transfer limit function. This effectively limits the number of validators and the amount of stake entering the staking pool, providing very slight relief for now.

3. Summary and conclusion

The Ethereum ecosystem is debating a proposed change to the ETH issuance rate that aims to slow the expansion of staking pools. The goal is to mitigate the impact of innovations such as Liquid Staking and Restaking, which are enhancing yield opportunities and thus increasing user demand.

Staking has surged, now at 31.4 million ETH, or about 26% of total supply, driven primarily by restaking protocols such as Eigenlayer. These developments are increasingly leading to the adoption of Liquid Staking Tokens (LST), which could begin to undermine Ethereum’s role as a monetary asset in the long term. The Ethereum Foundation has proposed limiting annual issuance to slow the growth of staking pools, but these proposals have been met with significant resistance in the community.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the author and guests, and have nothing to do with the position of Web3Caff. The information in the article is for reference only and does not constitute any investment advice or offer. Please comply with the relevant laws and regulations of your country or region.