This article is machine translated

Show original

Hot Tokens to Explore This Week: http:/io.net Coming Soon

#HottestCoin

👇👇

- AI + DePIN’s Edge Narrative

- http:/io.net Investment Opportunities

- $IO Price Prediction

🔎AI + DePIN's marginal narrative

The "marginal" narrative under the mainstream narrative, the mainstream narrative in the blockchain narrative, yes, is talking about the concept of AI + DePIN. Whether decentralized infrastructure can save AI is not discussed first, but AI has indeed saved the DePIN track to a certain extent. As we all know, AI is soaring at a rapid pace, and AI's potential demand for computing power has even triggered capital speculation in the energy sector. It can be seen that the level of revolution brought by AI is unprecedented, but why is the concept of AI + DePIN a marginal narrative under the mainstream narrative? Because DePIN actually provides edge computing power. This does not mean that DePIN is marginalized. Edge computing power is an important part of the computing power structure, but it means that supplementing some edge computing tasks with small computing requirements is complementary to large-scale computing in the cloud. But it also means that edge computing will not be the main battlefield for giants. What the giants care about is how many A100, H800, or next-generation XX100 orders they can get.

The training of a large model requires a huge amount of computing power, which often requires billions of dollars of hardware equipment investment, mainly from NVIDIA's A series and H series equipment. A professional operation and maintenance team is also needed to build and maintain the entire system. Slight delays and downtime will cause great damage to the scheduled plan. Edge computing is a supplement, mainly to solve small-scale, short-term computing needs. Edge computing lowers the entry threshold and reduces dependence on professional operation and maintenance teams, although this part of the market is almost monopolized by NVIDIA.

The combination of GPU mining and blockchain coordinates scattered computing power to rush towards the stardust sea of AI. This is the core narrative of AI + DePIN, so GPU mining project groups are considered mainstream narratives, and storage and wifi are all driven. Blockchain is naturally good at coordinating idle resources and attracting small and scattered investment equipment to participate in distributed networks. The point that the narrative depicts is that as long as the incentive flywheel turns, more and more people will participate in this system, and there will be centralized and managed computing power, users, and data. Assets can also be issued.

But can DePIN really meet the needs of AI-related companies from the perspective of real business needs at this stage? In other words, is it important that DePIN can be used at this stage? It is not important for the main narrative of AI, because edge computing power will not carry the banner at this stage; it is not important for the crypto either, because at this stage, what is important is to concentrate the scattered computing power. As for how to manage it and what needs to meet, these are all negotiable matters. When a certain amount of edge computing power is concentrated, value is generated.

🔎http:/io.net investment opportunities

Speaking of http:/io.net, http:/io.net can be seen as a professional product for coordinating edge computing power. In layman's terms, http:/io.net helps you solve operation and maintenance problems, computing power sales problems, and comes with certain incentives. These GPU mining projects are essentially solving these problems, the difference lies in the incentive method, etc. For retail investors, the learning cost of configuring nodes is already very high. The simplest and most direct way is to map it into a tokenized product and just invest. http:/io.net As the hottest GPU mining project, its token issuance is still worth looking forward to.

Simple summary of participation methods

- Participate in the node operation of the http:/io.net platform, and obtain availability rewards by maintaining and completing test operations online.

- Pledge IO tokens to get additional computing rewards and network loyalty rewards.

- Share the computing income of nodes by staking to specific nodes to further enhance investment returns.

- Participate in token trading after the token is issued.

http:/Io.net The number of nodes in the entire DePIN track is second only to Helium, ranking first in GPU, and the growth rate is amazing. There are only two rounds of public financing, and the A round is valued at 1 billion US dollars. For more details of the token, please refer to: medium.com@vivektechzone/understanding-io-a-guide-to-io-nets-tokenomics-955b399cd807…

Token key information

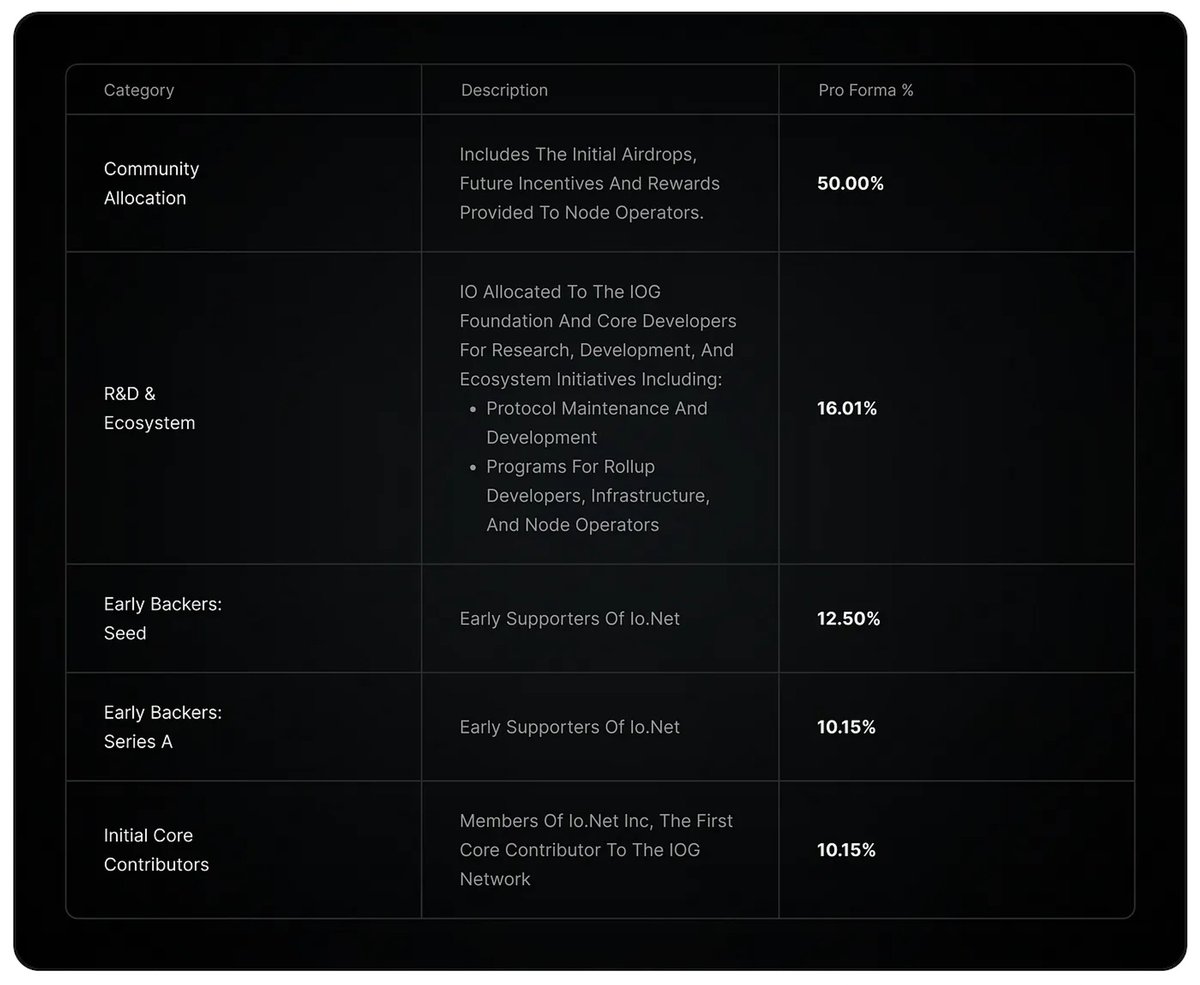

Token distribution, total 800 million, 300 million will be gradually distributed to future nodes, etc., 500 million initial supply.

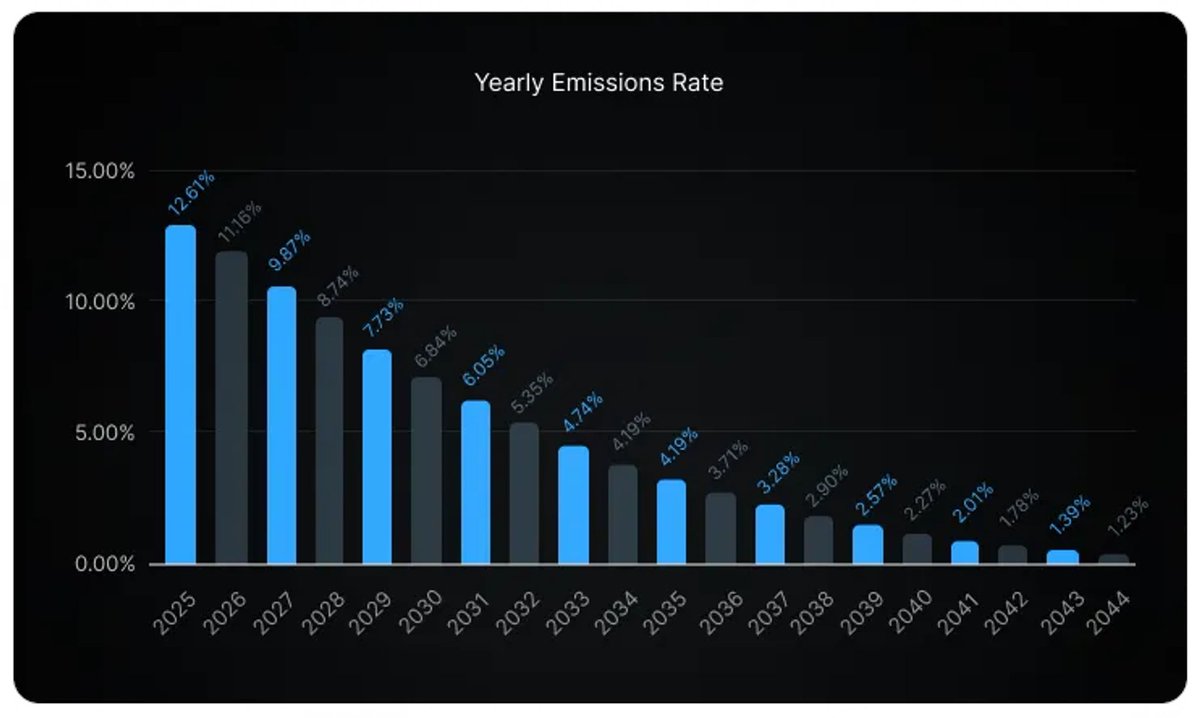

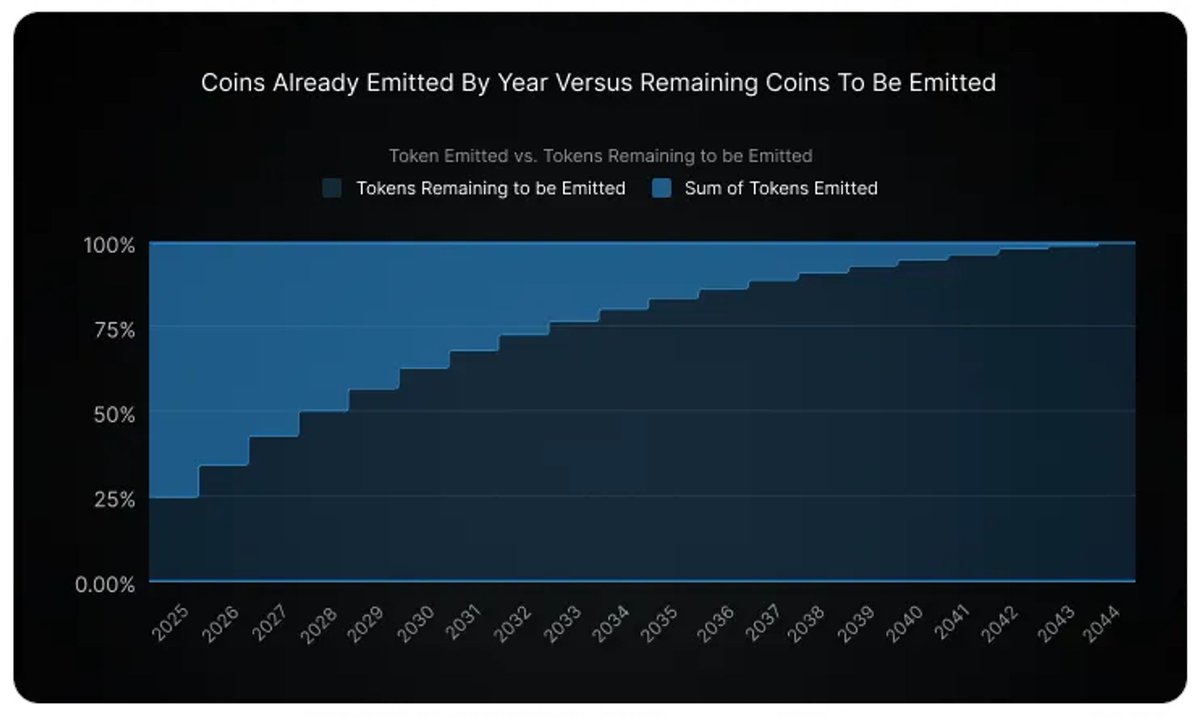

Tokens are released and inflation rate decreases. Tokens are unlocked.

Token Unlock

🔎Coin price prediction

According to the popularity and data of http:/io.net, it is going to be the top of GPU mining, but the market liquidity is insufficient recently, and it may not catch up with RNDR. RNDR's market value is about 3 billion US dollars, and FDV is close to 5 billion US dollars.

Based on the performance and liquidity of the newly listed coins recently, it is estimated that http:/io.net data may enter the top 100, but the top 50 depends on the hype, and the probability of exceeding RNDR is small. The estimated market value is more than 2 billion US dollars.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content