On April 24, Renzo, a popular liquidity re-staking project, officially announced detailed token distribution rules, but this caused dissatisfaction among many people in the community. The price of Renzo's ETH deposit certificate token ezETH once plunged, and a serious decoupling occurred, falling to as low as around $1,600.

Sell ezETH in advance and your points will be reset to zero

According to the official rules, Renzo Season 1 incentives will end on April 26, and users who sell their ezETH holdings before this date may not be eligible for the airdrop. Users can claim REZ on May 2 through the official claim website.

Large investors lock up 50% of their positions, which is good for retail investors

It is worth noting that the big depositors on Renzo may be the most affected. The official said that 500 million REZ (5% of the total) will be distributed linearly based on the ezPoints accumulated by users. 50% of the tokens of the top 5% of addresses will be unlocked immediately at TGE, and the remaining part will be released linearly within 6 months. Although this move offends big depositors, it is beneficial to small investors. After all, without the crazy dumping of big depositors, the selling pressure will be much lower.

Only 5% allocated, deposit users feel "let down"

The most controversial part of Renzo’s token distribution is undoubtedly the proportion of tokens allocated to users who deposit into the protocol.

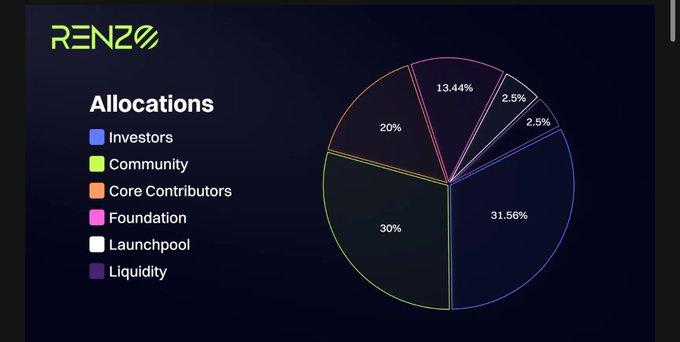

The official distribution map is as follows:

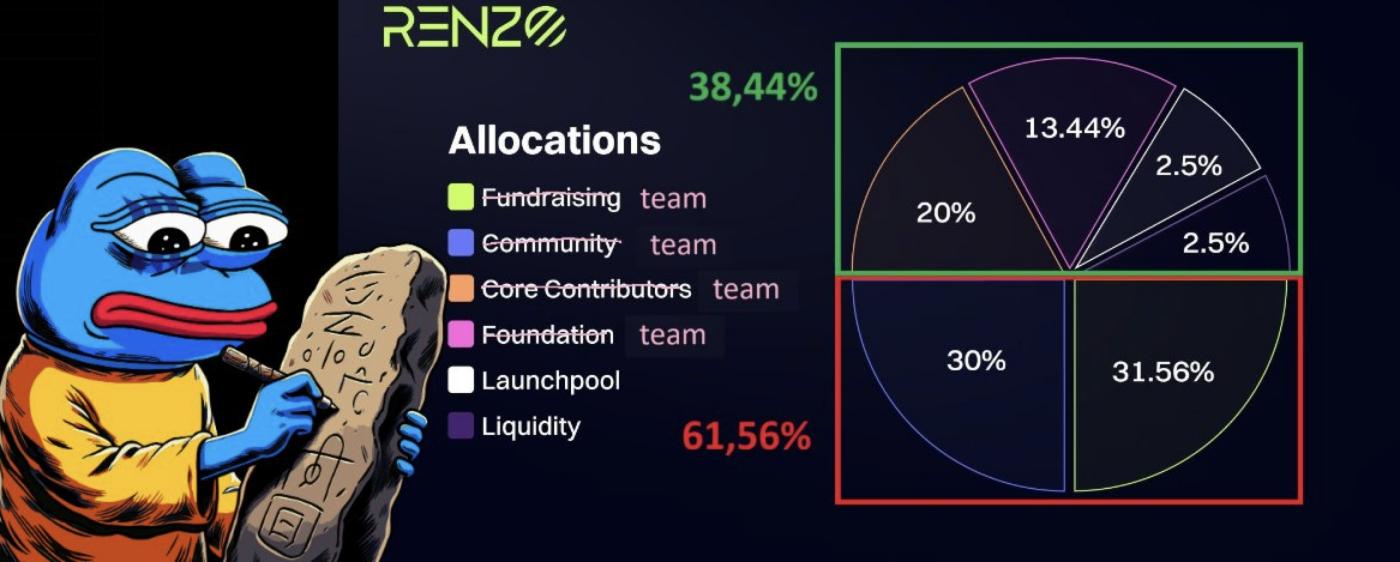

But it might actually be like this:

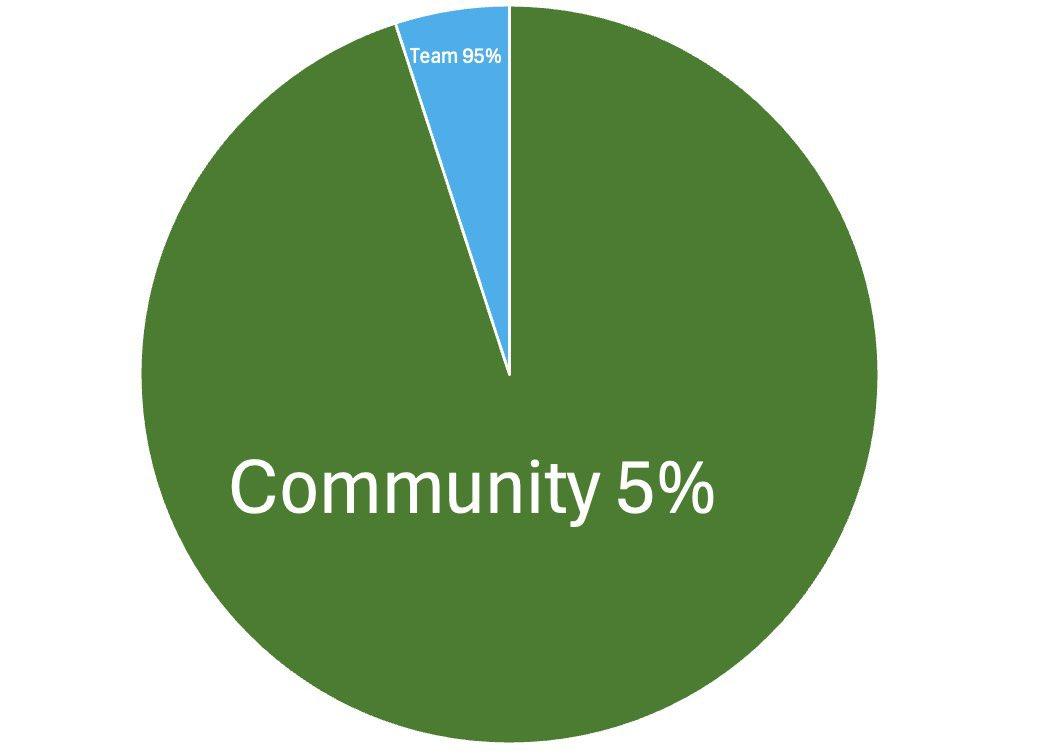

More intuitively, this:

Crypto KOL @0xCaptainLevi said that the Renzo protocol airdrop is a joke. Their entire business is built on depositors, but they only give customers 5%, half of which is locked, so the real airdrop is only 2.5%. It is absolutely clear that in the past 6 months, 250,000 users who deposited $3.5 billion worth of ETH for Renzo will only receive a 2.5% airdrop in the end, which is the same amount allocated to Binance new coin mining, while the team and investment receive 65% of the token allocation. And selling ezETH (Renzo deposit certificate token, which is exchanged at a 1:1 ratio with ETH) in advance will not receive an airdrop. Users take the risk of depositing funds into your protocol, but the community does not get a proper reward.

Perhaps the above view is not entirely pertinent, but the dissatisfaction of the community does exist. Coupled with the low liquidity pool depth of ezETH tokens on Uniswap, the price of ezETH has just deviated significantly, and once there was a spike, the price fell by as much as 50%, about $1,600.

Is the loss of anchor a good opportunity to pick up bargains?

The time of the significant unpegging was very short, but many people took this opportunity to successfully buy the dips. According to the monitoring of on-chain analyst @ai_9684xtpa, a whale used 2,400 ETH to buy 2,499 ezETH during the unpegging period of ezETH, worth 6.98 million US dollars, and made a net profit of 99 ETH.

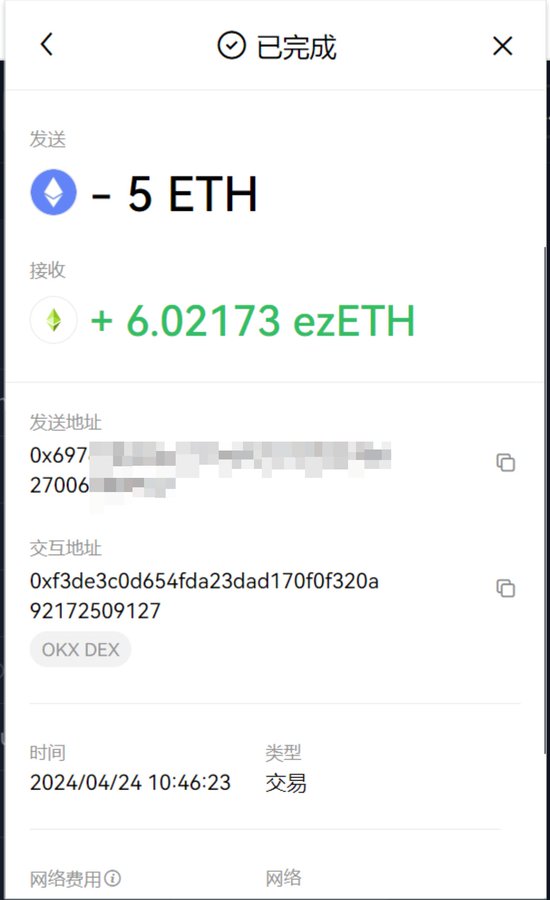

Many people also posted their own results of finding bargains.

The window of opportunity is short and only reserved for those who are prepared. As of press time, the ezETH anchoring situation has improved significantly and is almost back to anchoring.