Bitcoin has gained prominence as a safe-haven asset, but it remains undervalued.

Written by: Yassine Elmandjra, Head of Digital Assets at ARK Invest

Compiled by: Luffy, Foresight News

The 2008 global financial crisis led to a decline in public trust in governments and financial institutions. Subsequent events, such as the European sovereign debt crisis, the Federal Reserve's response to COVID-19, and the collapse of major regional banks in the United States , exposed the drawbacks of relying on centralized institutions.

The accelerating impact of technological innovation and declining trust have led to questions about the effectiveness of traditional safe-haven assets in protecting modern portfolios. Following events such as the European sovereign debt crisis, have the risks of government bonds decreased? Has the effectiveness of physical gold as a hedging tool diminished in the digital economy? Will inconsistent Federal Reserve policies threaten the dollar's status as the reserve currency? Traditional safe-haven assets may play a role in portfolio construction, but their limitations give investors reason to reassess so-called safe-haven assets.

While the "risk-seeking" and "risk-averse" characteristics of traditional assets are mutually exclusive, Bitcoin blurs the lines between the two. Its revolutionary technology and novelty represent risk-seeking, while its absolute scarcity as a monetary asset and its role as a "bearer instrument" represent risk-averse.

Bitcoin presents an interesting paradox: with its groundbreaking technology, it can effectively hedge against economic uncertainty and potentially achieve exponential growth.

Source: ARK Investment Management LLC, 2024

Bitcoin was created in 2008 as a response to the global financial crisis. Today, it has evolved from a fringe technology into a new asset class worthy of institutional allocation. As the network matures, investors may seriously evaluate Bitcoin's value as a safe-haven asset.

Bitcoin as a safe-haven asset

While Bitcoin's explosive growth and price volatility have led many investors and asset allocators to view it as a microcosm of risky assets, we believe that the Bitcoin network embodies safe-haven characteristics, enabling financial sovereignty, reducing counterparty risk, and increasing transparency.

Bitcoin is the first digital, independent, global, rules-based monetary system in history. By design, its decentralization should mitigate the systemic risks of the traditional financial system, which relies on centralized intermediaries and human decision-makers to formulate and enforce rules. The uppercase "B" in Bitcoin represents a financial network used to facilitate the transfer and custody of the lowercase "b" Bitcoin (a scarce digital currency asset).

We believe Bitcoin is the purest form of money ever made. It has the following characteristics:

Digital bearer assets similar to commodities.

Assets that are scarce, liquid, divisible, portable, transferable, and substitutable.

Auditable and transparent assets.

Assets that can be fully matched by ownership and held in custody without liability or counterparty risk.

Importantly, Bitcoin's attributes stem from the Bitcoin network, which runs on open-source software. While many institutions coordinate functions within the traditional financial system, Bitcoin operates as a single institution. Instead of relying on central banks, regulators, and other government decision-makers, Bitcoin leverages a global network to enforce rules, transforming enforcement from manual, private, and opaque to automated, open, and transparent.

Given its technological foundation, Bitcoin holds a unique position relative to traditional safe-haven assets, as shown below.

Source: ARK Investment Management LLC, 2024

Bitcoin's relative performance

As an emerging asset, Bitcoin's speculative nature and short-term volatility have garnered significant attention. Fifteen years after its inception, Bitcoin's market capitalization has exceeded $1 trillion, increasing its purchasing power while maintaining its independence.

In fact, Bitcoin has outperformed all other major asset classes in both the short and long term. Over the past seven years, Bitcoin has achieved an annualized return of nearly 60%, while the average return of other major assets has been only 7%, as shown in the chart below.

Source: ARK Investment Management LLC, 2024, based on data and calculations from PortfolioVisualizer.com, Bitcoin price data from Glassnode, as of March 31, 2024.

Importantly, since the inception of Bitcoin, investors who bought it and held it for 5 years have made a profit, as shown below.

Source: ARK Investment Management LLC, 2024, based on Glassnode data as of December 31, 2023.

In contrast, traditional safe-haven assets such as gold, bonds, and short-term U.S. Treasuries have lost 99% of their purchasing power over the past decade, as shown below.

Source: ARK Investment Management LLC, 2024, based on PortfolioVisualizer and Glassnode data as of March 31, 2024.

Is Bitcoin too volatile to be considered a safe-haven asset?

Paradoxically, Bitcoin's volatility is a function of its monetary policy, highlighting its credibility as an independent monetary system. Unlike modern central banks, Bitcoin does not prioritize price or exchange rate stability. Instead, by controlling the growth of Bitcoin's supply, the Bitcoin network prioritizes the free flow of capital. Therefore, Bitcoin's price is a function of demand relative to supply—explaining its volatility.

Nevertheless, Bitcoin's price volatility has decreased over time, as shown below:

Source: ARK Investment Management LLC, 2024, based on Glassnode data as of March 31, 2024.

Why does Bitcoin's price volatility decrease over time? As Bitcoin adoption increases, its marginal demand relative to its total network value decreases, thus reducing the magnitude of its price volatility. All else being equal, an additional $1 billion in demand out of a $10 billion network value should have a greater impact on Bitcoin's price than $1 billion out of a $1 trillion network value. Importantly, volatility should not hinder Bitcoin's role as a store of value in the context of significant price increases.

Perhaps a more relevant metric to illustrate Bitcoin's role in preserving capital and purchasing power is its market cost base. While market capitalization aggregates the value of all circulating Bitcoins at current prices, the market cost base values each Bitcoin at its last price change. The cost base provides a more accurate measure of changes in purchasing power. Fluctuations in the cost base are less pronounced than price fluctuations, as illustrated below. For example, while Bitcoin's market capitalization decreased by approximately 77% from November 2021 to November 2022, its cost base only decreased by 18.5%. Today, Bitcoin's cost base is trading at an all-time high, 20% higher than its 2021 market peak.

Source: ARK Investment Management LLC, 2024, based on Glassnode data as of March 31, 2024.

Bitcoin exhibits low correlation with other asset classes.

Another reason Bitcoin is suitable as a safe-haven asset is its low correlation with the returns of other asset classes. Bitcoin is one of the few assets that consistently exhibits low correlation, as shown below. Between 2018 and 2023, the average correlation between Bitcoin returns and traditional asset classes was only 0.27. Importantly, the correlation between Bitcoin returns and bonds (traditionally considered safe-haven asset classes) is relatively high at 0.46, while the correlations between Bitcoin returns and gold and bond returns are 0.2 and 0.26, respectively.

Source: ARK Investment Management LLC, 2024, based on data and calculations from PortfolioVisualizer.com; Bitcoin price data from Glassnode, as of December 31, 2023.

Adapting to changing interest rate policies

Furthermore, comparing Bitcoin's price to the federal funds rate reveals its resilience under different interest rate and economic environments, as shown below. Importantly, Bitcoin's price has surged under both high and low interest rate regimes, as shown below.

Source: ARK Investment Management LLC, 2024, based on FRED and Glassnode data as of March 31, 2024.

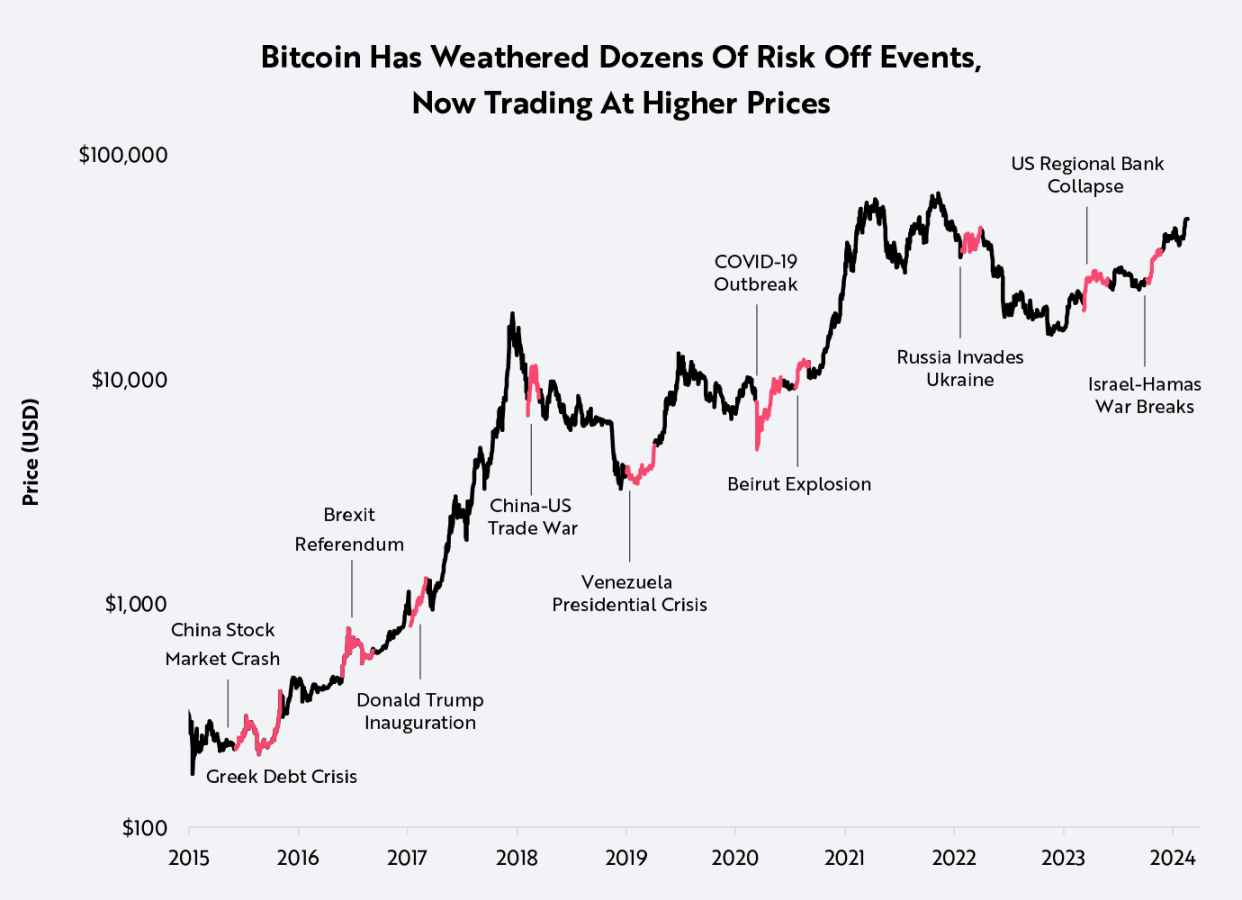

Over the past decade, Bitcoin's price has performed well during periods of safe-haven demand. As of this writing, Bitcoin's price has risen with each crisis event, as shown in the chart below.

Source: ARK Investment Management LLC, 2024, based on Glassnode data as of March 31, 2024.

Bitcoin's performance during the regional banking crisis is a prime example. In early 2023, during the historic collapse of regional banks in the United States, the price of Bitcoin rose by more than 40%, highlighting its role in hedging counterparty risk, as shown in the chart below.

Source: ARK Investment Management LLC, 2024, based on data from Bloomberg and Glassnode as of December 31, 2023.

While Bitcoin has experienced downturns, these setbacks are unique to the industry. These include the 2014 Mt. Gox exchange hack, the 2017 Initial Coin Offering (ICO) bubble, and the 2022 FTX crash due to fraud. In each cyclical downturn, Bitcoin has demonstrated its resilience.

Looking to the future

In its brief history, Bitcoin has gained significant status as a safe-haven asset, yet it remains undervalued. As the global economy continues its shift from a physical to a digital economy, the use of Bitcoin's decentralized global monetary system should continue to increase, potentially making it comparable to traditional safe-haven assets. Recent events have increased this possibility, such as the US approving a spot Bitcoin ETF, nation-states like El Salvador adopting Bitcoin as fiat currency, and companies like Block.com, Microstrategy, and Tesla allocating Bitcoin reserves. With Bitcoin currently valued at approximately $1.3 trillion, compared to $130 trillion for fixed-income assets, the global safe-haven asset market appears poised for disruption.

Source: ARK Investment Management LLC, 2024, based on data from Glassnode, VisualCapitalist, Statista, Macromicro.me, and Companiesmarketcap.com, as of March 31, 2024.

Summarize

Bitcoin is a relatively new asset class, and the Bitcoin market is highly volatile and uncertain. Bitcoin is largely unregulated, and compared to regulated asset classes, Bitcoin investments may be more susceptible to fraud and manipulation. Bitcoin faces unique and significant risks, including extreme price volatility, lack of liquidity, and theft.

Bitcoin's price fluctuates wildly, influenced by factors including the actions and statements of influential figures and the media, changes in Bitcoin's supply and demand, and others. These factors make it difficult for Bitcoin to maintain its value in the long term.