Although the bull market is generally rising, the hype is still centered on the sector. And if a coin soars, it will drive the hype of its sector. There are opportunities everywhere in the bull market, but you have to do what you are familiar with and what you are good at. If you are greedy and want to grab everything and try every opportunity, it will definitely not end well.

On the contrary, as long as you catch the main rising wave of a sector, it is enough for you to make a lot of money. If you are lucky, you can catch the main rising wave of the sector rotation and the second wave, then you can make a lot of money. You should also have a clear understanding of yourself, how much money you can make according to your ability. If you make 10 million from 1 million, that is 10 times. If you want to make 10 million from 100 yuan, isn't that a fantasy?

For more information, please visit Weibo Tuantuan Finance here .

What makes this bull market different from previous ones is that there is more money, more people and more professional institutions.

Therefore, we need to use new strategies to deal with new changes in the bull market. The pie is so big. You want to make money, institutions want to make money, and project parties want to make money. Whose money do you want to make?

Instead of chasing hot spots, it is better to focus on good projects/sectors and dig deeper to get higher returns;

Get together with a group of professional people for warmth;

The market value of hot projects is relatively fully valued, while non-hot sectors may have high multiples;

You need to distinguish between awesomeness and potential returns. A really awesome project may not necessarily make you money, because the market will fully price it. That is, even if everyone is optimistic about it, it may not necessarily have a very large increase.

Which ones to choose

Those that are recognized by the market but not favored by the whole nation are the focus of research, so the potential returns are high and the risks are low;

The market has low popularity, such as the mini-warehouse lottery sector;

If you really don’t know how to choose, you can contact me and I will choose a suitable site for you based on your position.

There are three types of speculation in the sector:

1) Deterministic major events, such as the Shanghai upgrade leading to the hype of LIDO and SSV, and the Arbitrum airdrop causing the rise of its ecological projects;

2) Sudden events. For example, the sudden popularity of chatgpt triggered the explosion of the AI sector, and the release of Sora also triggered a wave of increases. For example, in the second half of 2021, the popularity of the metaverse triggered a craze in the crypto GameFi.

3) After a certain coin explodes, it becomes the leader, causing the popularity of projects in its sector;

The hype of the sector is uncertain most of the time, which is why we have to wait for the wind to come in the bull market. Because the time of hype cannot be determined. Only the first major event is relatively certain. But its disadvantage is that due to its strong certainty, the increase you can participate in may not be very large. That is because there are always many people who will make arrangements in advance. The most typical example is this year's Cancun upgrade, the increase of arb and OP lags behind other coins.

To achieve truly high returns, consider the following when analyzing promising tokens:

- What is the upside potential? (Compare this token to other tokens in the space)

- Who are the largest holders and top venture capitalists?

- Roadmap, partnerships, team, and more

- Is the token about to be listed on more CEXs? (Listings usually lead to an increase in liquidity and price, especially when an announcement is made)

The reason why most people lose money in the bull market is that when the value coins they hold cannot outperform some MEME coins, they start to worry and can’t sleep at night, so they chase the rise and sell the fall, and frequently change positions! Another group of contract players frequently make moves, staring at the market 24 hours a day, wasting time, with uncertain profits and losses, and shocking handling fees. Faced with the midnight spike market, they start to hold orders without a bottom line, until the arrival of the liquidation message, they doubt their lives!

The final result must be that although you have experienced a bull market, others have made a lot of money, but you have lost a lot of money!

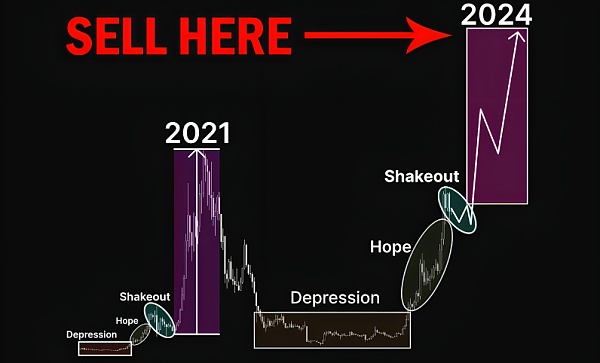

Generally speaking, the dealer will use the leeks to make a crazy wash when they are confused about the trend of the BTC. When most of the coin holders are still in fear of the previous decline, they will easily throw away their precious chips at the slightest sign of trouble, thus allowing the dealer to easily complete the wash process.

In the necessary stage of the bull market, on the way up, there will be several callbacks to clear most of the bubbles and restore the value of the currency! Instead of being dominated by anxiety, it is better to calm down and review why you miss the pump the opportunity. Is it because of information asymmetry? Or cognitive limitations? Or lack of currency selection logic? Or judgment and analysis ability?

What we can do is to make value investments based on hot narratives, with the premise of ambushing rather than FOMO at high levels!

Later, I will bring you analysis of leading projects in other tracks. If you are interested, you can click to follow. I will also organize some cutting-edge consulting and project reviews from time to time. Welcome all like-minded people in the crypto to explore together. If you have any questions, you can comment or send a private message. All information platforms are Tuanzi Finance .