Written by: TechFlow

No matter whether on-chain meme or a large MC memecoin, a dog that can make money is a good dog.

This sentence may have become a true psychological portrayal of the crypto leeks.

When memes frequently appear in the top 50 tokens in the crypto market value, and when Solana runs out of the large MC memecoin myth every now and then, from being missed to being "conquered by the rise", people's recognition of meme coins has gradually formed.

Everyone loves Memecoin. There are exceptions.

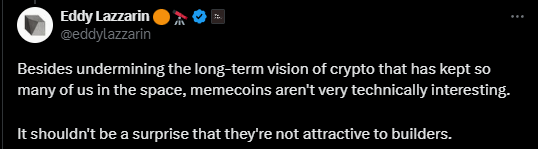

For example, A16Z’s CTO, Eddy Lazzarin.

In a discussion thread on Twitter today about the value of Meme Coin, Eddy made it clear:

" Memecoin undermines the long-term vision that keeps many people in crypto and is not technically appealing; it is not attractive for builders."

When someone suggested that Meme coin could attract many users and make the use of different chains more active, Eddy further expressed his disdain for this attraction effect:

" What users are attracted to? Providing a casino service to a select few is not exciting... Memecoin has changed the way the public, regulators, and entrepreneurs think about cryptocurrencies. At best it looks like a risky casino, or a series of false promises covering up a casino. This has profound implications for crypto adoption, laws and regulations, and Builder behavior. I see the damage every day . "

Apparently, A16Z's CTO sees Meme coin more as a casino, which has no real value and has affected the image of the industry.

From a technical perspective, Meme Coin is really just a simple copy and paste of an image and slogan. Of course, there is no technical innovation. From a CTO perspective, it is easy to understand Eddy's technical cleanliness and condescending attitude.

What we need is substantial technological innovation, optimizing or changing production relations, and contributing to the industry or the world. Meme What is not clean to make air, how can people with a little technical pursuit not be bored?

However, VCs and leeks do not share the same joys and sorrows. I can understand CTOs, but can CTOs understand leeks?

VCs delay gratification, while investors enjoy the present moment

Eddy's comments obviously drew blowback and rebuttal from the community.

A very insightful comment is:

Instead of criticizing meme coins, it’s better to criticize disruptive pseudo-innovations, such as the arbitrarily named ERCxxx standards, or people who conduct large-scale dust attacks on Bitcoin (sending tiny amounts of Bitcoin to many addresses in the network).

Does it have the flavor of ERC404 and inscriptions?

The subtext here is that the so-called technological innovations in the industry are all serving the purpose of hype; they are all about creating concepts, while Meme coins are more pure.

From the perspective of a pure leek, one netizen’s rebuttal is the collective heartfelt words of the leeks:

"Memes are our chance to flip big institutions. I like memes, and although most memes cost me money, I only need to grab one to greatly improve my life. But if I invest in projects invested by big institutions, I will have to wait for days to get a meager return."

Memes can do three things.

Fair, fair, and damn fair.

Although the fairness of the crypto needs to be put in quotation marks, compared with the previous round of VCs investing first, making a big technical narrative and then selling it to the secondary market, the leeks obviously prefer the Meme coin model.

This further highlights the irreconcilable contradiction between VCs and investors:

VC Delay gratification and enjoy the present moment.

VC's delayed gratification is based on extremely high information density and information advantage. They enter early enough, understand the situation thoroughly enough, and of course they are patient enough to have the confidence to delay gratification; this is also the basic logic of their investment business.

At the beginning, the leeks also delayed gratification, first ICO and then getting coins, which was nothing more than others eating meat while I just drank soup; but the current situation may be that the leeks cannot even get the bone residue, so naturally they have no position, motivation and patience to delay gratification.

As a result, Meme coin became a carnival for investors, who placed long bets, made small trials and errors, and when they hit the right one, they took off on the spot.

In an environment lacking opportunities, it’s all about gambling. Outsiders have no hope, while insiders must enjoy the present moment and place bets. This is the key to why Meme coin is popular among most ordinary people.

However, for a high-end VC CTO, there may be no need to take a gamble from a career perspective. The business model of their institution is more inclined to take the long view and catch the big fish. Instead, they will feel more fulfilled if they can invest in a technically capable product.

The position determines the mind

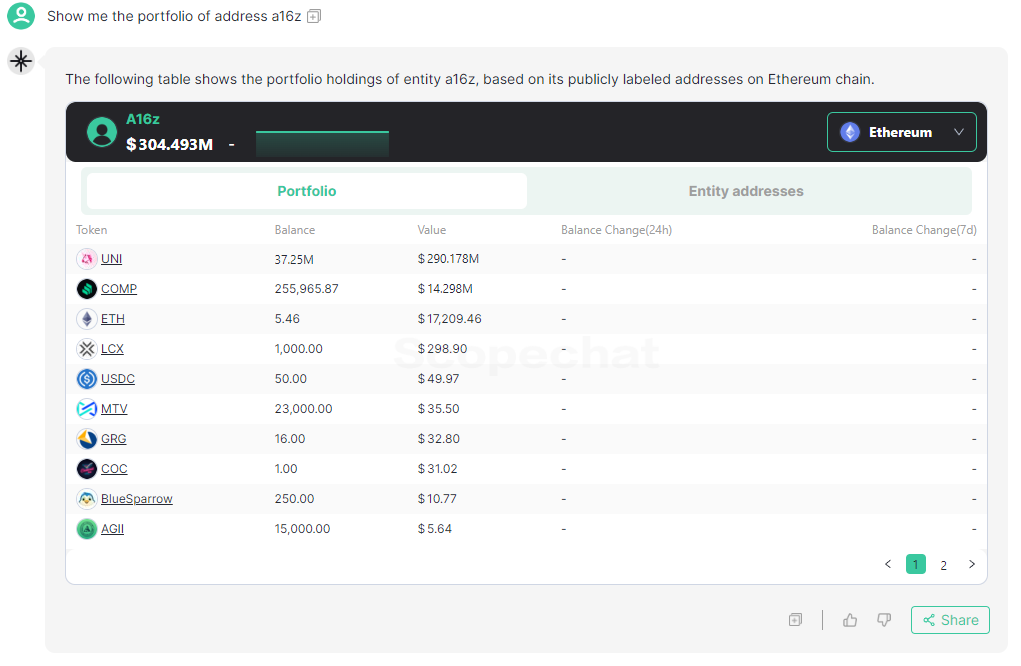

From a more practical perspective, A16Z’s CTO publicly expressed his dislike for Meme coins, which most likely means that they have no position.

According to on-chain address data compiled by Scopechat and Rootdata, the largest position of A16Z's public address is Uni, followed by COMP and ETH.

In contrast, Jesse Walden, co-founder of Variant Fund, also spoke out in the discussion thread, and his attitude towards Meme was obviously much more tolerant:

"It is debatable which of the following causes more damage:

a) Projects that promise breakthrough technology to cover up token liquidity scams

b) memecoin doesn’t promise anything except volatility and entertainment ”

Whether Variant itself holds a large amount of Meme has not been verified by public data, but its co-founder Li Jin previously announced the convening of a Meme hackathon, which was held at the headquarters of Variant Fund. (Related reading: When VCs hold Meme hackathons, is the end of crypto investment all Meme? )

Obviously, not all VCs are against Memes. Many VCs are also involved in this round of Meme bull market.

The position determines the mind. When it is not related to interests, of course you can objectively criticize Meme Coin; but once the position is really established, no one wants Meme Coin to fail.

In the crypto information that is filled with criticism or praise, FUD or shill every day, all the noisy debates are not important.

What matters is how you make your position benefit.