Author: Mia, ChainCatcher

Editor: Marco , ChainCatcher

With the official launch of the 53rd new coin mining project on Binance, the liquidity re-pledge protocol Renzo (REZ) quickly became the focus of the crypto community. It was originally expected that the listing on Binance would bring huge benefits to Renzo, but the actual situation was beyond people's expectations. The TVL that was supposed to rise did not surge, but was instead overwhelmed by the news about the decoupling of Renzo's derivative token ezETH. Within 24 hours of the announcement of the listing, ezETH was briefly decoupled, and the price fell to as low as $2,262, causing some users to be liquidated.

This sudden de-anchoring incident unexpectedly allowed some users to taste the sweetness of buy the dips. A whale keenly seized the opportunity and used 2,400 ETH to purchase 2,499 ezETH worth $6.98 million, making a net profit of 99 ETH. At the same time, the account associated with the wallet address 0xaa1 (related to czsamsunsb.eth) also earned 193 ETH, about $600,000.

This incident quickly attracted widespread attention and questions from users in the crypto community: "It was obviously good news, how come it suddenly became bad news?" So, what exactly did Renzo experience after the news of the listing was released?

Coincidental timing

According to relevant data, the ezETH depegging was detected at 11:17 on April 24, just 17 hours after Binance released the announcement of the new coin mining of Renzo (REZ), a liquidity re-pledge agreement. What is worth noting is what happened in these 17 hours that caused ezETH to depeg? The answer is that Renzo released the REZ token economic model and shared the airdrop details, which caused great dissatisfaction in the crypto community.

Token economics sparks community dissatisfaction

In the published token economics, the airdrop and launchpool shares allocated to the first season of the ezPoints activity accounted for only 5% and 2.5% respectively. In addition, according to the airdrop rules, the top 5% of addresses will immediately unlock 50% of the tokens at the TGE, and the remaining part will be gradually released over the next 6 months. This design means that at the TGE, most of the liquidity is actually still in the hands of the project party.

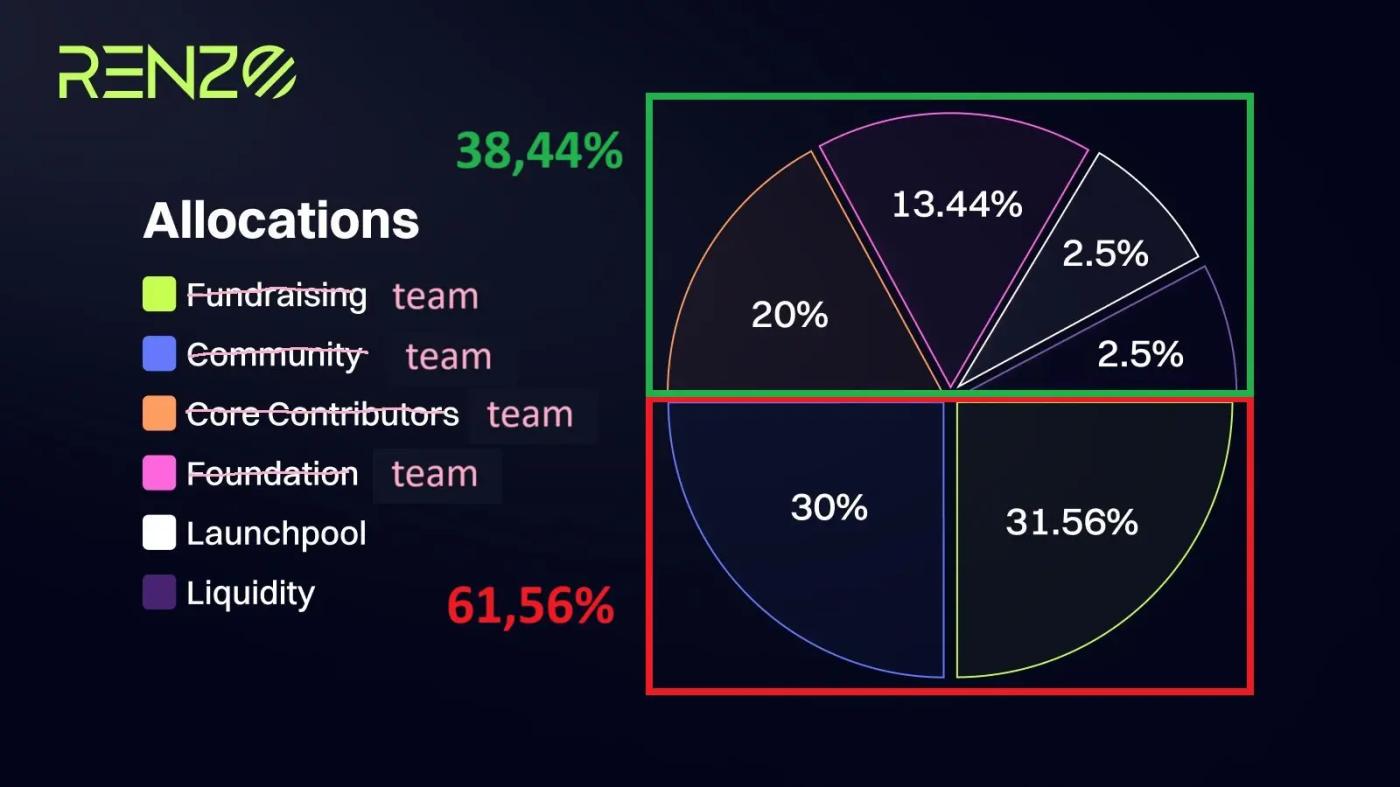

This fact has aroused concerns among some investors. They doubted the "decentralization of the protocol" claimed by the project party, believing that this was obviously inconsistent with the actual operation. Some even said that the project party advocated decentralization on the one hand, but only airdropped 5% of the token supply on the other hand, which was very ridiculous; up to 70% of the token supply was still in the hands of insiders, and the so-called decentralization was not achieved at all.

This dissatisfaction quickly spread in the community, and the discussion on "Renzo (REZ) token economics" continued to ferment, becoming the main fuse for ezETH's decoupling.

Some users believe that Binance stakers using Launchpool will have the opportunity to sell their tokens before the airdrop is unlocked for ezETH holders, which has caused some ezETH stakers to sell. Some stakers hope to use ETH to deploy other liquidity and then stake project tokens by selling ezETH.

Some users on X pointed out that Renzo depicted the distribution of tokens with unevenly proportioned pie chart slices on X, which led to confusion about how many REZ tokens went where. After adjusting the size, the pie chart actually showed that more than 60% of the tokens went to the team, investors, and advisors.

In addition, the airdrop rules show that 2% of the 5% airdrop in the first quarter (or 0.1% of the total token supply) has been allocated to NFT communities such as Milady Maker and SchizoPosters. These NFT communities do not seem to have any connection with the Renzo protocol itself, which has also caused users to worry about insider trading.

Looping "Death Loop"

In fact, there was a "looping" leverage strategy in the previous Renzo airdrop reward activity, that is, the airdrop farmer could sell ezETH in exchange for ETH, and then deposit ETH back into the protocol to accumulate more rewards, which also led to users exiting by selling a large amount of ezETH.

The thin on-chain liquidity was unable to cope with the selling pressure and exacerbated the massive sell-off of ezETH, causing the token value to plummet. This also led to a large number of liquidations in many lending markets. It is reported that individuals holding ezETH leveraged positions have lost more than US$50 million.

Renzo adjusts airdrop rules in response to community

The depegging of ezETH tokens has attracted the attention of Renzo project. In response to the community's doubts, the project responded quickly yesterday, clarifying that the airdrop qualification depends on the ezPoints at the time of the snapshot, and has nothing to do with the ezETH balance at the time of the snapshot (regardless of whether it is sold). Users whose Pendle YT expires before the snapshot can obtain airdrop qualifications as long as the score meets the minimum standard. NFT airdrops will be calculated based on the number of NFTs, not the number of wallets. However, such a response did not ease the concerns of community users, and ezETH is still in a "depegging" state.

When the Renzo project realized that the root of the problem lay in token economics and airdrop details, it made a series of corresponding adjustments to stabilize community sentiment and save the currency price.

In response to user dissatisfaction with the details of token economics, the project team increased the airdrop allocation ratio from 5% to 7% of the tokens in the first quarter. Renzo raised the airdrop amount to 12% of the total supply of 10 billion tokens, of which 7% of the tokens will be allocated in the first phase (launched at the end of the month) and 5% will be allocated in subsequent phases. In addition, the collection date of the first airdrop has been updated to April 30.

According to the new airdrop criteria, participants with 360 or more Renzo Points are eligible for airdrops, and they can receive airdrops in proportion to their points in the token generation event. Previously, the top 5% of eligible wallets would receive half of the airdrops over the next six months. In the new update, 99% of eligible airdrop addresses can be fully unlocked after TGE, and wallets with more than 500,000 ezPoints will unlock 50% at TGE, and the remaining part will be linearly vested within 3 months.

In addition, the project team also cancelled the previous "circular" leverage strategy to maintain the liquidity of ezETH.

According to Coingecko's market data, ezETH is currently quoted in the range of 3056-3121 US dollars on various platforms. Although it is still in a "depeched" state, the price is steadily recovering and the discount compared to ETH is narrowing.