01

X point of view

1. Benson Sun (@BensonTWN): Bitfinex ETH whale is quietly accumulating ETHBTC positions

Recently, ETHBTC has been falling for more than a month. It must be difficult for ETH holders in the near future, but since the exchange rate fell below 0.054, the main force of Bitfinex ETH has continued to leverage long ETHBTC. According to the current speed of opening positions, more than 10,000 ETH can be purchased in a day.

The financial strength of the Bitfinex ETH main force is definitely beyond your imagination. In July 2021, during the last bull market, during the decline of ETH, this main force showed amazing strength. There were tens of thousands of pending orders, which were all taken. Just continue to make up for it, resisting the panic selling pressure of the entire market with one person's power, it is simply amazing.

The blue line in Figure 1 is the ETHBTC whale indicator I made. As long as the blue line rises, it means that the main force is accumulating ETHBTC long orders (green arrow in the picture). The higher the slope, the faster the purchase. When the accumulation reaches a certain level, , the exchange rate has bottomed out, and conversely if it falls rapidly (red arrow in the figure), the exchange rate is often not far from peaking.

From the perspective of the general cycle, it can be said that the exchange rate of ETHBTC is tightly controlled by this main force. When he wants to buy, he will buy a bottom, and when he wants to sell, he will sell a top.

When I posted Figure 1, it was still in September last year. At that time, I was bearish on ETHBTC because the whale had no intention of holding on to the exchange rate. At that time, I suggested that everyone exchange ETH for BTC.

It was not until 1/9 that I found that the giant whale was quickly building positions at a nearly vertical slope (see Figure 2). It was just before the BTC ETF passed, and I posted a long article on ETHBTC. Not long after, the exchange rate soared by 20%.

Now the giant whale has taken action again, and it has accelerated its position building since it fell below 0.05. The last time the BTC profit came true (the BTC ETF passed), the exchange rate surged by 20%. Will it also surge after the halving this time?

If you are interested, you can take a look at Bitfinex’s ETHBTC transaction records, which are all market buy orders.

This is why I think that after the halving, the copycats should become stronger. When the benefits of BTC in the first half of the year are fully realized (BTC ETF & halving), the eyes of funds will not always be focused on BTC. As the leader of the copycats, ETH will also bring A group of copycat boys rushed together.

In the last bull market, ETH also started to run an independent market after the halving. The historical trajectories may not be exactly the same, but they often rhyme.

========Update======

The accumulated ETHBTC positions of Bitfinex whales have exceeded the size of 1/9 BTC ETF on the eve of its passage, and currently hold approximately US$600 million in ETH.

On the other hand, the gas fee on the ETH chain is currently at a freezing point of less than 10 gwei. Compared with the ruthless buying attitude of the giant whale, it is really a world of ice and fire.

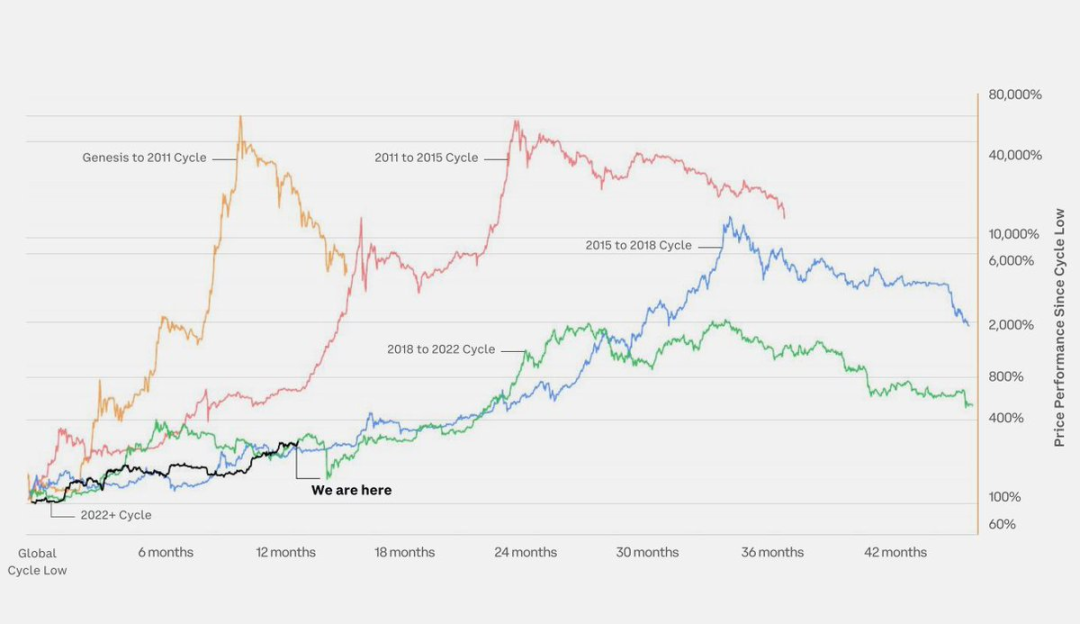

2.Chris Burniske (@cburniske): Performance of previous halving cycles

In case the lettuce hands need a reminder.

(Translation: in case newbies need a reminder)

3. Pyhrex (@Phyrex_Ni): Investors increase their holdings of BTC

Judging from the current position data, small-scale investors have maintained a trend of increasing their holdings of #BTC in the past 24 hours, while high-net-worth investors have a more obvious trend of increasing their holdings. Judging from the data of the past week, both Signs of accumulation.

02

Data on the chain

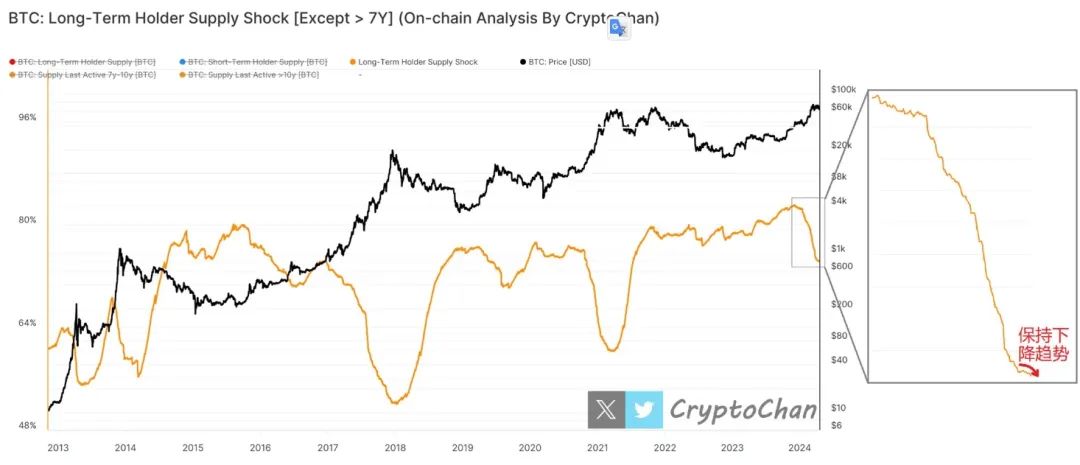

@0xCryptoChan: Currently, long-term BTC holders still maintain the trend of chip distribution

Fortunately, the current long-term holders of #BTC still maintain the trend of chip distribution, which may ensure that there is still room for good imagination in the future bull market. The black line in the figure is the BTC price; the orange line on-chain indicator is the proportion of chips held by long-term BTC holders (holding coins on the chain for >155 days) (BTC that has not been moved on the chain for >7 years is considered Long-term dormancy or losses are excluded from the calculation), when this indicator maintains a downward trend, it means that long-term BTC holders maintain a distribution trend.

@cs_zhaozilong: Currently, Ethereum has entered the stage of accumulation on the spot market.

At present, Ethereum has entered the accumulation stage on the spot market; according to the previous data of the main accumulation traders, the main force at this position will create 10% lower space to obtain chips; so Ether is between 2900-2700 Buy spot in separate warehouses.

During the top-building stage, you will feel that the price is very hard and cannot go down at all; during the bottom-building stage, you will feel that the price is very soft and cannot go up at all. The specific manifestations are as follows: Behavior during the top-building stage: the price keeps going near new highs, Sometimes it will break a new high; at this time, the FOMO mood starts, and everyone is looking at 100,000 for pie and 10,000 for Ether; the bottom-building stage behavior: the price continues to go near new lows, and sometimes it will break a new low, and at this time, the fud mood starts, One after another, the pie is looking at 10,000, and the ether is looking at 1,000.

03

Interpretation of sectors

According to Coinmarketcap data, the top five most popular currencies in 24 hours are: GALA, NPC, GPU, ONDO, and ORBS. According to Coingecko data, in the encryption market, the top five sectors with the highest growth are: Retail, IOT, Gemini Frontier FUND, Events, and Berachain Ecosystem.

Hot Spot Focus - The market is at a crossroads. What is the basis for the "big gods" to be bullish or bearish?

After the plunge in the early morning of April 14, the legendary trader GCR (who had short DOGE, SHIBA, and LUNA at the top), who had not published trading remarks on social media for a long time, publicly called for long. This news has now been read by nearly 9 million people on X , and the number of likes reached 55,000. GCR said: “If your position is insufficient, this will be a good opportunity for you to expand your position on the token with stronger consensus. If you are already full, then stick to it and stick to your spot position. Don't surrender. Someone once said that the essence of liquidation is a forced transfer of wealth from traders who need leverage to wealthy spot holders. I have retired from social media, but I don't want to see the future still so bright for my brothers. Next was eliminated.”

Arthur Hayes, co-founder of BitMEX, has long become one of the most popular “order leaders” in the market. Earlier this month, Arthur predicted that from April 15 to May 1, the U.S. annual tax filing period (April 15 is the tax deadline) will drain market liquidity. In addition, the Federal Reserve continues to shrink its balance sheet, and Bitcoin is expected to The halving event on April 20 may bring short-term oversold conditions, and the market may experience extreme weakness. However, starting from May 1, as the Federal Reserve slows down its balance sheet reduction and the U.S. Treasury Department uses funds to stimulate the market, a new round of crypto bull market is expected to begin. With the sharp decline in the past few days, Arthur also turned his gun and began to shout long. On April 15, Arthur posted on the X platform and shouted: "The bottom has arrived, let's start charging!"

On April 16, Arthur said again: “Until the weekend before the U.S. tax filing deadline on April 15, the trends of Bitcoin and gold remained in sync. Also during this weekend, the situation in Israel and Iran escalated, and the price of Bitcoin The market fell sharply, and gold was closed. On Monday, there was no volatility after the market opened, and Bitcoin’s general trend still works. People just need to pay their taxes.”

Chris Burniske, the former head of encryption at ARK Invest and now a partner at Placeholder VC, had previously accurately predicted that the market would see a significant correction after the ETF was approved. After this round of declines, Burniske also called out many times. This morning, Burniske posted: "There is significant panic in the market, but prices have gained a firm foothold within a reasonable range and excessive fluctuations have been eliminated. This will be the basis for the eventual rise in prices." Later, Burniske also forwarded it A post about "You guys will actually clear your positions 4 days before the halving" was accompanied by a picture of a whale swallowing it, or it may imply that the giant whale is eating the chips of panic selling by retail investors at low prices.

Bitwise Chief Investment Officer Matt Hougan (the one on the left in the picture below) has always been a representative of Bitcoin’s “dead bulls” active in the social media field. When Bitcoin fell last week due to higher-than-expected CPI and a delay in interest rate cuts, Hougan said, “I don’t think higher-than-expected CPI will interrupt Bitcoin’s rising trend. Whether the Federal Reserve will cut interest rates in June is not related to the price of Bitcoin.” The long-term drivers are just marginal factors, and ETF flows and growing deficit concerns are more important, and these data are bullish for Bitcoin.”

short

When explaining the logic behind liquidation, 10x Research said the main reasons were:

1. We are increasingly concerned that risk assets (equities and cryptocurrencies) are both in critical condition and may experience significant price corrections. The main trigger is unexpectedly persistent inflation, with current bond market forecasts pointing to fewer than three rate cuts and with the 10-year Treasury yield above 4.50%, we may have reached the point where risk assets An important turning point.

2. It must be understood that trading is an uninterrupted game full of opportunities. The key to trading is to continually analyze the market and spot opportunities when the times are favorable. Sometimes we will advocate a strategy of increasing risk (to gain more profits), while at other times preserving capital is the priority, which can allow you to maintain a higher risk level. Take advantage of opportunities when they are low.