Original | Odaily Odaily

Author | Nanzhi

Runes have been online for nearly a week. Due to its popularity, the Bitcoin network has been congested. The network fee for a single transaction is as high as tens of dollars, resulting in a relatively small transaction volume for each rune except the top rune, and the life cycle often lasts less than 24 hours. Shortly after the rune was launched, the BVM ecosystem launched RuneChain, which is specially designed for runes. It supports cross-chain of runes and has extremely low transaction fees. Can RuneChain bring new application scenarios for runes? Odaily will analyze its functions and data in this article.

Runechain Introduction

RuneChain is Bitcoin L2, which can expand the Bitcoin network for rune transactions. It uses BVM technology as its infrastructure and is designed for large-scale use. According to official documents, the average transaction fee of RuneChain is as low as $0.001 and the block time is about 1 second.

Basic Architecture

RuneChain is EVM-compatible, allowing developers to migrate DApps directly from the Ethereum ecosystem. Its underlying architecture uses OP Stack. In terms of data availability, RuneChain stores data on Bitcoin and other DA solutions, including Polygon and Celestia. Data hashes are stored on Bitcoin to enjoy the security of the Bitcoin network, while other DA solutions are more cost-effective. RuneChain stores compressed transaction data on these DAs.

Rune Cross-Chain Bridge

RuneChain has launched its rune cross-chain bridge, supporting cross-chain transactions from the Bitcoin mainnet to RuneChain, including the popular runes DOG•GO•TO•THE•MOON, RSIC•GENESIS•RUNE, SATOSHI•NAKAMOTO and ten other runes and BTC itself.

In addition, RuneChain also supports cross-chain runes to the Ethereum mainnet and Solana, but currently only the official rune (also the fourth rune) THE•RUNIX•TOKEN has been opened for cross-chain.

Rune Exchange

Similarly, RuneChain has also launched a cross-chain rune exchange . The above cross-chain runes are open for trading pairs. After testing, the network fee for a single transaction is about 0.00064 BVM (about 0.0023 USDT), which is of the same order of magnitude as the network fee shown in the official documents, and is very low compared to the mainnet.

So can low network fees lead to large-scale use of RuneChain? According to official data, the 24-hour transaction volume of RUNIX, which has the highest transaction volume on RuneChain, is as high as 153.89 BTC, and the most popular DOG rune on the current mainnet is as high as 4.19 BTC.

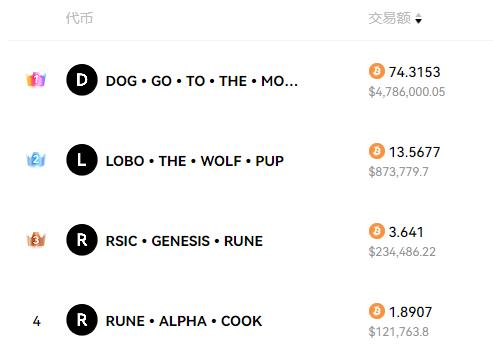

On the mainnet, DOG rune has the highest transaction volume, with a trading volume of 74 BTC in the OKX market in the past 24 hours, and the second place WOLF is 13.5 BTC.

But in fact, by observing the order book, we can find that the current transactions on RuneChain are not active. Taking RUNIX as an example, the five-level buy and sell orders are only 0.22 BTC, and the difference between the buy one and the sell one is as high as 150%. RuneChain has not brought about a significant increase in liquidity.

Ethereum to the rescue Rune?

As mentioned above, RuneChain has currently opened the cross-chain function of THE•RUNIX•TOKEN to the Ethereum mainnet and Solana. On-chain data shows that the transaction volume of RUNIX on the Ethereum mainnet has reached 1.07 million US dollars in the past 24 hours, about 16.6 BTC. The cross-chain RUNIX on Solana has also had a transaction volume of 151,000 US dollars in the past 24 hours, about 2.34 BTC. It can rank second and fourth in the OKX rune trading market.

in conclusion

From the above, we can see that extremely low transaction fees cannot be a fundamental means to attract mainnet users, either because the popular concepts of Rune are rapidly iterating and cross-chain transactions are not necessary, or because RuneChain is still in its early stages and is not yet known to the public. The high trading volume of cross-chain Runes on ETH and Solana also shows that the dual addition of active funds and transaction convenience can inject strong liquidity into assets.

Therefore, RuneChain still has a long way to go. At present, RuneChain can only have visible growth in the scenario of rune liquidity overflow. It is an accessory to the mainnet rune, and has not yet seen the ability to actively empower or even subvert the rune track.