introduction

The rise of Solana has expanded the DeFi space. We’ve always watched from afar, but never offered a fresh perspective. However, the frenetic activity on Solana over the past few months has given us a new opportunity to observe where it sits in the market, and how it might evolve. Zhev has previously written about technical explanations of AMMs and other DeFi primitives on his own Substack. This month, we partnered with him to take a deep dive into Solana’s fee markets. MEV has already dominated the fee market discussion on Ethereum, and as Zhev explores below, it will soon dominate on Solana as well.

Transaction fees are necessary to support the most basic activity on the blockchain, as they enable a user's transaction to gain validity and be included in a block. The primary purpose of these fees is to discourage spam; it also forms part of the subsidy paid to validators to build/validate blocks. In a sense, these network fees are akin to rent; users pay a fee to access a finite commodity per unit of time. The commodity here is "blockspace," that is, the space on a block.

Here, we assess blockspace on the two largest smart contract blockchains, Ethereum and Solana. As we dig deeper, we learn that fee markets, both designed into the protocol and organically developed from the ground up, enable validators to leverage their access to blockspace.

Solana’s fee market is optimized for high performance and is designed to avoid the issues seen in Ethereum’s approach. However, while Solana’s market may ultimately be more efficient than Ethereum’s, it will still need to go through a similar MEV revolution as its peers (validators begin to exploit their privileged position). Solana doesn’t have to go the Proposal Builder Separation (PBS) route that Ethereum has chosen, but it will need to determine a comprehensive approach to stabilize its fee market in the long term.

The Basics of Blockspace Valuation

Before we go any further, let’s try to understand how blockspace value is roughly determined.

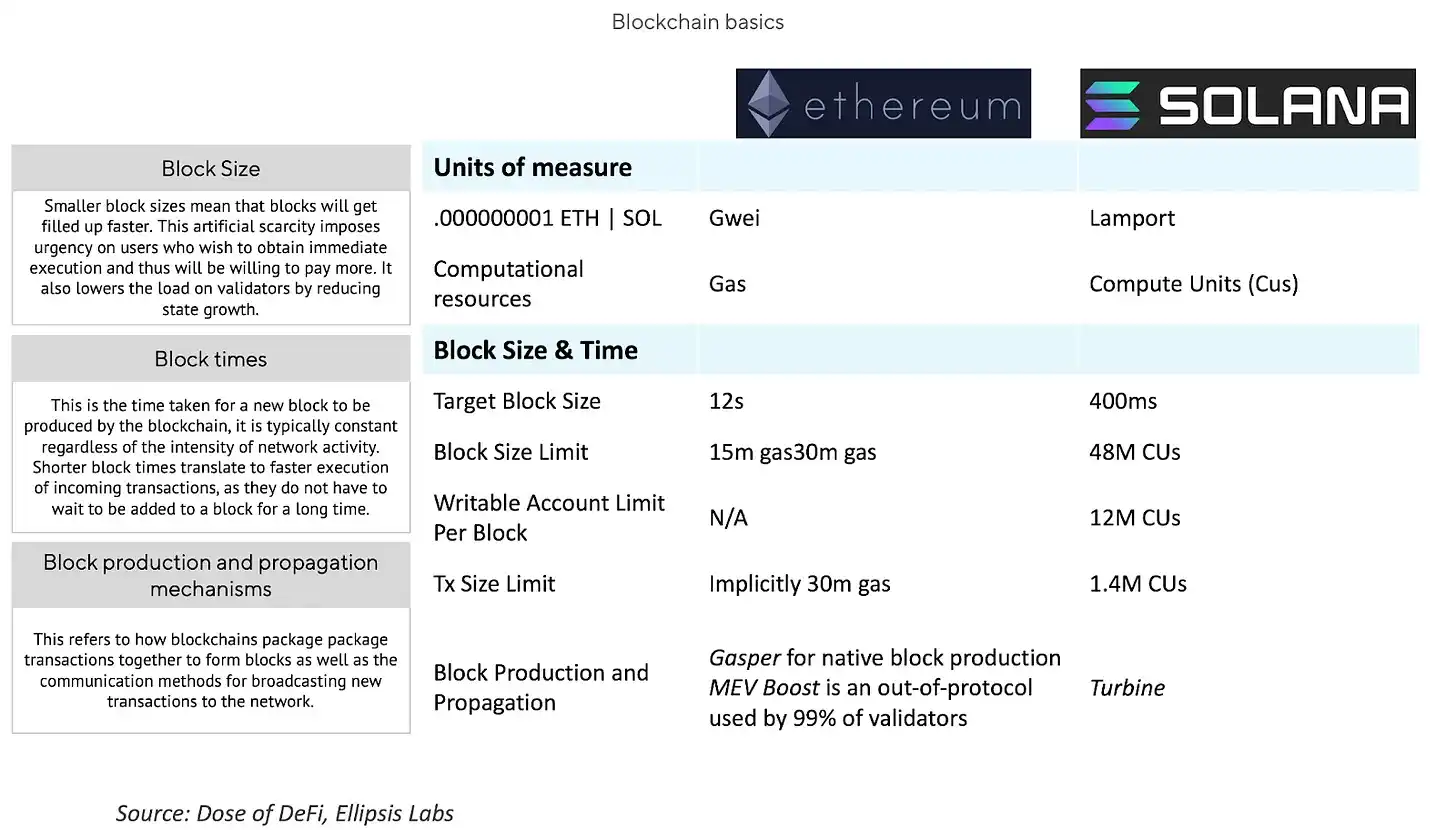

There are both technical aspects and social aspects (basically the coordination of the parties that give value to the blockchain). From a technical perspective, blockchains can adjust block size, block time, and block production and propagation mechanisms. The chart below provides a more detailed description and comparison of Ethereum and Solana’s approaches.

The social aspect refers to the coordination of blockchain stakeholders to achieve the technical and fiscal goals of the chain. It can also be seen as the social status of the blockchain, which, while subjective, is an important metric. Social pressure is as effective as establishing a specific culture for problem solving, which both Solana and Ethereum have established. Recent examples of discussions around the social layer include the debate over whether to increase Ethereum’s gas limit and issuance per epoch, and the recent shutdown of Jito’s mempool on Solana .

Now, let’s examine and compare Ethereum and Solana’s fee markets in more detail.

Summary of Ethereum’s Fee Market

Ethereum's popularity is largely due to its execution environment: the Ethereum Virtual Machine (EVM), which makes smart contracts possible. Another factor is that Ethereum's permissionless nature has generated multiple cycles of various innovative applications: the ICO boom in 2017-2018, the DeFi Summer in 2020 , and the NFT craze in 2021-2022. The continued existence of these applications creates value for validators, who provide block space for these activities.

Soon after the surge in economic activity on Ethereum, miners (this was a few years before the switch to PoS) began exploring how to leverage their position as block proposers to insert their own transactions when arbitrage opportunities arose.

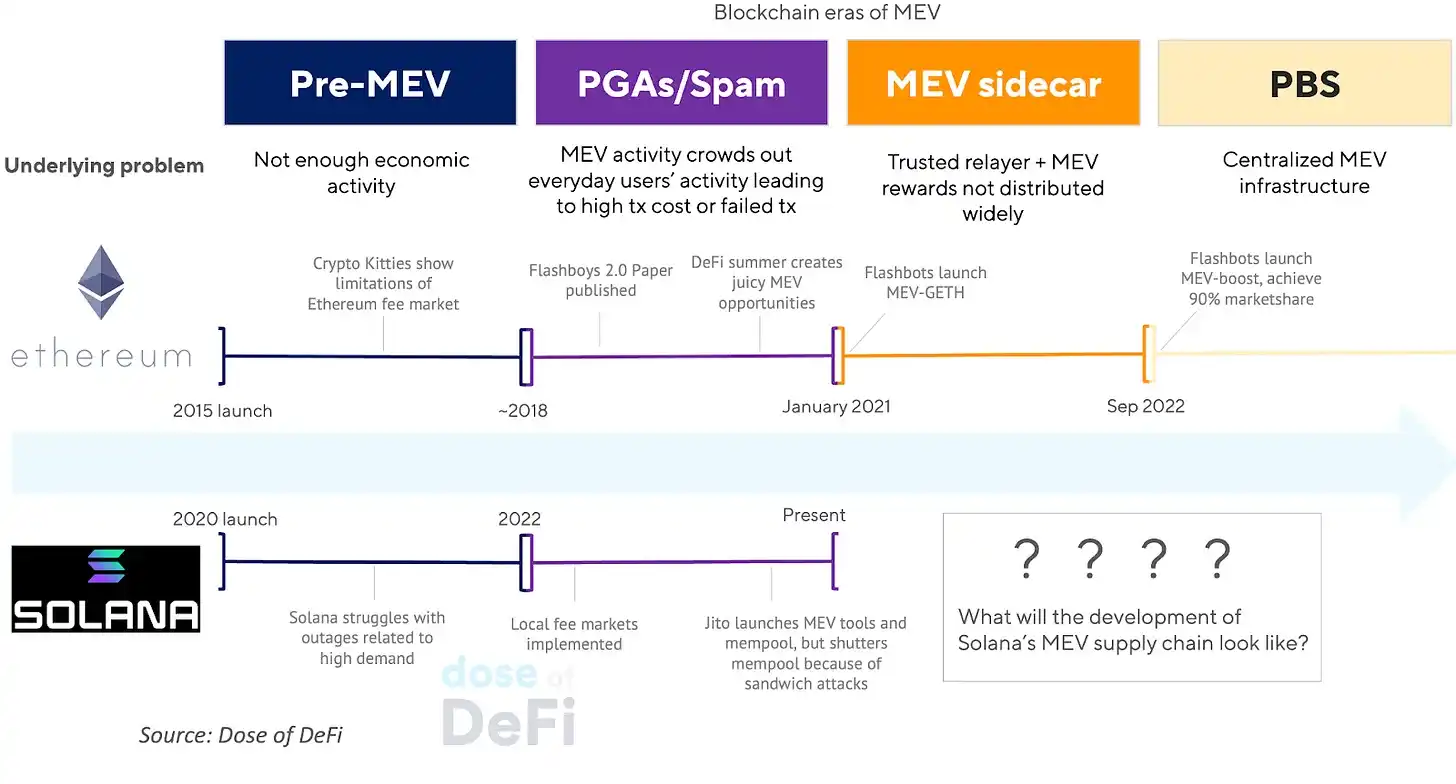

Phil Daian was the first to document this activity (which we now call MEV) in his seminal 2019 paper (Flash Boys 2.0) . At the time, Ethereum’s fee market only allowed higher gas prices as a way to incentivize transaction inclusion. These priority gas auctions (PGAs) clogged the Ethereum network and drove up gas prices until Flashbots (co-founded by Daian) were launched. This created a market for miners to pay transaction inclusion fees through searchers, who are on-chain arbitrage traders. Ethereum researchers then realized that MEV extraction could be more powerful than in-protocol fees.

Perhaps the biggest change to the Ethereum fee market is EIP-1559 , which creates a base fee (determined dynamically each epoch, to discourage spam, and burned), and a priority fee (used to show urgency or specify preference, and paid to block proposers to include transactions). An important takeaway is that a "priority fee" is functionally different from a "tip." The former ensures inclusion and is mediated by the underlying chain, while the latter ensures ordering as well as inclusion and is mediated by the fee market.

Ethereum’s approach has been evolving; see our two-part deep dive into MEV last fall. This is happening through a combination of a social layer, which seeks to decentralize a centralized MEV industry, and a technical layer, where MEV is now a key part of the technology roadmap ( Vitalik calls this part of the roadmap “The Scourge” ).

How Solana’s Fee Market Works

Solana takes a radically different approach to blockchain architecture, particularly when it comes to scalability.

Some of Solana’s notable innovations include:

1. No universal memory pool: In Solana, transactions are forwarded directly from the initiating client to the Leader currently responsible for generating blocks, so there is no need for a memory pool. This theoretically reduces the latency of transaction confirmations, but in practice this is not always the case due to the existence of "jitter" (i.e., the different processing times experienced by different validators when processing transactions or blocks).

2. State isolation: The lack of a memory pool extension makes transactions on its dAPP more independent of each other. This approach is similar to the concept of "adding more lanes to ease traffic"; different types of transactions on Solana must follow a specific "path" from user to leader before they can be added to the block. This article provides more details.

3. Parallel execution: Solana is able to process non-overlapping transactions in parallel in the same block at the same time. This is due to two factors:

- Block production on Solana is (roughly) continuous, in that leaders are expected to add transactions to blocks as they receive them.

- Slot Leaders are fixed because they are pre-arranged in the queue, and these Leaders are also responsible for producing four blocks in a row.

These two factors, plus Solana’s state isolation, make transactions “multi-threaded”. This is when the leader of the current epoch schedules multiple transaction packages to be confirmed at roughly the same time (provided that transactions in the same thread do not change the same state) in the same way and at the same time.

Solana’s Fee Market: Cheaper ≠ Better

Network fees on Solana are generally very low (although rising with recent demand). In contrast to Ethereum, Solana has a static base fee measured in lamports . It then has a priority fee measured in microlamports per requested unit of compute.

This means that while fees algorithmically scale with increasing complexity and demand on the EVM, the SVM only needs to increase its priority fee with simple demand. The technical issues with the resulting non-dynamicity are detailedhere , but the point is that pricing a commodity with wildly volatile demand and a deterministic supply in a static manner is not ideal.

Solana’s Fee Market: The Inevitability of MEV

Solana’s social consensus considers its low fees to be its unique advantage over other blockchains. This approach invites spam, so some have called for higher fees or dynamic base fees during periods of high activity (similar to EIP-1559).

Solana’s approach to date has been to implement localized fee markets in response to increases in demand. Since states are isolated, it is easy for the network to identify “hotspots,” or states that are experiencing surges in demand. This hotspot approach enables the blockchain to algorithmically price higher target transaction fees for transactions in other states that are less in demand than others. This approach is similar to how the block builder role on Ethereum is fulfilled by the scheduler, who helps place transactions in consecutive blocks based on priority fees.

As part of implementing a local fee market, Solana built an in-protocol scheduler that natively schedules transactions for execution based on a first-in, first-out algorithm. Transactions are continuously streamed to slot leaders, which then order transactions based on the hints they provide.

The algorithm also requires slot leaders to share the shards they are building with some of the nodes they are connected to, based on the latter’s stake. However, as mentioned earlier, this process is disrupted by jitter. Specifically, scheduler jitter (due to Solana’s random assignment of incoming transactions to execution threads) and network jitter (from P2P relay delays for incoming transactions and shards).

These "jitters" cause transaction ordering uncertainty on Solana, which makes block space auctions economically viable. In other words, every time there is a jitter, validators have an economic incentive to insert or reorder transactions. For users, this means MEV leakage, and for validators, it means MEV profit.

Solana and Ethereum

A quick recap of MEV-Ethereum: On Ethereum before Flashbots, MEV activity crowded out regular blockchain activity, driving up gas prices for all users via PGAs. On Solana, fees don’t spike because it doesn’t have a shared state and a global minimum price like Ethereum, but it can be difficult for regular users to complete transactions on Solana when activity increases. Flashbots released MEV-GETH to handle PGAs, creating a separate channel for MEV value that is auctioned outside of the in-protocol fee mechanism. In the case of Solana, Jito launched a similar product for validators, providing them with a pseudo-mempool and a custom scheduler that orders transactions in the most advantageous way. Jito’s mempool is attractive to users, providing them with a guaranteed inclusion right to be front-run (aka have their MEV extracted).

Although a popular product, Jito’s mempool came under social pressure and shut down last month. This was likely for the same reason that over 20% of Ethereum transactions run through private mempools: users got tired of being sandwiched. Spam is now once again the only mechanism on Solana that (probabilistically) guarantees execution of time-sensitive transactions. The lack of an efficient mechanism to bid for block space leads to uncertainty during periods of high demand.

Since transactions on Solana are now streamed directly to slot leaders, and the priority model has been broken, topology (and resulting latency) is the most important component that users will consider for time-sensitive transactions.

The topology of a user in the network can be understood as how "far" they are from the leader, which is determined by their stake weight and/or the stake weight of the nodes they are connected to. Therefore, rational agents will seek to connect to nodes that already control high stakes, leading to centralization.

As a short-term consequence of spam, Solana is now so congested that it is almost unusable for less sophisticated users due to failed transactions . Therefore, addressing the long-term consequences (colocation and centralization of network stake) becomes even more important.

A more structured market?

Solana’s original design philosophy centered around removing user friction and allowing the validating network to fulfill demand in any way it can. What they missed is that markets work best when there is some certainty in how they operate. Fee markets offer a way to democratize inclusion by requiring users to pay more, shifting the problem from a topological perspective to an incentive-based one.

While this changes the user experience, accepting fee markets, and especially their relationship to MEV, is the best path forward for Solana and its users. Arguably, providing a cost-intensive way to mint while maintaining chain integrity is much better than having no method at all.

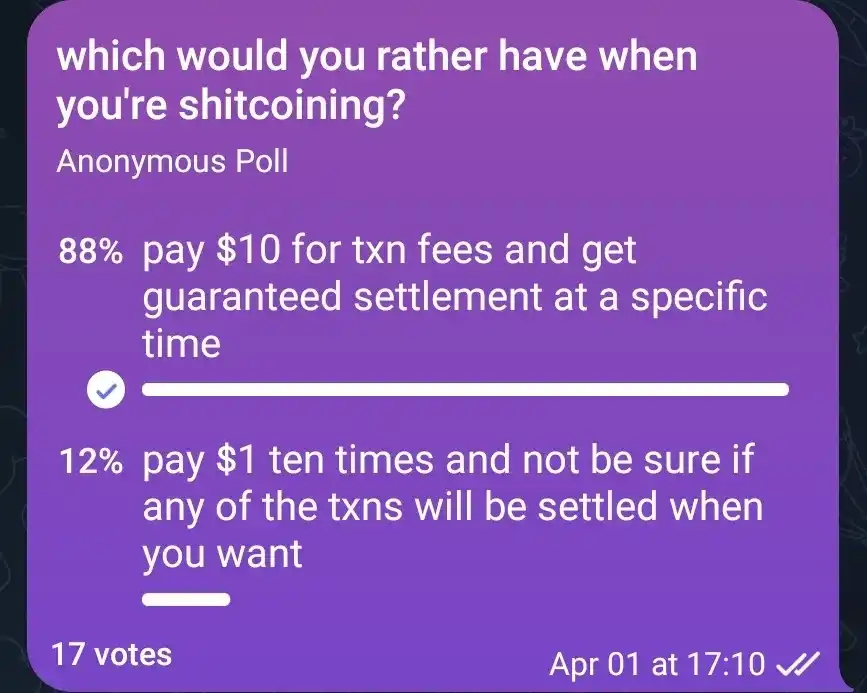

In reality, on-chain activity is almost always time-sensitive, especially when agents seek to extract value at little or no economic cost. Excessively deterministic execution is better than cheap probabilistic execution.

The professionalization of the fee market allows the bargaining and auctioning of block space to occur at a higher level, away from consensus and execution. As a result, validators can perform their duties without having to worry about optimizing for the best outcome of accumulating block space value.

Solana’s Coming MEV Revolution

Solana is in the middle of a chain-wide discussion about how its fee market should be restructured (something Ethereum has been pondering for years but still hasn’t solved).

Solana has not yet undergone the necessary MEV transition. While the recent increase in on-chain activity has attracted MEV players like Jito and Ellipsis to begin building MEV infrastructure, major validators have not yet made the leap and started running their own Solana MEV strategies. In stark contrast, all major staking providers on Ethereum are running MEV. The Solana validator community is not as adversarial as the Ethereum community, so in order to prioritize the end-user experience, the two sides reached a handshake agreement not to extract MEV (so far).

This won’t last; the social layer can’t police behavior forever. Blockchains must operate in an adversarial environment of self-interested actors. Solana may fare better than Ethereum because it can solve some of the MEV problems without being as severely constrained by decentralization as Ethereum. However, it will also have to answer some tough questions, such as whether all staked SOL should receive MEV rewards, as Ethereum does with MEV boost?

To address Solana’s congestion issues, we are already exploring a number of minimization mechanisms. These includedynamic fee structures , upcoming changes to the local scheduler spec, stake-based limits , and other application-level optimizations. Things are moving fast. Jito’s CEO recently admitted that “a small group of operators/seekers are sandwiched running private mempools.”

MEV is a hallmark of economic growth and is therefore inevitable. In fact, even Bitcoin, whose simplicity is often hailed as its greatest feature, has begun to undergo a reinvention following the rise of Ordinals and economic activity . Choosing to ignore solutions because of negative externalities (like in Jito’s case) does not eliminate said externalities, it simply leads to an uncoordinated market.

The social layer is an effective tool to deter predatory behavior, but it only lasts for a short time. Ethereum is experiencing a social layer shortfall with the rise of time gaming , a strategy where block proposers intentionally delay publishing their blocks for as long as possible to maximize MEV capture. This weakens the security of the chain but makes economic sense from a validator perspective. Shame can last for a while, but protocol research is the only long-term solution.

It’s too early to say what Solana’s MEV supply chain will look like in a few years. But one thing we can be sure of right now is that most of the value will be captured by a large number of validators.

Welcome to BlockBeats the BlockBeats official community:

Telegram subscription group: https://t.me/theblockbeats

Telegram group: https://t.me/BlockBeats_App

Twitter Official Account: https://twitter.com/BlockBeatsAsia