I saw a report a few days ago in which the blogger shared in the article: Shenyu believes that there is a high probability that there will be no copycat season in this bull market.

As for whether Shenyu really said this, I don’t know, but personally, I still tend to think that there is a relatively high probability that altcoin season will occur in this round of bull market. We have also shared some of the topics of altcoin season in our previous articles. The so-called altcoin season refers to the period when the growth of most Altcoin is better than that of Bitcoin. The occurrence of altcoin season generally indicates that funds are shifting from Bitcoin to tokens with smaller market capitalization.

Of course, if we look at historical experience, this bull market has indeed produced relatively big changes. In past cycles, it usually took Bitcoin several months after the halving to reach a new high, but in this bull market, Bitcoin has set a new historical high much faster than in past cycles.

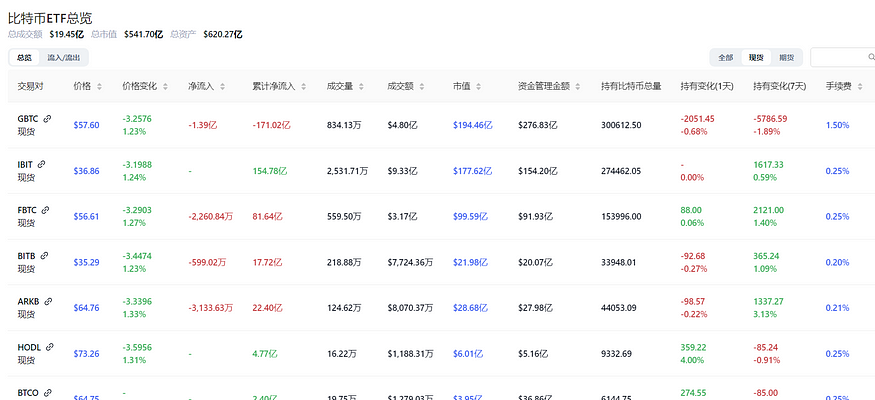

The main reason for this change is the promotion of Bitcoin spot ETFs, that is, the current Bitcoin holders are not only the typical whales and leeks in the previous encryption field, but also investors in Bitcoin ETFs (although they cannot convert these funds into other tokens). As shown in the figure below.

1. Why is the copycat season still likely to occur?

Although ETFs have dominated the market sentiment to a large extent, and the rotation of sectors in this round of bull market has also produced some new changes, I still believe that the alt season will continue to occur, because the liquidity of funds is one aspect (and the current market liquidity is still insufficient), but human greed is another aspect that needs to be considered. I believe that as the bull market progresses, more retail investors will return to the market, greed will regain the upper hand, and then many people will turn to buying Altcoin(especially small-cap Altcoin) for fear of missing out.

But as mentioned above, there have been relatively big changes in this round of bull market. The so-called copycat season in the past was equivalent to buying with your eyes closed, and you could achieve several times the profit in a short period of time, but this round of copycat season may be different.

In the case of insufficient water, there are now N times more monks in the temple, and new monks continue to join every week, and many new monks have special skills, which will lead to insufficient water and some old monks have no water to drink. Therefore, except for those Altcoin in hot tracks, hot sectors, strong dealers or strong backgrounds, other Altcoin without any hype value may not have too many opportunities to rise in this round of bull market, and those old Altcoin that cannot keep up with the times are estimated to be unable to break through the previous highs.

Therefore, there is a high probability that the altcoin season will still occur, but it may not be the situation you imagine where all the coins rise together. Instead, only some Altcoin will rise sharply.

In the previous market, we only need to pay attention to the diversification logic from the time perspective, because as time goes by, funds will basically rotate in most projects. But this round is different. We need to pay attention not only to the diversification logic from the time perspective, but also to the diversification logic from the space perspective. In other words, if a new round of altcoin season breaks out, you may only see a few hundred Altcoin have a relatively large increase (even a few Altcoin may skyrocket), while the remaining Altcoin will not have any obvious performance due to liquidity issues.

As for when the Altcoin will appear, it is impossible to predict. We might as well use several basic indicators in other dimensions (non-on-chain indicators) to make a judgment:

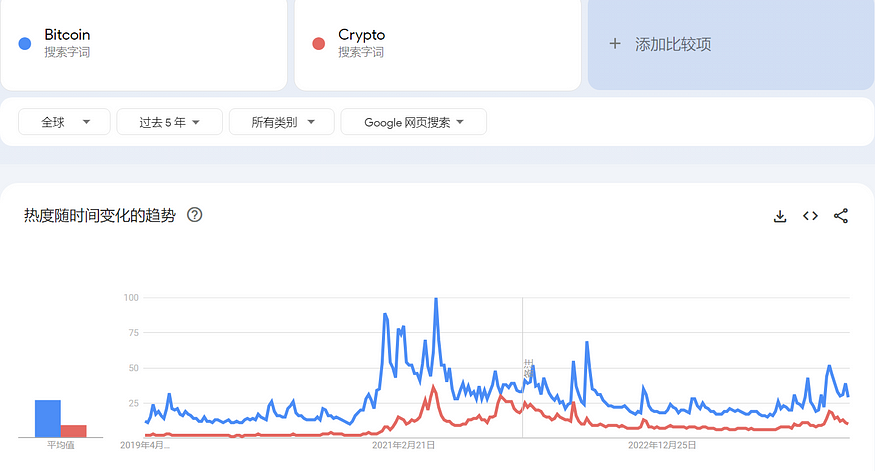

The first indicator is Google Trends

Google Trends has been mentioned several times in previous articles. Through this trend data, we can intuitively see whether a certain field is really recovering or is being paid attention to by more people outside the circle. For example, you can try to enter keywords such as Bitcoin, Crypto, Altcoins, etc. to compare with past cycles. Then you will find that we are still a long way from the level of 2021. As shown in the figure below.

The second metric is YouTube Views

As the world's largest video website, YouTube covers a lot of crypto bloggers and various knowledge sharing. If you compare some well-known KOL channels, you can find that the number of viewers of their latest videos is still a certain gap compared with the number of viewers in 2021. And you should know that the number of fans following these channels has continued to grow in recent years.

In other words, many retail investors do not seem to have really returned to the market. Similarly, you may also find that many Spaces currently have few listeners. If one day you can find that there are thousands of people listening to any Space, then it may mean that the bull market is really coming.

The third indicator is App Top Charts

It mainly refers to the popular download rankings in the App Store and Google Play. I remember that during the previous bull market, many encrypted applications such as CEX and Wallet appeared in the download rankings, and some APPs even dominated the list for a period of time.

If you find that the download volume of some crypto apps gradually enters the top 50, then from a certain perspective, it may also mean the arrival of a bull market and the return of more retail investors.

In addition to the above basic indicators, we can also feel that the current mainstream media does not seem to have begun to report on Bitcoin or encryption on a large scale. If you find that major mainstream media have begun to report on Bitcoin or encryption in a unified and extensive manner (different countries have different reporting angles), it may also mean that more retail investors have returned, which means that the bull market may be about to peak.

Therefore, based on the current overall market situation and long-term considerations, we are still some distance away from the peak of this round of bull market. As for how long it will last, this is still unpredictable. Recently, I saw some KOLs on the Internet saying that this round of bull market has passed 70% so far, which means it may end in the next few months. Some KOLs also believe that we are still in the middle of the bull market and may usher in a big bull market in 25 years.

No matter which view you are inclined to, at this stage, if you still choose to wait and see, then it is very likely that you will continue to become the new buyer.

If you haven't joined yet, what should you do now?

If you are interested in BTC, then I can tell you that our expectations for BTC in this round remain unchanged. I personally would consider selling some Bitcoin in the 100,000-120,000 range. BTC is currently at $64,000. If you have the same expectations as us, then you can still consider entering the market (in batches). Of course, this is only a reference suggestion, not an investment guide.

If you are interested in Altcoin, considering the risks, the only advice we can give you at the moment is to only invest in a few leading projects in the field that you are most optimistic about.

If you hope to discover more opportunities by studying some low-market-cap projects, we will continue to sort out some basic methods and ideas for your reference.

2. How to use on-chain tools to quickly discover potential Altcoin?

As mentioned above, many people like to buy low-market-cap projects because, in theory, once these projects rise following the narrative, the increase will often be the largest. But everything has two sides, and many people only see the possibility of rising prices, while ignoring (or downplaying) the risk of returning to zero at any time.

My general advice is not to take too many risks. Taking too much risk is sometimes no different from gambling. Besides, everyone’s time and energy are limited. There are at least 3.3 million tradable currencies on the chain, as shown in the figure below. It is impossible for you to study all the low-market-cap projects.

There are two ways to trade low-market-cap currencies: The first is to follow orders. That is, you see some bloggers or other partners in the group working hard to recommend a low-market-cap currency to you, and you choose to buy it directly. The second is to study. That is, you use some on-chain tools to find some low-market-cap projects, and filter them according to certain conditions, and then choose the currency you are optimistic about.

We will not discuss the first idea. Next, we will discuss the second idea and give you some specific steps.

Step 1: Filter by Market Cap

Here I recommend using tools such as CoinMarketCap or CoinGecko. Here we take CoinMarketCap as an example. Currently, the ranking list of the platform includes 9,823 projects, which is actually a very large volume. So we need to do some subtraction based on our time and energy. For example, we only focus on the currencies ranked between 100-1000 and sort them by market value. As shown in the figure below.

Step 2: Search for tokens by K-line

Because I rarely do short-term transactions in Altcoin except hoarding coins, so I have very little time to watch the market, but the K-line, as a reflection of the results of various comprehensive factors, is a good reference to historical data, and it is also a practical feedback of people's emotional performance. For example, smart money can always accumulate in the status range, and most of the leeks tend to rush in to take over when the peak is approaching. As shown in the figure below.

Therefore, in order to improve the success rate of our investment, before deciding to buy a specific Altcoin, we need to think clearly about a few questions: - Is the fundamentals of this currency good? - How big is the gap between the current price and the potential price? - Does the K-line trend meet the entry conditions?

For fundamentals, you need to conduct some basic investigations through the project's official website, Google, Twitter and other platforms or some on-chain tools, such as its token economics, team, products, financing, track it belongs to and its competitive products, etc. Of course, it does not mean that every project needs to make a complete investigation report by itself. After all, there is not so much time and energy, so you can focus on investigating and understanding the corresponding aspects (1-3 aspects) that you value most. For example, if you only focus on the aspect of token economics, then you only need to understand its token distribution ratio (focus on the team distribution ratio, investor distribution ratio, community distribution ratio) and whether it is unlocked. In short, it is still based on the most basic principle of "don't touch if you don't understand" mentioned many times by Huali Huawai.

The issue between current price and potential price is ignored by many people, but I think the estimation in this aspect is also very important. For example, if the current market value of SOL is 64 billion US dollars, and you buy SOL and think that the token will rise 100 times, then you should think about it at this time. Your 100-fold increase means that the market value of SOL will reach 6.4 trillion US dollars. Do you think this is possible? For another example, someone bought ENA and thought that the token would rise 100 times, then you might as well think about a question first. The current circulation of DAI is 5.34 billion, the market value of Maker is 2.7 billion US dollars, the circulation of USDe is currently 2.36 billion, and the market value of ENA is 12 US dollars. Do you really think that the market value of ENA will exceed Maker and reach 120 billion US dollars?

As for the K-line, we need to click on the details of each token to see, and then use the K-line to find the most likely tokens and determine the entry opportunity. Of course, the best entry opportunity is definitely to buy on dips. In the previous article of Hualihuawai, we have sorted out some basic strategies in this regard and summarized them from the aspects of buying time, entry point, position planning, etc.

Today we continue to provide you with a specific idea:

First of all, it is still necessary to remind you that the short-term trend of the market is unpredictable. No one can predict when a certain token will break through and rise. Buying based on K-line indicators is just a matter of probability. To put it bluntly, it has a higher chance of winning than buying blindly. Secondly, it should be noted that investments based on the following ideas are likely to bring you profits, but patience is the most important thing here.

So, based on the K-line, what kind of token trend should we look for?

Just look for coins that have a good bottom. As shown in the figure below.

When you see a token that is currently in the bottoming mode, you can add it directly to the list of candidates and set a price alert at the same time. Once it breaks through the upper price of the bottoming range, you can pay close attention to it and consider whether to enter the market.

In general, we should make some psychological preparations in advance: - There is a high probability that the altcoin season will still appear in this round of bull market, but it may not be the situation where all the altcoins rise as you imagine, but only some Altcoin will rise sharply. - Many popular new projects born in this round have a relatively consistent phenomenon, that is, they have high FDV as soon as they go online. This is actually not a good phenomenon, because high FDV means higher supply, but can the market demand (supply and demand relationship) really cover so many new projects with high FDV? Or, as time goes by, a large number of airdropped tokens or unlocked tokens flow into the market, how much liquidity is needed to undertake it? - From the perspective of the crypto market itself, the biggest expectation for this round of bull market should be when more retail investors will return to the market and where the greater liquidity needs to come from?

Finally, I leave you with two questions to think about.

first question:

The total market value of the 21-year bull market reached a maximum of 2.8 trillion U.S. dollars (1.6 trillion U.S. dollars for Altcoin). In the process of BTC rising from the previous high of 20,000 U.S. dollars to 60,000 U.S. dollars, the total market value of Altcoin rose from 200 billion U.S. dollars to 1.6 trillion U.S. dollars (an increase of about 8 times). The current total market value is 2.3 trillion (110 million U.S. dollars for Altcoin). Assuming that you still believe that the total market value of Altcoin can also increase by another 8 times, the total market value of Altcoin in the future will reach 8.8 trillion U.S. dollars. If we calculate BTC.D at 40% by then, the highest total market value in the bull market will reach 15 trillion. This is more than 5 times the previous bull market, minus the current 2.3 trillion, so 12.7 trillion in liquidity is still needed. Where does so much money come from?

second question:

You may feel that the prices of many Altcoin have not increased, but in fact, from another perspective, they have increased a lot. Take ARB as an example. From the price point of view, ARB seems to have not increased much, and it is almost on par with stablecoins, but if you look at it from the perspective of market value, ARB has actually increased by more than a billion US dollars in the past year (the circulation of tokens has increased from the initial 12.75% to the current 26.5%).

Even if the high FDV tokens do not seem to have increased in price, they still need a lot of investors (capital) to buy them. There are many popular high FDV projects now. If you are still expecting those new high FDV projects to increase tenfold or a hundredfold, where does all this money come from?

Okay, we will share the content of this issue here for now. This is the 447th article updated by Huali Huawai. We will continue to bring you more related sharing in the future. Those who are interested can check and learn more content through Huali Huawai.

Note: The above content is only personal opinions and analysis, and is only for popular science learning and communication purposes. All projects mentioned in the title or text have no interest relationship with Hualihuawai and do not constitute any investment advice.

about Us:

Hualihuawai is an independent and autonomous We Media platform that mainly shares some knowledge related to the encryption field. In addition to publishing articles through Hualihuawai from time to time, we currently have other communication channels and auxiliary learning tools, including communication groups, e-books, emoticons, etc.

For more information, please click: https://senlonlee.notion.site/b675992eca0c4a3e99456e62961e8969