A. Market View

1. Macro liquidity

1. Macro liquidity

Monetary liquidity weakened. The US economy continued to grow faster than expected, while inflation remained sticky. Against this backdrop, the market expected the Fed to further postpone its first rate cut to September, with a maximum of two rate cuts this year. Before the Fed gains enough confidence that inflation will continue to fall back to its 2% target, long-term Treasury bond rates may need to climb higher to cool economic demand. US stocks have suffered a series of heavy losses, and the crypto market has followed the US stock market in adjusting.

2. Market conditions

2. Market conditions

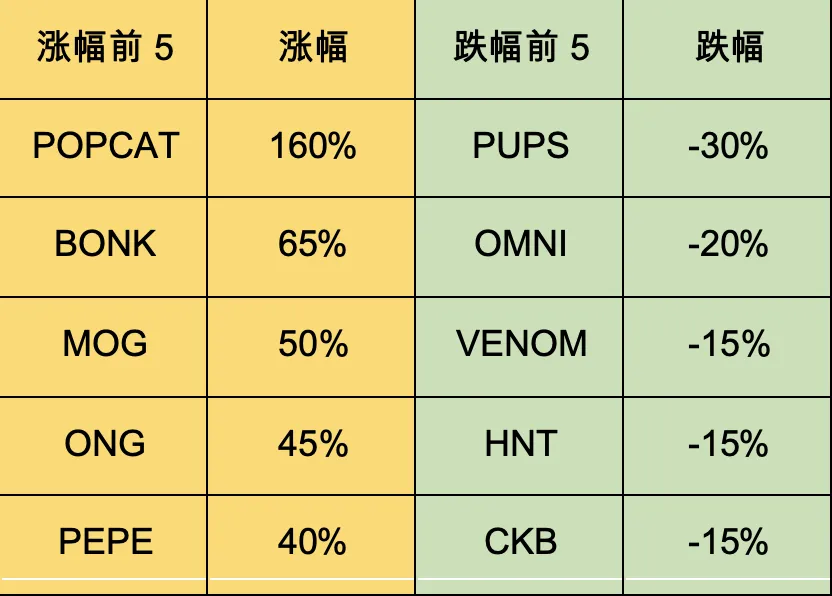

The top 100 companies with the highest market capitalization:

This week, BTC fell weakly, and value coins fell across the board. The main trend of the market revolves around the Meme sector, which is the direction with the least resistance to market growth and has no massive selling pressure from VCs.

1. BNB: The exchange rate of platform currency BNB/BTC broke through the monthly line. CZ's US sentence at the end of April continues to ferment. If CZ is sentenced to a light sentence, BNB may retaliate and pull up the price. 2. RENZO: Binance Exchange is going to list RENZO, which is an ETH re-pledge business. ETHFI in the same track has a market value of 4 billion US dollars. The special thing is that the listing time is April 30, and the time for retail investors to receive the airdrop is May 2. 3. DOG: The overall expectation of the BTC rune ecosystem is low. Runestone airdrops DOG runes to holders, with a market value of 350 million US dollars and a large short-term trading volume.

3. BTC market

3. BTC market

1) On-chain data

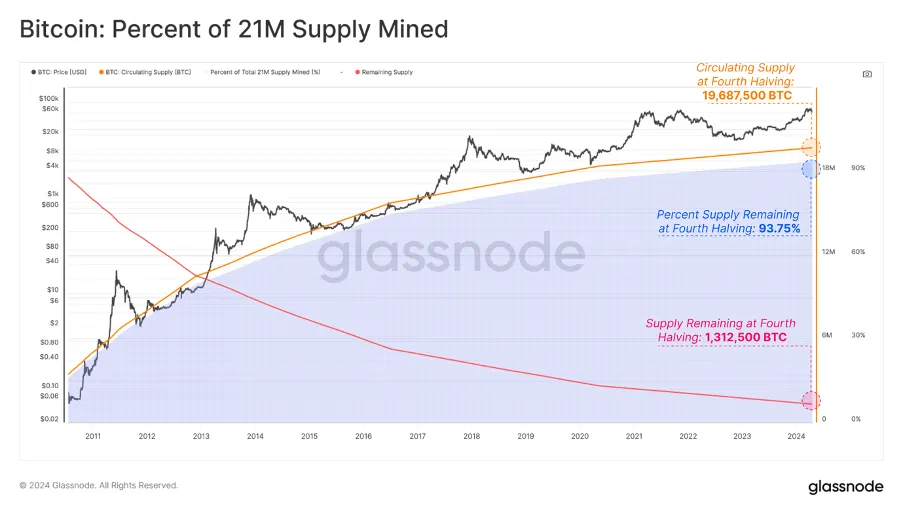

The fourth BTC halving has occurred, reducing supply inflation by 50%. The new annualized inflation rate is 0.85%, surpassing gold's 2.3% in terms of issuance scarcity. The difference in 24 years compared to previous halvings is that there has been over $12 billion in spot ETF inflows, the highest interest rate environment in more than 20 years, and about 94% of BTC has been mined.

The market value of stablecoins increased by 2%, and the long-term funding fundamentals remain positive.

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is the top range; when the indicator is less than 2, it is the bottom range. MVRV falls below the key level of 1, and the holders are generally in a loss state. The current indicator is 2.3, entering the middle stage.

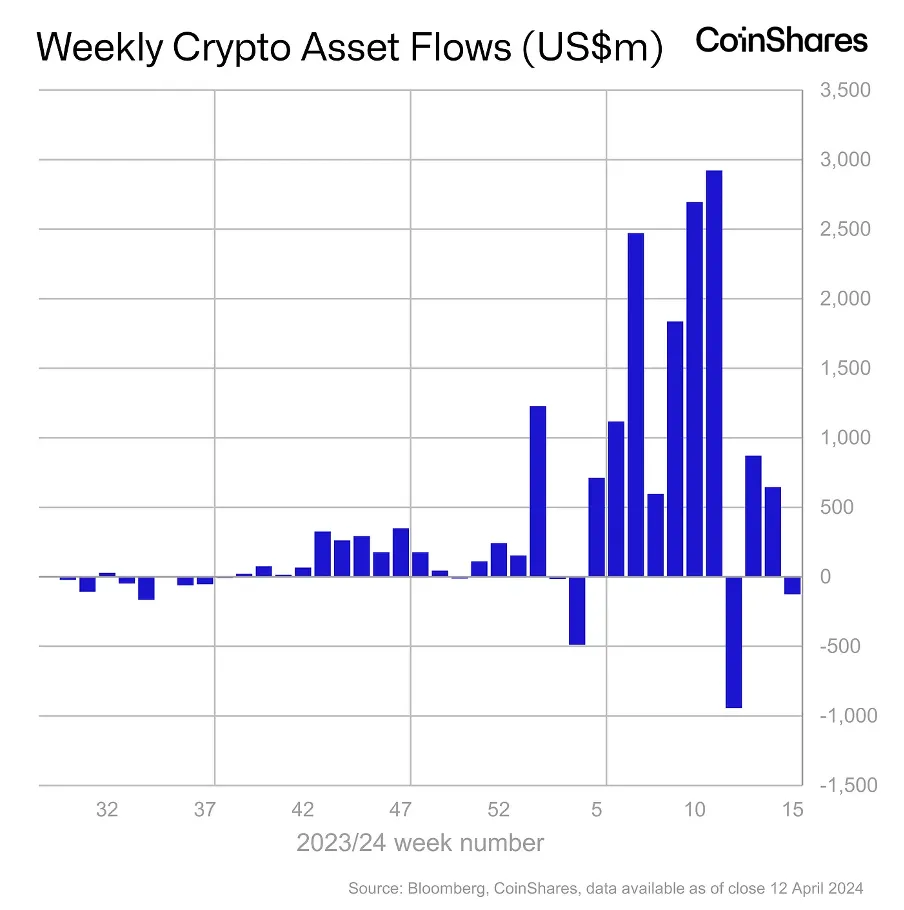

Institutional funds have been outflowing for two consecutive weeks. Investor interest continues to weaken due to the Federal Reserve's possibility of keeping interest rates at a high level for longer than expected.

2) Futures market

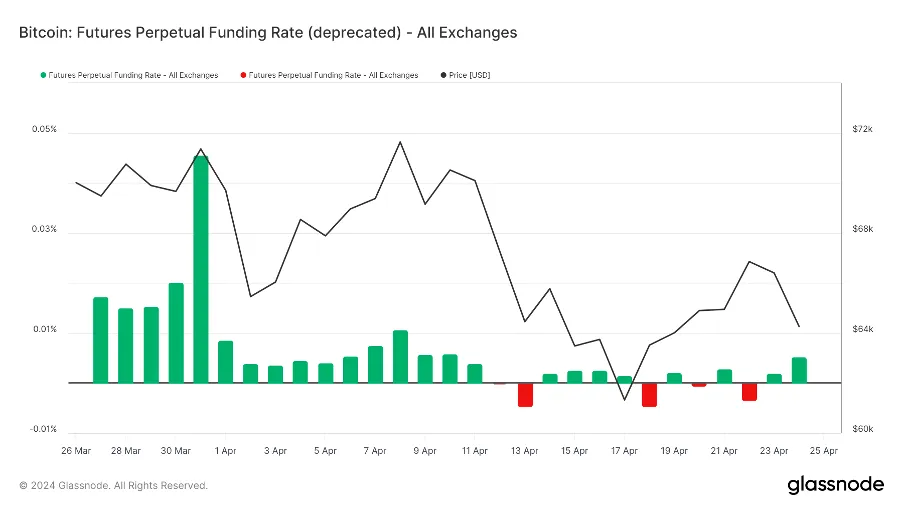

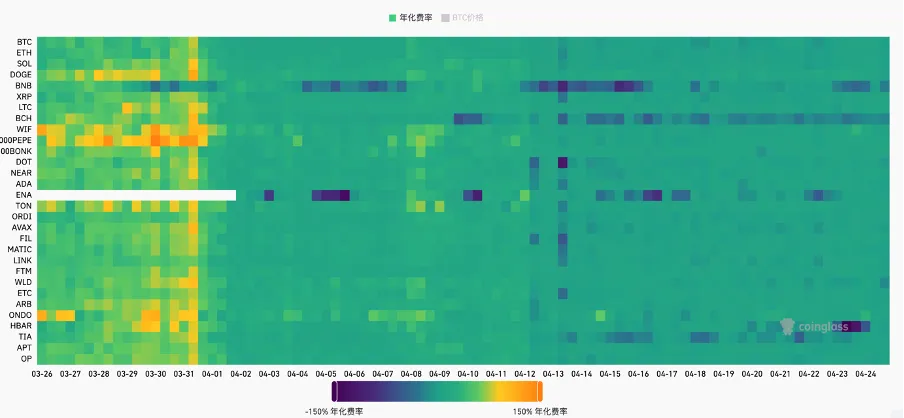

Futures funding rate: This week's rate is close to 0. The rate is 0.05-0.1%, with more long leverage, which is the short-term top of the market; the rate is -0.1-0%, with more short leverage, which is the short-term bottom of the market.

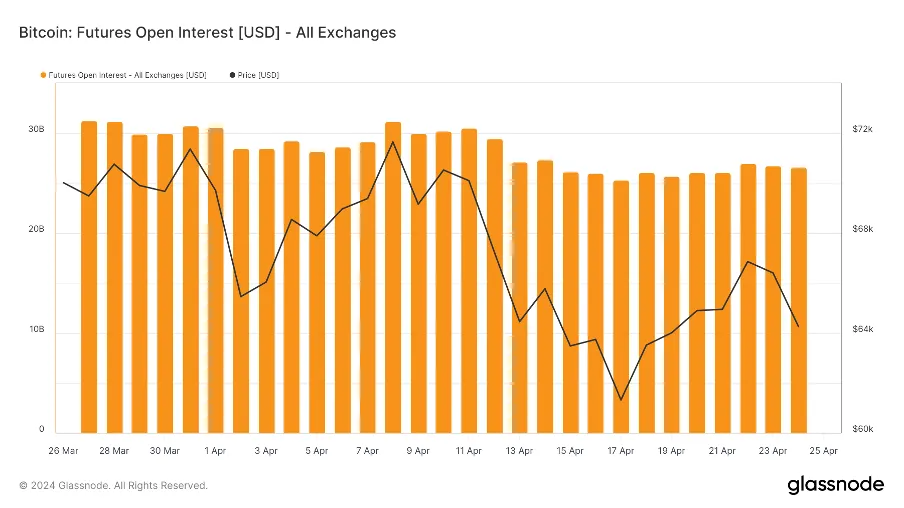

Futures open interest: BTC open interest remained unchanged this week.

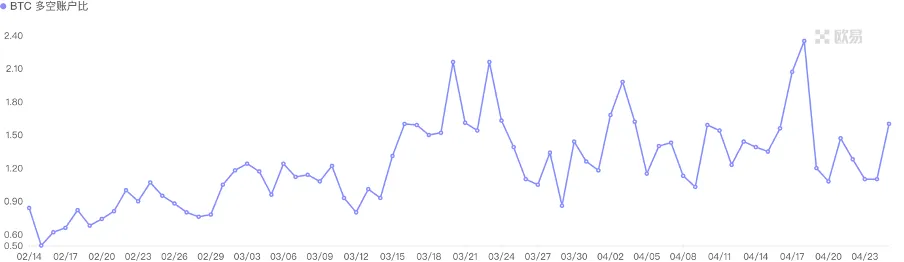

Futures long-short ratio: 2.4, market sentiment is still greedy. Retail investor sentiment is mostly a reverse indicator, below 0.7 is more panic, above 2.0 is more greedy. The long-short ratio data fluctuates greatly, and its reference value is weakened.

Futures long-short ratio: 1.7, market sentiment is still greedy. Retail investor sentiment is mostly a reverse indicator, below 0.7 is more panic, above 2.0 is more greedy. The long-short ratio data fluctuates greatly, and its reference value is weakened.

3) Spot market

The market fluctuated and fell, and experienced the stress test of war risks. The BTC contract rate was once negative, and the sentiment was too pessimistic. In the long run, we are still on the bull market track. Although the Federal Reserve is unlikely to inject a large amount of liquidity in the short term, some markets still have growth momentum.

B. Market Data

1. Total locked-up amount of public chains

1. Total locked-up amount of public chains

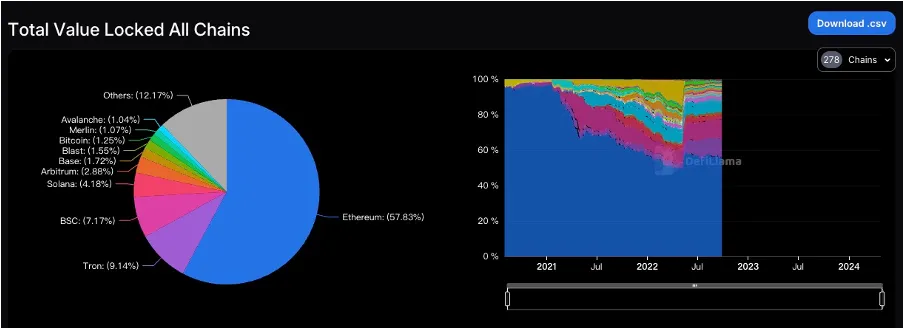

2. TVL Proportion of Each Public Chain

2. TVL Proportion of Each Public Chain

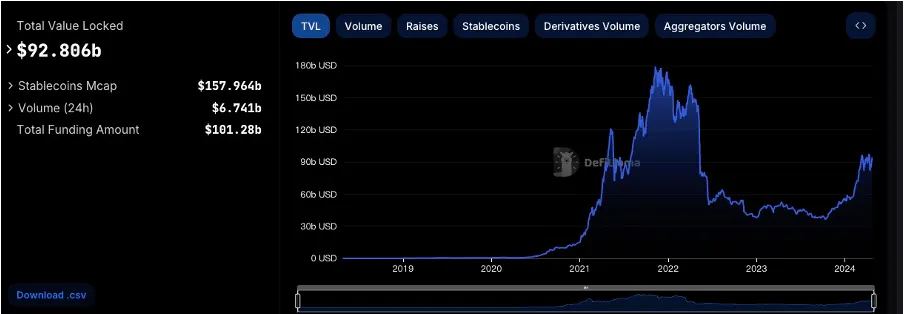

This week, the total TVL is around $93 billion, with an overall increase of $6 billion, or 6.9%. This week, the TVL of all mainstream public chains increased except for the BTC chain. ETH and BASE chains increased by 7%, TRON chain, POLYGON chain, and ARB chain all increased by about 5%, SOLANA chain increased by nearly 11%, BSC chain increased by 17%, and MERLIN chain continued to surge by 22%. In the past month, the increase of MERLIN chain has exceeded 2100%, and the total TVL has exceeded $1 billion. POLYGON chain and OP chain have now fallen out of the top ten.

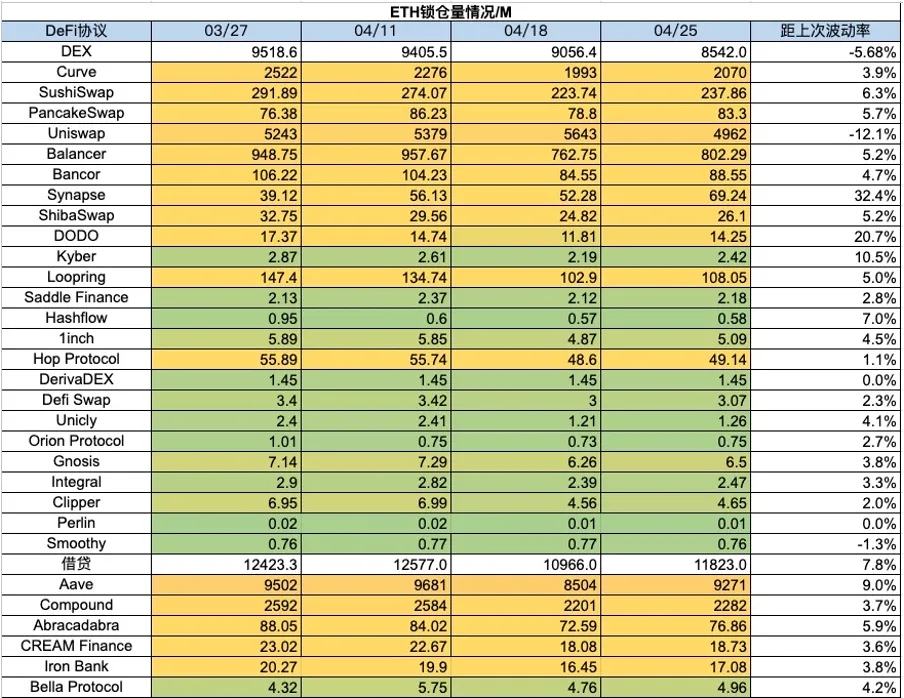

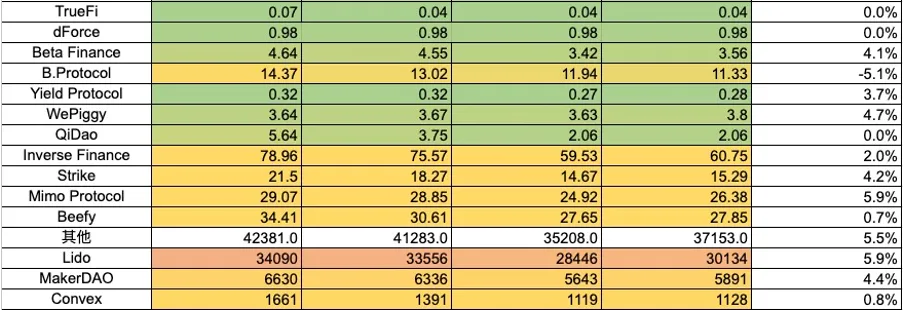

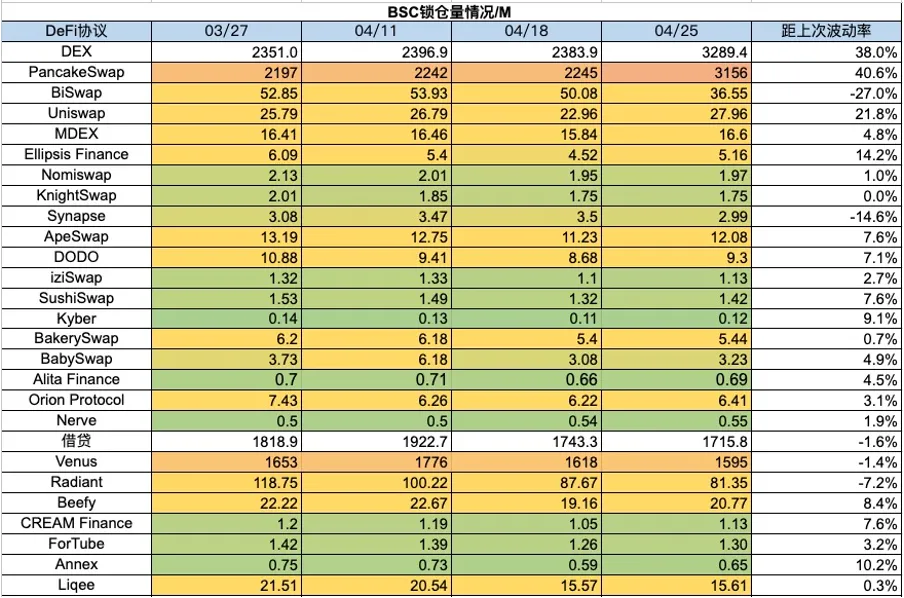

3. Locked Amount of Each Chain Protocol

3. Locked Amount of Each Chain Protocol

1) ETH locked amount

2) BSC locked amount

3) Polygon locked-up amount

4) Arbitrum locked amount

5) Optimism locked amount

6) Base locked amount

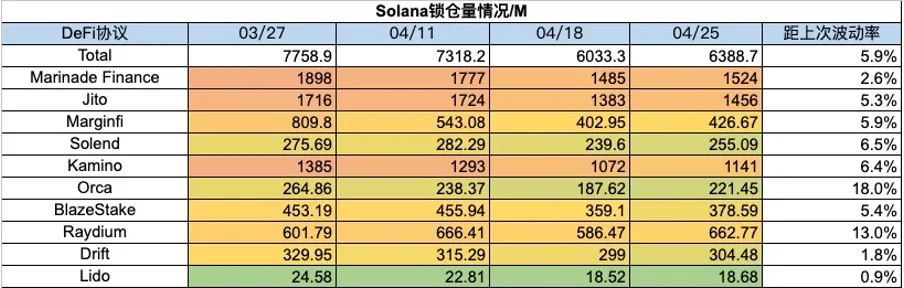

7) Solana locked amount

4. Changes in NFT market data

4. Changes in NFT market data

1) NFT-500 Index

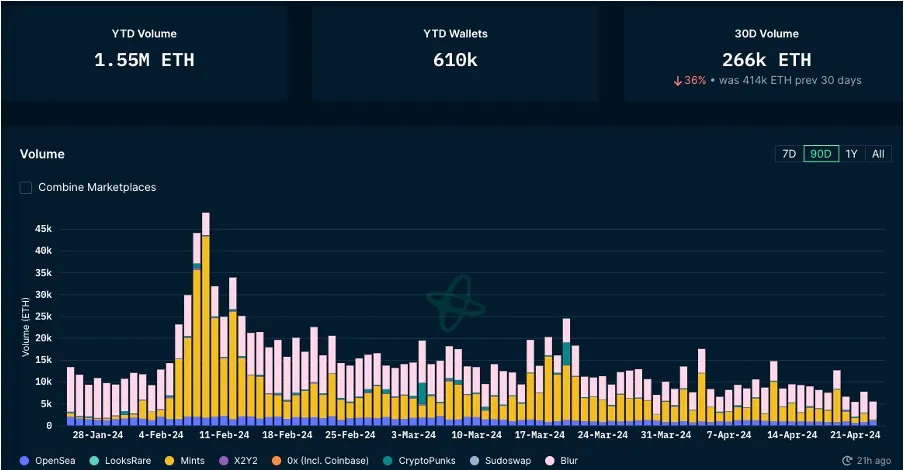

2) NFT market situation

3) NFT trading market share

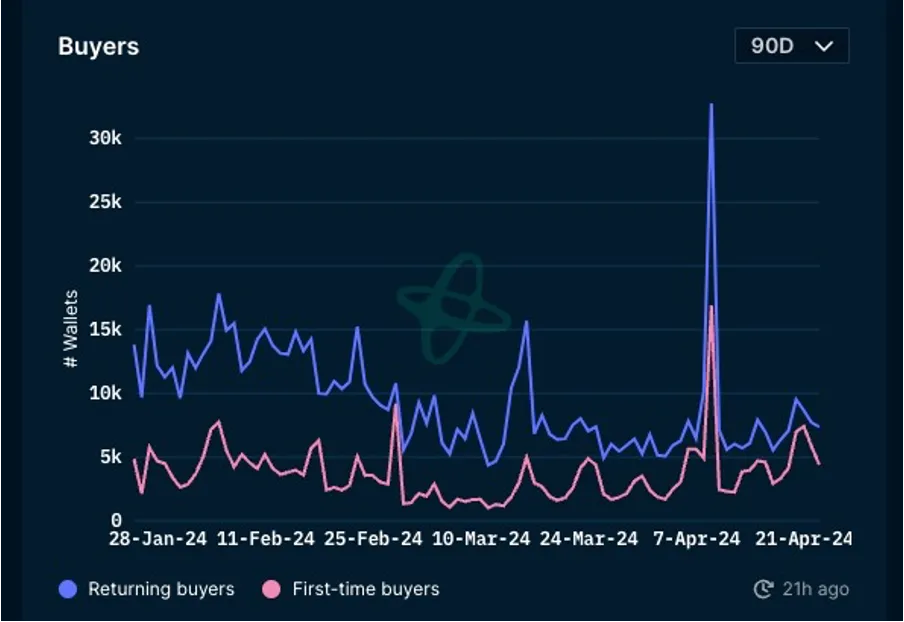

4) NFT Buyer Analysis

This week, the floor prices of blue-chip projects in the NFT market mainly rose, and the market stabilized and rebounded slightly. This week, BAYC rose 13%, MAYC rose 3%, Pandora rose 14%, Space Doodles rose 26%, Azuki rose 8%, LilPudgys rose 8%, CryptoPunks fell 8%, and Defrogs fell 8%. The transaction volume of the NFT market is still declining overall, and the number of first-time and repeat buyers has increased slightly. There have been no hot projects in the NFT market recently, and the market's depressed sentiment is still continuing.

V. Latest project financing situation

6. Post-investment dynamics

1) Puffverse — Web3 Gaming Platform

Puffverse has completed a $3 million financing round, led by Animoca Brands, with participation from Arcane Group, Spartan Group, Foresight Ventures, HashKey Capital, Sky Mavis and Xu Family Office. Puffverse will migrate to Ronin to release its first casual party game centered on the Puff IP, PuffGo, where users can participate in multiplayer competitions, create their own levels using the UGC editor, and interact and socialize in the big world.

The platform plans to issue platform tokens this year, which can be used in multiple games in Puffverse in the future. The platform will also realize cloud gaming and upgrade to a cloud gaming platform next year. At the same time, it will invite other NFT project parties to join through cloud rendering technology, and convert 2D NFT into 3D NFT. Users will be able to operate NFT characters to socialize and compete in the cloud Metaverse scenes or game scenes built by the project party.

2) Ola — Modular ZKVM

Ola's mobile verification module Massive has been launched on the Solana mobile Saga app market. Saga users can download the Massive app and complete the registration immediately. At the same time, Ola launched a limited-time event: before 0:00 on May 1, Beijing time, all existing users who successfully invite Saga users will receive an additional 50 OVP points airdrop reward.

Officials said that Massive, as a decentralized ZK verification network with practical significance, currently has more than 180,000 registered users and is still growing. The launch of Massive on the Solana Web3 mobile application market is aimed at effectively expanding the user base of Web3 mobile phones and becoming a key force in promoting the transition of Web2 users to Web3.

3) Xterio — Gaming Platform

Xterio and BNBCHAIN announced their collaboration, an important strategic partnership that enables us to bring rich AI and Web3 immersive gaming experiences to millions of users and further drive BNB adoption around the world.

Developers can tap into its 6 million user base, gain access to technology solutions, and help their players enter a complete gaming ecosystem.