Runes are coming soon, and I think we need to think seriously about how to make money. There is a particularly important point that needs to be reminded. Don't use the idea of new runes as the idea of new inscriptions. This is not a logical idea at all. If you still play according to the old idea, you will definitely be disappointed and miss out.

This article may be too hardcore. As a lawyer, I would like to sort out the overall logic in detail. It is very long, so please click with caution.

1. Bitcoin Ecosystem

I strongly agree with @0xcryptowizard 's statement. If you are in the cryptocurrency circle, there is no reason not to ALL IN the Bitcoin ecosystem now. The reasons are as follows:

1. The halving of Bitcoin will cause a sharp drop in the mining income of miners. They need to make Bitcoin transactions more frequent and use the increase in handling fee income to make up for the reduction in mining income. Therefore, the group that is most motivated to make the Bitcoin ecosystem prosperous is the biggest beneficiary of this blockchain.

2. The passage of Bitcoin ETFs allows real-world funds to flow in through legal channels. There must be a very reasonable narrative to give these funds the logic of holding Bitcoin. You can't tell everyone that it can be traded on the black market, nor can you tell everyone that it is the so-called digital gold, or that it is a very good speculative product? The prosperity of the Bitcoin ecosystem is the best reason to accept huge amounts of funds.

3. The cryptocurrency world needs new stories. Yesterday, an article went viral, titled: A bull market where no one takes over. The narratives played by institutions are not played by retail investors, the BRC20 played by retail investors is not accepted by institutions, the East plays inscriptions and the West plays DEPIN. The author attributed it to the stock game, and everyone is a veteran and elite. I don’t think so, because there has not been a new story that makes retail investors and institutions FOMO together, which @0xcryptowizard said very well. Good assets and narratives must be FOMO by everyone, including everyone, whether they are institutions or leeks.

Whether it is the Graphcoin protocol, GAMEFI, or Layer2, it is the same thing over and over again. For example, GameFi, everyone has always thought that this round of GameFi will rise because the games have become more fun and 3A institutions have invested. But why has it not risen? Because it is not a new narrative. The wealth effect of GameFi in the last round is essentially that it hit the second of the three new things I mentioned.

The so-called three new things refer to: new assets, new distribution models, and new liquidity provision methods. The targets of the huge wealth effect in the currency circle must be related to these three. GameFi is actually a new distribution model, the so-called Play to earn, which innovatively allows everyone to experience the method of playing games to get first-level chips. After the game becomes fun, is there any improvement in the three new things? No? The difference is just playing fun games and unfun games. In comparison, the project party is well-made, pays attention to word of mouth, and prevents Ponzi schemes. For example, Bigtime adjusts the explosion rate at every turn. In this state, how can it create a myth of ten thousand times? So you see that this round of studios playing Bigtime is like opening a factory, with one or two hundred people paying wages and playing games 24 hours a day. Do you call this a currency circle?

So, why complementary takeover? There are no new assets, new distribution models, or new liquidity provision methods. Such a huge narrative condenses everyone's FOMO consensus. The currency circle is not short of money or fools, but a huge mercury.

After looking around, the narrative of Bitcoin ecology is still the most exciting. First of all, runes and inscriptions are both new types of assets. @0xcryptowizard has explained in detail why Bitcoin ecology is suitable for new assets, so I won’t repeat it. Then, based on the “isomorphic binding” method, a collateral-type liquidity method can be realized, which has never appeared in the currency circle. If this is successful, it will activate the liquidity of trillions of assets in Bitcoin.

Many people don’t realize how powerful “isomorphic binding” is, and I will elaborate on this in this article. In fact, some experts on ETH have discussed this before, and many protocols to amend ERC721 were proposed in 2022, but they only solved the problem of NFT. On the one hand, the overall market value of NFT is still too low, and it won’t make much money even if it is solved. On the other hand, NFT has been falling, so this track has not taken off. However, if this problem can be solved in the Bitcoin ecosystem, it would be awesome, with enough money and enough imagination. Moreover, compared with the ledger logic of ETH, the UTXO of Bitcoin can better realize the separation of rights and interests of currency assets.

In summary, the huge amount of money in this bull market is actually the most interesting in the Bitcoin ecosystem. Get on board in time. Every sector in the currency circle is competing for everyone's attention: AI, games, expansion, real assets on the chain, and even every chain is competing for assets. Someone will tell you that there are many local dogs in the BASE chain, so hurry up; someone will tell you that GameFi 3A institutions will definitely be fierce with their masterpieces; someone will tell you that parallel EVM is very powerful and is a good expansion solution. Each one is actually good, and the tentacles of blockchain technology extend in all directions. However, as an old leeks, I need to remind everyone that you come to the currency circle to make money, not to witness the development of blockchain technology. The huge amount of money in the currency circle is always in new assets, new distribution models, and new liquidity provision methods. There is a saying that the currency circle is a history of currency issuance. It is difficult for ordinary people to make money in a certain field. You might as well jump to the biggest outlet in the currency circle like a pig.

2. Isomorphic Binding

Miners need frequent Bitcoin transactions to make money, and frequent Bitcoin transactions require frequent use. So the question is, what are you doing in the Bitcoin ecosystem? GameFi? DeFi? Inscription? If you think that you are moving ETH to Bitcoin and building a second layer, then your level is about the same as some brainless leaders. Seeing others attracting investment and making a lot of money, you also build an industrial park and then attract investment. The result is that coastal institutions come to get land and preferential policies, do nothing, make money and run away.

So, the big cake needs to adapt to local conditions, my dears. The big cake needs to think, what is special about my place, as long as it is activated, it will prosper. It is meaningless to be just a second layer. If you waste your time to participate in those brainless Bitcoin L2, it is equivalent to you and those stupid leaders building an industrial park together, hahahahahaha.

Next, it’s a bit confusing, and I need to help you sort out the current situation.

The most valuable thing about Bitcoin is that it is valuable, my dears. However, because it is valuable, it has lost liquidity. The creation of Bitcoin was originally to combat the problem of arbitrary issuance of credit currency, and it is a human exploration of currency. However, as Bitcoin becomes more and more valuable, people cannot use it as currency. 100 yuan can buy a chicken today and a house tomorrow. Will you spend it today? No. You will only hoard it as an asset.

Therefore, Bitcoin has become an asset rather than a currency. This sentence is very important.

If a high-quality asset can only lie quietly in your wallet, what’s the point of it? Isn’t it a waste of resources? For example, if you have 3 houses, would you just leave them there? Wouldn’t you want to mortgage millions to buy Bitcoin or do business? Wouldn’t you want to rent them out and collect rent?

Understandably, people are naturally motivated to make assets more profitable and maximize their returns. High-quality assets are not just bought and waited for appreciation, they have to do something else. To make assets more profitable, we need two things:

1. Separation of Equity and Interests

2. Contract protection

Here, I need to give you some knowledge of property law. When I say that I have rights to a property, I actually mean that I have the right to possess, use, dispose of, and benefit from the property. However, if I transfer the right to use, for example, I rent my car to Zhang San, although I do not have the right to use it, I can get rent. Or, if I freeze the right to dispose of it, for example, I mortgage my house to the bank, I can no longer sell the house, but I can continue to use and enjoy the appreciation of the property and get a sum of money.

That is to say, if we own an object and we freely transfer or freeze these four rights, we can obtain more benefits.

Let's think further. There are two ways to borrow money with collateral. One is to transfer the property to the lender, and the other is not to transfer the property to the lender. Which one would you prefer? For example, I want to use my Maserati as collateral to borrow 300,000 yuan. One lender said the interest rate is 10% but the car must be placed with him, and the other lender said the interest rate is 12% but the car does not need to be placed with him. Most people will definitely choose the second one. On the one hand, they can still use it, and on the other hand, it is safe. What if the car breaks down or he sells it?

So, now you can understand an important concept. An important way to revitalize assets is to use assets as collateral to borrow money. People prefer the collateral method that does not transfer objects. Otherwise, we dare not use too many assets as collateral because there are risks.

So, why is it that so far, out of the 2000B market value of blockchain assets, only 86B are on the chain? Merlin Chain is so powerful, but there are only a few billion US dollars on it. You should know that the total market value of Bitcoin is 1212B, 1212 billion US dollars, less than one ten-thousandth of the assets. It is because we dare not transfer large funds to Merlin Chain to earn profits because it is not safe. People are naturally not brave enough to transfer assets to make money.

Let me put it another way, if one day, we can use Bitcoin to borrow money or participate in some money-making activities without transferring Bitcoin, does it mean that we can mobilize trillions of assets?

I don’t know if you can really feel the impact of this number. If that’s the case, it will be hard for the Bitcoin ecosystem not to prosper, brother.

So, do you know where the biggest source of bitcoin ecosystem prosperity comes from? In the new liquidity model, a liquidity model that does not require the transfer of assets to guarantee the loan of money, it will make the bitcoin ecosystem transaction volume take off, and miners will naturally have a lot of handling fees.

So, here comes the question. From the borrower's perspective, it is of course the best to borrow money without transferring the property. BUT, from the lender's perspective, it must be a loan with the property transferred, right? Otherwise, if you don't pay back the money, who can I turn to?

By the way, you finally found the core problem. What kind of solution can achieve the goal of not transferring the property and make both the borrower and the lender feel at ease?

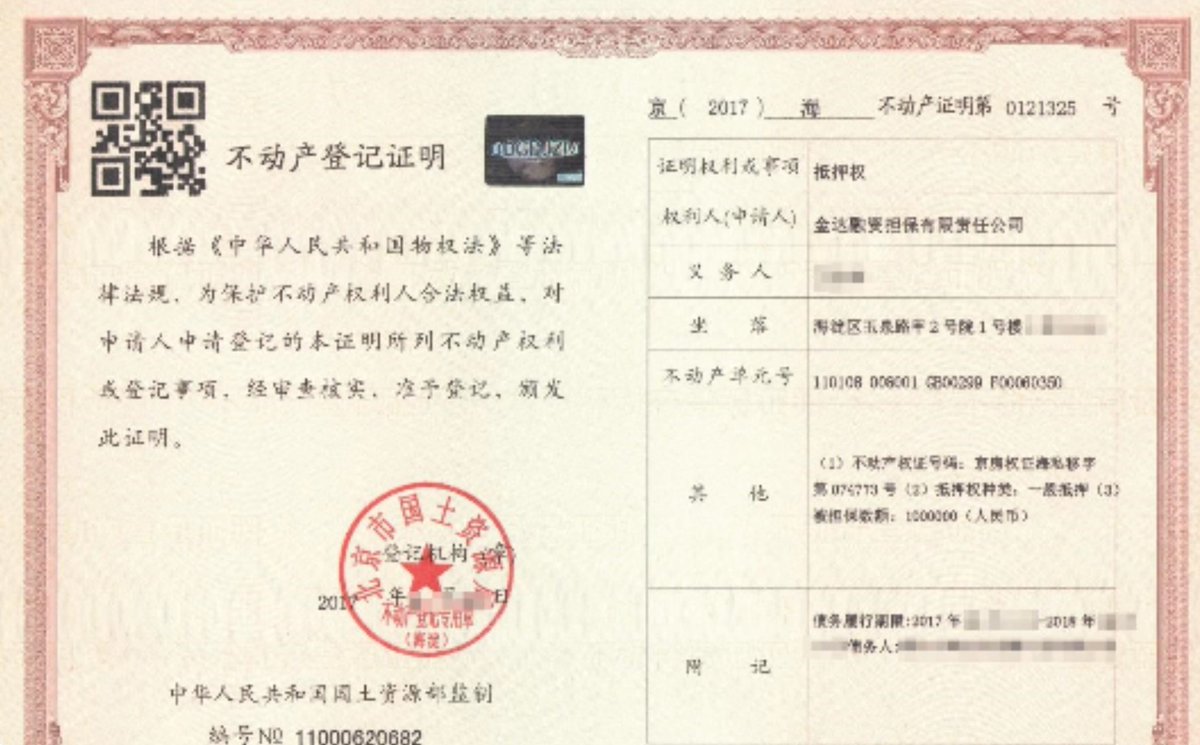

Back to the real world, you can understand that if you use your house as collateral to borrow money from a bank, the bank can only lend you 70% of the value of your house. Why is the bank not afraid that you will not pay it back? Because if you do not pay it back, the bank can auction your house. Why does the bank believe that it can definitely sell your house? Because when you borrow money, you have to register at the Real Estate Registration Center, which is called mortgage registration.