Why have LSTs on Solana seen slow growth to date?

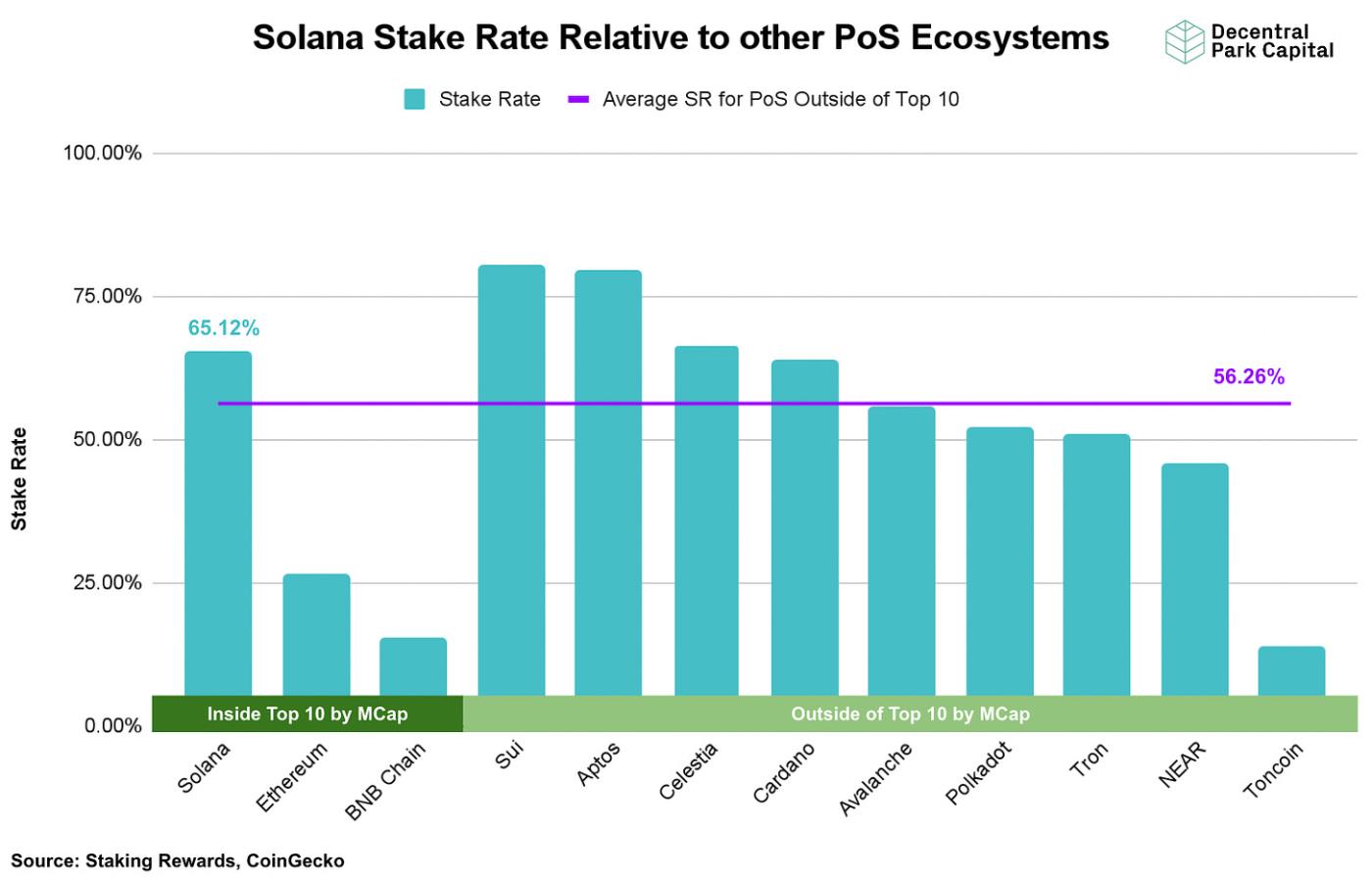

Solana boasts one of the highest staking reward rates amongst large Market Capitalisation (MCap) ecosystems at 7.31%. Unsurprisingly, this high reward rate has translated into a relatively high portion of SOL being staked. Solana’s stake rate, defined as the percentage of circulating tokens that have been staked, sits at 65.01%.

As you can see below, Solana’s stake rate is the highest of PoS native tokens within the top 10 digital assets by MCap and is above average for PoS native tokens with an MCap above $1.5b.

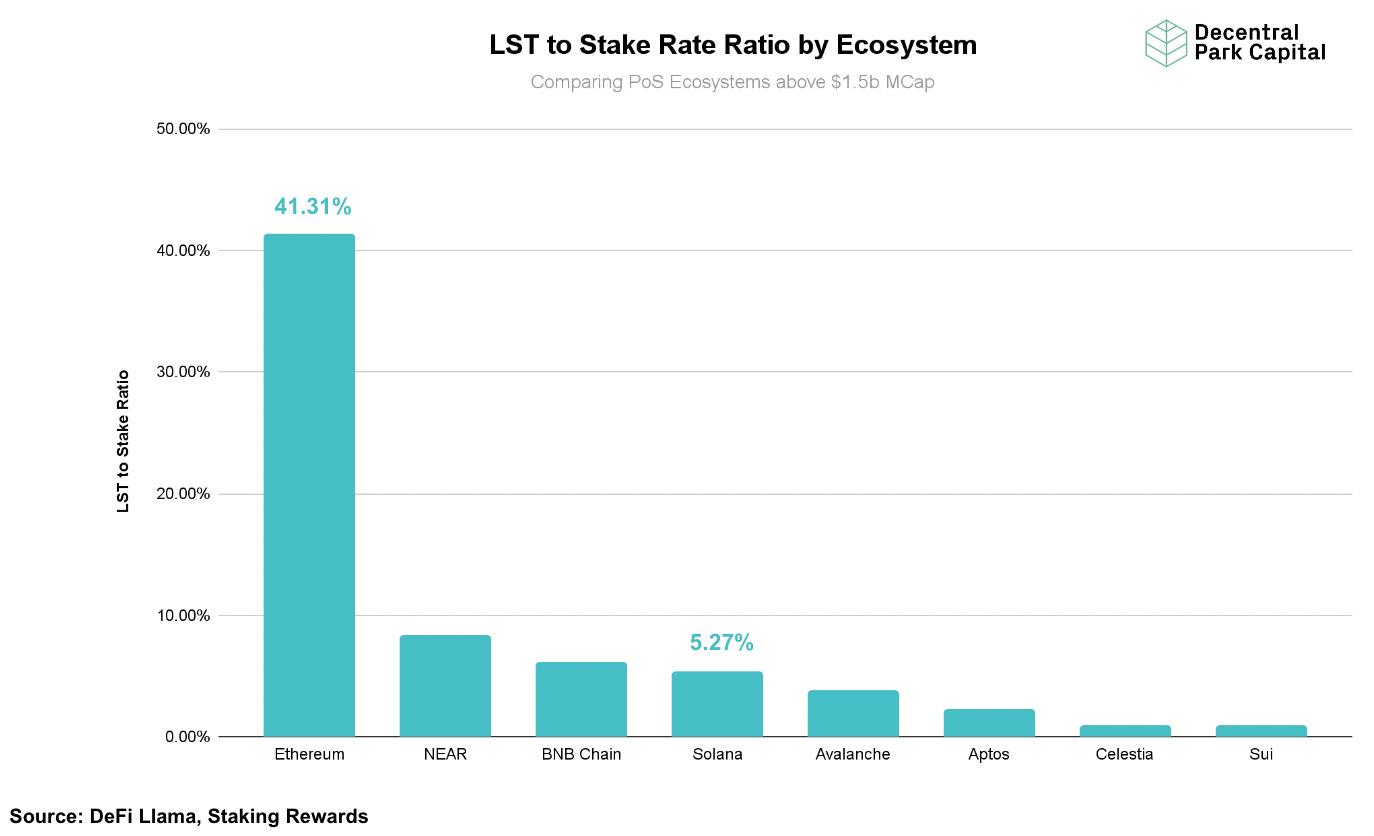

Despite the evident demand to stake SOL, and the ecosystem having strong Liquid Staking Token (LST) offerings in Jito and Marinade, Solana’s LST to Stake Rate ratio is relatively low, sitting at just 5.27%.

Comparing across PoS ecosystems with native token MCaps greater than $1.5b, a pattern emerges that the more developed the DeFi ecosystem, for which Ethereum is far and away the winner, the higher the LST to Stake Rate ratio appears to be.

This is intuitive, because the more developed a DeFi ecosystem is, the greater the opportunity cost of static native tokens locked in staking accounts becomes. Users are incentivised to convert this stake to a liquid stake to utilise their capital within the many use cases developed within the DeFi ecosystem, be that generating additional yield or using this capital as collateral.

The Solana DeFi ecosystem is growing rapidly, in terms of fundamentals such as capital (6M increase in TVL: 1,053%) and users (6M increase in DAUs: 493%), but also in terms of use cases. However, we have not observed a growth in the LST to Stake Rate Ratio expected from the recent DeFi growth.

The reasons for this boil down to the inherent design dissimilarities of Solana relative to other ecosystems such as Ethereum. Firstly, the time taken to unstake ETH averages at ~10 days, while on Solana it averages ~2 days. While investors are averse to lock-ups to ensure the ability to react rapidly to investment conditions, a ~2-day delay to access capital is seemingly more acceptable than a ~10-day delay.

Moreover, liquidity has historically been more fragmented in the Solana LST ecosystem, with the largest LST provider, jitoSOL, only commanding 49.3% market share. In contrast, stETH, the largest LST provider in the Ethereum ecosystem, commands a 71.3% market share.

To increase the Solana LST to Stake Rate ratio, we need to see liquidity unification across LST offerings and a way to incentivise holders of SOL to stake in a liquid manner beyond simply the fact that it is liquid.

Sanctum is the answer to both this liquidity unification and incentivisation, in what I believe will be the ‘cure’ for the Solana LST to Stake Rate ratio.

What is Sanctum?

Sanctum is a Solana-based protocol designed to act as a unified liquidity layer to address the fragmentation and inefficiencies associated with an ecosystem having multiple LSTs.

The Sanctum protocol consists of three core products that facilitate this goal: (i) The Sanctum Reserve, (ii) The Sanctum Router and (iii) Infinity.

To understand Sanctum in its entirety, it’s important to have a high-level understanding of how staking works on Solana:

When staking SOL, users deposit their SOL into a staked account, which can be thought of as a locked wallet of SOL used specifically for delegating SOL to validators on the network.

The same type of stake accounts are used whether staking natively, i.e. direct to validators, or via an LST provider.

An LST is effectively just a wrapper around a staked account, which defines fees, validator delegation etc. LSTs on Solana are therefore semi-fungible.

SOL can be withdrawn from staked accounts at any point, and will become available at the end of the epoch the withdrawal occurred in. Epochs on Solana last ~2 days, so this is the maximum withdrawal time, although it could be shorter.

The Sanctum Reserve

The Reserve is essentially a liquidity pool of SOL, that allows LST holders to instantly swap their LST for SOL. The Reserve then automatically withdraws the SOL from the LST-wrapped staked account and returns it to the SOL liquidity pool to replenish the reserves.

Users pay an additional premium for the luxury of bypassing the withdrawal period. At current ~210k SOL is sitting in the pool.

Given LSTs are merely wrappers around staked accounts, and the staked accounts themselves are all identical in architecture, the Reserve is available to all LSTs, regardless of liquidity.

The benefits of this are two-fold, firstly the LST itself has deep liquidity from launch, meaning DeFi protocols can safely integrate them without the need for the LST to run a liquidity incentive scheme. Secondly, it provides a safety net for users, enabling them to quickly revert their LSTs to SOL, which could be crucial during market volatility or for facilitating personal liquidity needs.

The Sanctum Router

Much like the Sanctum Reserve, the Sanctum Router is a liquidity mechanism for LSTs. Unlike the Reserve, however, the Router opens up liquidity from LST to LST, as opposed to LST to SOL.

The Sanctum Router is a product that unwraps and rewraps staked accounts in LST wrappers, which allows for the instant swapping of one Solana LST to another.

The result is that all LST liquidity is now unlocked and shared among all. The Router completely removes the dependency on the liquidity of individual LSTs, minimising slippage and enhancing user control over their staking preferences.

The combination of the Router and the Reserve means that LSTs have deep, instant liquidity into other LSTs and SOL by first order, and any SPL asset by second order, given liquidity is primarily denominated in SOL, just one additional cheap swap away.

Infinity

The icing on the cake for Sanctum is their Infinity product, a large-scale liquidity pool that encompasses various LSTs and facilitates swaps among them.

Unlike the Router, these swaps occur as one simple transaction, as opposed to multiple unwrapping and rewrapping transactions, and thus are cheaper and quicker.

Infinity incentivises users to deposit SOL into the pool by rewarding them with yield from the underlying staked assets, in addition to trading fees generated by the pool.

At the time of writing, Sanctum boasts ~1.1m SOL in its Infinity product, making it the deepest LST liquidity pool across Solana DeFi. It should therefore come as no surprise that Sanctum facilitates ~80% of LST swaps on Jupiter.

Check Out Sanctum's Wonderland Now

Sanctum as the Cure for the Solana LST to Stake Rate ratio.

Sanctum significantly lowers the barriers to creating and trading LSTs by providing a robust infrastructure that supports even the smallest players in launching their LSTs.

By removing concern around liquidity, this open and accessible system fosters a healthy, competitive environment that incentivises innovation atop LST wrappers.

Combining this with the benefits of the Solana network, i.e. an incredibly cheap, fast infrastructure, opens up a Cambrian explosion of potential use cases atop Solana LSTs.

Here are a few examples of existing and potential innovative LST wrappers on Solana:

Validator-Specific LSTs: A Validator LST is an LST that represents your stake with a validator in the form of a token. Examples include picoSOL and jupSOL. Existing validator LSTs can reach the highest yields in the space, 10.73% and 15.31% respectively between picoSOL and jupSOL at the time of writing, by having 0% commission, 100% kickback on MEV returns and distributing a portion of block rewards.

Unruggable NFTs: Pathfinders released pathSOL, an ‘unruggable’ NFT mint, whereby users receive an LST which holds the SOL they used to mint the NFT. Rather than the project using the proceeds of the NFT mint to develop the project, they use the staking rewards, which go entirely to the project. The NFT is unruggable because the user's SOL remains in their control within the LST, and can be redeemed in exchange for the NFT at any time.

Charitable LSTs: A charitable LST could use the proceeds of staking rewards to donate to a particular cause. It is possible in the future this becomes another avenue to donate while maintaining exposure to SOL price action. This could be charity-specific, i.e. staking rewards go to one charity, or cause-specific, i.e. holders of the LST vote on how to use the funds to address a specific cause.

Collateral LSTs: Perp exchanges require collateral to open positions, and then charge funding rates to maintain positions. A potential use case here is to mint an LST as SOL-based collateral, and have the staking rewards contribute to the funding rate, thus diminishing the funding rate by ~8% per year.

So now we have both pieces to the Solana LST puzzle, liquidity unification via Sanctum’s arsenal of products, which enables small LST protocols to launch with specific use cases that can foster LST demand.

The growth potential for Solana LSTs is fairly remarkable from here. The target should be reaching Ethereum’s LST to Stake Rate ratio of 41.31%, which is certainly achievable given the expanding DeFi ecosystem on Solana, liquidity unification afforded by Sanctum and use case generation.

Assuming this Stake Rate ratio level is reached, it will equate to a 7.84x from current LST TVL, equivalent to a $20b growth in Solana LSTs.

While Sanctum fees on each of their specific products are not yet publicly available, their strategic positioning will enable them to capitalise materially on the associated growth in LST volumes.

I believe based on the above that Sanctum will become as important to the Solana ecosystem as a Lido is to the Ethereum ecosystem. Given LST protocols have generally pulled in large MCaps, with Lido sitting at $1.9b, and Jito at $405m, it would not be unexpected to see Sanctum do the same.

Luckily for active participants in the Solana staking ecosystem, Sanctum recently won its Jupiter LFG round, to gain a spot launching on the Jupiter Launchpad, and confirmed their airdrop farming scheme, for which I was a part of its closed beta testing. This means a token is on the horizon.

For active DeFi participants looking to earn a yield on their SOL, while potentially exposing themselves to token allocation for what I believe will be one of the most exciting protocols of this cycle, ‘Wonderland’, Sanctum’s airdrop farming program is a must-understand.

Check Out Sanctum's Wonderland Now

Wat is a Wonderland?

Wonderland can be thought of as Sanctum’s gamified points system, in which points will likely equate to the allocation of the Sanctum token upon TGE. No details of the Sanctum TGE have yet been shared, so it’s unclear what percentage of the protocol will be distributed to users.

In Wonderland, there are 17 Pets, each representing a different Sanctum whitelisted LST. For example, the INF pet is Infinite, and the jupSOL pet is Jupitie.

If you own 0.1 SOL worth of an LST, you gain the respective Pet in Wonderland. For every 1 SOL of an LST you hold, your respective pet earns 10 EXP points per minute.

Pets have levels, which are essentially EXP targets. As you earn EXP to level up your Pets, they evolve for a total of three iterations, which beta testers of Wonderland are speculating will equate to favourable allocations upon Sanctum TGE.

Beyond the simple EXP system, Wonderland is laying on weekly quests that if completed will equate to multipliers on EXP accrual for predefined periods. This is a strategy we saw in the Kamino airdrop, where they were able to utilise points multiples to direct capital to pools that required deeper liquidity, thus improving the protocol.

I would imagine that Sanctum will utilise these quest multipliers to expand Sanctum LST depth across the DeFi ecosystem, requesting users deploy to protocols such as Kamino, MarginFi etc.

If you would like to take part in Wonderland and earn a yield on your SOL while simultaneously furthering the Sanctum protocol and potentially exposing yourself to a future Sanctum airdrop, follow the link below: