After a six-year hiatus, payment giant Stripe has decided to return to the cryptocurrency payment field, first supporting USDC stablecoins based on Solana, Ethereum, and Polygon. This change marks the first time Stripe has re-accepted cryptocurrencies since it stopped supporting crypto payments in 2018 due to excessive Bitcoin price volatility.

In 2022, Stripe tried to return to the crypto market by supporting USDC for spending. Although it did not directly accept payments at the time, major customers had already started using this service. This updated decision shows Stripe's continued commitment to exploring and adapting to the ever-changing digital payment environment. Let's explore Stripe's past and present below.

First look at Stripe: A global payment giant that provides users with the ultimate transfer experience

As a global fintech giant, Stripe is more than just a payment service provider. It has rebuilt the financial infrastructure of the Internet. Through a series of modular solutions, Stripe powers business activities from small startups to multinational groups, both online and offline. Through its fully integrated payment and financial product suite, Stripe has globalized payment processes and powered the development and innovation of various business models.

Stripe's payment services not only improve authorization rates and checkout conversion rates, but also meet the specific needs of local markets through a variety of local payment channels. Its service portfolio includes automated tax processing tools, fraud prevention systems, and offline payment terminal solutions customized for merchants. In terms of billing, Stripe optimizes the management of recurring revenue, reduces customer churn and improves the efficiency of financial operations through its invoicing system and revenue certification tools.

Stripe Connect integrates payment functions into the customer's platform, bringing an end-to-end payment experience to the trading market, including instant payment withdrawals and personalized payment interface services. Stripe's banking-as-a-service products, such as the issuance and management of business cards, do not require additional setup fees and provide flexible financing options.

Globally, Stripe makes the convenience of money transfer comparable to the circulation of data. Its vast network covers the world and processes hundreds of billions of dollars in transactions each year. Stripe's developer-friendly features are reflected in its powerful API, which simplifies gateways and payment tracks in the global economy, enabling development teams to efficiently build all the business functions they need on a single platform.

A look back at Stripe’s six years in the crypto world

Six years later, Stripe once again stepped into the world of cryptocurrency, this time taking the first step by accepting the USDC stablecoin. However, this is not the first time Stripe has entered the field of cryptocurrency. Looking back at history, we can see the connection and difference between Stripe's early attempts at cryptocurrency and its current development.

In 2014, Stripe first entered the cryptocurrency field and began testing Bitcoin. At that time, a partner pointed out: "Because of the nature of Bitcoin, Stripe's support is crucial: it does not have all the characteristics expected of ordinary currencies." This ushered in Stripe's recognition and exploration of the potential of cryptocurrency.

However, in 2018, Stripe removed support for all cryptocurrencies, calling them "highly unusual and unstable." The company stated in a statement: "In two years, Bitcoin has evolved into an asset rather than a means of exchange as blockchain scales." This decision shows Stripe's distrust of Bitcoin and reflects its views on the future development of cryptocurrencies.

However, in 2022, Stripe has once again attracted attention. It not only cooperated with Ethereum extension solution Polygon to try to accept cryptocurrency payments on Twitter, but initially only supported USDC on Polygon. This is another attempt at cryptocurrency payments and part of Stripe's continued development to adapt to the changing payment market.

In 2022, Stripe further consolidated its position in the cryptocurrency field. It announced support for fiat currency payments for cryptocurrencies and NFTs, and partnered with FTX, FTX US, Blockchain.com, Nifty Gateway, and Just Mining to launch a crypto business suite. This not only provides companies with a new interface for accepting fiat currency payments for cryptocurrencies, but also provides full support for digital wallets, KYC solutions, and fraudulent transaction detection.

Time flies, and now it is 2024. Stripe is once again leading the trend in the cryptocurrency circle. It began to accept USDC stablecoin payments, providing users with a more convenient, fast and stable payment option. This move has promoted Stripe's major decision on cryptocurrency payments and also reflects its confidence and expectations for the future of cryptocurrency.

Stripe's cryptocurrency journey is full of twists and turns, but also full of challenges and opportunities. From the initial attempt at Bitcoin to the current acceptance of USDC, Stripe continues to explore and innovate, committed to providing users with a better payment experience. As the cryptocurrency market continues to develop, we can expect Stripe to bring more surprises and possibilities to the cryptocurrency payment field in the future.

Web3 financial business will enter a steady state, and Stripe's future trend is worth paying attention to

After a series of challenges, it is time to use Stripe's survival. Once praised as a Silicon Valley unicorn, it has experienced explosive growth and growth during the epidemic, but it has also encountered some difficulties in adversity and management comparison. However, it is not easy to judge Stripe's future direction, because the company still has many advantages and potential, but also faces unprecedented challenges.

First, Stripe has a strong position and influence in the global payment field, and its product updates and innovation capabilities keep it at the forefront of the industry. For example, by launching new payment method options and payment method rules engines, Stripe provides users with more flexible payment solutions and further expands its market. In addition, Stripe Connect's embedded payment and financial services provide users with more customized options and tools, further enhancing its competitive advantage.

However, Stripe also faced some challenges last year. Excessive expansion and management errors led to a deterioration in financial conditions and increased employee turnover, which called the company's valuation into question. In addition, in the face of a cold response from the capital market, Stripe postponed its plan to go public, further increasing uncertainty about its future.

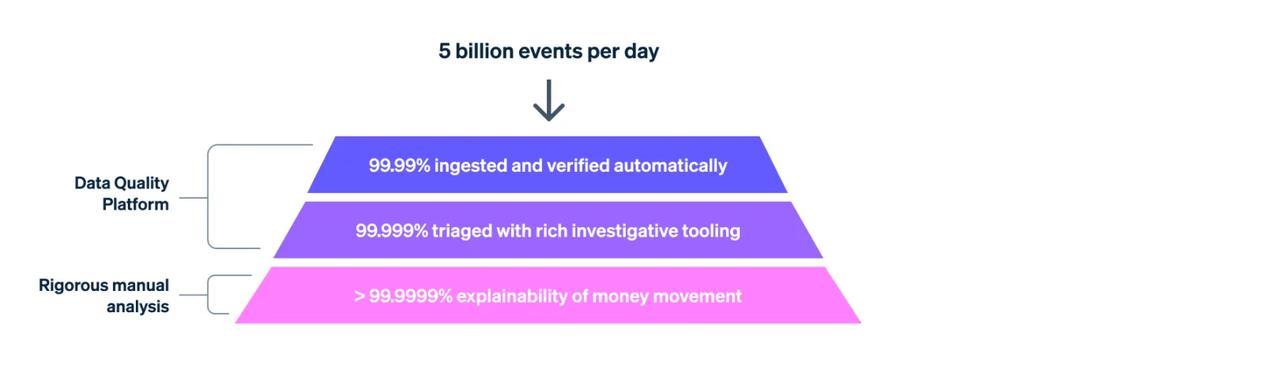

Stripe shared a series of important product updates at its 2024 annual conference, covering areas such as global payments, embedded finance and payment finance, and embedded finance and payment revenue and automation, but whether it can survive the disaster as expected remains an unknown.