Table of contents

ToggleRates fall ahead of decision

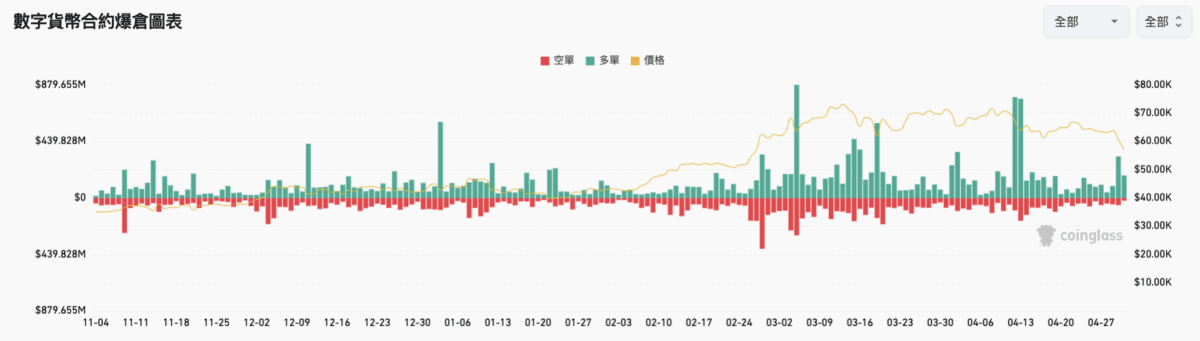

Before the U.S. Federal Reserve announced its latest interest rate decision, the cryptocurrency market experienced a broad decline. At the time of writing, Bitcoin once fell below $57,000, Ethereum fell to the level of $2,800, and Altcoin also fell sharply. The entire network exploded in the past 24 hours. The warehouse exceeds 500 million magnesium.

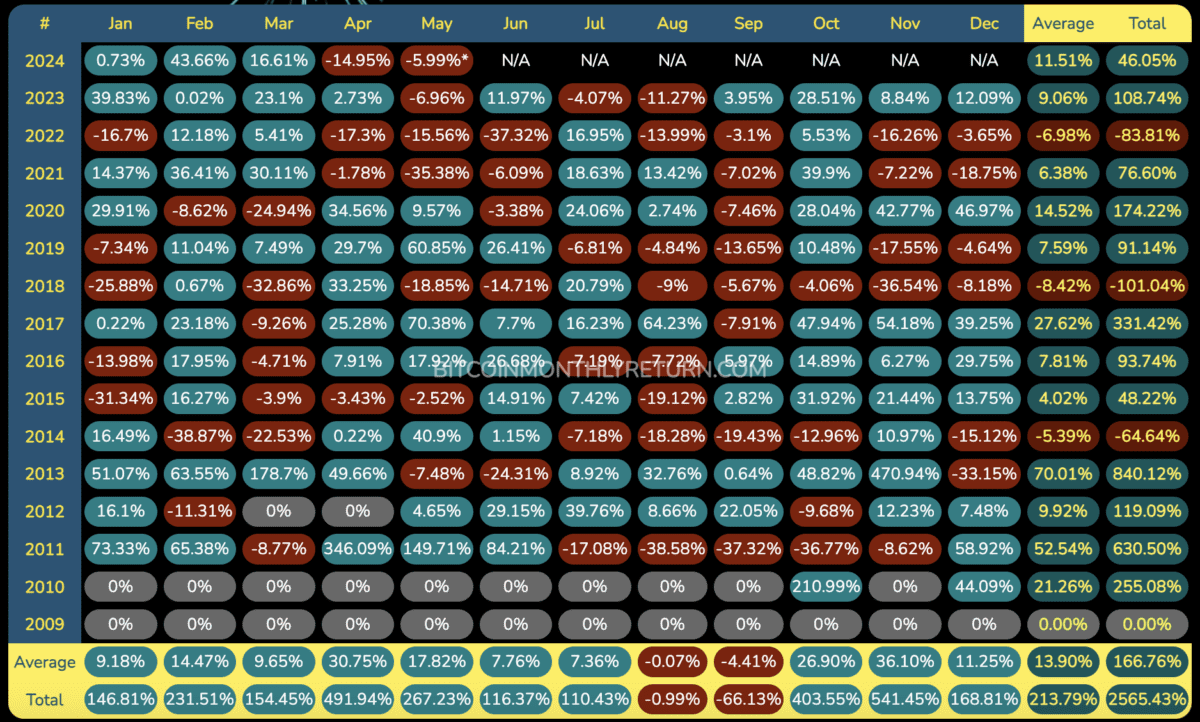

Bitcoin closed down 15% in April, posting its first monthly decline since August and its worst drop since the collapse of cryptocurrency exchange FTX in November 2022.

Cryptocurrencies have also been affected by risk aversion in financial markets as signs of slowing economic growth and sticky inflation have weakened hopes of a rate cut by the Federal Reserve, creating a sense of stagflation in the United States.

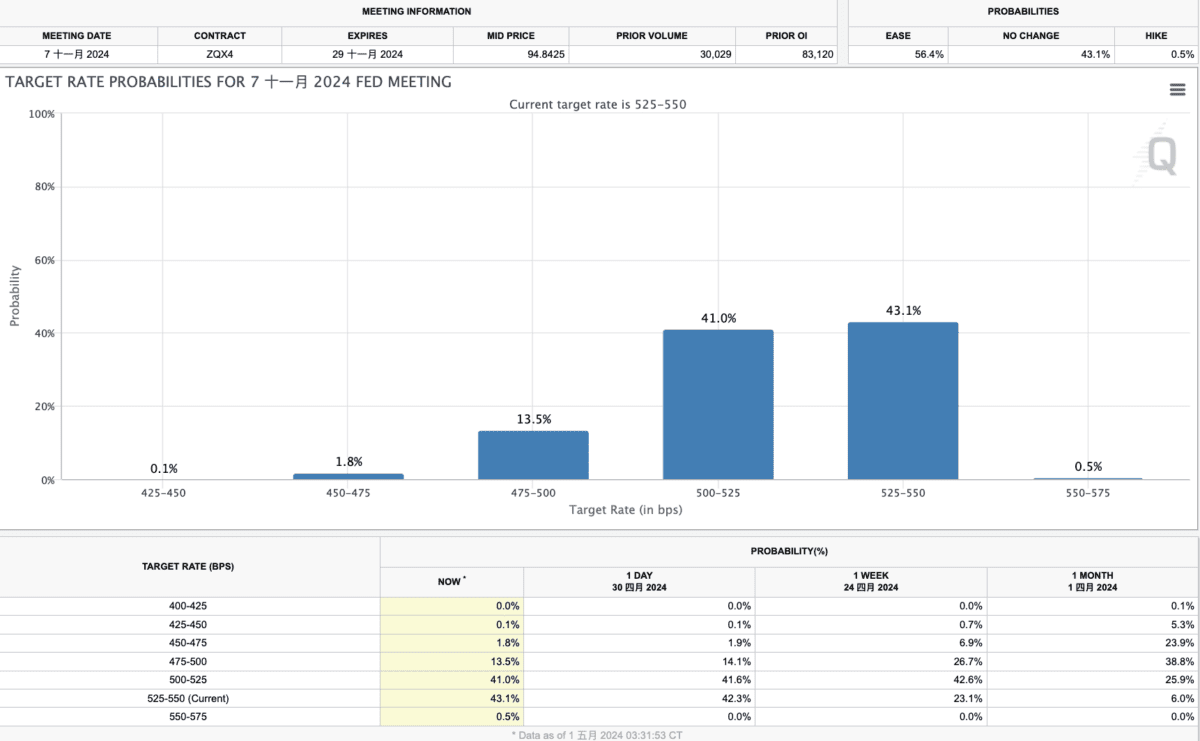

Interest rate cut expectations divided

According to CNN reports , Wall Street banking giants currently have large differences in their forecasts for interest rate cuts. JPMorgan Chase and Goldman Sachs expect the first interest rate cut to be in July, while Wells Fargo is betting on September, and Bank of America does not expect the first rate cut until December. Cut interest rates. According to FedWatch data, market expectations for the first interest rate cut mainly fall in November and December, with a probability of about 41%.