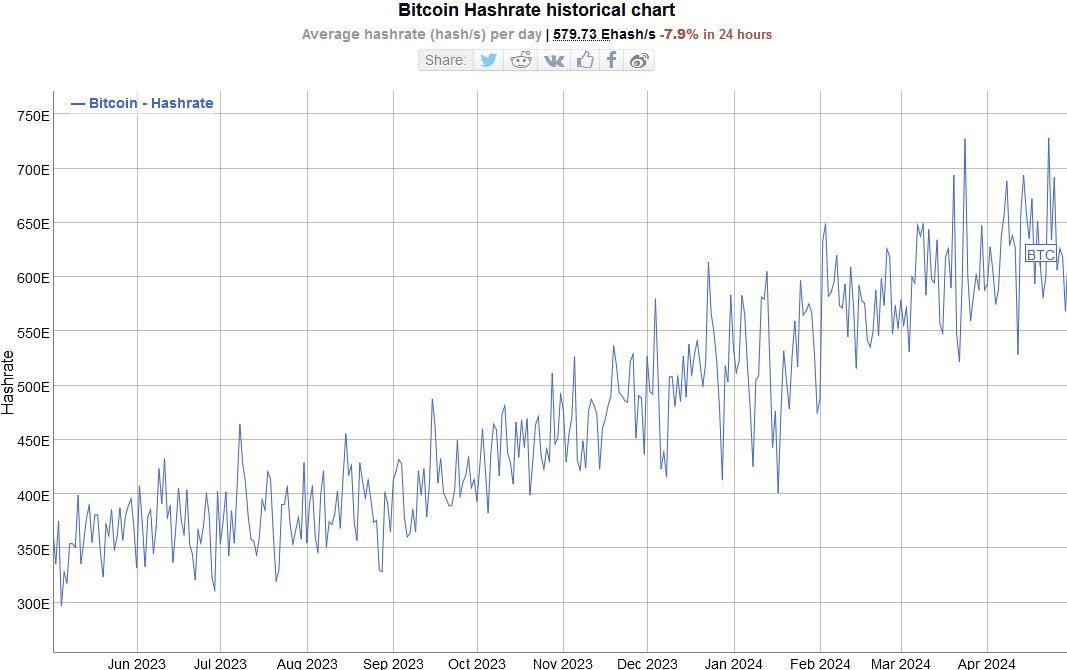

From the miner's perspective, this is not too bad, still reluctant to survive, but this reluctance means that miners continue to sell most of the Bitcoin they mine to cover costs, even though the during the rainy season in the Northern Hemisphere. - Mining output has decreased by half, but every day miners still download about 450 BTC, most Mining Rig are still the old technology of last season, they will have to sell about 50% of the BTC they mine to pay. electricity, excluding machinery depreciation and reinvestment costs. (They will sell a minimum of 1/2 of 54k BTC in the next 120 days if Bitcoin price maintains at current levels). - If Bitcoin drops another $10k, miners will likely have to sell 70% of daily mining output. If Bitcoin drops another $20k, they may have to sell up to 90% of daily mining output and some mining pools will of course be affected. bankrupt forced to sell the Bitcoin they had accumulated before halving. From a conspiracy theory perspective, if big boys want to buy Bitcoin from miners, they will have to maintain low prices throughout this rainy season. The sign of a stretched market is that the Bitcoin diff continues to increase continuously throughout the rainy season. Bitcoin price decline. Then the weak mining pool will be purged at the beginning of the dry season before Bitcoin increases strongly. 👉Miners belong to the diamond hand group, but they have costs, compared to previous seasons, after the halving is the part where miners are forced to sell if the price drops sharply. -> That is the basis for you to buy cheap, not cut losses like miners.

This article is machine translated

Show original

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content