Written by: Elixir

Compiled by: TechFlow

The purpose of this post is to provide data from the Elixir Network Trusted Mainnet launch, including key statistics such as users, TVL, percentage of order book liquidity based on live native integrations, and share of aggregate order book liquidity controlled by the Elixir Network.

The Elixir Network has become an influential force in the order book trading space. This post aims to provide a data-driven view of the Elixir Network’s growth across a number of metrics: user growth, total liquidity, order book integration efficiency, and its relative market share of order book liquidity provided across exchanges.

User growth

A fundamental indicator of the adoption and health of any network is its user base. Since the end of the first month of Elixir’s native integration into Vertex, Elixir has seen a 21% month-over-month increase in active users. Less than 2 months after launching Apothecary, there are now 101,553 unique potion holders as of this writing.

Total value provided by Elixir

Liquidity is the lifeblood of order book exchanges, and Elixir has shown significant growth since launching its trusted mainnet. Total liquidity deposited with Elixir is approximately $200 million. This large amount of capital (especially relative to existing decentralized order book exchange liquidity) supports the network's ability to bring large amounts of liquidity to order book DEXs, bringing them closer to the efficiency of centralized exchanges.

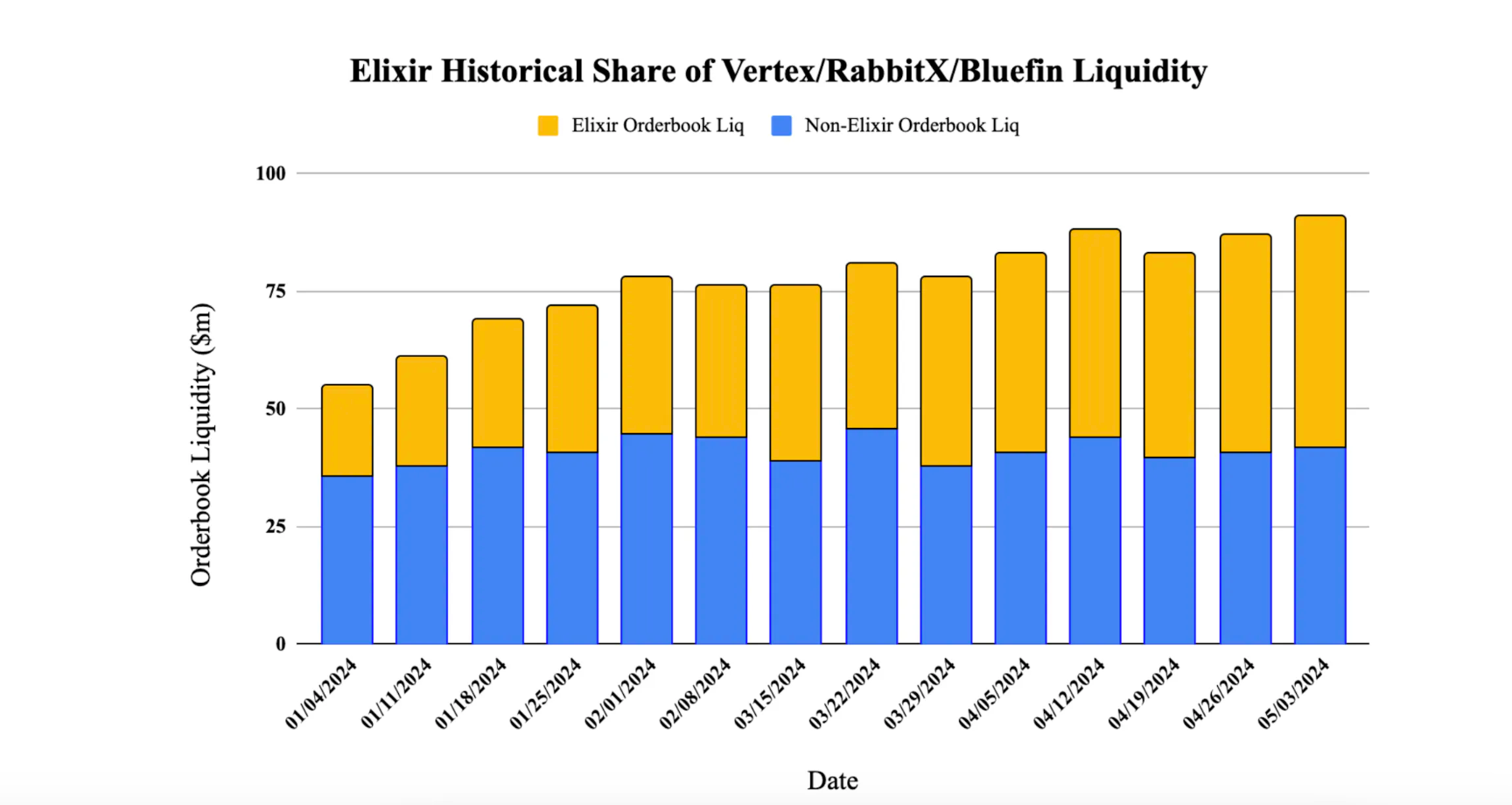

Percentage of liquidity provided by the order book

Elixir has multiplied order book liquidity for exchanges that natively integrated the network. Each exchange that has launched a native front-end feature powered by Elixir has more than doubled its liquidity. Elixir currently powers 66% of total order book liquidity on Bluefin, 56% on Vertex, and 52% on RabbitX. This metric highlights Elixir’s critical role in facilitating liquidity on the power exchanges.

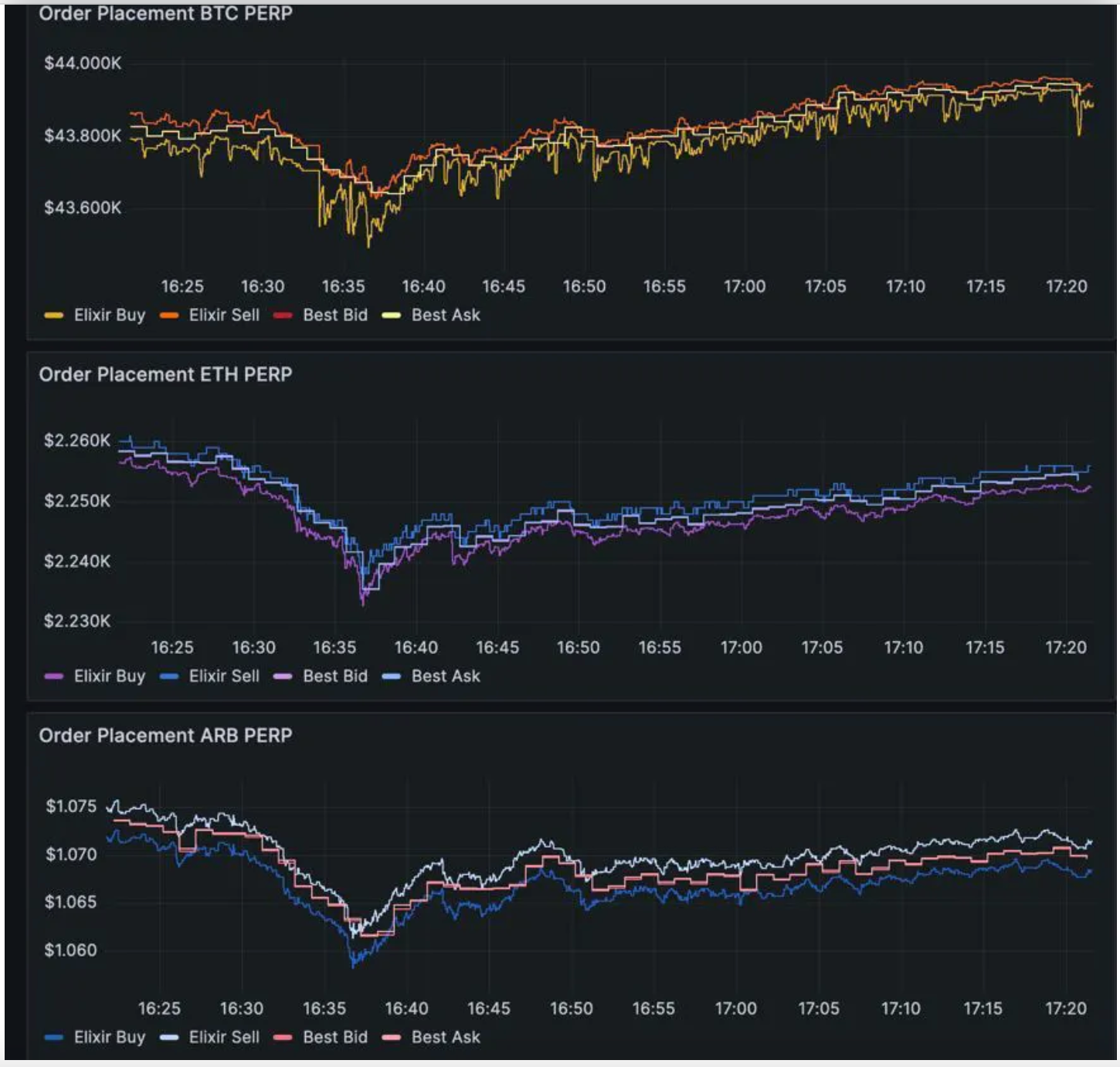

The following chart shows the capital efficiency of the Elixir Network for multiple token pairs quoted on Vertex:

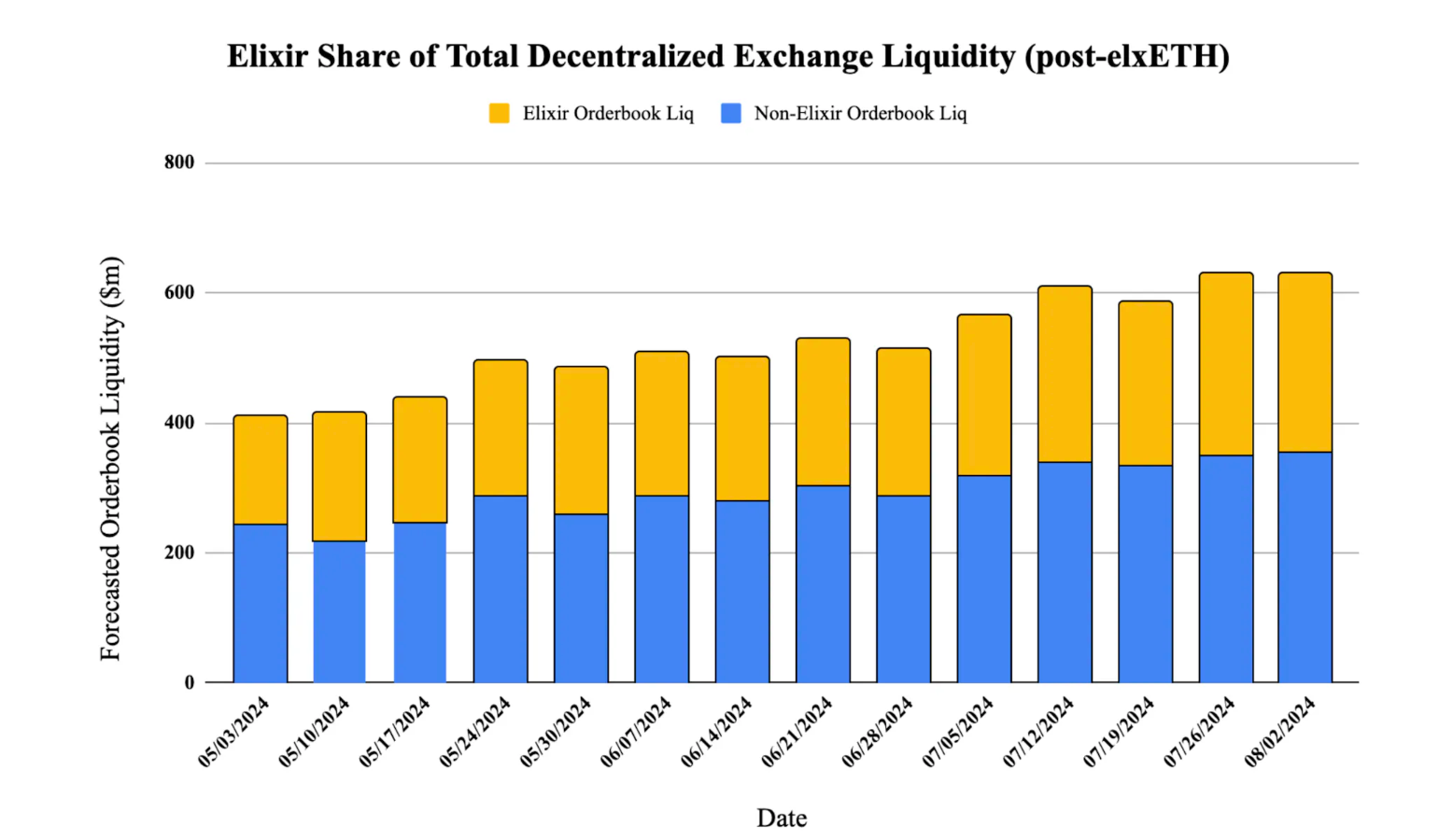

Share of order book liquidity across all DeFi exchanges

Elixir will account for ~40% of the total liquidity on all DeFi order book exchanges after factoring in elxETH liquidity. These elxETH deposits will be transferred across all native integrated exchanges at mainnet launch (currently not actively utilized). These exchanges include names like dYdX, Orderly, Hyperliquid, and more.

More information and updates will be provided in the future to provide greater transparency into the network’s development. Until then, we encourage users to track network statistics on the Network and Explore pages of our website.