In mid-April, Iran launched an attack on Israel, and the conflict between the two countries was imminent. Bitcoin, known as "digital gold", plummeted 15% in two days, once plummeting to nearly $60,000.

When the war broke out, BTC prices not only did not rise as they did before and after the Ukrainian-Russian war, but the entire cryptocurrency market collapsed as a result of the international conflict. Does this mean that Bitcoin does not have the characteristics of a safe-haven asset?

In the three international conflicts, the single variable that affects the price trend of BTC is not just "whether it can be hedged". The popularity of local cryptocurrencies, whether the country is subject to economic sanctions, and whether local residents have initiated cryptocurrency fundraising may all affect the price trend from the perspective of market sentiment or actual use cases.

This article reviews the price trend of Bitcoin after three regional conflicts in the past two years, compares the variables that affect the trend of cryptocurrencies in the three conflicts, and analyzes whether Bitcoin has the characteristics of a safe-haven asset.

Article Outline

1. The Russo-Ukrainian War

2. Israel-Hamas conflict

Summarize

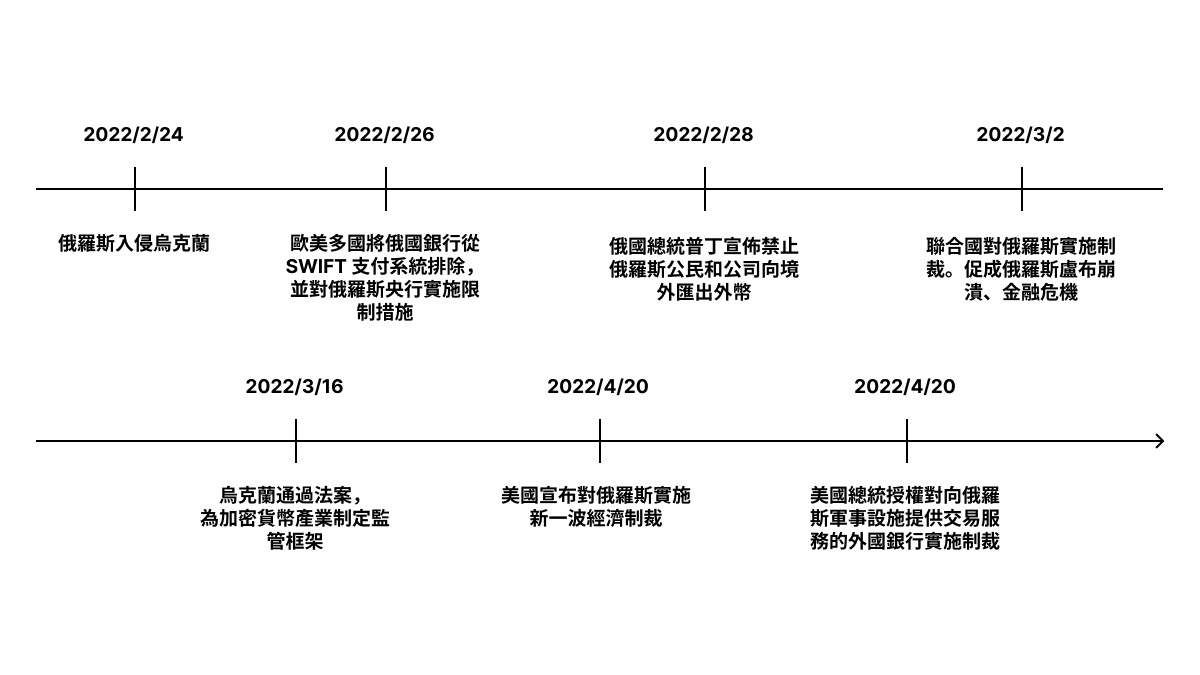

1. The Russo-Ukrainian War

Key points of the war

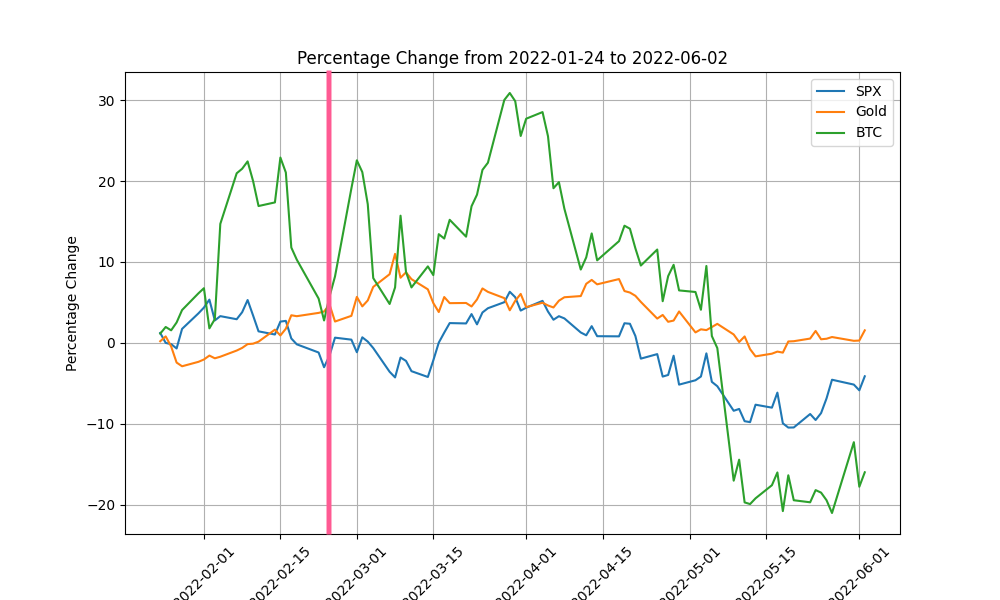

Bitcoin, Gold, S&P 500 Price Trends

- Bitcoin: It experienced large fluctuations on the day the war broke out. It started to rise and exceeded $40,000 four days later, but then continued to fall from April to July.

- Gold: It rose, reaching a high of $2,068 in March. It remained above $1,900 in the two months after the conflict broke out. But from April to July, it fluctuated and fell like BTC.

- S&P 500: A brief uptrend after the war began, but continued to fall from April to mid-June

(The red line in the figure below indicates the time when the conflict broke out)

In 2022, affected by the Fed's continuous hawkish stance and global liquidity tightening, Bitcoin ended the bull market that had continued to rise in the previous two years and entered a bear market with a volatile downward trend. Although Bitcoin and gold rose when the war broke out, they immediately returned to a downward trend two months later.

However, the S&P 500, which is a "risk asset", had a trend very similar to that of Bitcoin and gold at the time. Therefore, it is difficult to judge whether BTC is a safe-haven asset or a risk-off asset.

Local cryptocurrency penetration

Data source: Triple A

Cryptocurrency Fundraising

According to blockchain analysis company Elliptic, within two weeks of the start of the war, the Ukrainian government received more than 35,000 cryptocurrency donations and raised more than $35 million.

Although this move cannot have a direct impact on the price of BTC, it has certainly attracted the market's attention to cryptocurrencies. It has begun to explore the effectiveness of cryptocurrencies in wars and other extreme events.

Economic sanctions

The outbreak of war often causes a sharp drop in the country's fiat currency exchange rate. Fiat currency assets deposited in local banks may also be unable to be transferred abroad due to economic sanctions or martial law orders by local governments. In such an emergency, people will begin to transfer and exchange their fiat currencies to protect the safety of their assets.

Since its invasion of Ukraine, Russia has faced more than 16,500 sanctions imposed by the United States, Britain, the European Union, as well as Australia, Canada and Japan. The European Union said at the time that up to 70% of Russian banks' assets were frozen and nearly half of their foreign exchange reserves were frozen, worth $350 billion. Some of these banks were also excluded from the Swift international funds clearing system.

In Ukraine, due to the government's martial law, the central bank has imposed restrictions on foreign exchange transactions, and people are unable to buy dollars or euros for safe havens. The transfer of monetary funds is also restricted.

Chainalysis analyzed order book data from Binance and LocalBitcoins, two exchanges that accept local fiat currencies, from July 2021 to August 2022. In March, trading volume for the Ukrainian currency UAH increased by 121% from the previous month, while trading volume for the Russian currency RUB also increased by 35%.

At the same time, Chainalysis also counted the monthly amount of cryptocurrency transfers in Eastern European countries between July 2021 and June 2022.

From the start of the war until June 2022, the volume of cryptocurrency transfers in Ukraine continued to increase.

However, after a brief rise in March, Russia’s trading volume has remained in a relatively narrow range. This may be attributed to the fact that many cryptocurrency institutions and exchanges have begun to impose restrictions on users in the Russian region.

The reason behind the increase in trading volume and fund transfers may be that Russia is facing economic sanctions, and the Ukrainian Central Bank has restricted local foreign exchange transactions and fund transfers. In order to transfer assets abroad or for risk aversion, local residents and companies have begun to convert fiat currency into cryptocurrencies.

2. Israel-Hamas conflict

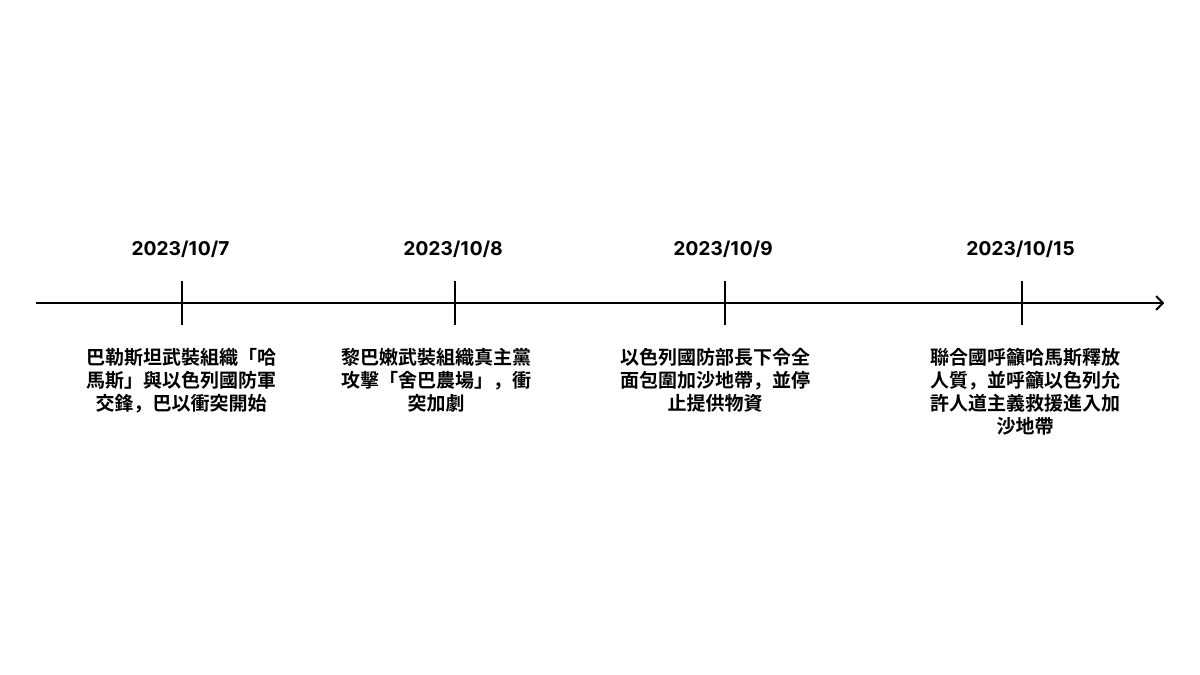

Key points of the war

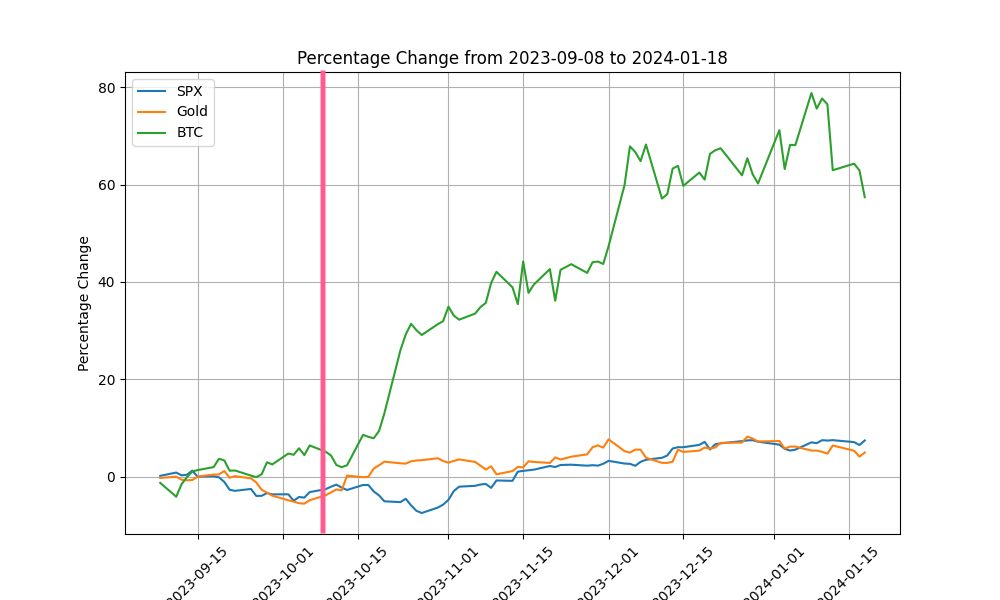

Bitcoin, Gold, S&P 500 Price Trends

- Bitcoin: Bitcoin fell briefly, but has been rising for seven consecutive months since mid-October

- Gold: It has continued to fluctuate and rise since the war, but the increase is far less strong than BTC

- S&P 500: It fell after the war started, but rebounded in late October and has been rising ever since

(The red line in the figure below indicates the time when the conflict broke out)

After the war started, Bitcoin and S&P 500 fell for a short time, and only gold rose. But after mid-October, the upward trend was close, with different increases.

In terms of Bitcoin prices, the optimism surrounding the expected approval of the Bitcoin ETF has continued to push up the price since mid-2023. Therefore, after a short-term decline, a seven-month-long upward trend began.

Local cryptocurrency penetration

Data source: Triple A, Gemini

Cryptocurrency Fundraising

After the outbreak of the war, both sides tried to raise funds through cryptocurrencies for military expenses, rescue, etc. Among them, the Israeli crypto community established Crypto Aid Israel, and the Palestinian side also raised funds through cryptocurrencies.

A report by cryptocurrency research firm BitOK shows that from August 2021 to June this year, wallets associated with Hamas received a total of approximately $41 million.

Economic sanctions

In the case of the Ukrainian-Russian war, cryptocurrencies may be used as a tool to circumvent economic sanctions. However, Israel continues to take measures to strangle Hamas's economic sources, including cryptocurrency flows.

According to the Times of Israel, the Israeli police cooperated with Binance to freeze nearly 200 Binance accounts related to Hamas. In addition, Tether quickly froze 32 addresses related to terrorism and war a week after the war began, holding a total of 873,118.34 USDT.

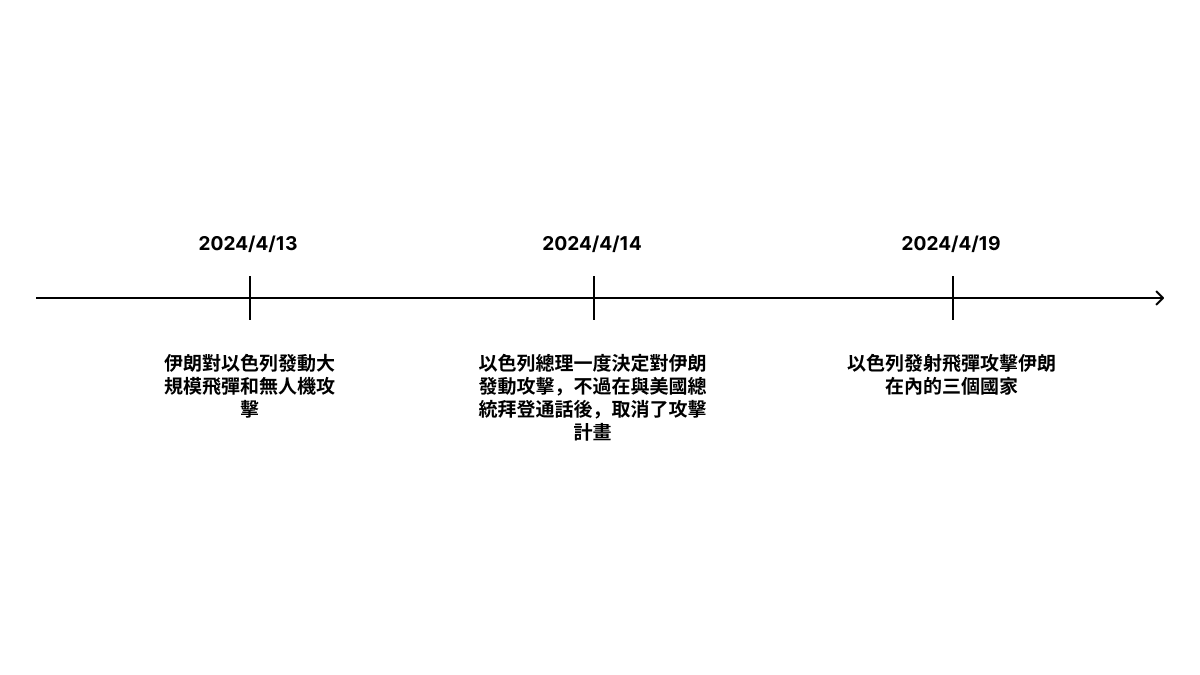

Israel-Iran War

Key points of the war

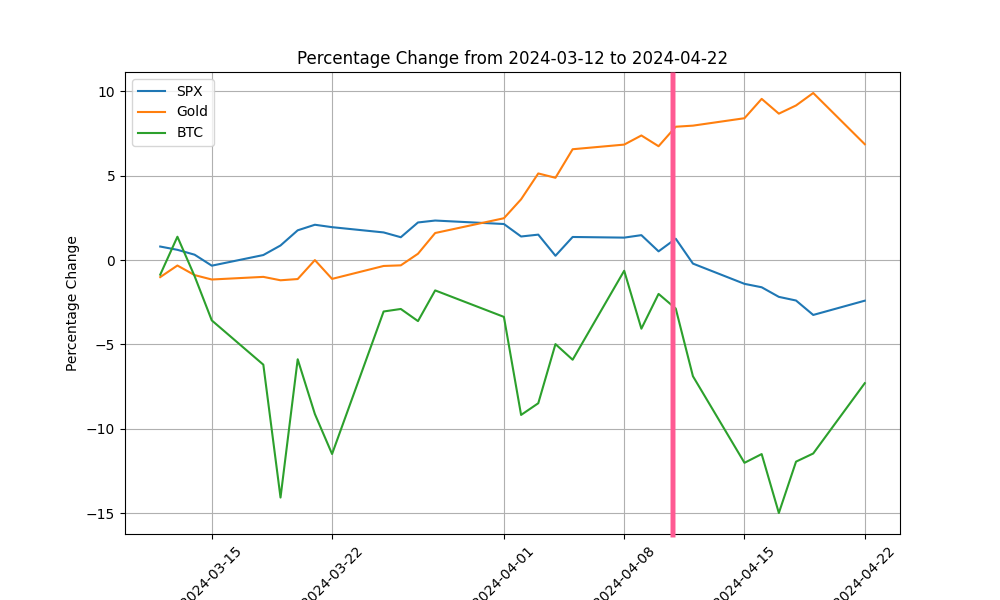

Bitcoin, Gold, S&P 500 Price Trends

- Bitcoin: Bitcoin plunged 15% in two days, approaching the $60,000 mark, and then recovered slightly

- Gold: Gold rose first and then fell, and currently rebounded to around $2,391

- S&P 500: Continued decline since April 15

(The red line in the figure below indicates the time when the conflict broke out)

Local cryptocurrency penetration

Data source: Triple A, Gemini

Iran is the sixth country with the highest cryptocurrency penetration rate, and the number of people holding cryptocurrency exceeds that of Russia, Ukraine, Israel, and Palestine in this comparison. However, in this Israel-Iran conflict, so far, no economic sanctions have been imposed by the United States or other European countries on Israel and Iran, and no cryptocurrency-related fundraising has been seen. Therefore, the attention paid to the wartime use case of cryptocurrency is relatively low.

Summarize

Bitcoin has a limited total supply, is resilient to fluctuations in traditional markets, and is considered by cryptocurrency investors to have the ability to store value, so there is a discussion that it can be used as a safe-haven asset.

However, in the recent three international conflicts, the price trend of Bitcoin is sometimes closer to that of risky assets: S&P 500, and the overall economic situation and the overall market conditions of the crypto have a great impact on the price fluctuations of Bitcoin. Therefore, it is still impossible to assert whether it has the characteristics of a safe haven.

Cathie Wood has used the example of the 2023 US banking crisis in the past to say that Bitcoin is not only a risky asset but also a safe-haven asset.

We witnessed this last year: Bitcoin rose 40% when a banking crisis broke out in the United States. Bitcoin has no counterparty risk and is both a risk asset and a safe haven asset.

It can be seen that if you want to reduce volatility when the overall market is turbulent, gold may be a better choice. Because gold has smaller long-term and short-term fluctuations and a higher value preservation rate. If you also want to have investment and value-added benefits, and can bear higher price fluctuations, then Bitcoin, which has the characteristics of both risk assets and safe-haven assets, may be a better choice.