Author: Tom Analysis, SoSoValue resident researcher

The Hong Kong Securities and Futures Commission has officially announced the list of approved virtual asset spot ETFs , including Bitcoin spot ETF and Ethereum spot ETF under China Asset Management (Hong Kong), Harvest Global, and Bosera International . These six spot ETF products will be available for subscription from April 25 to 26 and will be listed on the Hong Kong Stock Exchange on April 30.

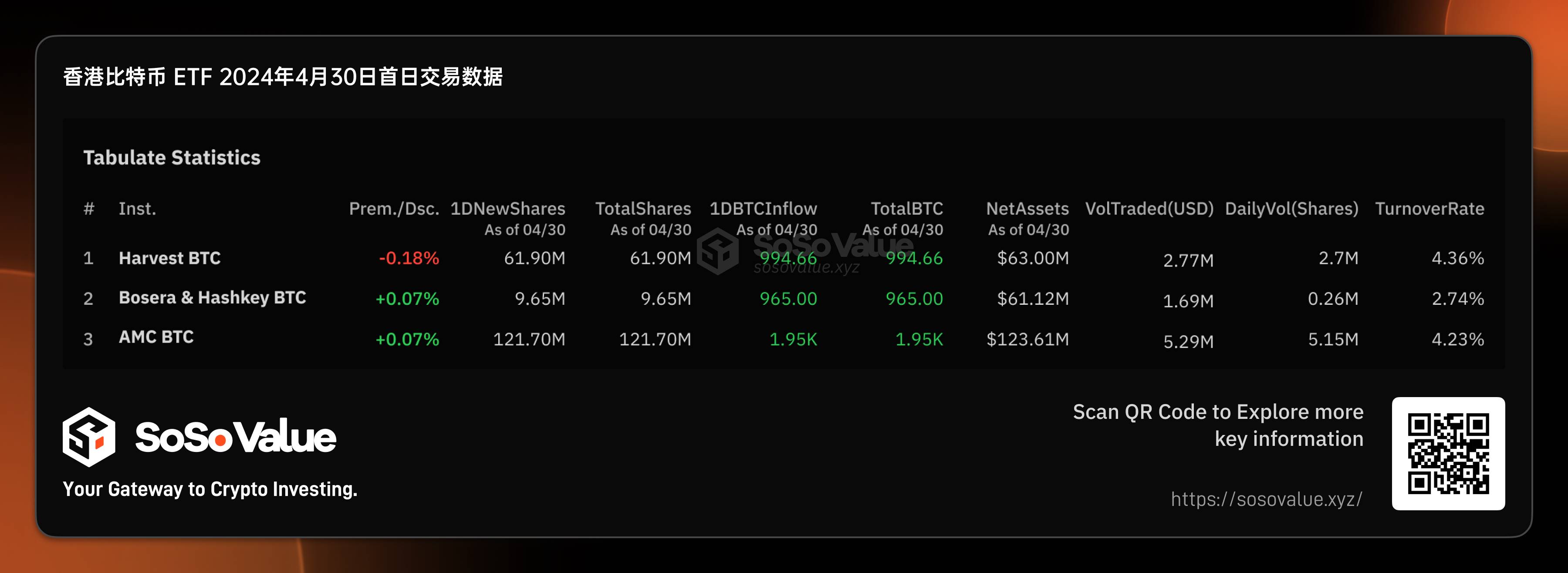

Through new subscriptions, the six Hong Kong spot ETFs achieved a good initial scale . According to SoSo Value data, the total net value of the three Bitcoin ETFs was US$248 million, and the total net value of the three Ethereum ETFs was US$45 million, with a total net value of nearly US$300 million. However, the total net value of the US Bitcoin spot ETF products, excluding Grayscale (GBTC), which was converted from a trust to an ETF, was only US$130 million on the first day.

However, in terms of first-day trading volume, Hong Kong crypto ETFs are far smaller than their US counterparts . According to SoSo Value data, the trading volume of the six Hong Kong crypto ETFs on the first day of listing on April 30 was only US$12.7 million, far lower than the US$4.66 billion trading volume of US ETFs on the first day of listing.

We have observed that there is a huge mismatch between the initial scale of Hong Kong's crypto ETF and its first-day trading volume. How big can the Hong Kong crypto spot ETF be, what impact can it have on the crypto market, and how should we seize related investment opportunities? The editor will analyze this through the supply and demand relationship of Hong Kong ETF.

Figure 1 : Hong Kong Crypto Spot ETF Data Overview (Data Source: SoSo Value)

Demand side: Mainland Chinese RMB investors are not allowed to buy, and the incremental funds may be limited, resulting in low transaction volume

The Hong Kong cryptocurrency ETF still has strict restrictions on investor qualifications, and mainland investors cannot participate in the transaction. Taking Futu Securities as an example, the account opening party must be a non-mainland & US resident before trading can be carried out. The mainland funds expected by the market to trade through the southbound Hong Kong Stock Connect are currently not allowed, and it is expected to be difficult to open up for a considerable period of time.

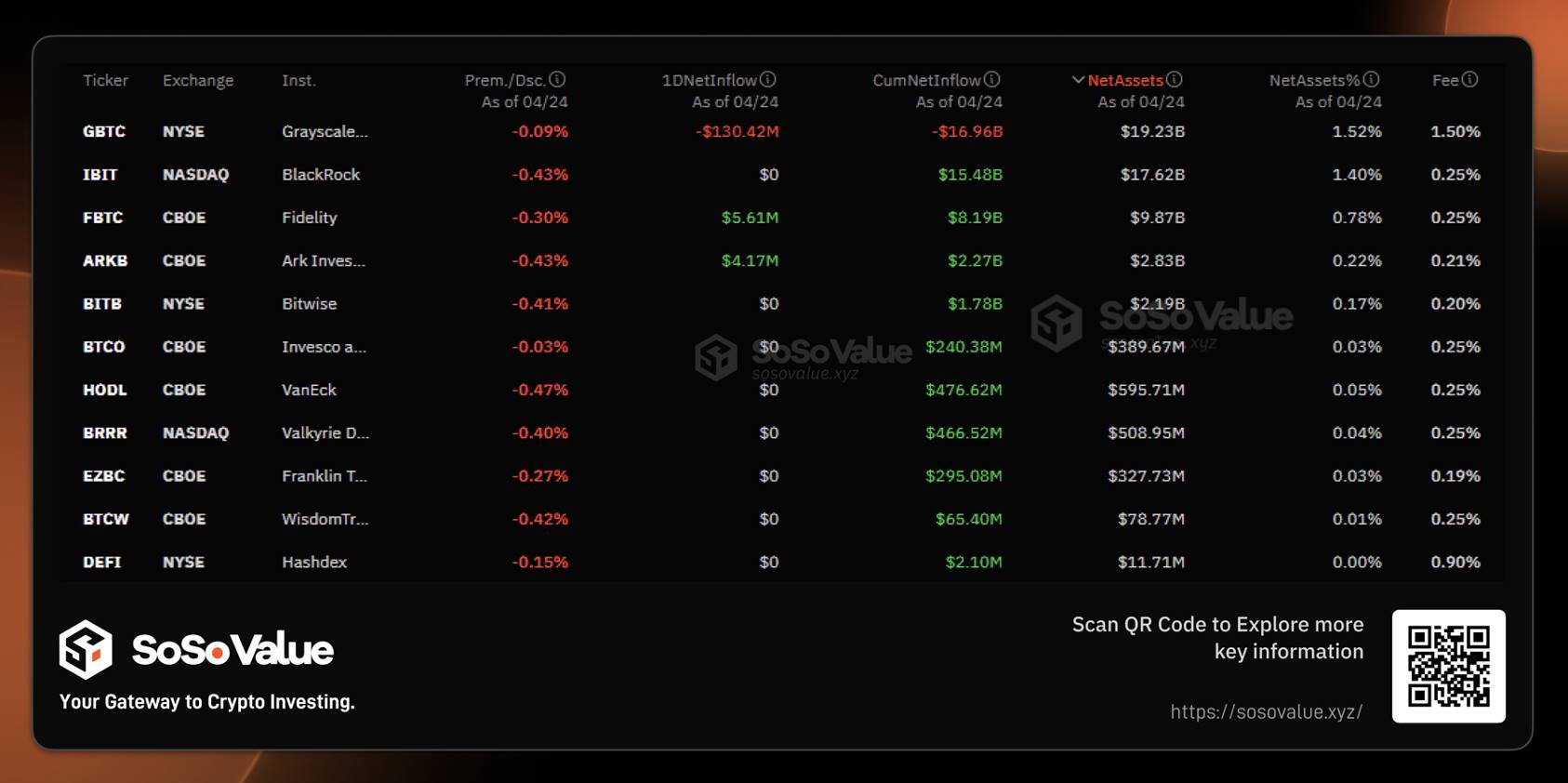

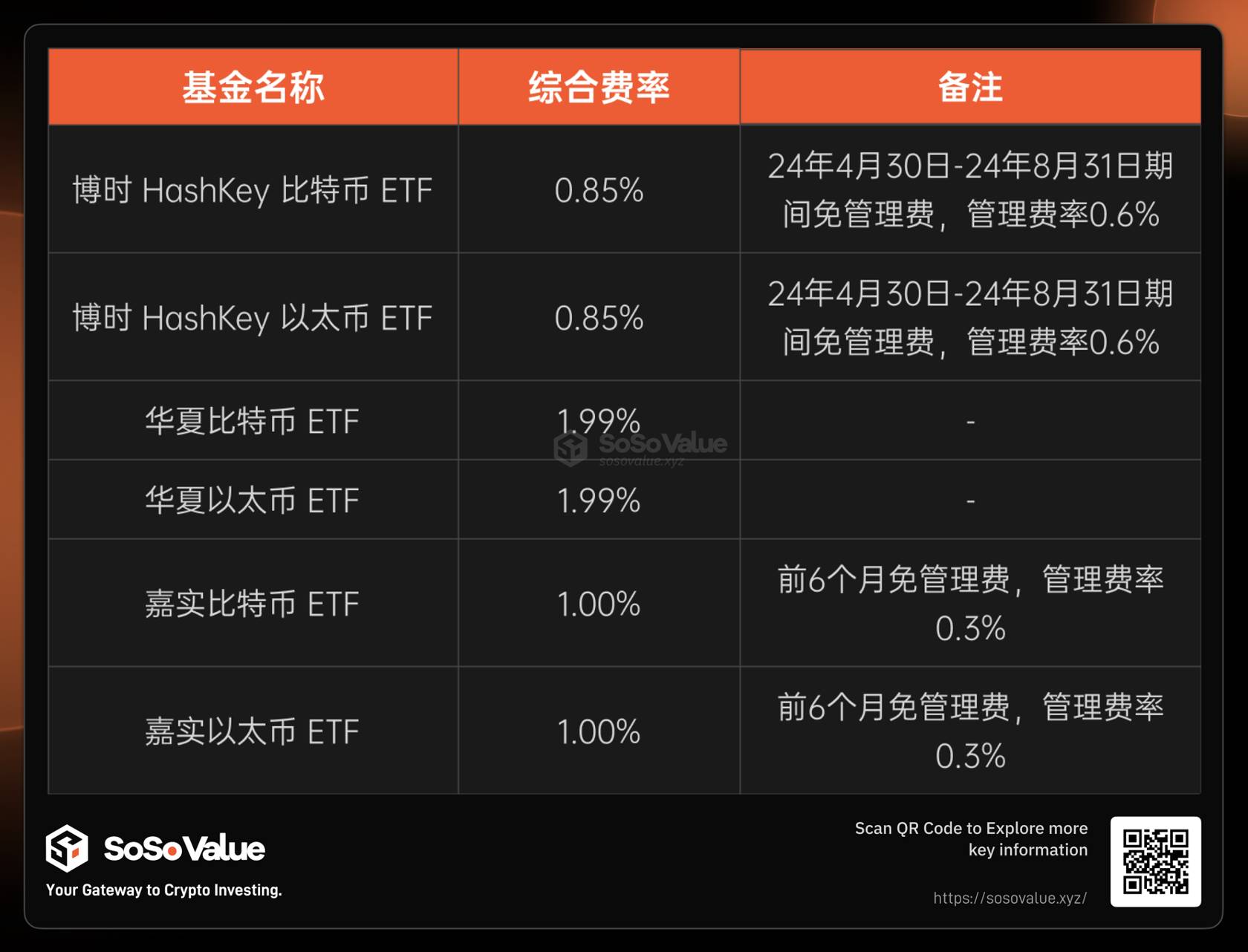

In terms of fees, Hong Kong crypto ETFs are not superior, and compared with US ETFs , they are not very attractive to institutions that want to hold for the long term. According to SoSo Value data, of the 11 US Bitcoin spot ETFs, except for Grayscale and Hashdex, the largest ones such as IBIT and CBOE have management fee rates of around 0.25%, while the comprehensive fee rates of Hong Kong's three Bitcoin ETFs are relatively high, with Huaxia 1.99%, Harvest 1.00%, and the lowest Bosera 0.85%. Even with a short-term reduction in management fees, there is still no fee advantage. With the difference in fees, for institutional investors who are optimistic about the crypto market and want to hold for the long term, the US Bitcoin ETF has a lower holding cost.

In the future, the demand side funds may mainly come from two sources: 1 ) Hong Kong retail investors. For retail investors with Hong Kong ID cards, the threshold for purchasing Hong Kong crypto ETFs is lower. For example, to purchase the US Bitcoin spot ETF , you need to have a professional investor qualification ( PI ) , and to apply for PI qualification, you need to provide proof of an investment portfolio of 8 million Hong Kong dollars or a total asset of 40 million Hong Kong dollars. This time, the Hong Kong Bitcoin spot ETF allows retail investors to trade, and the trading time is more in line with the Asian schedule, which is an important increase . 2 ) Traditional investors interested in Ethereum. The Hong Kong Ethereum spot ETF is the world's first launch, so investors who have substantial difficulties in holding coins and are optimistic about the prospects of Ethereum may bring incremental growth to the Ethereum ETF.

Figure 2 : US Bitcoin spot ETF fee situation (data source: SoSo Value)

Figure 3: Hong Kong crypto spot ETF fee situation (data source: SoSo Value)

Supply side: In-kind subscription and redemption methods increase the supply of ETF shares and increase the initial scale

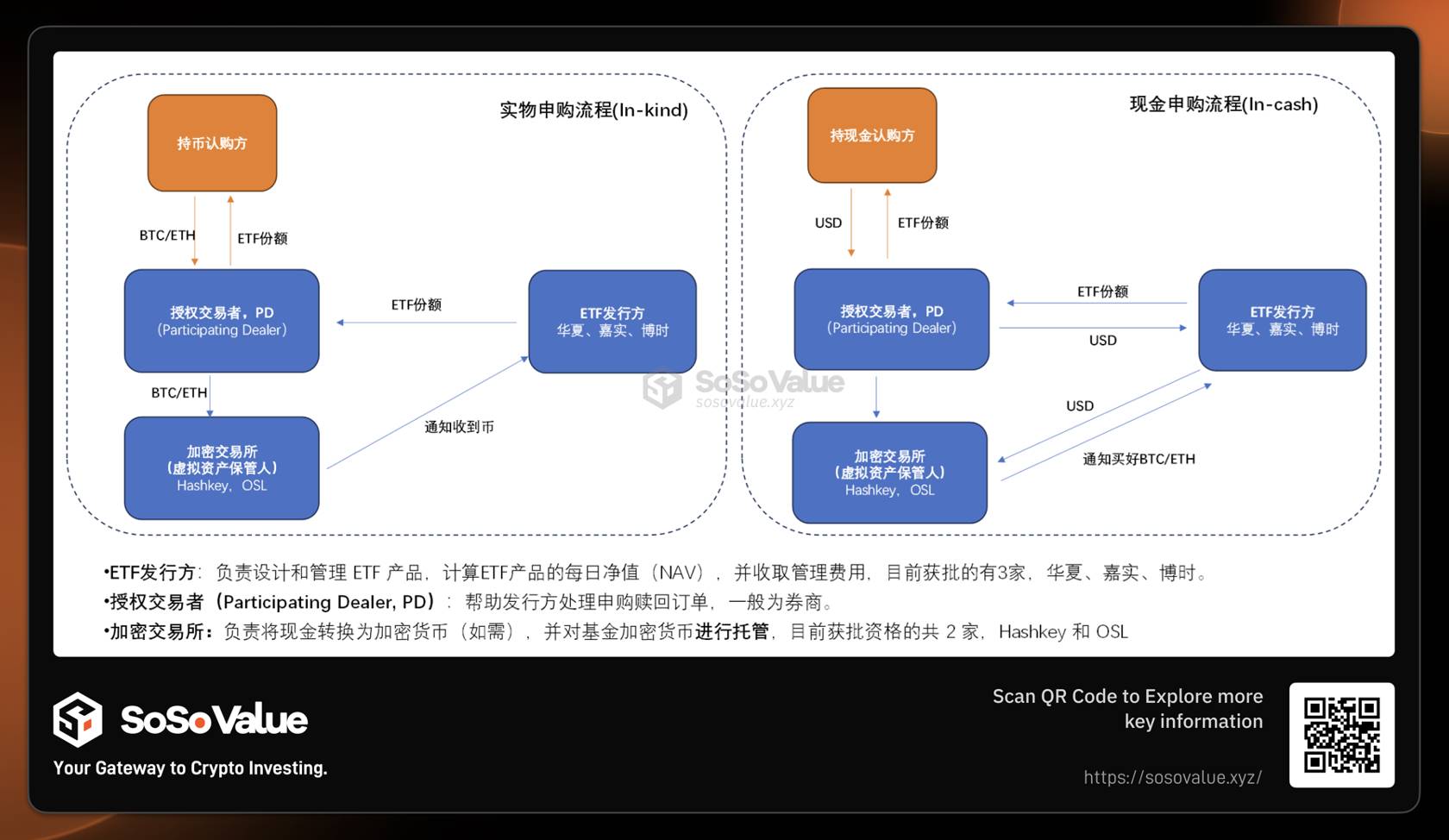

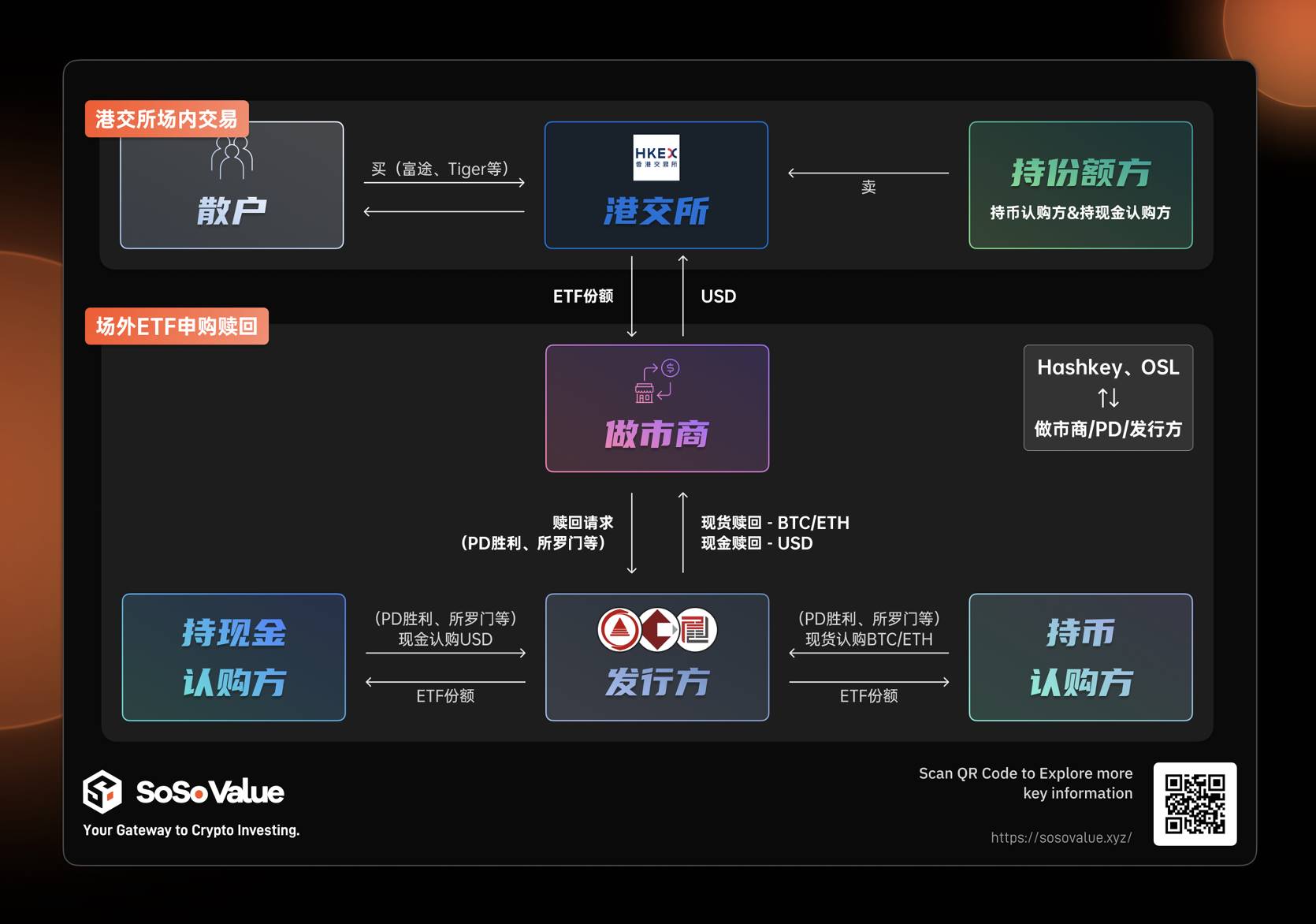

The biggest difference between Hong Kong crypto spot ETF and US Bitcoin spot ETF is that in addition to cash redemption (in-cash), an additional in-kind redemption method has been added. This also directly determines that at the ETF share level, Hong Kong crypto ETF may have more suppliers.

Physical subscription and redemption means that investors can use cryptocurrency (Bitcoin or Ethereum) to exchange instead of cash when subscribing (creating) or redeeming ETF shares. When subscribing, investors provide a certain amount of cryptocurrency to the ETF in exchange for ETF shares; when redeeming, investors return ETF shares in exchange for the corresponding cryptocurrency.

Referring to the comparison of the Hong Kong cryptocurrency subscription process in Figure 2, we can see that there are two major differences between physical subscription and cash subscription:

1) Coin holders can subscribe directly with coins : Some large coin holders, such as miners, can easily convert their coins into ETF shares. In addition to holding ETF shares, they can also support cash redemption and direct sale for cash on the Hong Kong Stock Exchange, which provides a very flexible processing method.

2) For the crypto market, physical subscription does not bring incremental funds into the market , but is just the transfer of cryptocurrencies between different accounts. Cash subscription, on the other hand, brings actual buying to the crypto assets on the chain.

Therefore, the subscribers of Hong Kong crypto ETF shares include both traditional cash subscribers and large currency holders. Although the specific shares of physical subscription and cash subscription have not yet been disclosed by each company, according to OSL's public communication, the first batch of ETF shares subscribed in kind may account for more than 50%, which also explains why the initial fundraising scale of Hong Kong crypto ETF can reach nearly 300 million US dollars, and physical subscription has played an indispensable role. But on another level, these ETF shares subscribed in kind may be converted into selling orders in subsequent secondary market transactions.

Figure 4 : Comparison of physical VS cash subscription process for Hong Kong crypto spot ETFs

Consider supply and demand, pay attention to the discount and premium rate to seize investment opportunities

According to the comprehensive analysis of both supply and demand above, unlike the US Bitcoin spot ETF, we can track the daily net inflow of ETFs ( Total Net Inflow ) to intuitively judge the impact of the incremental funds brought by the Bitcoin ETF on the price of crypto assets. The supply and demand of Hong Kong crypto spot ETFs are more complicated, and the data released by various fund companies cannot clearly distinguish between the subscription and redemption volume of physical and cash. In this context, we believe that the premium and discount rate of the open market (Hong Kong Stock Exchange trading) may be a better indicator to observe.

As we analyzed above, in the on-site trading of the Hong Kong Stock Exchange, the premium and discount are the best reflection of the power of both supply and demand. If the ETF is discounted, it means that the seller is more willing to sell and the supply exceeds the demand. The market maker has the motivation to buy the ETF shares at a discount in the Hong Kong Stock Exchange, and then go to the ETF issuer to redeem the shares over the counter, thereby earning the difference. The overall net assets of the ETF are reduced, and funds are outflowed, which has a negative effect on the overall crypto market. The whole process can be simply summarized as: ETF discount -- > stronger selling -- > possible redemption --> negative impact on the crypto market. On the contrary, assuming that the ETF premium --> stronger buying --> possible subscription --> positive impact on the crypto market.

According to SoSo Value data, as of the close of April 30, except for the Harvest Bitcoin Spot ETF (3439.HK) and the Harvest Ethereum Spot ETF (3179.HK), which generated negative premiums of -0.18% and -0.19% respectively, all other products had positive premiums, and the highest positive premium during intraday trading was 0.33%. The selling on the first day was restrained, and the buying was relatively strong. Considering the influence of market makers on the first day of ETF listing, this discount and premium data can be continuously observed. If the positive premium can be maintained continuously, it is expected to continue to attract investors to subscribe, especially the subscription of investors holding coins, and the scale of Hong Kong crypto spot ETF will exceed the estimated value of US$ 500 million; if it turns to a negative premium, be wary of arbitrage transactions to redeem ETF shares, and the ETF issuer sells cryptocurrencies, driving the crypto market down.

Figure 5 : Hong Kong crypto spot ETF supply and demand impact mechanism (data source: SoSo Value)

Hong Kong crypto ETFs also have an important value for investors: adding a conversion and circulation path for crypto assets and tradable financial assets

Although the rapid approval of Hong Kong's crypto spot ETF may have less short-term impact on the crypto market than US spot ETFs, in the medium and long term, the physical subscription and redemption mechanism of Hong Kong's crypto ETF also provides a channel for crypto assets to be converted into traditional financial assets. Through physical subscription, cryptocurrencies are converted into ETF shares, and ETF shares have fair value and liquidity in the traditional financial market. Holding crypto asset ETFs can be used as asset proof in the traditional financial market , which can be used for various leverage operations, such as mortgage lending, building structured products, etc. The channel between crypto assets and traditional finance is further opened up, and the value of crypto assets can be more fully reflected and realized.

From a more macro and long-term perspective, Hong Kong's approval of Bitcoin and Ethereum spot ETFs is an important development in the global crypto market. This policy will have a long-term impact on the financial landscape of the Chinese community and is also an important step in further legalizing cryptocurrencies in the global financial system.