By: Justin Bons , Founder of Cyber Capital

Compiled by: Frank, Foresight News

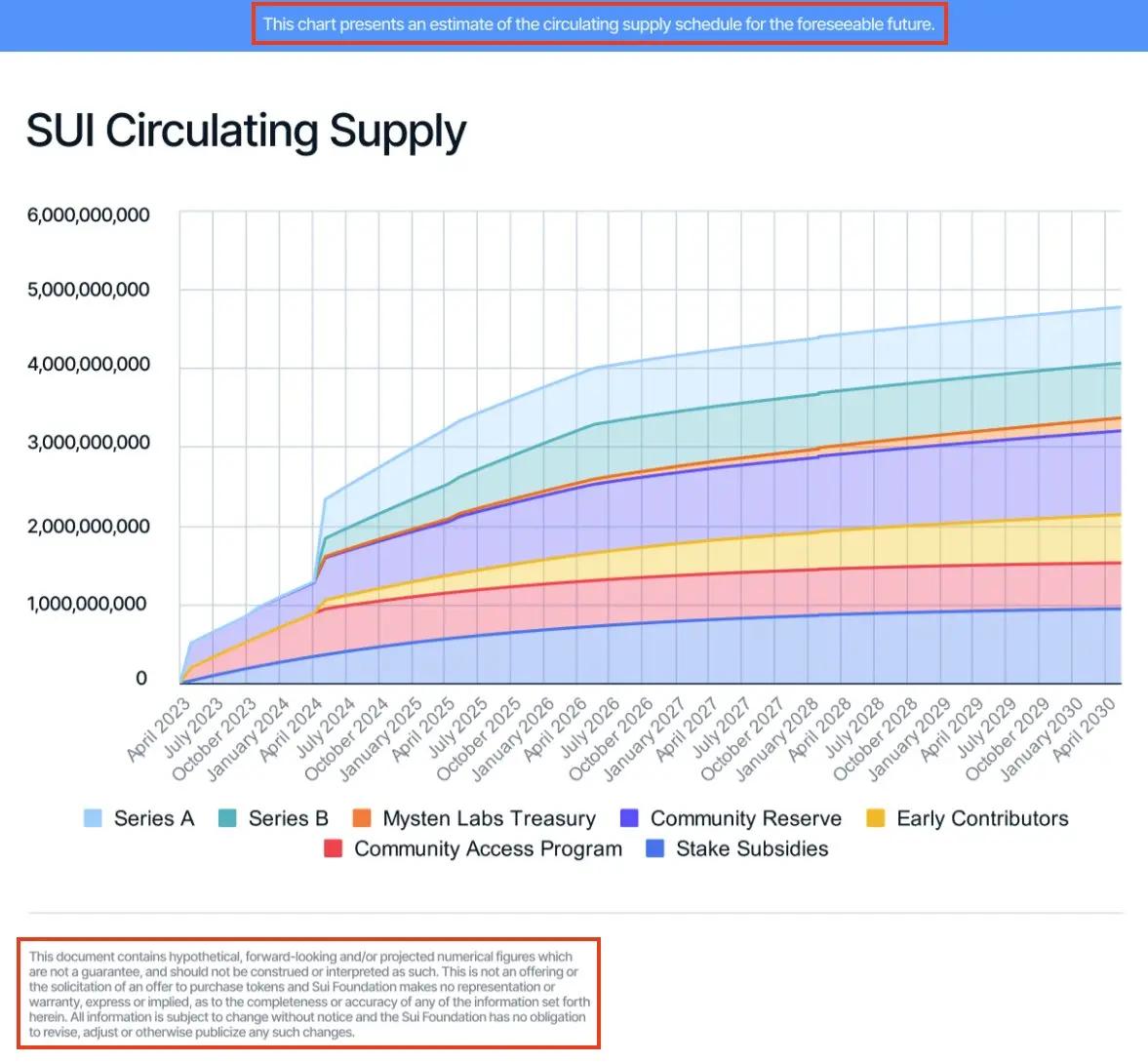

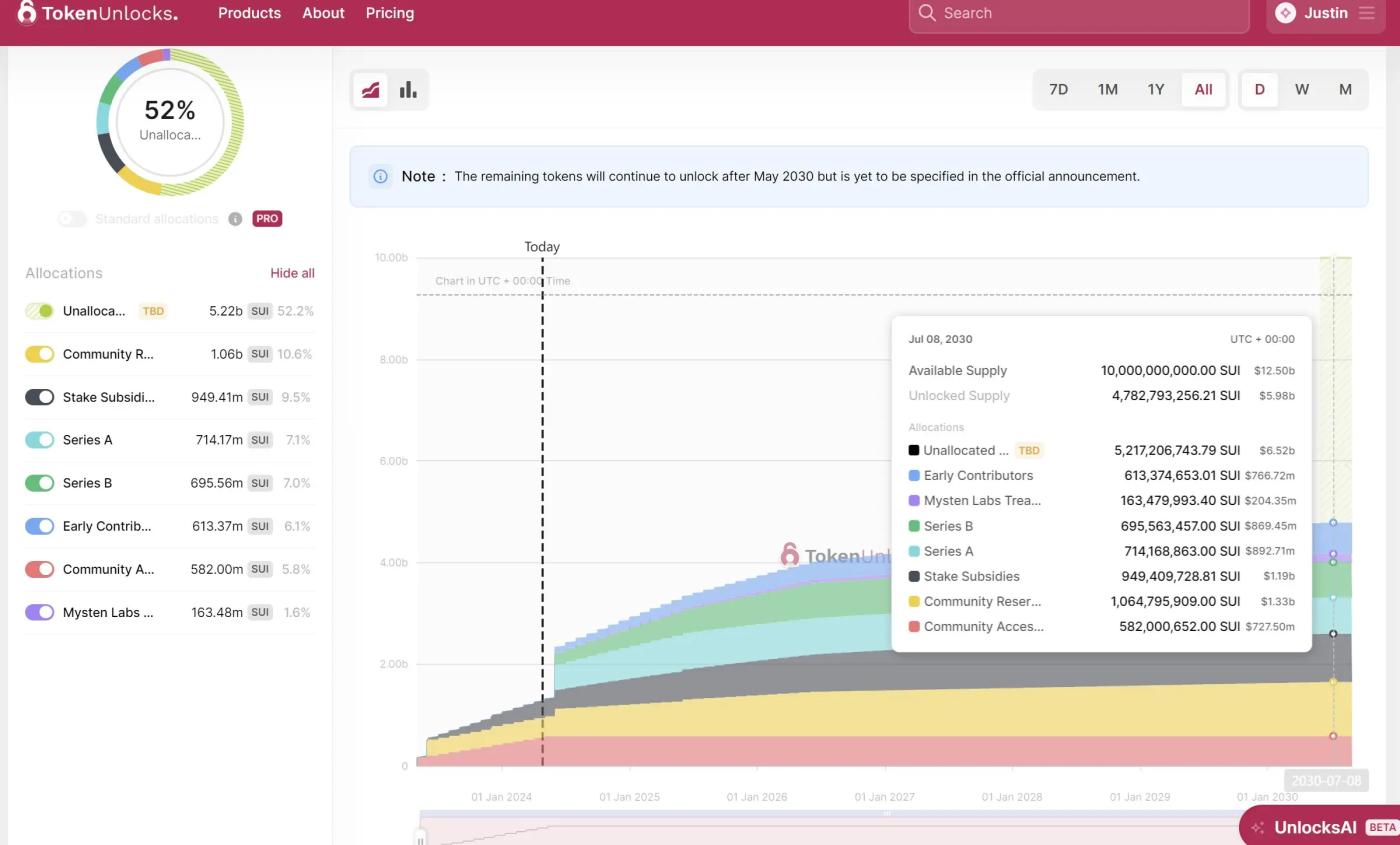

Sui’s design is great, except for its token economics: SUI claims to have a total supply cap of 10 billion, of which 52% will be “unallocated” before 2030.

But the problem is that more than 8 billion SUIs have been staked, and more than 84% of the staked supply is held by the founding team . So to some extent, SUI is undoubtedly centralized, that is, the founders control most of the supply, and there is no lock-up period or legal guarantee.

That is, legal loopholes protect them, which is why the liquid supply chart released by the Sui Foundation is a lie - it means that the so-called staked SUI has no lock-up period at all!

All the legal documents confirm this, because it allows the Sui team to do whatever they want with their part of SUI, whenever and wherever they want.

Given these facts, much of their communications are extremely deceptive, presenting a glaring lack of disclosure coupled with lies and unbridled greed.

We previously asked SUIs to disclose their addresses, but they refused. They did reveal that these SUIs are held by custodians, specifically BitGo, Anchorage, and Coinbase Prime.

However, this implies that someone does have legal ownership of the entire “unallocated” SUI supply. These custodians must work with a legal entity, as is the case with Cyber Capital and BitGo.

In short, they do not enforce vesting periods, but rather enable centralized institutions to safely hold their cryptocurrencies, which confuses the issue of centralization as these institutions use multiple staking services.

In other words, we don’t even know whether it is the foundation or the for-profit organization Mysten Labs that controls this part of the pledged SUI. It may even be some random individuals behind it - without further disclosure from the core team, we really can’t know the details.

For a project that raised over $330 million, this is totally unacceptable.

In addition, of the total supply of 10 billion, 160 million were allocated to the for-profit institution Mysten Labs, 600 million were allocated to "early contributors", and nearly 1.5 billion went directly to venture capital firms ...

Add to that over 1 billion in “staking subsidies” — these subsidies will ultimately go back to the founding team, as they actually control the majority of the staked shares.

At the same time, SUI had no public sale at all (meaning it was 100% pre-mined), which has been a trend in cryptoeconomics over the past few years, and SUI is one of the worst examples, especially considering the "unallocated" portion of the supply.

This is why I wrote this article. We must raise the bar for the good of the entire industry. To describe Sui’s token allocation as “excessive” would be a gross understatement.

To date, Sui still refuses to disclose information about the majority of its token supply, which poses an extremely high risk to us because Sui’s leadership actually controls the network consensus.

Not only can they manipulate consensus, but if they decide to sell, they can also crash the entire market overnight. However, from a game theory perspective, they are more likely to choose to slowly drain the interests of retail investors by gradually selling.

This may explain why SUI has a “supply cap”, but it is clearly not a project focused on the future.

Since I'm going to criticize, I'll also propose a solution. It's simple: destroy the "unallocated" SUI supply:

This is a radical solution that is equivalent to destroying more than half of the supply, worth more than $1 billion , which sounds crazy, but it will also send an incredibly bullish signal!

Another solution is to transfer control of this portion of the supply to a treasury address controlled by the Sui on-chain governance system. The advantage is that this portion of the funds can still be used, bringing more competitive advantages to Sui .

Sui's technology itself has great potential. Its object-oriented model allows more control and local partitioning. Sui also proposed a novel solution to the state expansion problem - since the object requires the user to lock the SUI, the SUI will be released when the object is destroyed. This combined with parallel processing achieves high scalability.

In the field of cryptocurrency, few things are absolute and nothing is flawless. Sui is a permissionless public blockchain with a predatory token distribution method. Good and bad coexist. Shockingly, SUI's token distribution makes SOL look like a saint and ETH an angel.

Faced with such a situation, we can’t help but feel conflicted. However, SUI still has a chance to get on the right track. They just need to give up control of the “unallocated” supply and destroy them!