Author: Liu Zhengyao, lawyer at Shanghai Mankiw Law Offices

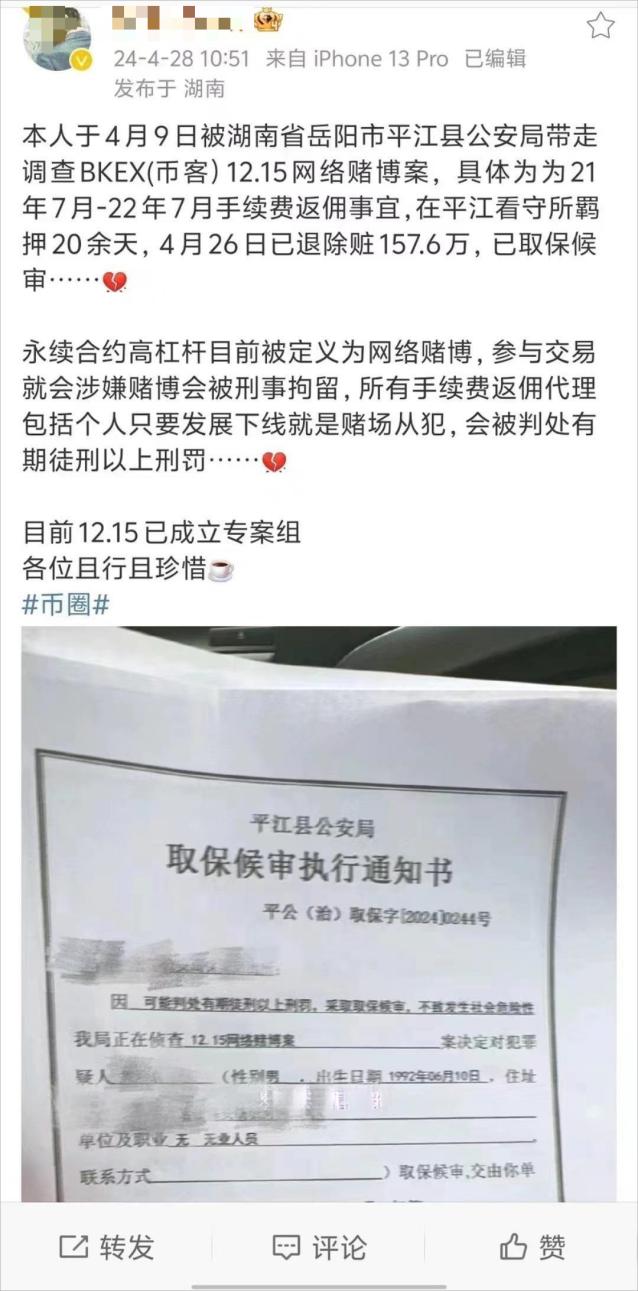

Recently, a blogger on Weibo (possibly a KOL in the crypto) announced that he was under investigation by the Pingjiang County Police in Hunan Province for his suspected involvement in the BKEX (Bitcoin Exchange) online gambling case and is now on bail pending trial.

The blogger reminded that "perpetual contracts with high leverage are currently defined as online gambling. Participating in transactions will be suspected of gambling and will be subject to criminal detention. All commission rebate agents, including individuals, will be accomplices of the casino as long as they develop downlines and will be sentenced to fixed-term imprisonment or above..."

In fact, the blogger's statement was not entirely accurate, but it did cause a bit of a stir. Several netizens in the WeChat group talked about this and were quite shocked. Lawyer Liu analyzed the relationship between playing contracts, leveraged trading and gambling crimes in virtual currency exchanges from a legal practice perspective, as well as the possibility that virtual currency exchanges themselves constitute the crime of opening a casino.

1. BKEX

According to public information on the Internet, BKEX was established in June 2018 by Ji Moumou, Yuan Moumou and others. Since its establishment, especially since 2020, a lot of negative information can be found online, such as launching multiple air coin projects, malicious freezing and deducting customer funds, etc. Lawyer Liu even saw photos of users holding banners to defend their rights at Dongfang Hope Tianxiang Plaza in Chengdu Hi-tech Zone (said to be the actual operating address of BKEX). The authenticity of these contents is unknown, but no official statement from BKEX has been seen. BKEX's official website also shows a DNS error and cannot be opened. According to an article on the "Metaverse NEWS" public account on November 5, 2021, BKEX still publicly solicited customers for transactions in China after the "9.24 Notice", which is indeed a play with fire operation.

There is also a post on Zhihu (posted on May 31, 2023) saying that the Biker exchange was "taken down" by the police. Of course, as lawyers, we cannot guarantee that the above information is 100% true without seeing the specific information of the case against Biker (such as the case filing notice issued by the public security organ to the victim, the detention/arrest notice to the family, the police report of the public security organ, etc.). But what is certain is that many of Biker's operations do have great criminal legal risks.

2. What is a perpetual contract?

In the above screenshot, the Weibo blogger said that perpetual contracts and high-leverage transactions have been classified as gambling. If you want to know whether this statement is correct, you must know what perpetual contracts are (if you understand perpetual contracts, you will naturally understand the meaning of high leverage).

Many ways of playing in the crypto today are derived from traditional securities and futures markets, and perpetual contracts are one of them. However, perpetual futures (PERP) is a unique investment model in the crypto. It is a crypto futures derivative invented by Arthur Hayes, the founder of BitMEX, in 2016. Unlike futures contracts, perpetual contracts have no expiration date (delivery date), which means that you can hold a contract permanently without a margin call and freely choose the settlement date.

Generally speaking, perpetual contracts have the following characteristics: first, they can be long or short, which is a basic operation for both traditional futures contracts and virtual currency contracts; second, they have high leverage. Compared with the maximum leverage of 20 times for traditional futures contracts, the leverage of virtual currency exchanges can be increased to more than 100 times if they are fully utilized, which is simply too exciting; third, they have margin mechanisms and funding rates. Friends who are interested in these two knowledge points can learn about them on their own. As a legal practitioner, Lawyer Liu will not teach in the financial field.

Leveraged trading differs from contract trading in terms of transaction details. For example, in terms of funding sources, the funds for leveraged trading are borrowed from the platform, and the leverage ratio of leveraged trading depends on the amount of funds borrowed by the trader. In addition, the forced liquidation price of leveraged trading is different from that of contract trading, and there are also differences in transaction fees (handling fees). However, in essence, contract trading and leveraged trading are both risky games of "small bets for big wins".

3. Is using leverage to play contracts in an exchange a gambling crime?

my country's criminal law or judicial interpretation does not explain in detail what gambling is. According to academic interpretation, "gambling" refers to the act of gambling or gambling with money based on accidental wins and losses (Zhang Mingkai). Accidental wins and losses require that the results of gambling cannot be foreseen in advance, which is "speculative behavior."

In practice, not all gambling behaviors constitute criminal offenses. There are two main types of gambling in my country's criminal law: one is gambling in a crowd; the other is gambling as a profession. According to judicial interpretation, the so-called gambling in a crowd must be for the purpose of profit, "organizing more than 3 people to gamble, and the amount of profit collected from the gambling reaches more than 5,000 yuan; or organizing more than 3 people to gamble, and the amount of gambling funds reaches more than 50,000 yuan; or organizing more than 3 people to gamble, and the number of participants reaches more than 20 people" and other conditions. In addition, knowing that others are committing gambling crimes and providing them with funds, computer networks, communications, payment settlements, etc., constitutes an accomplice to the crime of gambling. If the above conditions are not met, they may be punished by administrative public security.

So, does playing contracts in an exchange constitute a gambling crime?

In fact, whether it is a contract or leverage, we analyzed in the first point of this article that their basic model is to make a small bet for a big gain. However, the crime of gambling in the criminal law does not only look at making a small bet for a big gain, but whether its model conforms to the following closed loop: property investment - gambling gameplay (contingency, speculation, and luck) - property output. According to the ruling regulation of the Supreme People's Court's Guiding Case No. 146 in 2020, "Chen Qinghao, Chen Shujuan, and Zhao Yanhai Opened a Casino Case": In the name of "binary option" trading (that is, just buy up or buy down), use the Internet outside the legal futures exchange to recruit investors, use the price trend of foreign exchange products in the future as the trading object, and determine the profit and loss according to "buy up" and "buy down". The "investor" who buys the right direction of rise and fall will profit, and the principal of the wrong purchase belongs to the website (dealer). The profit and loss results are not linked to the actual price increase or decrease. The essence is "betting on size and winning or losing", which is a gambling crime.

From this we can conclude that if the contract transactions conducted on virtual currency exchanges, even if the leverage ratio is high, do not adopt the "binary option" trading model, the future profit and loss results of the contract correspond to the real market fluctuations (rise and fall) of virtual currency, and there are not only simple and crude losses or profits, but there are stop-profit and stop-loss functions in the transaction settings, and you can choose to close the position by yourself, etc., then Lawyer Liu believes that it is not enough to constitute the crime of gambling. As for whether it constitutes other crimes such as illegal business operations, see the analysis below.

4. Does the opening of a contract on a virtual currency exchange constitute the crime of opening a casino?

According to the analysis in the third point of the article, if the contract transactions in virtual currency exchanges do not constitute a gambling crime, then for the virtual currency exchanges, it naturally does not constitute the crime of opening a casino.

However, it must be mentioned that in practice, many exchanges have indeed been identified as opening casinos because of contracts and high-leverage transactions. There are two possibilities: First, the contracts opened by the convicted virtual currency exchanges are fake contracts. The common "pin-in" operations in the virtual currency market today (even some so-called head exchanges did this in the early days), the exchange dealers cutting leeks, or the "binary options" betting model in the aforementioned case No. 146, etc., do constitute crimes. Even the crime of opening a casino is considered light, and some also meet the composition of the crime of fraud (with heavier penalties); second, the exchange contracts that fully conform to the mainstream market gameplay are wrongly identified as gambling, and then the exchange is wrongly identified as opening a casino. This situation is not uncommon. Some grassroots judicial organs cannot understand emerging things well due to their lack of knowledge of virtual currencies, exchange operating models, and even traditional securities and futures, which ultimately leads to wrong characterization.

However, for defense lawyers, Lawyer Liu's advice is that if you think the client's behavior does not constitute the crime of opening a casino, don't rush to defend your innocence. You must consider whether opening a virtual currency exchange and providing contract services will constitute the crime of illegal business operations? Especially in the case of opening a virtual currency exchange (violating the provisions of the "9.24 Notice") under the premise of violating regulatory regulations and operating a virtual currency contract business that is very similar to a futures contract. Although virtual currency exchanges are not equivalent to futures exchanges, and virtual currency contracts are not futures contracts in the strict sense, in the judicial context where the crime of illegal business operations is easily expanded, once it is identified as the crime of illegal business operations, the fine is significantly higher than the crime of opening a casino. Under the premise that the main sentence is not much different, the crime of illegal business operations is actually disadvantageous to the parties.

V. Conclusion

The essence of many criminal cases in the crypto today is the country's cautious and strict attitude towards virtual currencies. The policy regulations are represented by the "9.24 Notice", not to mention opening a virtual currency exchange on your own (whether domestically or overseas). For domestic citizens (or other legal entities), even if they provide marketing, payment settlement, technical support and other services to overseas virtual currency exchanges, they are considered illegal financial activities and will be held legally responsible.

As a lawyer who specializes in providing legal services in the fields of web3, blockchain, virtual currency, etc., Liu has seen too many joys and sorrows in the crypto. Regarding the contract issues discussed in this article, I can’t help but give a clichéd suggestion at the end: cherish your life and stay away from contracts. This is not only for ordinary crypto players, but also for entrepreneurs in the crypto industry, because players may lose their property, while entrepreneurs may also lose their freedom.