The Market

It was a macro-heavy week, culminating in the FOMC meeting last Wednesday. The Fed decided to hold rates unchanged, citing a lack of progress toward the 2% inflation target in recent months. It’s been 9 months since the last Fed rate raise, marking this cycle as the second longest period between Fed rate changes following the last rate increase.

There are two silver linings worth highlighting when comparing this FOMC statement to the last meeting in March. First, the Fed mentioned the risk to achieving its employment and inflation goals have moved toward a better balance. Powell also mentioned he doesn’t see stagflation as a concern, since the unemployment and inflation are both still below 4%. Second, the Fed will slow down quantitative tightening starting in June, by reducing the monthly Treasury Securities redemption cap from $65 billion to $25 billion, effectively injecting $40 billion cash into the market every month.

BTC started the week selling off as much as 10% before the FOMC meeting, anticipating a possible harsher tone from the Fed, but it bounced back, ending the week with a slight positive return. The main driver behind the recovery came on Friday with the April jobs report showing lower than expected job growth, leading the market to anticipate earlier Fed cuts.

It’s starting to look like 2023, when BTC and the crypto market had a good rally in Q1, emerging from the shadow of FTX and encouraged by the regional bank crisis. Q2 and Q3 were relatively flat followed by a steep rally in Q4 2023 and Q1 2024, encouraged by the spot ETF approval. Barring major macro surprises, we expect the crypto market to move sideways during Q2-Q3, until there is a clearer signal toward a Fed rate cut.

Another positive catalyst that could happen sooner is big ticket institutional inflows into the BTC spot ETF. The strong inflows YTD are mostly from the pent-up demand of self-directed investors. As that demand saturates, the next wave will be driven by large wealth management and brokerage platforms, which typically requires at least a 6-month track record for new ETFs before they can solicit the products to their clients. Thankfully, Blackrock has become the biggest KOL for crypto, doing a great job in teaching institutional investors about the merit of owning Bitcoin in their portfolio. We expect institutional demand will drive fresh and sticky capital to Bitcoin. This, coupled with reduced supply from halving, will provide strong price support for BTC.

Last but not least, due to the attractive yield offered by re-staking, some of the crypto native capital is parking their ETH to earn an attractive yield and farm airdrops from EigenLayer and other LRT protocols. EigenLayer currently attracts $15B TVL. Pendle, the DeFi protocol that enables leveraged points farming on LRTs, also attracts $4.6B TVL. Since EigenLayer just announced their TGE, we expect some capital will rotate to other crypto opportunities for higher return.

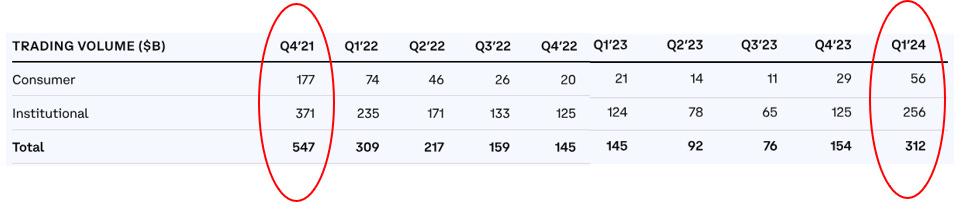

A broad crypto market rally requires new capital. Despite BTC touching new highs in Q1, the retail FOMO capital hasn’t kicked in yet. Per Coinbase’s recent Q1 report with a breakdown on consumer (i.e., retail) vs. institutional trading volume, the retail volume is about ⅓ of last cycle’s peak, while institutional volume has reached 70% of the previous peak level. There is more dry powder from the retail side waiting for the market to give them a reason to get in.

Source: Coinbase

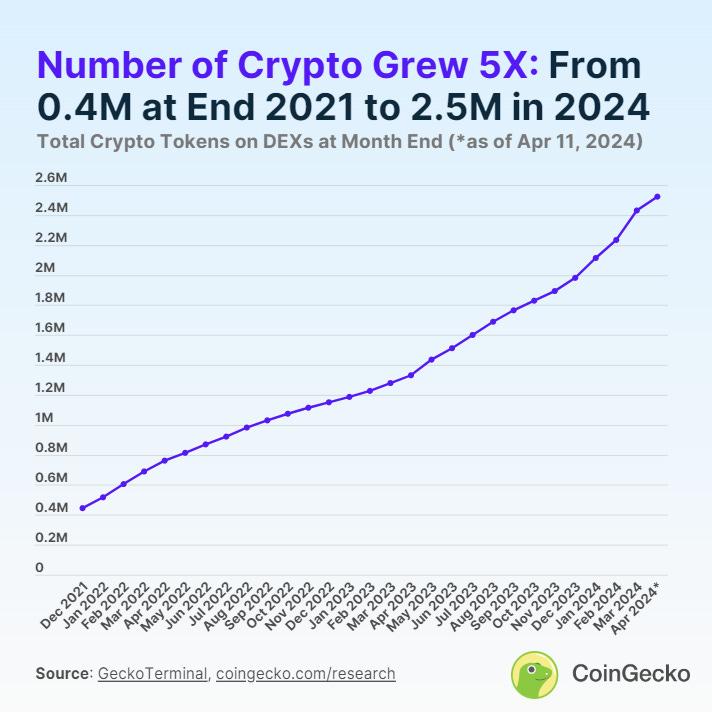

In the meantime, the number of altcoins traded on DEXes have grown 5X since the last cycle. With limited capital chasing more projects, it is critical for investors to pick the right token in the right sector. As we mentioned previously, winners in this cycle either need to be strong earners with established PMF and large user base, or innovators who can create new use cases with a big TAM.

DeFi Update

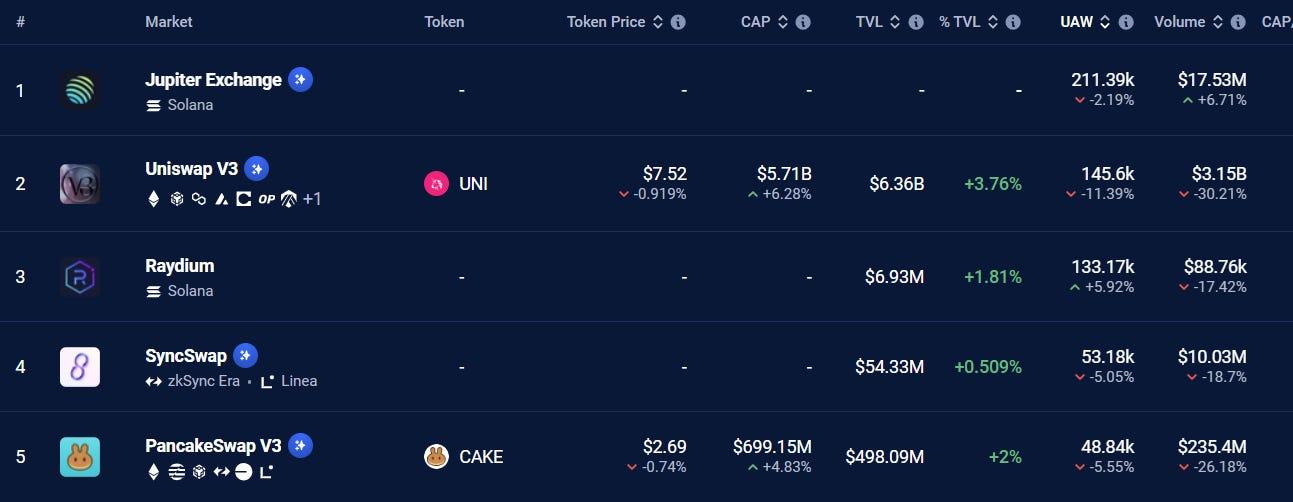

The April correction hasn’t been friendly for Solana given its steep ascent last year and the recent network congestion issues. However, SOL’s price relative to BTC and ETH has established resistance levels that are rising over time, indicating SOL’s strength. Since Anja released the network congestion fix on April 12, Solana’s failed transaction rate has declined from 75% to 59%, close to the level seen in Q4 2023. The Solana dApps are also showing robust strength in their ability to attract users.

Jupiter, the leading DEX aggregator on Solana, has grown to have more active users than Uniswap v3.

Kamino, the leading lending protocol on Solana, has grown more than 15X in TVL since Q3 2023. Despite the initial selloff at TGE, about 60% of the claimed $KMNO token is staked, indicating user interest in staying in the ecosystem. Like many leading DeFi projects on Solana, Kamino has a low circulating supply relative to FDV, but even at a $772M FDV, Kamino is about half of AAVE’s FDV. Unlike AAVE, which focuses on lending, Kamino also offers innovative solutions in yield farming and leverage, providing a more integrated experience for users and indicating more growth potential.

Solana has also scored a few big institutional wins in April, furthering its mainstream user adoption. Stripe is supporting USDC payment on Solana and Ethereum, but Solana clearly has an advantage on cost and speed. Franklin Templeton just wrote a research report on Solana, endorsing it as the “third major crypto asset” after BTC and ETH. We believe Solana has demonstrated its PMF as more users are attracted to its killer apps and return opportunities. Users beget builders beget institutional adoption, creating a flywheel effect that will sustain Solana ecosystem’s growth in this cycle.

Top 100 MCAP Winners

Helium (+32.31%)

Pepe (+24.90%)

Dogwifhat (+24.46%)

Wormhole (+21.94%)

Nervos Network (+13.24%)

Top 100 MCAP Losers

SUI (-9.779%)

CORE (-9.02%)

NEAR protocol (-8.10%)

Gnosis (-6.82%)

Theta Nework (-6.49%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.

About the Author

Kelly is Portfolio Manager and Head of Research at Decentral Park Capital. Investing across sectors with a thesis driven, deep research approach.

Prior to this, Kelly has led research and product efforts at CoinDesk Indices and Fidelity Digital Asset Management. Kelly has been a TradFi investor for 15 years before joining the crypto space.

You can follow Kelly on Twitter and LinkedIn for more frequent analysis and updates.