The US Department of Justice (DOJ) has escalated its crackdown on international money laundering. Authorities have indicted Maximilien de Hoop Cartier, allegedly linked to the Cartier family, for laundering drug proceeds through cryptocurrency.

In a parallel development, Alexander Vinnik, operator of the BTC-e crypto exchange, pleaded guilty to laundering over $9 billion. These efforts showcase the DOJ’s intensified efforts against financial crimes involving digital currencies.

Cartier Heir Entangled in Multi-Million Dollar Laundering Conspiracy

On May 2, the DOJ charged Maximilien de Hoop Cartier along with five Colombian nationals for their involvement in laundering drug trafficking proceeds between the US and Colombia using cryptocurrency. Claiming descent from the prestigious Cartier family, Maximilien was arrested in Miami. He is now facing a series of grave charges.

The officials accused him of conspiring to commit money laundering and engaging in money laundering activities, each charge carrying a potential twenty-year prison term. Cartier is also facing a bank fraud charge, which could result in up to thirty years of imprisonment.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Additionally, the authorities charged him with conducting a monetary transaction on property derived from specific unlawful activities, which could result in a possible sentence of ten years. Lastly, the DOJ also charged Cartier with operating an unlicensed money-remitting business, which could lead to five years in prison.

Cartier allegedly converted drug proceeds into the stablecoin Tether and then into US dollars. He utilized a network of shell companies and bank accounts in the US for these unlicensed transactions. This scheme involved running an unlicensed over-the-counter cryptocurrency exchange.

US Attorney Damian Williams expressed his thoughts regarding the case. He praised the relentless work of law enforcement and Office prosecutors in tackling money laundering and drug trafficking in Cartier’s case.

“Cartier is additionally alleged to have committed a series of financial offenses while working with this money laundering network that resulted in hundreds of millions of dollars’ worth of unlawful transactions. I commend the efforts of our law enforcements partners and the career prosecutors from this Office who work tirelessly to investigate and disrupt these money laundering and drug trafficking networks. We will continue to relentlessly protect the US financial system from exploitation,” Williams said.

Besides Cartier, several Colombian nationals are facing serious charges in this case. The DOJ accused Leonardo de Jesus Zuluaga Duque of conspiring to commit money laundering and to import over five kilograms of cocaine into the US. These offenses could result in a life sentence.

Similarly, Alexander Areiza Ceballos and Adrian Fernando Areiza Ceballos face charges of conspiring to import over five kilograms of cocaine into the US. This charge carries a mandatory minimum of 10 years and could lead to life imprisonment.

The authorities have also implicated Erica Milena Lopez Ortiz and Felipe Estrada Echeverry. They each face charges of conspiring to commit money laundering, a crime that carries a punishment of up to 20 years in prison.

BTC-e Exchange Operator Pleads Guilty

Moving on from Cartier’s story, another major development highlights the intricacy of global money laundering. On May 3, the DOJ’s officials announced that Alexander Vinnik, who was associated with BTC-e, had confessed to his involvement in a substantial money laundering operation.

BTC-e was once a notable player in the crypto exchange industry. The DOJ pointed out that BTC-e processed over $9 billion in transactions. Moreover, it served as a financial hub for cybercriminals, ranging from ransomware profiteers to drug traffickers.

Additionally, BTC-e failed to comply with US regulatory standards, including anti-money laundering and customer identification requirements. This failure made it a preferred platform for the anonymization of illicit proceeds.

In discussing Vinnik’s case, Deputy Attorney General Lisa Monaco stressed the international effort required to tackle such complex operations. She also underscored the global collaboration necessary for dismantling sophisticated schemes.

“This guilty plea reflects the Department’s ongoing commitment to use all tools to fight money laundering, police crypto markets, and recover restitution for victims,” Monaco added.

This announcement followed a report by BeInCrypto, which detailed charges brought by the DOJ against Aliaksandr Klimenka, a national of Belarus and Cyprus. The officials alleged he engaged in a complicated money laundering scheme through BTC-e. An indictment in February outlined that Klimenka, alongside Vinnik, managed BTC-e from 2011 until its closure in July 2017.

Read more: How to Choose The Right Crypto Exchange

The recent actions against Cartier and Vinnik demonstrate the Department of Justice’s unwavering dedication. These efforts aim to safeguard the US financial system from the exploitation of high-level international money launderers.

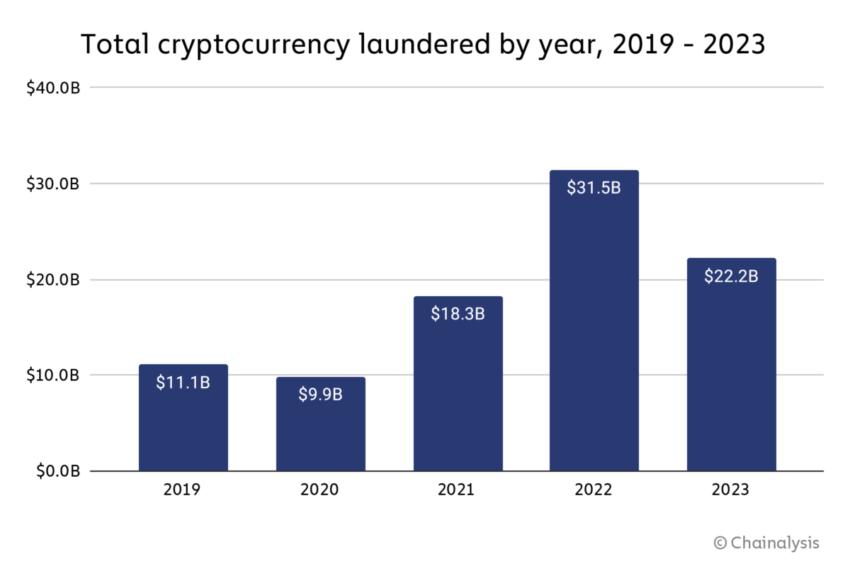

Indeed, cryptocurrency is commonly associated with money laundering by authorities worldwide. However, recent research from Chainalysis in 2023 shows a notable decline in illicit cryptocurrency transactions. Illicit addresses sent $22.2 billion to services, down from $31.5 billion in 2022.

Total Money Laundering in Cryptocurrency (2019 – 2023). Source: Chainalysis

Total Money Laundering in Cryptocurrency (2019 – 2023). Source: ChainalysisContrary to the perception that cryptocurrencies are primarily used for money laundering, the US Department of Treasury’s report highlights that criminal organizations prefer traditional cash transactions for such activities. This finding indicates a lower risk associated with cryptocurrency in money laundering compared to conventional methods.