On November 27th, Blur surpassed Opensea in terms of transaction volume. Many new NFT marketplaces have popped up lately, but none of them were aimed at domination...until now.

Current NFT marketplace platforms focus too much on the retail experience and not enough on professional traders. Blur is working to address these issues, institutionalizing the NFT space while increasing decentralization.

Blur background

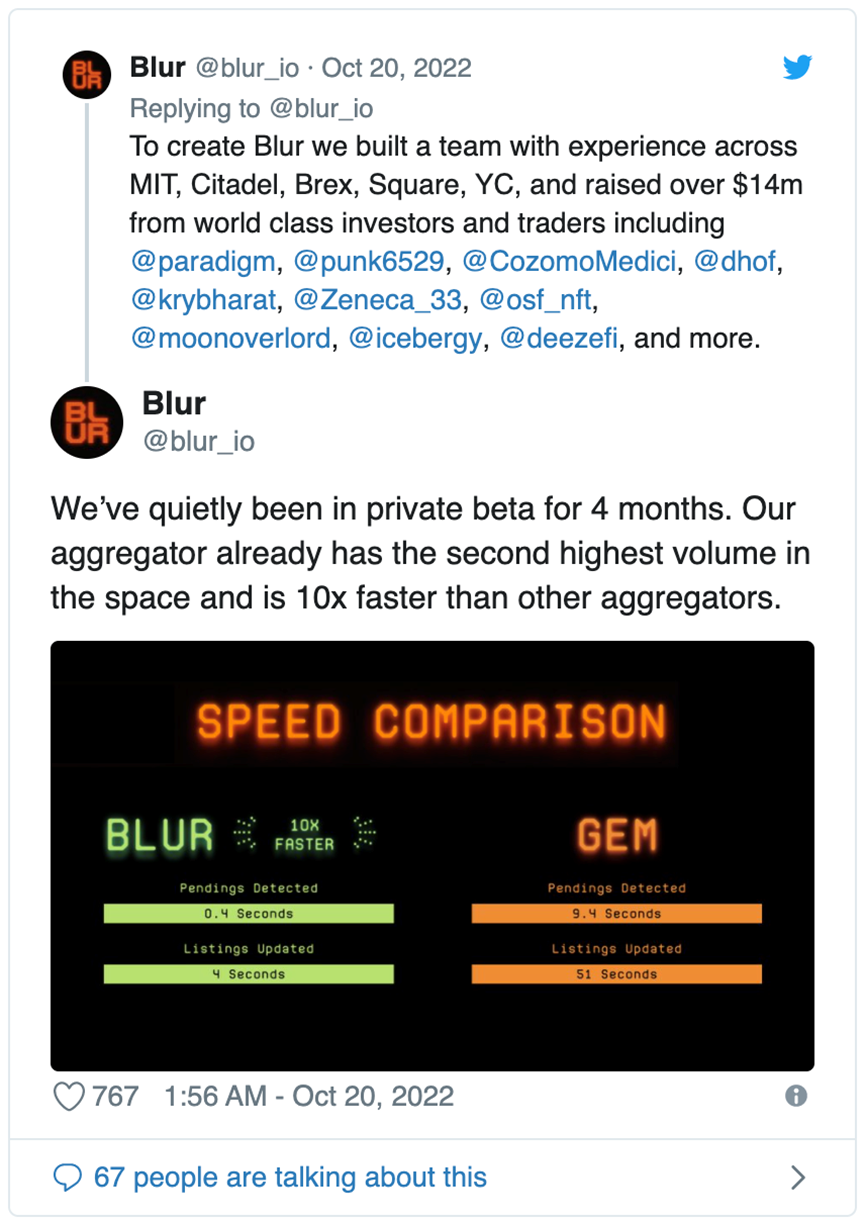

Blur is a new NFT marketplace backed by big-name investors like Paradigm, 6529, Cozomo Medici, and Bharat Krymo. The team consists of developers from well-known institutions such as MIT, Citadel, Five Rings Capital, Twitch, Brex, Square, and Y Combinator.

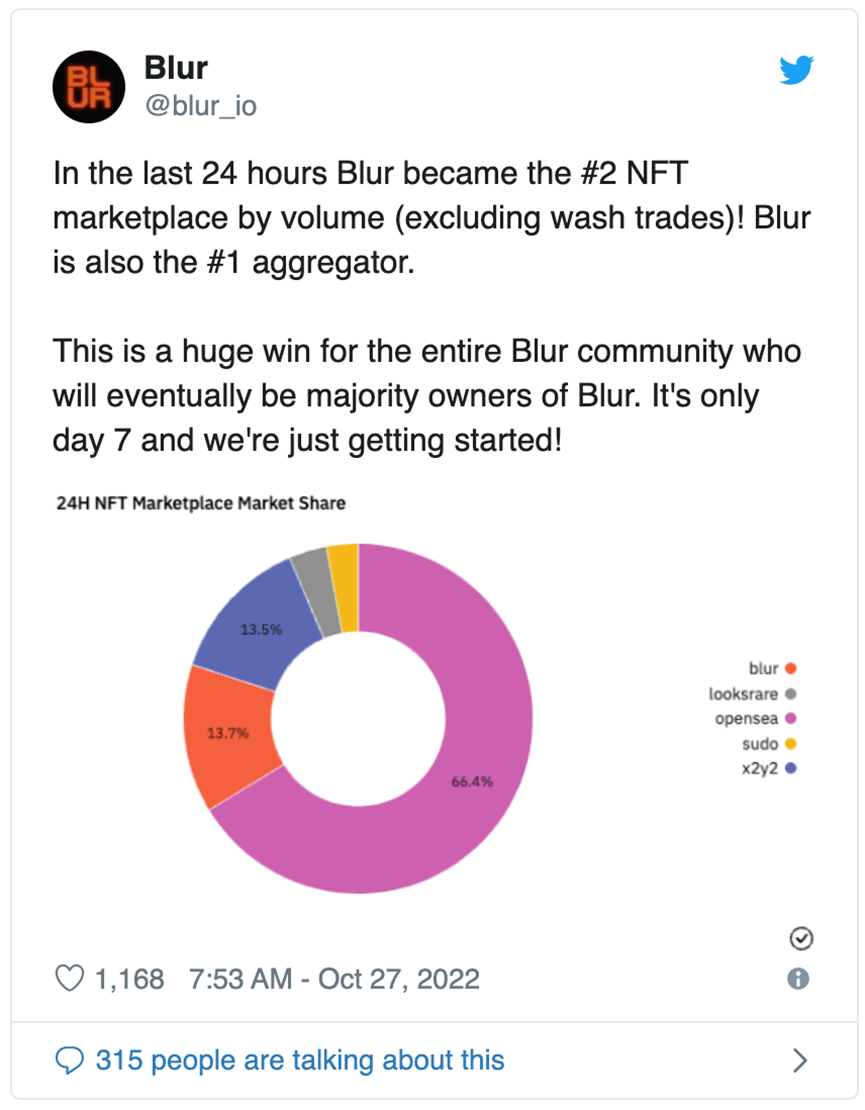

This new exchange market will remain in private development for approximately 276 days before its official launch on October 19, 2022. Blur's aggregator already has the second-highest volume in the space. Blur celebrated the milestone on Twitter, saying it "became the #2 NFT marketplace by volume (excluding wash trades)!" and the "#1 aggregator" for NFTs.

Royalty mechanism and fee structure

Blur has no market fees, so you can trade as much as you want without worrying about any commissions. Additionally, the advanced trading tools on Blur are also free for users. Blur encourages traders to set royalties above zero, potentially earning them even more rewards through incentivized AirDrop.

Blur's royalty system is different from most NFT marketplaces. Here, NFT traders set their own royalties, which means that if the dealer doesn't pay the royalties, the original creator doesn't get any income from the secondary sale. However, the incentive program favors traders who use royalties. For example, those who pay higher rates will receive more AirDrop.

It is important for traders to understand that those who set the royalty rate above 0.5% will receive a larger AirDrop than those who stick to the base rate of 0.5%.

Blur is a marketplace and aggregator in one

A comprehensive comparison of NFT aggregators, including Blur, has not been done. Based on Blur's private beta transaction data, the company claims its transactions are ten times faster than Gem.

According to a recent tweet from the Blur team, they are the largest aggregator by volume.

Blur is for professional traders, similar to other aggregation services. Sweeping the floor, buying many NFTs in a single transaction, is an everyday use case that requires fast transaction processing and avoiding fees in addition to buying NFTs in bulk. This is often done by whales and advanced traders before a project gains significant traction.

Blur's AirDrop

The two AirDrop announced by Blur are the main reason behind this growth. The first AirDrop is a care package that NFT traders must claim within 14 days of launch, and is only available to those who have traded within the past 6 months.

These packages include an undisclosed amount of BLUR tokens, which will be used as governance tokens. In order to earn these care packages, traders must list at least one NFT on the Blur marketplace. Users will not be able to earn these rewards until January 2023 when the BLUR token is listed.

In November, the second Blur AirDrop happened to active traders. According to the Blur team, if traders list NFTs of well-known and reliable collectibles, they will potentially receive more valuable BLUR rewards.

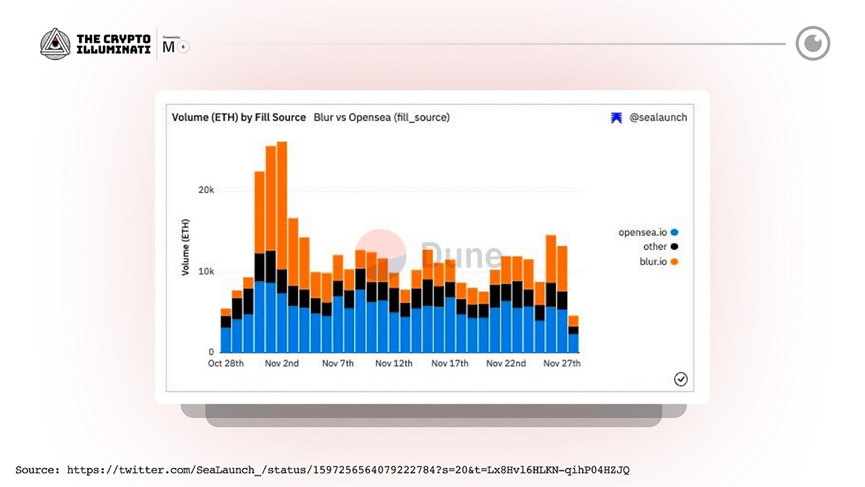

Blur, once again surpasses OpenSea's transaction volume

On November 27, Blur outnumbered Opensea with 5.5K ETH(Blur) to 5.3K ETH(Opensea).

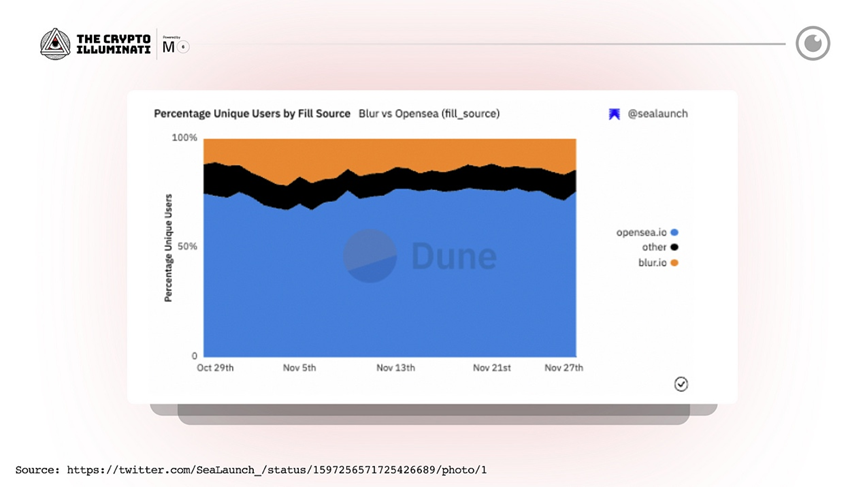

While OpenSea continues to dominate, with over 70% market share, Blur has attracted many active traders, indicating a deep recognition of value.

What's the Catch?

The downside of Blur, based on user feedback, is that it might not be as secure as it seems. For users to perform on marketplaces like OpenSea or LooksRare, a high level of trust is required. However, one Blur user discovered a major problem with the app.

The problem is that in their system, those same few lines of code only show up when the caller is allowed to transfer tokens, which means that someone with a smart contract can keep taking tokens and adding new addresses to the map.

As a recently established NFT marketplace, Blur has no guarantees yet.

final thoughts

Time can only tell what the future holds for this NFT trading platform, but Blur deserves credit for competing with industry giants like OpenSea. Its cutting-edge approach to enabling NFT transactions is a major reason for its success so far.

Editor in charge: Kate