Editor of this issue | Colin Wu

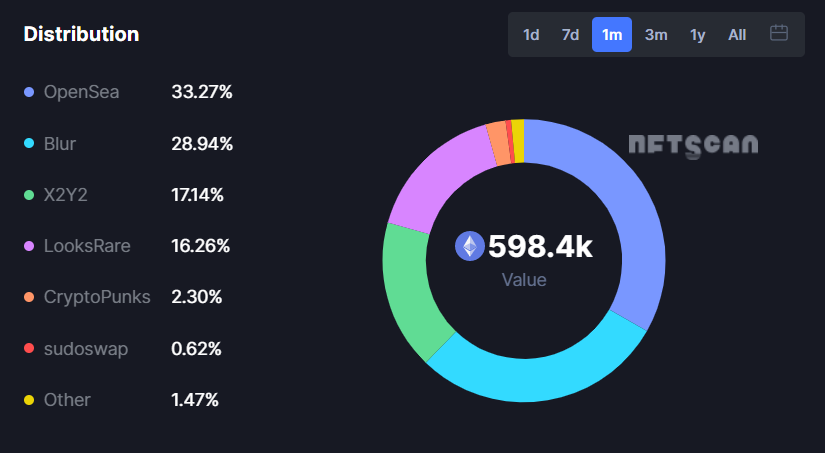

After receiving more than 14 million US dollars in financing from Paradigm and other institutions, Blur, the NFT trading market that claims to "provide services for professional traders", has seen a lot of glory in the near future. According to NFTScan data, as of December 16, Blur's NFT transaction volume in the past month was second only to Opensea, accounting for about 29% of the entire NFT market share (as shown in the figure below), making it the largest NFT aggregation transaction on the current chain The market has given OpenSea unprecedented pressure.

As a clear AirDrop, the official stated previously that BLUR Token will be launched next year, but this is still based on the situation that Tokenomics such as the total amount and Token distribution have not yet been clarified. The wool party is actually in a passive state with the risk of being turned back, but this has not affected the enthusiasm of the wool party. This enthusiasm may be related to the AirDrop FOMO tide caused by the OP and APTOS enrichment effect, and the background of the "unicorn" Opensea in the NFT market's delay in issuing Tokens. "As long as you have transaction records in Opensea, LooksRare, X2Y2 and other NFT trading markets in the first 6 months, you will have the opportunity to obtain the first AirDrop BLUR", which appeared as a consolation prize and the new publicity form of AirDrop"open blind box" has attracted wool party concern. However, in the follow-up AirDrop promotion, Blur twice moved out the rhetoric of "the next round will be bigger" to the PUA community. However, the expectation of Blur's ongoing third AirDrop of airdrops, and the official announcement on Twitter that "the third round is the last round with the largest rewards" still contributed to the surge in the number of users of Blur, especially the giant whales that are almost It monopolized the leaderboard, and briefly drove up both the trading volume and floor price of blue-chip NFT projects such as BAYC and Azuki.

Blur attracts traders through the "custom royalty + zero fee + AirDrop expectation" model

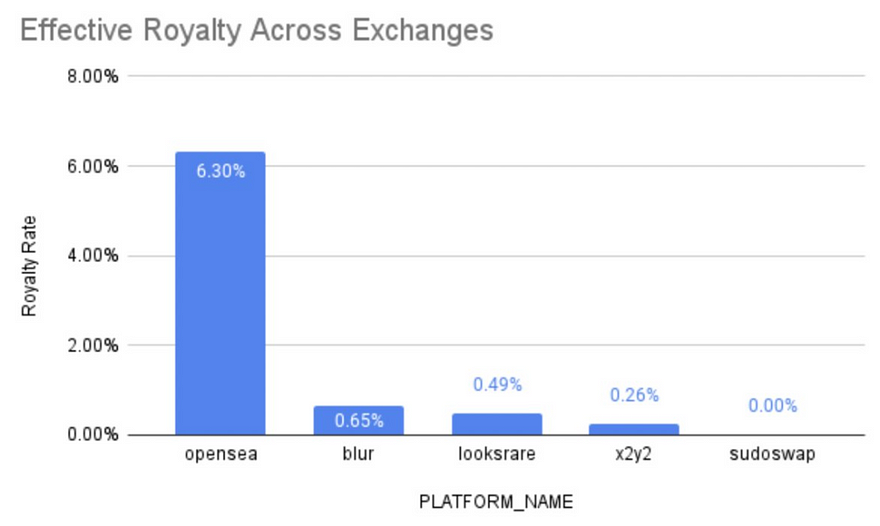

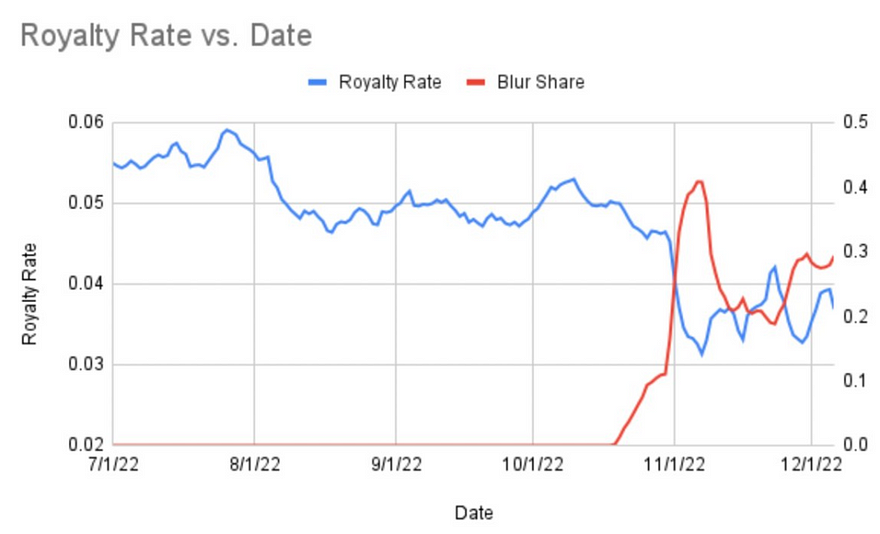

Royalties have always been a sensitive topic in the NFT trading market. "Traders want to maximize profits, collectors want to support creators, and creators want to get more royalties." Because royalties cannot be enforced in multiple markets, the royalties of different platforms are set differently. Blur defaults to the highest royalties among OpenSea, LooksRare and X2Y2. When traders list on Blur, they can customize the royalties for their listings. However, SudoSwap and X2Y2’s zero royalties and custom royalties respectively have caused a lot of discussion in the market. The market believes that custom or zero royalties will cause the project side to lose part of the funds and continue to develop. Therefore, Blur hopes to encourage expectations through AirDrop to encourage prospective traders Use royalties. In the second AirDrop of airdrops, the higher the user royalty setting of Blur, the higher the loyalty and more AirDrop will be obtained. For the zero-royalty platform user migration reward of Sudoswap, traders who pay royalties will change to Blur Putting up a pending order and setting the royalty to Sudoswap's platform fee (0.5%) can make as much profit and get a bigger AirDrop than would otherwise be possible. However, according to the data of NFTstatistics.eth, the research director of Proof, this expected encouragement did not prevent low or even zero royalties. Blur's overall average royalty rate was only 0.65% (as shown in the figure below), and led to a decline in royalties in the overall NFT market ( As shown below).

Blur does not charge users fees like OpenSea, LooksRare and X2Y2 trio. There is no cost for traders to use Blur aggregator, trading market and other features. Under the premise that the royalties are customized, traders can directly obtain full income, but the current zero fee should be used as a short-term strategy to attract new users.

Blur's profit model has not yet been determined, and currently it only relies on financing to support its development

As for when the "custom royalty, zero fee" model will last, Blur officially stated that it will wait for Token to go online before voting on royalties and cost specific plan decisions and discussions through community governance. Before that, Blur will not earn a penny . No matter what the final plan is, it is foreseeable that Blur will eventually fall into the "involved" battle of royalties and fees commonly encountered in the NFT trading market. On the other hand, there is no profit model, no income distribution, and the value of BLUR Token is actually 0; if it only exists as a governance token, it not only does not conform to the positioning of the platform token, but also faces the risk of being imitated by other latecomers. possibility of defeat.

Match the experience of professional trading, but it cannot become a moat

In terms of user experience, the official claims that Blur is 10 times faster than the aggregator Gem acquired by OpenSea. In actual experience, the speed and smoothness of Blur's operation are not fake, but when buying in bulk, you will need to pay more gas fees than other trading markets. Taking Element as an example, the gas cost of buying one NFT at a time and buying NFTs in batches is equivalent, while Blur consumes more gas when buying more NFTs in batches, which may be why Blur buys NFTs in batches There is almost no reason to fail.

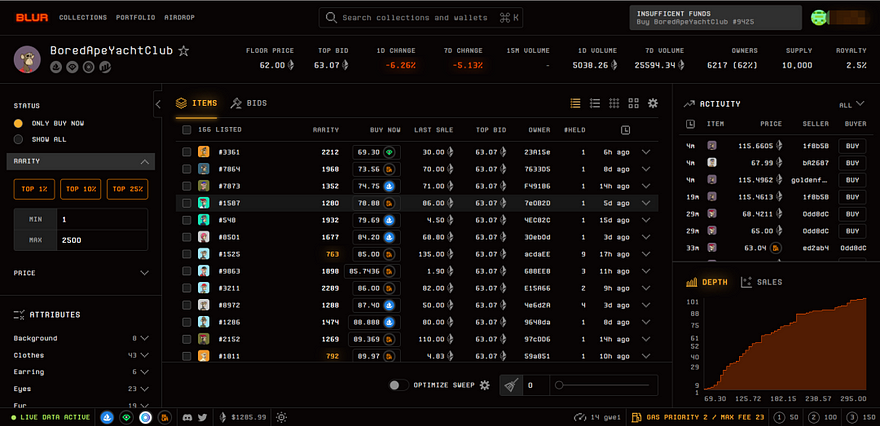

On UI/UX, Blur also matches the habits of professional traders. Taking BAYC as an example, in addition to displaying the price, launch time, and last selling price on the Blur homepage, it will also directly display the rarity of different NFTs. Users can directly choose the rarity of NFTs (1%, 10%, 25%) or price The right side of the screen displays real-time NFT sales, purchase and shelf time information, and the lower right side displays the NFT price range of the project. When clicking on a specific NFT, Blur will display the specific characteristics of the NFT, and display the last sale time, floor price, and transaction volume ratio of each characteristic given the relevant characteristics, allowing traders to judge the rarity of the NFT by themselves degree.

Blur provides traders with professional tools, good UI/UX and other auxiliary functions, but it needs to be realized that these auxiliary tools are not monopolistic and highly imitable. Until now, Blur still does not have a deep enough "moat" to ensure that Blur will not be defeated by subsequent challengers. With the brand effect under the first-mover advantage of Opensea has formed a strong enough user stickiness, when ordinary users use the NFT trading market, they first consider the depth and liquidity of the transaction, whether the transaction cost is low enough, and the platform function The consideration of whether it is easy to use is behind the two.

On the whole, the main reason for Blur's attention in the market is the mid-term AirDrop expectation. It remains to be seen whether it can form long-term user stickiness, especially after the AirDrop lands.

Reference article:

https://mirror.xyz/blurdao.eth/2nba-2j0zHPrBX0iPSNGquZ9s_WotNH6B4e5usz85mM