I've run into the same problem as you! Some people are asking why I wasn't always supporting Binance before, but now I'm saying Binance had problems with October 11th?

🤣😂😂 I'm laughing so hard... I've always felt there were problems, but not the kind of conspiracy theories people are talking about, like malicious crashes, price spikes, liquidity withdrawals, or deliberate liquidation of positions. Their problems mainly lie in things like inadequate risk control (given the limited liquidity, they allowed so many coins to be staked for positions), liquidation algorithms, staking algorithm design, ignoring dual variables, and failure to promptly cancel zombie orders, etc.

Anyway, from my perspective, the probability of Binance having any malicious intent during October 11th is extremely low; it doesn't make any sense at all.

Why do I say this? Because I'm part of a project team and also trade on Binance myself, I know all too well that Binance, in extreme situations, will "squeeze" project teams to protect users. Yes, you read that right, it's that inhumane (project teams in the current version are really struggling). When there's a large deposit, the exchange will ask what happened, whether your customer service can handle it, and if not, to send more funds immediately. Therefore, I tend to look for the cause in the mechanism itself—it's like a knife that looks fine normally, but then an earthquake happens and it cuts someone. You can't say the knife was premeditated, can you? 🤣 For example, if you ask me about Hyperliquid's price spikes, I'll approach it from this angle to see which part went wrong (long-time followers of my contract algorithm "scythe" series should know this).

Binance does bear some responsibility, but it doesn't deserve such a severe punishment. Anyone would react the same way to this level of collapse. To put it bluntly, in court, the defense lawyer would argue, "This is just Binance's fault, not a mistake."

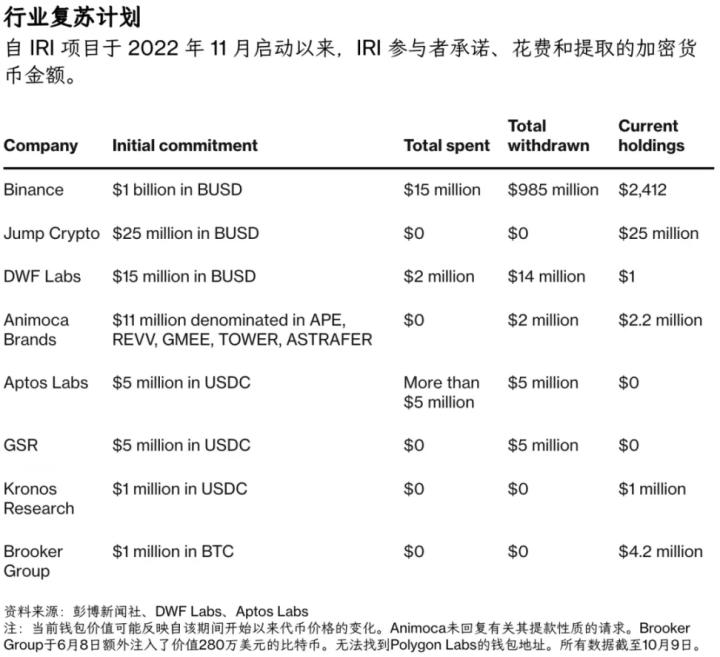

Benson mentioned that as a "capital-draining institution," Binance also "drains" capital from each project to replenish BNB holders. This is undoubtedly adding insult to injury for project teams (fyi, all exchanges do this, it's just a matter of quantity; compared to Korean exchanges and CB, it's negligible).

As a project team member, I really dislike this, especially those new projects whose valuations are propped up by fundraising. Because of their high valuations, they give away less capital, or just a meme, and they can get listed directly. Why?! And after listing, their performance is worse than ours. Why can't grassroots builders be given a chance?

But then I thought, if they don't do this, how else will they empower users? Will they, like SBF, misappropriate funds to speculate on cryptocurrencies and then use that money to support FTX users? Their business philosophies are different; one is custody, the other is banking.

And from Binance's perspective, after looking at so many projects, they're probably all the same – choosing the best from the worst, so they might as well empower BNB (from this perspective, Binance doesn't owe BNB holders anything).

Ultimately, Binance is a commercial institution. Besides security, liquidity, and service, we always hope they can do more, but we can't seem to generate higher returns for them. If you were in their shoes, what would you do?

On a side note, the reason why some people in English cryptography (even now) still admire SBF is because he dares to "confront"—confront those outside the crypto sphere and confront politics (Brian certainly excels at this). The essence of crypto is to confront old mechanisms. Why can Coinbase take the lead? Because they dare to do it (although it's due to vested interests), suing the SEC and Doj. The general consensus in Chinese/Eastern cryptography is still "integration," ideally involving peaceful, gradual, and non-confrontational intervention. But revolution/confrontation means daring to cause conflict.

Compared to something like buying BTC with 10 billion, for an old-timer like me, trying to fight for the industry's progress is far more admirable.

Directly suing the US/UK government to release [something], or funding [something] organization to push for [something] legislation.

Leading the industry to confront the old testament—that's what Nakamoto would want to see, right? That's all.