Multicoin's Investment Thesis Update. This is their thesis for their investment portfolio, so you can take a quick look and see what they're thinking.

Full Text: assets.ctfassets.net/qtbqvna1l...

1. Fintech 4.0

• Specialized stablecoin fintech with better unit economics at lower costs

• Covering most of the fintech stack (e.g., Altitude)

• Companies providing stablecoin accessibility to global users/enterprises (e.g., p2p.me, El Dorade)

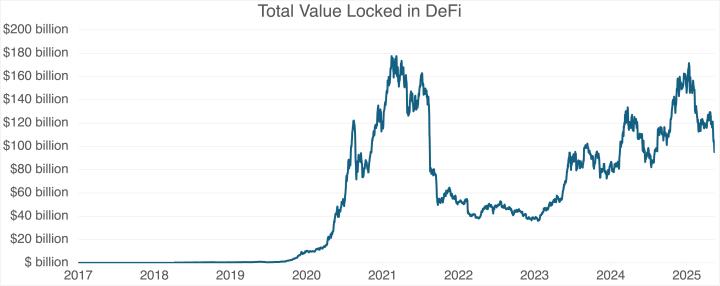

2. DeFi

• Consumer-facing front-end (e.g., Phantom, Fuse Wallet, Robinhood)

• DeFi-based company equity (e.g., Coinbase, Morpho)

• DeFi middleware (e.g., Li.Fi, Fun.xyz, Yield.xyz)

• DeFi protocols (e.g., Kamino, Drift, Aave, Ethena)

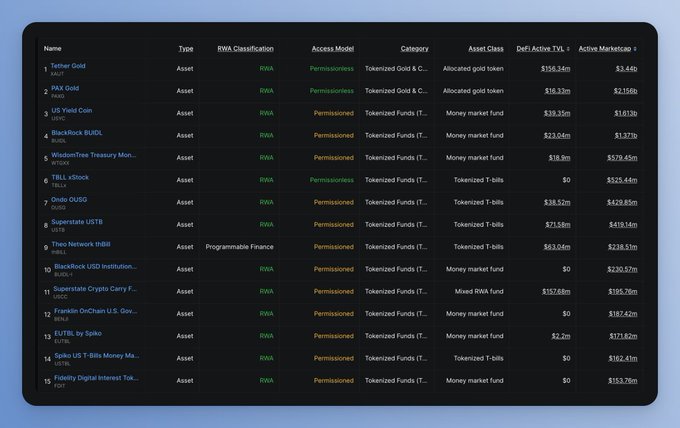

3. Financial globalization

• Liquid market tokenization (e.g., Paxos)

• Global accessibility of synthetic derivatives (e.g., Drift, Hyperliquid, Lighter)

• Black market decentralization and efficiency (e.g., BAXUS, Triumph)

• New markets (e.g., Kalshi, Sway)

• On-chain microstructures (e.g., DFlow, Jito, FastLane)

4. More efficient borrowing/lending

• Kamino, Aave

5. Entertainment economy

• Cheddr, Novig

6. Programmable ownership

• DePIN (e.g., Hivemapper, Render, io.net, Geodnet, Pipe, Gradient)

• Internet labor markets (e.g., CrunchDAO, Fuse)

• Virtual markets controlled by DAOs (e.g., Jito, Drift, Kamino)

• Exploring the Equity 2.0 market

7. Trusted, neutral blockchains

• Blockchains with corporate interests will struggle to attract third-party builders and liquidity

• Currently, Aptos, Solana invested in Say.

8. Cryptographic Primitives

• Zama, Fheniz, zkMe