[2/3]

(The Block | BlockBeats | The Block)

9. Israel Indicts Polymarket for "Insider Betting": Accused of Using Classified Military Information to Trade Prediction Markets. Israeli prosecutors have accused Israeli reservists and civilians of using classified military information to engage in "insider betting" on the Polymarket, involving serious security-related charges.

(The Block | Foresight News)

10. Trove Markets Accused of "Discriminatory" Refunds: KOLs Offer Private Compensation, Retail Investors Suffer Losses, Rug Controversy

Bubblemaps claims that after the crash, approximately 100,000 USDC and 350,000 USDT were transferred from wallets associated with the deployer to new wallets. On-chain evidence and leaked chat logs point to private compensation to pre-sale KOLs. The project had previously raised approximately $11.5 million through an ICO, escalating community controversy.

(Foresight News | BlockBeats)

Market Analysis

1. Standard Chartered: Lowers BTC/ETH price target for year-end 2026, suggesting a possible sharp drop before a rebound. Standard Chartered lowered its BTC price target for year-end 2026 from $150,000 to $100,000, and warned that it may first drop to $50,000 before a rebound; it also lowered its ETH price target from $7,500 to $4,000, believing that ETH may first reach $1,400 before rebounding later this year.

(The Block | Decrypt | Foresight News)

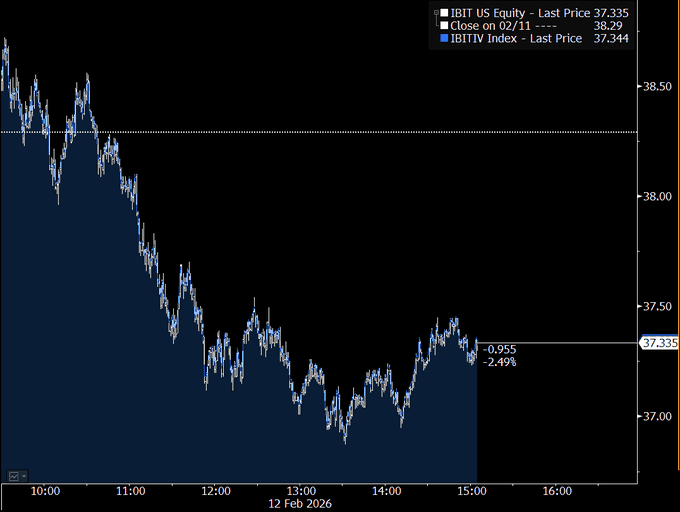

2. Volatility and Positions: Total liquidations across the network amounted to approximately $175 million to $215 million; some funds also leveraged their positions to long on Hyperliquid.

Different statistical methods indicate that approximately $175 million to $215 million in liquidations occurred within 24 hours; meanwhile, a whale deposited 5 million USDC into Hyperliquid, long on HYPE/ETH/BTC with 5x leverage and planning to further increase its position using TWAP, which could amplify volatility.

(TechFlow | Foresight News)

3. Rebound Conditions and Range: 10X Research indicates that the "negative gamma sell-off" is nearing digestion; Glassnode suggests a bottoming-out process.

10X Research believes the current decline is related to "liquidity trap + negative gamma hedging leading to market makers selling futures," and that a rebound is possible once the negative gamma is digested near key price levels. Glassnode suggests that BTC may be in a period of consolidation and bottoming out, with the key range being approximately $55,000 to $79,000.

(BlockBeats)

4. Macroeconomic Interest Rates: A Reuters survey indicates that expectations for two rate cuts this year remain, but supply pressure on US Treasuries may push up long-term yields. The Reuters survey shows that the market still expects two rate cuts this year, but against the backdrop of massive bond issuance, the median forecast for the 10-year yield one year from now has been revised upward to 4.29%; some strategists believe that a large-scale reduction in the balance sheet in the next few years is "not feasible".

(TechFlow)

Project Updates

1. Espresso (ESP) and Aztec (AZTEC) are being listed on exchanges in quick succession: spot, perpetual, and airdrop trading are proceeding simultaneously (with different timelines).

Coinbase announced that AZTEC and ESP spot trading will be available on February 12th after liquidity and regional requirements are met; Coinbase International/Advanced will list AZTEC-PERP. Espresso will open airdrop applications and staking; Binance/Gate/Bybit and others are advancing ESP spot trading and perpetual bonds (including migrating pre-market perpetual bonds to standard perpetual bonds), but different channels give different descriptions of the launch timeline, and the final announcement from the exchange shall prevail.

(Foresight News | BlockBeats | Foresight News | Foresight News)

2. Ondo: Tokenized stocks/ETFs entering DeFi lending; SPYon and QQQon integrate Morpho + Gauntlet.

Ondo states that its tokenized stocks/ETFs can serve as collateral for risk management in Ethereum DeFi lending scenarios, and the first batch of SPYon and QQQon have been integrated with Morpho and Gauntlet.

(Foresight News | BlockBeats)

3. Robinhood Chain Public Beta Launched: Based on Arbitrum, focusing on RWA tokenization.

Robinhood has launched the Robinhood Chain testnet, primarily targeting the issuance and trading of RWA tokenized assets such as stocks, ETFs, and private placements.

(Foresight News | BlockBeats)

4. Stablecoins and Yield Infrastructure: Lighter and Circle share USDC deposit returns; OKX Ventures invests in STBL and plans to launch ESS.