[2/3]

(BlockBeats | TechFlow | PANews | Foresight News)

Market Analysis

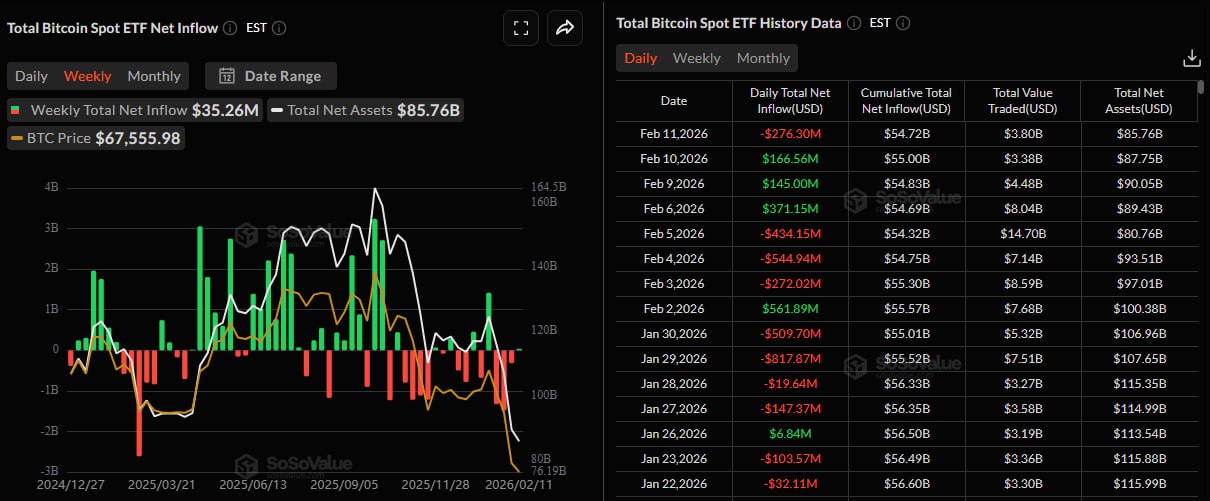

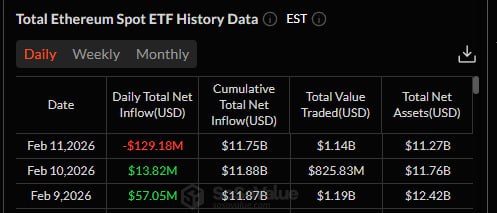

1. Weakening Funding: On February 11th, US Eastern Time spot ETFs saw net outflows, with BTC experiencing a net outflow of $276 million and ETH a net outflow of $129 million. Data shows that both BTC and ETH spot ETFs experienced net outflows. By product, the BTC-side FBTC saw a net outflow of approximately $92.5958 million, and the ETH-side FETH saw a net outflow of approximately $67.0874 million.

(PANews | BlockBeats | Foresight News | Cointelegraph)

2. Extremely pessimistic sentiment: The fear and greed index has dropped to 5; perpetual funding rates are relatively low.

Alternative.me The index dropped to 5 (extreme fear). Coinglass shows that the perpetual funding rates of mainstream CEX/DEX are relatively low, and market sentiment remains bearish.

(TechFlow | Foresight News | BlockBeats)

3. Glassnode: During the pullback period, whales accumulated losses, and the exchange's 30-day average net outflow accounted for 3.2%; on February 5th, it triggered a record $3.2 billion in single-day losses.

Glassnode points out that whales are adding to their positions during the pullback, and trading platforms are experiencing net outflows (the 30-day average net outflow is 3.2%, a pattern similar to the first half of 2022); it also states that during the BTC crash on February 5, on-chain "realized losses" reached approximately $3.2 billion, setting a new single-day record.

(BlockBeats | CoinGape | PANews)

4. QCP: BTC's large fluctuations are more like a "liquidity reset"; pay attention to the $60,000-$65,000 range and ETF fund flows.

QCP believes the recent sharp drop and rebound are more like a liquidity reset than a structural collapse. It recommends focusing on the key range of $60,000–$65,000, ETF fund flows, leveraged liquidations, and changes in the correlation between Bitcoin and US stocks, and managing short-term risk using a "high-beta risk asset" approach.

(TechFlow | BlockBeats)

5. Derivatives Event: Deribit's BTC options expiring tomorrow have a notional value of $2.52 billion, with the biggest pain point at $75,000.

Deribit data shows that at 16:00 tomorrow, there will be BTC options worth approximately $2.52 billion and ETH options worth approximately $390 million expiring; the BTC put/call ratio is approximately 0.76 with a maximum price limit of $75,000, while the maximum price limit for ETH is approximately $2,200.

(BlockBeats | Odaily)

Project Updates

1. Binance will remove and suspend trading of 13 spot trading pairs. Binance will remove the following pairs at 16:00 (UTC+8) on February 13: AT/BNB, AVAX/BNB, BANANA/BTC, COTI/BTC, FF/BNB, HIVE/BTC, IO/BNB, LRC/BTC, MANA/BTC, SAGA/BNB, W/FDUSD, XPL/BNB, and ZK/BTC.

(BlockBeats | Foresight News | Odaily)

2. Binance lists Espresso (ESP) spot trading and tags it with the Seed tag.

Binance will list ESP spot trading at 21:00 (UTC+8) today, offering ESP/USDT, ESP/USDC, and ESP/TRY, and tagging it with the Seed tag. The announcement states that Espresso is a decentralized base layer designed to improve L2 Rollup performance.

(Binance | BlockBeats | Foresight News)

3. Binance completes integration of RLUSD on the XRP network and opens deposits. Binance now supports deposits of Ripple USD (RLUSD) on the XRP network; withdrawals will be opened once liquidity is sufficient.

(PANews | Odaily)

4. Coinbase launches Agentic Wallets: an infrastructure that allows granting wallet permissions to AI agents.

Coinbase Developer Platform has released Agentic Wallets, which allow AI agents to independently manage funds, identity information, and perform on-chain interactions under permission policies and security barriers; the report mentions that it adopts a sandboxed self-custody design to isolate private key risks.

(Foresight News | Decrypt | TechFlow)

5. STBL receives strategic investment from OKX Ventures and plans to launch an institutional-grade RWA-backed ecosystem-exclusive stablecoin on X Layer.