Written by: LBank

With the passage of BTCETF at the beginning of this year and the approaching US election, the impact of cryptocurrency on US political volatility is gradually increasing. With a series of recent operations by Trump, although cryptocurrency is an emerging and controversial field, it is now becoming an important bargaining chip for gaining votes and financial support in US political elections.

Today, LBank will take stock of the U.S. political circles’ attitude towards cryptocurrencies and further predict future trends in the crypto market.

Crazy Candidates, Crypto and Votes

2024 is the next "yes" moment for the US election.

He does not want to miss out on the new power brought by cryptocurrency, but at the same time, he lets the SEC play a double-faced tiger, using various economic sanctions to maintain a serious distance relationship. Compared with Singapore's early move, the U.S. political circles and cryptocurrency are more like the upper part of the ambiguous period, neither officially announcing nor hiding, and are more immersed in this seemingly confusing and nameless tug-of-war.

The first is Trump, who is extremely crazy and at the peak of public opinion. He quickly opened the floodgates of the crypto market through his remarks and meme effects.

On May 22, the cryptocurrency donation website was opened to officially accept cryptocurrency donations;

On May 26, he made a public statement that "he will ensure that the future of cryptocurrency and Bitcoin is created in the United States (Made in the USA)... and will support the self-custody rights of 50 million cryptocurrency holders across the United States." He also promised to pardon the founder of Silk Road if elected, strongly support cryptocurrency and protest Biden's actions to suppress the industry.

On May 30, the Wall Street Journal reported that Donald Trump is considering appointing Elon Musk as a policy advisor to promote a pro-cryptocurrency agenda.

Influenced by his remarks, the token $MAGA, $TRUMP has skyrocketed, surpassing 99% of the tokens in the crypto market, and has become the hot star MEME on the LBank platform in the past two weeks, and its popularity remains high.

According to the on-chain data monitoring platform Arkham, the value of Trump's crypto assets has increased significantly and has now exceeded US$12 million, including 579,290 TRUMPs worth US$8.08 million; 464,706 ETHs worth US$1.76 million; 374,889 WETHs worth US$1.42 million, and other MEME coins including MVP, CONANA, BABYTRUMP, etc.

From "not liking Bitcoin and other cryptocurrencies" five years ago, and even calling them "scams", to "supporting, affirming, and ensuring that cryptocurrencies happen in the United States" today, it is undeniable that his transformation is indeed keeping up with current events. As expected, in the May 28 poll, Trump's approval rating rose on prediction platforms such as Polymarket due to his support for the crypto industry.

The second is the current President Biden. Influenced by Trump’s remarks, Biden has also made some pandering moves to win more Generation Z voters.

On May 22, the Biden team was hiring a "meme manager" to manage Internet content and memes (including MEMEs);

On May 23, the Biden administration issued a statement calling on Congress to work together on a “comprehensive and balanced regulatory framework for digital assets”;

On May 29, Biden sent a presidential delegation to attend the inauguration ceremony of the President of El Salvador

At the same time, people familiar with the matter revealed that Biden's re-election campaign has begun to contact key figures in the cryptocurrency industry, seeking guidance on "the crypto community and crypto policy moving forward." This marks a major "shift" from the government's previous cold attitude towards the industry.

Cryptocurrency game theory, Consensus2024 reveals market signals

At the Consensus2024 consensus conference, ARK Invest CEO and Chief Investment Officer Cathie Wood (female stock god) said: Because cryptocurrency is an election issue, the Ethereum spot ETF application was approved.

She said in an interview: "The interpretation at the time was that it would not be approved, absolutely not approved. If it was approved in the usual way, we would be questioned by the US SEC. But before that, no one had received such an inquiry."Cathie Wood also said that the mood in the House of Representatives surrounding the Financial Innovation and Technology Act of the 21st Century (FIT21), which was passed last week with bipartisan support, is constantly changing, indicating that this may be an election year issue.

During the period, Brian Nelson, Deputy Secretary of the U.S. Treasury Department and the Office of Terrorism and Financial Intelligence, also stated that FinCEN's proposal in 2023 to require cryptocurrency companies to report transactions involving mixing is intended to increase transparency rather than ban mixers.

Nelson said he sympathized with cryptocurrency users’ desire for financial privacy but suggested the industry and the Treasury Department should work together to find ways to enhance privacy while avoiding terrorist financing.

Meanwhile, NYSE President Lynn Martin and Bullish CEO Tom Farley discussed cryptocurrency regulation, changing U.S. politics, and the limitations and opportunities of blockchain technology to improve traditional markets. Among them, Farley highlighted the sudden shift in U.S. political attitudes toward cryptocurrencies, including the removal of the anti-crypto chairman of the Federal Deposit Insurance Corporation (FDIC), the passage of the 21st Century Financial Innovation and Technology Act (FIT21) in the House of Representatives, and Republican presidential candidate Donald Trump doubling down on his support for cryptocurrencies in a series of rapidly evolving events.

“Whether it’s Trump, Biden or Michelle Obama (who will be president), you’re going to see progress in 2024 and 2025,” he added.

Earlier on May 28, former CFTC Chairman Christopher Giancarlo also said in an exclusive interview with Forbes: The dam of the United States resisting cryptocurrency innovation is about to collapse, and cryptocurrency will eventually make a comeback in the United States.

Money Flows and Politics: BTC ETF Data and Voters

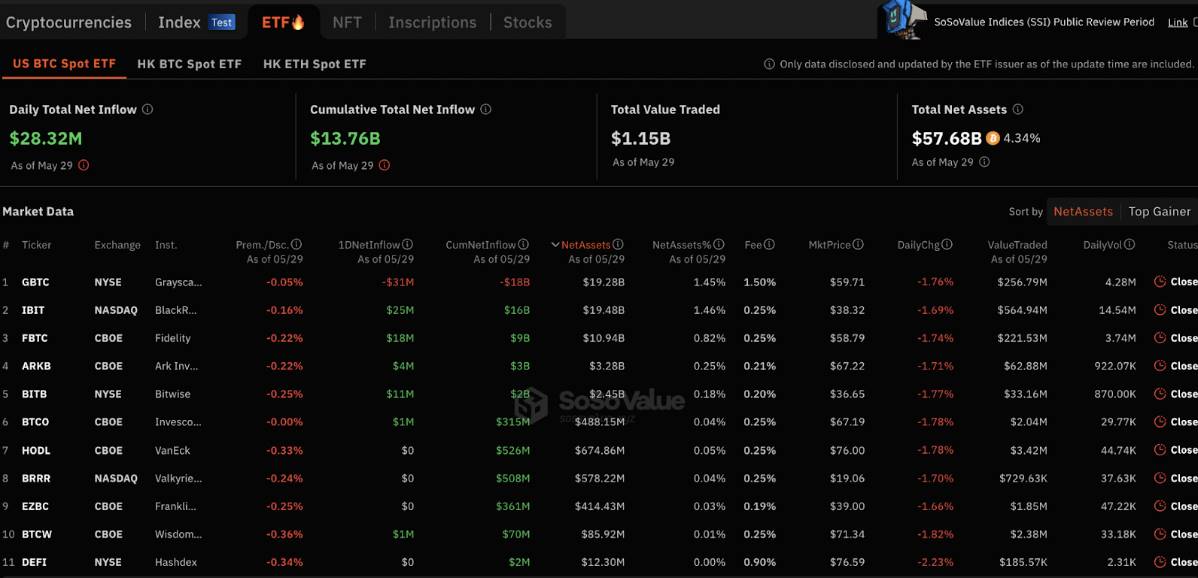

According to sosovalue data, as of May 29, the total net asset value of the Bitcoin spot ETF was US$57.683 billion, and the ETF net asset ratio (market value as a percentage of the total market value of Bitcoin) was 4.34%. The historical cumulative net inflow has reached US$13.76 billion, and net inflows have continued for 12 consecutive days.

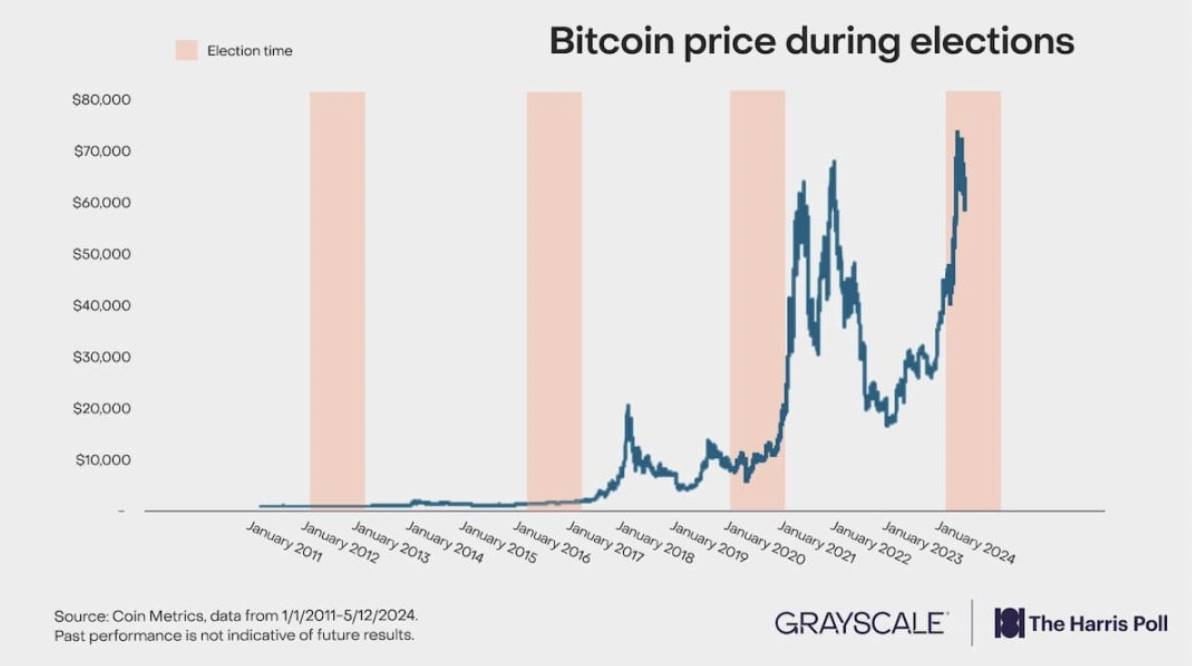

Grayscale Investments®, the world’s largest crypto asset manager, today announced the second phase of its national survey, “2024 Election: The Role of Cryptocurrency,” which found that in the face of geopolitical tensions, inflation, and a weak dollar, two in five likely voters (41%) are looking at Bitcoin and other crypto assets—a statistic that is up from 34% in the first phase of the Harris Poll survey, which began in November 2023.

Likewise, voters increasingly say they expect to have part of their portfolios include cryptocurrencies (47% in 2021, compared to 40% in 2023). "Consistent with recent votes in the House and Senate, this data further demonstrates that cryptocurrency has become a bipartisan concern that cannot be ignored by either party," said Grayscale research director Pandl.

The rise in interest is mainly attributed to the successful launch of a spot Bitcoin ETF in the United States in January, which has now attracted $13.7 billion in net flows since its launch. Grayscale said that nearly a third of voters became more interested in cryptocurrencies as an asset class after the ETF received regulatory approval.

Outlook and Risk Reminder

The United States is currently at a critical moment and needs to make many important decisions, involving macroeconomic policy issues such as government interest rate hikes, inflation, and the United States' position on the international stage. As people's interest in cryptocurrencies increases, the government's future attitude towards this emerging digital asset has attracted much attention.

As the US election approaches, Trump and Biden have engaged in a heated debate on the most controversial issue of cryptocurrency in order to win voter and financial support. This move not only shows that the US political parties have an ambiguous attitude towards cryptocurrency, but also indicates the future direction of regulation and more rational risk management.

At the same time, with the election approaching, frequent law enforcement activities have also created a sense of conspiracy in the market, and the SEC seems to have expressed its stance. LBank reminds users to understand the inherent volatility of the cryptocurrency market and invest with a cautious and informed perspective, and not to blindly follow hype or social media trends.